Disclaimer: Copyright infringement not intended.

Context

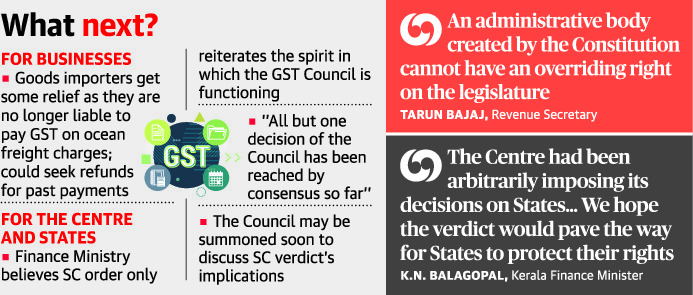

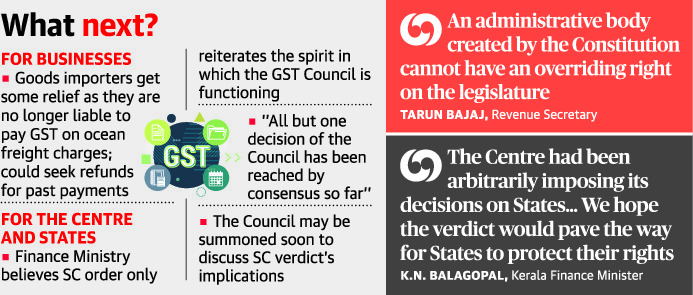

- The Supreme Court held that Union and State legislatures have “equal, simultaneous and unique powers” to make laws on Goods and Services Tax (GST). Thus, the recommendations of the GST Council are not binding on States.

- SC confirmed a Gujarat High Court ruling that the Centre cannot levy Integrated Goods and Services Tax (IGST) on ocean freight from Indian importers.

Observations made by the court

- The recommendations of the GST Council are the product of a collaborative dialogue involving the Union and the States. They are recommendatory in nature. The recommendations only have a persuasive value.

- To regard them as binding would disrupt fiscal federalism when both the Union and the States are conferred equal power to legislate on GST.

- Article 246 A: The court emphasized that Article 246A (which gives the States power to make laws with respect to GST) of the Constitution treat the Union and the States as “equal units”. “It confers a simultaneous power (on Union and States) for enacting laws on GST.

- Article 279A, in constituting the GST Council, envisions that neither the Centre nor the States are actually dependent on the other.

- The judgment said that though the Centre may have a larger share of power in certain instances to prevent chaos and provide security, the States still wielded power.

- The federal system is a means to accommodate the needs of a frugalistic society.

- Democracy and federalism are interdependent to each other. Federalism would only be stable in a well functioning democracy. Additionally, the constituent units of a federal polity check the exercise of powers of one another to prevent one group from exercising dominant power.

Implications

- The GST Council must endeavour to encompass the goals of its commitment to cooperative principles of federalism.

- It should aim towards the reformation of the contemporary tax structure, proper rationalisation of the rates of tax and broadening the tax rates.

- The GST Council must make way for transparency in the existing fiscal scenario through revisiting the revenue projections and consultations between the union and state finance ministers.

- It is important to keep the future of India’s hard-fought federal consensus in mind, and treat issues as a matter of erosion of the constitutional principles of federalism, rather than of simply the central government vs. the opposition.

GST

- GST is an Indirect tax which introduced to replacing a host of other Indirect taxes such as value added tax, service tax, purchase tax, excise duty, and so on.

- Goods and Services Tax Law in India is a comprehensive, multi-stage, destination-based tax that is levied on every value addition. GST is a single domestic indirect tax law for the entire country.

- Under the GST regime, the tax is levied at every point of sale.

- The GST was introduced via the Constitution (One Hundred and First Amendment) Act, 2016 by way of an amendment to the Seventh Schedule of the Constitution.

