Description

Copyright infringement not intended

Picture Courtesy: www.a2ztaxcorp.com

Context: Luxembourg has surpassed Mauritius to become India's third-largest region for Foreign Portfolio Investors (FPIs), with a 30% growth in assets under custody (AUC) to ₹4.85-lakh crore.

Details

Luxembourg Overtaking Mauritius

- Luxembourg has surpassed Mauritius to become the region with the third-largest assets under custody (AUC) in India.

- Luxembourg's AUC grew by 30% to ₹ 4.85 lakh crore, making it a significant player in the Indian investment landscape.

- The shift is attributed to factors such as evolving regulations for foreign investments in India and Luxembourg being perceived as better regulated compared to tax havens.

Mauritius Decline

- Investments from Mauritius experienced a decline of 9% to ₹3.9-lakh crore. This decline is attributed, at least in part, to greater regulatory oversight in Mauritius.

- The renegotiation of the tax treaty between India and Mauritius in the past, which made capital gains on the sale of shares fully taxable after April 1, 2019, might have contributed to this decline.

Rise of Luxembourg's Salience Since 2020

- Luxembourg's importance has been increasing since 2020, following virtual meetings between European and Indian leaders. These meetings resulted in three financial agreements aimed at strengthening trade relations.

- Luxembourg has seen a surge in Foreign Portfolio Investor (FPI) accounts, with over 1,400 originating from the country.

France's Entry into the Top 10

- France has entered the top 10 club of countries investing in India after more than a year. The country's AUC has grown over 74% to ₹ 1.88 lakh crore.

- The growth is attributed to changes in the geopolitical environment, including events like Brexit, and beneficial tax treatment on investments, particularly for those investing under the FPI route.

Other Changes in Rankings

- Ireland and Norway have both moved up one position in the rankings, now ranking fifth and seventh, respectively, among the jurisdictions.

- Canada slipped one place, even though its AUC grew by 19% year-on-year.

- The impact of the diplomatic row between India and Canada on investments remains unclear.

Reasons for Changes

- The changes in rankings are attributed to various factors, including evolving regulations, geopolitical events, and beneficial tax treatments.

- Investors may be seeking new fund locations beyond traditional ones due to increased scrutiny of tax havens.

