Disclaimer: Copyright infringement not intended.

Context

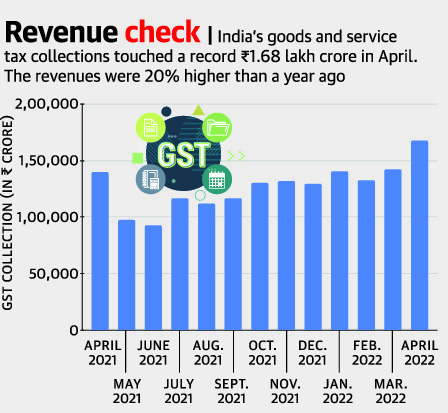

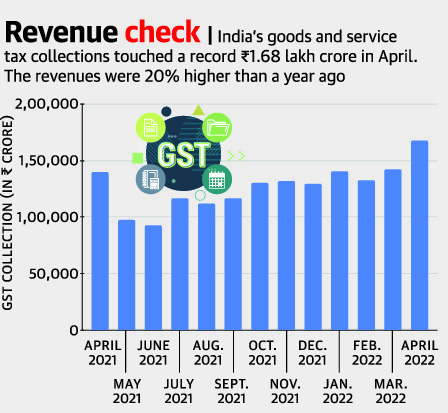

- India’s gross Goods and Services Tax (GST) revenues hit a fresh high of Rs 1,67,540 crore in April, with revenues from goods imports rising 30% year-on-year and domestic transactions, along with services imports, rising 17%.

What are indirect taxes?

- In India, there are two main types of taxes that taxpayers pay to the government. The first type of taxes are called Direct Taxes, and they are levied directly on the income of an individual in the form of Income Taxes, Surcharges, etc.

Advantages and Disadvantages of Indirect Taxes

- The second type of taxes are called Indirect Taxes and these are not directly levied on the income of an individual but rather on the expenses that they incur. Indirect Taxes are actually levied on sellers of commodities and services, but they pass it on to the consumers, and hence they end up indirectly paying such a tax.

- The Goods and Services Tax (GST) is a good example of indirect tax. GST is applicable to anyone selling goods or commodities, but they usually do not pay this out of their own pocket, but rather add it to the cost of the commodity and charge it to the consumer themselves.

Advantages of Indirect Taxes

Everyone can contribute

- Unlike Income Tax, which has to be paid by individuals in certain income brackets and not others, Indirect Taxes have to be paid by each and everyone who purchases the commodity.

- Persons not working in India like tourists and persons of lower economic strata also have to pay it because they will in some form purchase commodities.

They are convenient

- Indirect taxes are very convenient as far as charging them is concerned.

- Firstly, the taxes can be very nominal and consumers do not feel burdened when paying such small amounts.

- Secondly, these indirect taxes are said to be ‘hidden in the price’, which means that the consumer only effectively sees the price of the commodity itself.

They cannot be evaded

- Indirect taxes cannot be evaded, because they are part of the price of the commodity. So anyone who buys the commodity, will pay the tax.

They are spread over a wide range

- Heavy taxation in any one aspect of a service or commodity will be highly noticeable as well as a burden on the consumer. In this regard, indirect taxes can be beneficial since they are spread out over a wide range of products in smaller amounts.

Disadvantages of Indirect Taxes

Indirect Tax can be regressive

- Since indirect tax is the same for both the rich and the poor, it can be deemed unfair to the poor. Indirect tax is applicable to anyone who makes a purchase, and while the rich can afford to pay the tax, the poor will be burdened by the same amount of tax. Thus, indirect taxes may be seen as regressive.

They raise price of commodities

- Sellers cannot always calculate and collect the exact fraction of tax applicable on all commodities that they sell. And hence they consciously charge more than the tax amount so they can be sure that every buyer paid the indirect tax.

- But this has a cumulative effect and increases the price of commodities.

No civic consciousness

- Indirect taxes do not raise civic awareness because millions are not even aware that they’re paying a tax because it is hidden in the price.

What are Direct Taxes?

- Direct taxes are one type of taxes an individual pays that are paid straight or directly to the government, such as income taxIncome Tax Payable Income tax payable is a term given to a business organization’s tax liability to the government where it operates. The amount of liability will be based on, poll tax, land tax, and personal property tax.

- Such direct taxes are computed based on the ability of the taxpayer to pay, which means that the higher their capability of paying is, the higher their taxes are.

- For example, in the case of income taxation, an individual who earns more pays higher taxes. It is computed as a percentage of the total income. Additionally, direct taxes are the responsibility of the individual and should be fulfilled by no one else but him.

Types of Direct Taxes

- Income tax

It is based on one’s income. A certain percentage is taken from a worker’s salaryRemunerationRemuneration is any type of compensation or payment that an individual or employee receives as payment for their services or the work that they do for an organization or company. It includes whatever base salary an employee receives, along with other types of payment that accrue during the course of their work, which, depending on how much he or she earns. The good thing is that the government is also keen on listing credits and deductions that help lower one’s tax liabilities.