Types of GST

The four different types of GST are given below:

- Central Goods and Services Tax : CGST is charged on the intra state supply of products and services.

- State Goods and Services Tax: SGST, like CGST, is charged on the sale of products or services within a state.

- Integrated Goods and Services Tax: IGST is charged on inter-state transactions of products and services.

- Union Territory Goods and Services Tax: UTGST is levied on the supply of products and services in any of the Union Territories in the country, viz. Andaman and Nicobar Islands, Daman and Diu, Dadra and Nagar Haveli, Lakshadweep, and Chandigarh. UTGST is levied along with CGST.

GST Council

- It is a constitutional body for making recommendations to the Union and State Government on issues related to Goods and Service Tax.

- The GST Council is chaired by the Union Finance Minister and other members are the Union State Minister of Revenue or Finance and Ministers in-charge of Finance or Taxation of all the States.

- As per Article 279A of the amended Constitution, the GST Council which will be a joint forum of the Centre and the States.

- The Goods and Services Tax Council make recommendations to the Union and the States on—

- The taxes, cesses and surcharges levied by the Union, the States and the local bodies which may be subsumed in the goods and services tax;

- The goods and services that may be subjected to, or exempted from the goods and services tax;

- Model Goods and Services Tax Laws, principles of levy, apportionment of Goods and Services Tax levied on supplies in the course of inter-State trade or commerce under article 269A and the principles that govern the place of supply;

- The threshold limit of turnover below which goods and services may be exempted from goods and services tax;

- The rates including floor rates with bands of goods and services tax;

- Any special rate or rates for a specified period, to raise additional resources during any natural calamity or disaster;

- Special provision with respect to the States of Arunachal Pradesh, Assam, Jammu and Kashmir, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura, Himachal Pradesh and Uttarakhand; and any other matter relating to the goods and services tax, as the Council may decide.

- One-half of the total number of Members of the Goods and Services Tax Council shall constitute the quorum at its meetings.

- Every decision of the Goods and Services Tax Council shall be taken at a meeting, by a majority of not less than three-fourths of the weighted votes of the members present and voting

The Goods and Services Tax Council establish a mechanism to adjudicate any dispute —

- between the Government of India and one or more States; or

- between the Government of India and any State or States on one side and one or more other States on the other side; or between two or more States, arising out of the recommendations of the Council or implementation thereof.

Advantages of GST

- Single tax system subsumes multiple taxes.

- Solve the issue of double taxation;

- Helps to create a unified common national market for India.

- Boost to foreign investment and “Make in India” campaign;

- Mitigates cascading of taxes as Input Tax Credit will be available across goods and services at every stage of supply;

- Harmonization of laws, procedures and rates of tax between Center and States and across States;

- Improved environment for compliance as all returns are to be filed online, input credits to be verified online, encouraging more paper trail of transactions at each level of supply chain;

- Similar uniform SGST and IGST rates reduce the incentive for evasion by eliminating rate arbitrage between neighboring States and that between intra and inter-state sales;

- Common procedures for registration of taxpayers, refund of taxes, uniform formats of tax return, common tax base, common system of classification of goods and services lends greater certainty to taxation system;

- Greater use of IT reduces human interface between the taxpayer and the tax administration, which will go a long way in reducing corruption.

- Facilitates companies to generate savings in logistics and distribution costs as there would be free movement and supply of goods in every part of the country without the need to depend on multiple sales depots across the country.

- The tax transparency and ease of doing business, as resulted from the implementation of GST, leads to increased tax compliance and attract more foreign direct investments across sectors.

Disadvantages of GST

- Petroleum Products Undefined Under GST

- Inevitable Inflation: In many sectors, GST results in inflation. While there were steps taken to initiate anti-profiteering at retail level, there have been no concrete steps as such.

- Operating Cost Hike: Requirement to hire professionals to manage accounts and taxes.