FPI in India

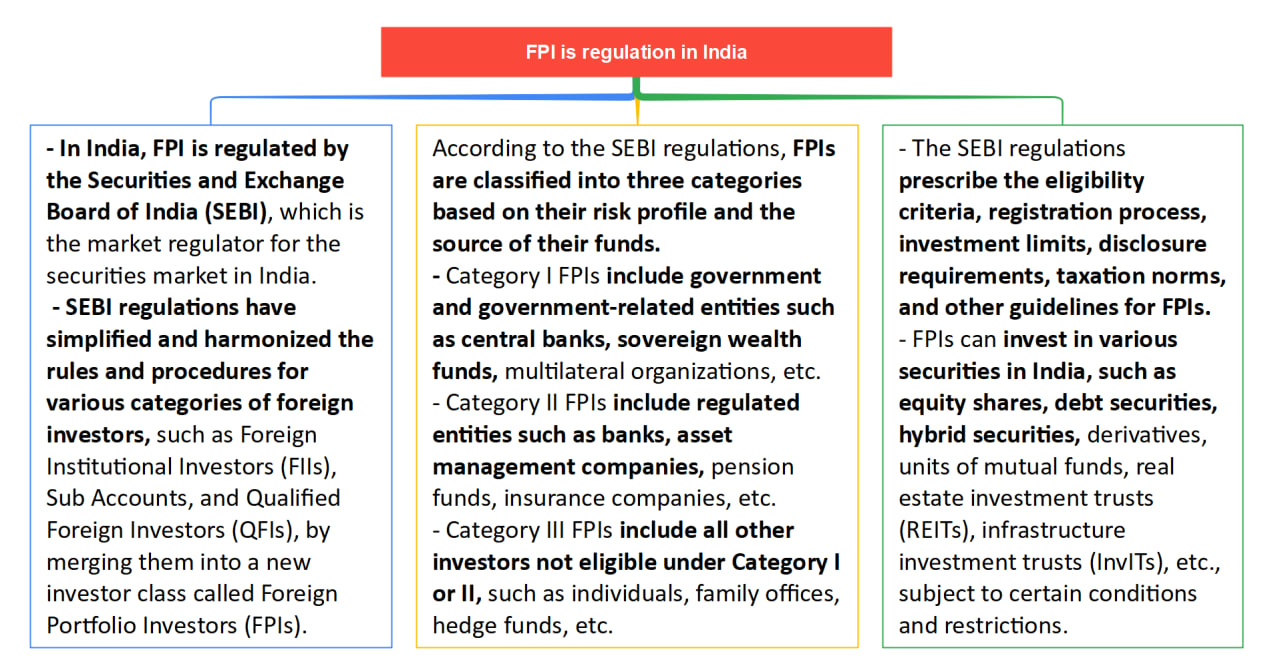

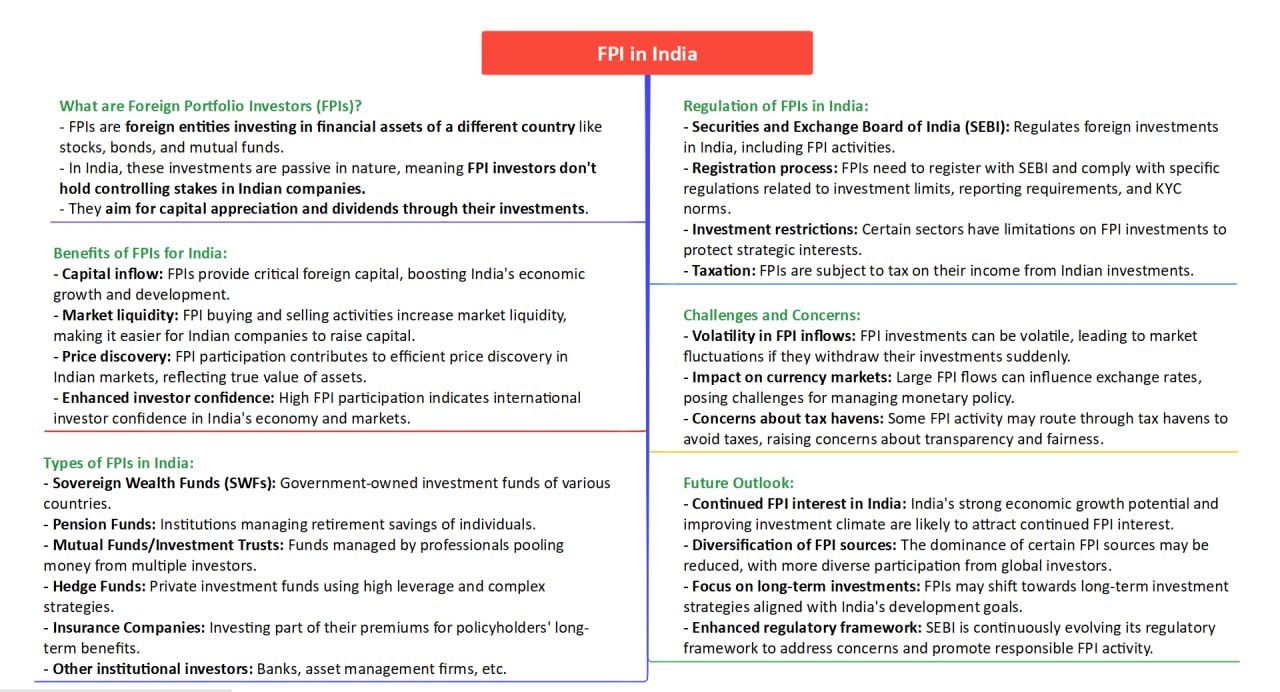

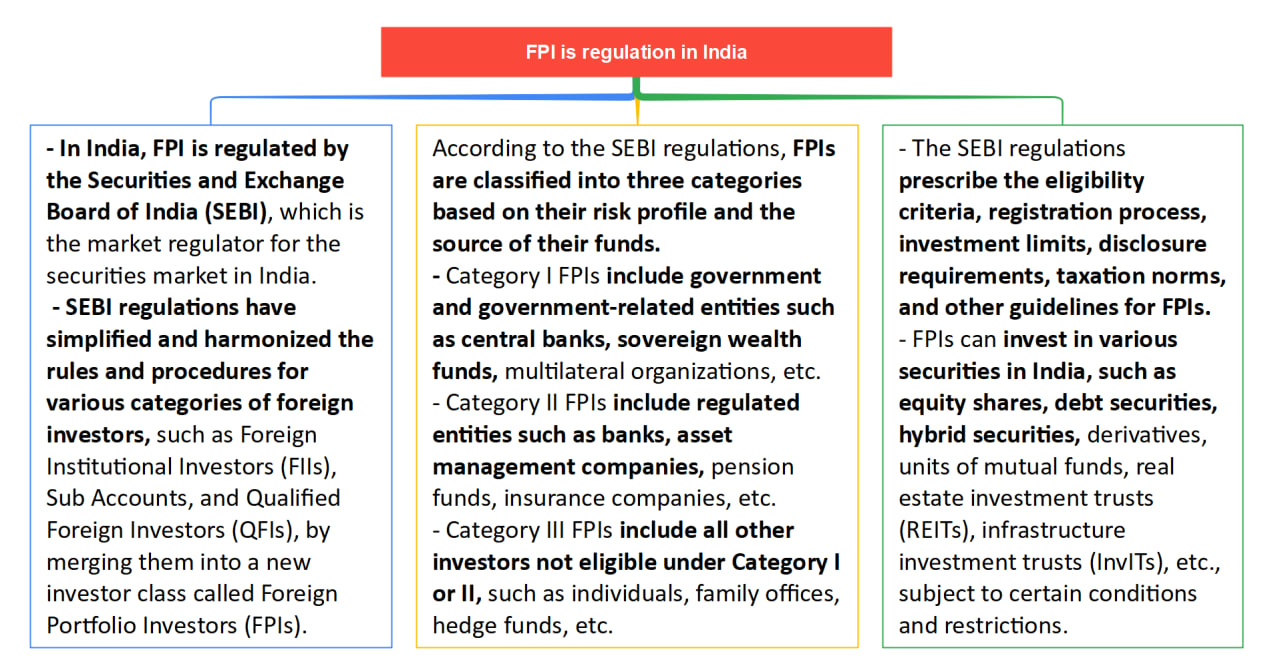

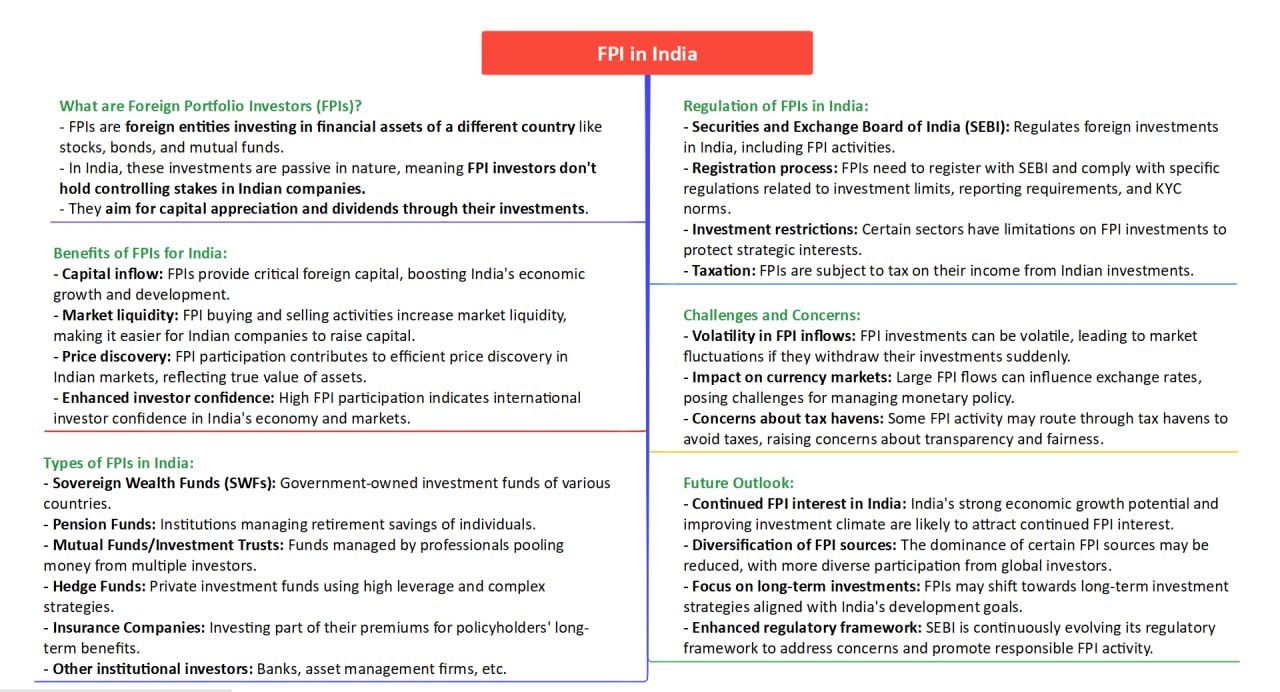

- Foreign Portfolio Investment (FPI) is a type of cross-border investment that involves the buying and selling of securities such as stocks, bonds, mutual funds, exchange-traded funds, etc. by foreign investors in the domestic market of another country.

- FPI is different from Foreign Direct Investment (FDI), which involves acquiring a controlling stake or a long-term interest in a business entity in another country. FPI is considered a source of capital inflow, liquidity, and diversification for the host country, as well as a means of earning returns and diversifying risk for foreign investors. FPI can also have an impact on the exchange rate, interest rate, inflation, and economic growth of the host country.

Significance

- FPI provides an additional source of capital inflow for India, which can help finance its current account deficit and augment its foreign exchange reserves.

- FPI enhances the liquidity and efficiency of the Indian securities market by increasing the trading volume and reducing transaction costs.

- FPI diversifies the investor base and reduces the dependence on domestic savings for investment.