- Transfer taxes

The most common form of transfer taxes is the estate tax. Such a tax is levied on the taxable portion of the property of a deceased individual, including trusts and financial accounts. A gift tax is also another form wherein a certain amount is collected from people who are transferring properties to another individual.

- Entitlement tax

This type of direct tax is the reason why people enjoy social programs like Medicare, Medicaid, and Social SecuritySocial SecuritySocial Security is a US federal government program that provides social insurance and benefits to people with inadequate or no income. The first Social. The entitlement tax is collected through payroll deductions and is collectively grouped as the Federal Insurance Contributions Act.

- Property tax

Property tax is charged on properties such as land and buildings and is used for maintaining public services such as the police and fire departments, schools and libraries, as well as roads.

- Capital gains tax

This tax is charged when an individual sells assets such as stocks, real estateReal EstateReal estate is real property that consists of land and improvements, which include buildings, fixtures, roads, structures, and utility systems., or a business. The tax is computed by determining the difference between the acquisition amount and the selling amount.

Advantages of Direct Taxes

Though it is strictly implemented on every individual who does not qualify for an exemption, there are actually numerous advantages of paying taxes directly. They include:

- Promotes equality

Since direct taxes are based on the ability of a person to pay, it promotes equality among payers and citizens. Every person is charged a different amount, depending on how much they make.

- Promotes certainty

The good thing about direct taxes is that they are determined and made final before they are even paid. In the case of income tax, the annual tax is the same every year as long as the salary does not change.

- Promotes elasticity

Taxes are the earnings of the government, and when they fluctuate, the earnings also change. They can go higher or lower.

- Saves time and money

The government does not need to spend on the collection of taxes because they are already taken right at the source of the income. Some companies use automatic payroll deduction systems, which help save time and money.

GST

- GST is an Indirect tax which introduced to replacing a host of other Indirect taxes such as value added tax, service tax, purchase tax, excise duty, and so on.

- Goods and Services Tax Law in India is a comprehensive, multi-stage, destination-based tax that is levied on every value addition. GST is a single domestic indirect tax law for the entire country.

- Under the GST regime, the tax is levied at every point of sale.

Taxes subsumed under GST

- Central taxes:Taxes currently levied and collected by the Centre:

Central Excise duty

b. Duties of Excise (Medicinal and Toilet Preparations)

c. Additional Duties of Excise (Goods of Special Importance)

d. Additional Duties of Excise (Textiles and Textile Products)

e. Additional Duties of Customs (commonly known as CVD)

f. Special Additional Duty of Customs (SAD)

g. Service Tax

h. Central Surcharges and Cesses so far as they relate to supply of go .

2) State taxes: State taxes that are subsumed under the GST are:

a. State VAT

b. Central Sales Tax

c. Luxury Tax

d. Entry Tax (all forms)

e. Entertainment and Amusement Tax (except when levied by the local bodies)

f. Taxes on advertisements

g. Purchase Tax

h. Taxes on lotteries, betting and gambling

i. State Surcharges and Cesses so far as they relate to supply of goods and services.

Types of GST

The four different types of GST are given below:

- Central Goods and Services Tax : CGST is charged on the intra state supply of products and services.

- State Goods and Services Tax: SGST, like CGST, is charged on the sale of products or services within a state.

- Integrated Goods and Services Tax: IGST is charged on inter-state transactions of products and services.

- Union Territory Goods and Services Tax: UTGST is levied on the supply of products and services in any of the Union Territories in the country, viz. Andaman and Nicobar Islands, Daman and Diu, Dadra and Nagar Haveli, Lakshadweep, and Chandigarh. UTGST is levied along with CGST.

Advantages of GST

- Single tax system subsumes multiple taxes.

- Solve the issue of double taxation;

- Helps to create a unified common national market for India.

- Boost to foreign investment and “Make in India” campaign;

- Mitigates cascading of taxes as Input Tax Credit will be available across goods and services at every stage of supply;

- Harmonization of laws, procedures and rates of tax between Center and States and across States;

- Improved environment for compliance as all returns are to be filed online, input credits to be verified online, encouraging more paper trail of transactions at each level of supply chain;

- Similar uniform SGST and IGST rates reduce the incentive for evasion by eliminating rate arbitrage between neighboring States and that between intra and inter-state sales;

- Common procedures for registration of taxpayers, refund of taxes, uniform formats of tax return, common tax base, common system of classification of goods and services lends greater certainty to taxation system;

- Greater use of IT reduces human interface between the taxpayer and the tax administration, which will go a long way in reducing corruption.

- Facilitates companies to generate savings in logistics and distribution costs as there would be free movement and supply of goods in every part of the country without the need to depend on multiple sales depots across the country.

- The tax transparency and ease of doing business, as resulted from the implementation of GST, leads to increased tax compliance and attract more foreign direct investments across sectors.

Disadvantages of GST

- Petroleum Products Undefined Under GST

- Inevitable Inflation: In many sectors, GST results in inflation. While there were steps taken to initiate anti-profiteering at retail level, there have been no concrete steps as such.

- Operating Cost Hike: Requirement to hire professionals to manage accounts and taxes.

