Description

Copyright infringement not intended

Picture Courtesy: www.businesstoday.in

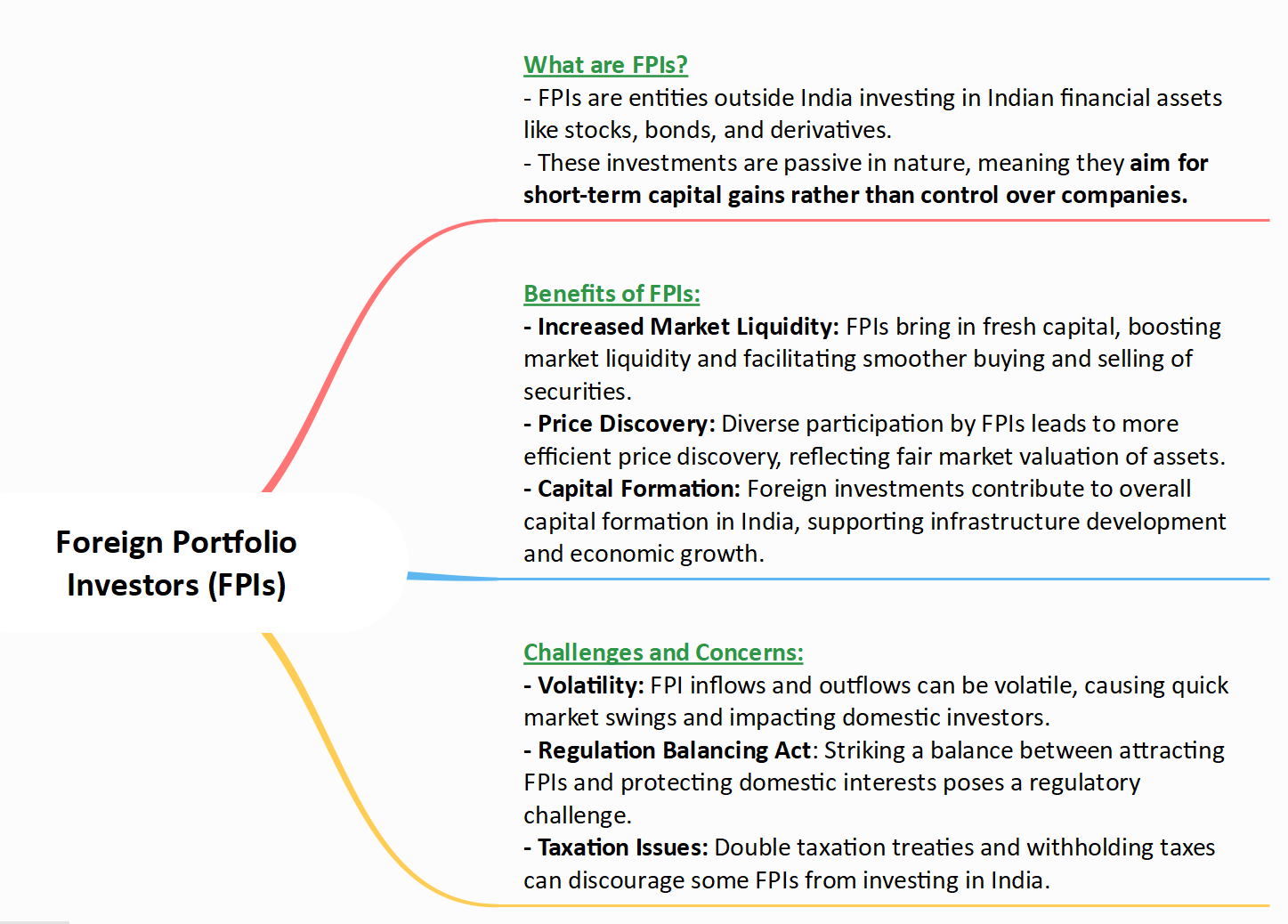

Context: The Securities and Exchange Board of India (SEBI) is implementing additional disclosure norms for Foreign Portfolio Investors (FPIs) to address concerns about possible round-tripping.

Details

- The Securities and Exchange Board of India (SEBI) has asked Foreign Portfolio Investors (FPIs) to provide additional disclosures, particularly for those holding a concentrated portion of their equity portfolio in a single investee company or corporate group.

- The rationale behind these additional disclosure norms is to prevent possible round-tripping by certain promoters who might be using the FPI route to bypass regulatory requirements.

Key points related to SEBI's additional disclosure norms

Concentration of Investments

- SEBI has identified specific Foreign Portfolio Investors (FPIs) with concentrated equity holdings in a single investee company or corporate group.

- Concerns arise over potential misuse of the FPI route by promoters or coordinated investors to bypass regulatory requirements, including those related to substantial acquisition disclosures and maintaining minimum public shareholding in listed companies.

Preventing Misuse of FPI Route

- While Press Note 3 issued by the government in April 2020 does not apply to FPI investments, there are concerns that entities with large Indian equity portfolios could potentially disrupt the orderly functioning of Indian securities markets by misusing the FPI route. The additional disclosures aim to mitigate these concerns.

|

Press Note 3, issued during the COVID-19 pandemic, amended the foreign direct investment (FDI) policy to prevent opportunistic takeovers/acquisitions of stressed Indian companies at a cheaper valuation. It introduced restrictions on entities from countries sharing a land border with India and mandated government approval for changes in beneficial ownership in FDI entities in India.

|

Details Required

- FPIs holding more than 50% of their Indian equity assets under management (AUM) in a single Indian corporate group or holding over Rs 25,000 crore of equity AUM in the Indian markets are required to disclose granular details of all entities holding any ownership, economic interest, or exercising control in the FPI.

Exempted FPIs

- Sovereign wealth funds (SWFs), listed companies on certain global exchanges, public retail funds, and other regulated pooled investment vehicles with diversified global holdings are exempted from making enhanced disclosures.

Potential Impact on Market

- Some experts suggest that the recent withdrawal by FPIs from the domestic market may partly be attributed to meeting the end-of-January deadline set by SEBI for disclosure. FPIs sold a significant amount of domestic shares in January.

Conclusion

- SEBI's move to seek additional disclosures from FPIs aims to enhance transparency and prevent potential misuse of the FPI route by entities with concentrated investments in Indian equities. The exempted categories indicate a focus on specific types of investors, allowing regulatory scrutiny where it is deemed necessary.

Must Read Articles:

FPI: https://www.iasgyan.in/daily-current-affairs/fpi#:~:text=FPI%20is%20an%20investment%20by,units%20of%20business%20trusts%2C%20etc.

|

PRACTICE QUESTION

Q. How are technological advancements like blockchain or artificial intelligence impacting the landscape of foreign portfolio investment in India, and how can these technologies be leveraged to improve efficiency, transparency, and risk management in the FPI ecosystem?

|