- FPI fosters competition and innovation in the Indian securities market by bringing in global best practices and standards.

- FPI enables Indian companies to access global capital markets and raise funds at lower costs.

- FPI allows foreign investors to participate in the growth potential of the Indian economy and diversify their portfolio risk.

Challenges

- FPI can create volatility and instability in the Indian securities market due to its short-term and speculative nature.

- FPI can exert pressure on the exchange rate of the Indian rupee due to its sensitivity to global and domestic factors.

- FPI can increase the vulnerability of the Indian economy to external shocks and contagion effects due to its exposure to global financial markets.

- FPI can create regulatory arbitrage and compliance issues due to differences in laws and regulations across countries.

- FPI can pose tax evasion and money laundering risks due to a lack of transparency and information disclosure by some investors.

Way Forward

- Simplifying and rationalizing the regulatory framework for FPI by introducing a single-window registration system, reducing documentation requirements, easing KYC norms, etc.

- Increasing the investment limits for FPI in various sectors such as corporate bonds, government securities, REITs, InvITs, etc.

- Providing tax incentives for FPI such as lower withholding tax rates on interest income from certain bonds, exemption from capital gains tax on the sale of certain securities, etc.

- Strengthening the market infrastructure and surveillance mechanisms for FPI by enhancing the role of custodians, intermediaries, and depositories, improving the reporting and disclosure standards, etc.

- Enhancing the coordination and cooperation among various regulators and authorities for FPI such as SEBI, RBI, CBDT, ED, etc.

Conclusion

- India's strong economic growth prospects, ongoing market reforms, and focus on attracting foreign capital are expected to continue attracting FPIs in the future. However, addressing challenges, diversifying the investor base, and promoting sustainable investments will be crucial to ensure the long-term benefits of FPI for India's financial markets and economic development.

Must Read Articles:

Foreign portfolio investors (FPIs): https://www.iasgyan.in/daily-current-affairs/foreign-portfolio-investors-fpis

|

PRACTICE QUESTION

Q. What are the key regulatory frameworks and recent policy developments governing Foreign Portfolio Investors (FPIs) in India, and how do these factors impact their investment activities and contribution to the Indian financial markets?

|