Positive impact of GST on various stakeholders

- Ease of doing business: Since the GST rate is the same across the country for a particular supply, traders and manufacturers in the organized sectors have more freedom to choose the best vendors, suppliers, and other stakeholders with better pricing, regardless of their location.

- Impact on logistical efficiency: More than 50% of logistics effort and time is saved as GST has ensured the removal of multiple checkpoints and permits at state border checkpoints. As a result, more road hours and faster delivery have been added, enhancing the business efficiency in India.

- Impact on price-cost margins: GST has resulted in competitive pricing and large-scale economies due to more straightforward business procedures. GST has almost ended the era of multiplicity of taxes and its cascading effect. This has sufficiently reduced production costs, leading to better margins for the industry, which were passed on to the consumers in the form of better products or lower prices.

- E-way bill - It resulted in the national unification of permit bill systems, allowing logistics to experience fewer interruptions en route the delivery. Use of technology has resulted in smoother consignment movement and much less disputes with officials. This will also add to the bulk of big data analytics in the country, catching the tax evaders near to the event of tax evasion.

- E-invoice: With widespread non-compliance and non-filing of GST returns by a considerable percentage of taxpayers, revenue collections in the first three years of GST were poor. Non-compliance with the GST was on the rise, and more cases of fraudulent invoices claiming input tax credit (ITC) were being discovered. To put an end to this practice “E-Invoicing” was introduced in October 2020. This ensured that a trade invoice is identified by a unique identification number which is generated by automated government-backed online portals. Since the introduction of E-invoice, GST collections have risen steadily. In fact even post the onslaught of the second wave of COVID leading to a Lockdown 2.0 in several parts of the country, tax collection stood strong.

- Impact on transaction costs: There has been a significant reduction in transaction costs. Earlier, all the interstate transactions were loaded with an additional cost of 2% (Central Sales Tax), which post GST has now been reduced to 0%. GST has been a huge breakthrough in the interstate movement of products after the introduction of e-way bills.

- It led to a single national unified market for businesses and convenience of doing business.

In a nutshell,

Simpler tax structure

- With GST, the taxation system of our country has become simpler. It is a single tax, ensuring easier calculation. With this tax, the buyer gets a clear idea of the amount paid as tax when purchasing certain products. This is crucial when considering GST and its impact on the GDP.

More funds for production

- Another effect of GST on the Indian economy has been the reduction in the total taxable amount. This saved fund can again be invested back into the production cycle to foster production.

Support for small and medium enterprises

- Based on the size of your organization, the amount of GST depends on your firm's annual turnover, provided you have been registered under the Composition Scheme introduced by GST. Enterprises with a yearly turnover of 50 lakhs have to pay 6% GST whereas enterprises with 1.5 crores worth of turnover have to pay 1% GST.

Increased volume of export

- When considering GST and its impact on the Indian economy, customs duty on exporting goods has reduced. So now production units save money while producing goods and also while shipping them. This two-way savings has lured many production units to export their goods, increasing the export quantity.

Enhanced operations throughout India

- With a unified taxation system, transporting goods around India has now become easy, boosting operations throughout the country.

No more cascading effect

- With GST, taxes of the State and Central Government have been merged. This has removed the cascading effect of taxes, reducing the burden on the buyer and the seller. So even if it may look like one big chunk of tax to be paid, you pay lesser hidden taxes.

GST Council

- It is a constitutional body for making recommendations to the Union and State Government on issues related to Goods and Service Tax.

- The GST Council is chaired by the Union Finance Minister and other members are the Union State Minister of Revenue or Finance and Ministers in-charge of Finance or Taxation of all the States.

- As per Article 279A of the amended Constitution, the GST Council which will be a joint forum of the Centre and the States.

- The Goods and Services Tax Council make recommendations to the Union and the States on—

- the taxes, cesses and surcharges levied by the Union, the States and the local bodies which may be subsumed in the goods and services tax;

- the goods and services that may be subjected to, or exempted from the goods and services tax;

- model Goods and Services Tax Laws, principles of levy, apportionment of Goods and Services Tax levied on supplies in the course of inter-State trade or commerce under article 269A and the principles that govern the place of supply;

- the threshold limit of turnover below which goods and services may be exempted from goods and services tax;

- the rates including floor rates with bands of goods and services tax;

- any special rate or rates for a specified period, to raise additional resources during any natural calamity or disaster;

- special provision with respect to the States of Arunachal Pradesh, Assam, Jammu and Kashmir, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura, Himachal Pradesh and Uttarakhand; and any other matter relating to the goods and services tax, as the Council may decide.

- One-half of the total number of Members of the Goods and Services Tax Council shall constitute the quorum at its meetings.

- Every decision of the Goods and Services Tax Council shall be taken at a meeting, by a majority of not less than three-fourths of the weighted votes of the members present and voting

The Goods and Services Tax Council establish a mechanism to adjudicate any dispute —

- between the Government of India and one or more States; or

- between the Government of India and any State or States on one side and one or more other States on the other side; or between two or more States, arising out of the recommendations of the Council or implementation thereof.

https://epaper.thehindu.com/Home/ShareArticle?OrgId=GJD9P4P7E.1&imageview=0