Description

Disclaimer: Copyright infringement not intended.

Context

- Foreign portfolio investors (FPIs) pulled out from the Indian markets in a big way in 2022 with the highest-ever yearly net outflow of Rs 1.34 lakh crore.

What is Foreign Portfolio Investment?

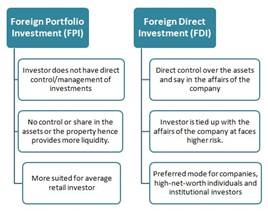

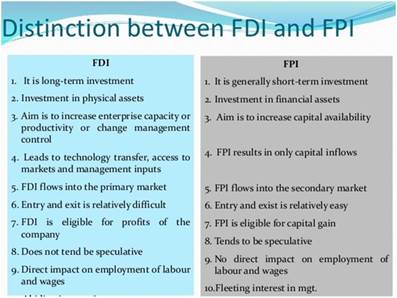

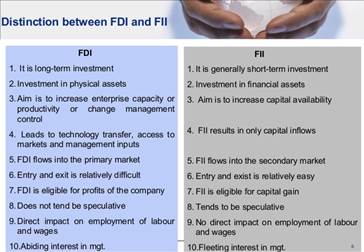

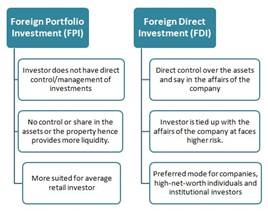

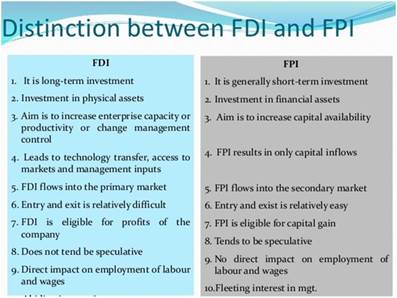

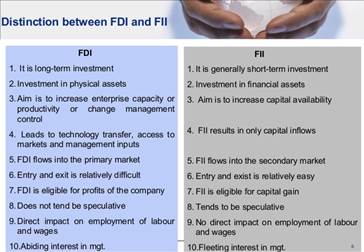

- FPI is an investment by non-residents in Indian securitiesincluding shares, government bonds, corporate bonds, convertible securities, units of business trusts, etc. The class of investors who make an investment in these securities is known as Foreign Portfolio Investors.

What are the major laws/regulations applicable to an FPI in India?

- FPIs are primarily governed by The Securities and Exchange Board of India (SEBI).

- SEBI has recently introduced the SEBI (Foreign Portfolio Investors) Regulations, 2019, repealing the erstwhile 2014 Regulations.

- Further, FPIs are also required to comply with the Foreign Exchange Management Act, 1999and the Income-tax Act, 1961.

Foreign Portfolio Investment Eligibility Criteria

To become an FPI, an individual must meet the following requirements:

- The petitioner must not be a non-resident Indian,according to the Income Tax Act of 1961.

- Should not be a citizen of a country that is subject to the FATF's public statement.

- If the bank is the applicant, it must be from a country whose central bank is a Bank for International Settlements member.

Reasons behind recent outflow of FPI from India

- Rising geo-political risk,

- Rising inflation,

- Tightening of monetary policy by central banks

- Supply Chain Disruption due to the ongoing war between Russia and Ukraine.

- Impact on crude oil prices amid uncertainty due to Russia-Ukraine war.

- On the domestic front, the concerns over surging inflation as well as further rate hikes by the RBI, and its impact on the economic growth, loomed large.

- Globally, the rate hikes by US Federal Reserve, tightening of monetary policy by the global central banks and appreciation of the foreign currency dollar rate has triggered the offshore investors to withdraw the equities from sensitive markets.

- Investors are also cautious due to the fear that high inflation could hamper corporate profits and also impact consumer spending.

.jpg)

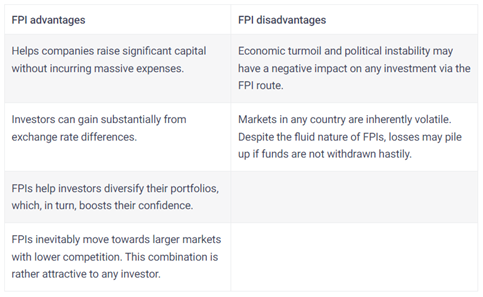

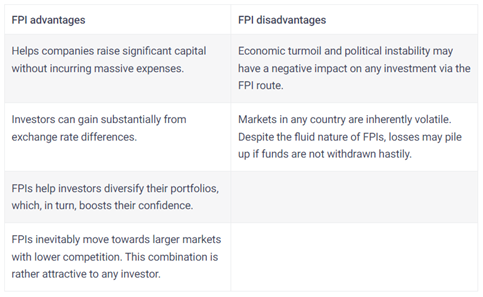

Pros and Cons of FPIs

Conclusion

- Foreign Portfolio Investment is one the most accessible routes for small and retail investors living outside India, to invest in India and take benefit from its economic growth.

- Indian market also capitalizes on this influx of fund and hence it is beneficial for economy too. Keeping this aspect in mind the Government of India through the market regulatory body SEBI has made the process of investment via FPI route easier and more streamlined.

- The regulatory framework is now more investment friendly and offers various advantages to any foreign individual/entity investing as Foreign Portfolio Investor in India.

https://indianexpress.com/article/business/market/fpis-pull-out-rs-1-34-lakh-cr-in-2022-in-a-highest-ever-yearly-outflow-8349591/#:~:text=Foreign%20portfolio%20investors%20(FPIs)%20pulled,of%20Rs%201.34%20lakh%20crore.