Performance of GST in the past few years

Summary of hits and misses of the GST Act in the past four years:

HITS

Ease of doing business: Since the GST rate is the same across the country for a particular supply, traders and manufacturers in the organized sectors have more freedom to choose the best vendors, suppliers, and other stakeholders with better pricing, regardless of their location.

Impact on logistical efficiency: More than 50% of logistics effort and time is saved as GST has ensured the removal of multiple checkpoints and permits at state border checkpoints. As a result, more road hours and faster delivery have been added, enhancing the business efficiency in India.

Impact on price-cost margins: GST has resulted in competitive pricing and large-scale economies due to more straightforward business procedures. GST has almost ended the era of multiplicity of taxes and its cascading effect. This has sufficiently reduced production costs, leading to better margins for the industry, which were passed on to the consumers in the form of better products or lower prices.

E-way bill - It resulted in the national unification of permit bill systems, allowing logistics to experience fewer interruptions en route the delivery. Use of technology has resulted in smoother consignment movement and much less disputes with officials. This will also add to the bulk of big data analytics in the country, catching the tax evaders near to the event of tax evasion.

E-invoice: With widespread non-compliance and non-filing of GST returns by a considerable percentage of taxpayers, revenue collections in the first three years of GST were poor. Non-compliance with the GST was on the rise, and more cases of fraudulent invoices claiming input tax credit (ITC) were being discovered. To put an end to this practice “E-Invoicing” was introduced in October 2020. This ensured that a trade invoice is identified by a unique identification number which is generated by automated government-backed online portals. Since the introduction of E-invoice, GST collections have risen steadily. In fact even post the onslaught of the second wave of COVID leading to a Lockdown 2.0 in several parts of the country, tax collection stood strong.

Impact on transaction costs: There has been a significant reduction in transaction costs. Earlier, all the interstate transactions were loaded with an additional cost of 2% (Central Sales Tax), which post GST has now been reduced to 0%. GST has been a huge breakthrough in the interstate movement of products after the introduction of e-way bills.

It led to a single national unified market for businesses and convenience of doing business.

MISSES

Input Tax Credit (ITC) - GST Credit is not so seamless after all. GST law provides that credit becomes a vested right eligible to a registered person after certain conditions are met. These include the requirement to possess a valid tax invoice/debit note, actual receipt of goods/service by the recipient, and furnish the return. The most peculiar condition imposed: The taxpayer is ineligible to claim a credit against the tax paid on goods and services if the seller/service provider has failed to submit such tax due with the government treasury. Government utility in the form of GSTR -2, which never worked well, was kept in abeyance since July 2017 and later scrapped.

|

Input Tax Credit

Input Tax Credit refers to the tax already paid by a person at time of purchase of goods or services and which is available as deduction from tax payable.

For eg- A trader purchases good worth rs 100 and pay tax of 10% on it. And now this trader sold such goods at Rs. 150 and collect tax of Rs. 15 from buyer. Now the trader has to pay Rs. 15 to government but he had already paid Rs. 10, so this Rs. 10 is ITC of the trader and will be allowed as deduction from tax payable and he has to pay net Rs. 5 as tax.

|

Frequent alterations to the law- The GST law has seen many amendments. Multiple and frequent revisions confuse the taxpayer and tax administrators, creating misunderstandings and misconceptions. Dates, modifications, and rates based on time periods need to be ascertained. CBIC /GST Council could have exercised some discipline over this. Till date, more than 1000 notifications/circulars/instructions/orders have been issued by the government machinery.

Transitional Credit Issues- Even though the GST is a four-year-old law, many assesses are still experiencing technical/legal issues as a result of the transition from the old to the new GST system. Even after 4 yaers, the GST Council /CBIC is not able to resolve the issue. Many of the taxpayers are still fighting a case in the High Court/Supreme Court. Important judgments like Brand Equity etc. have been stayed by the Supreme Court of India.

Conflict of interest and interference between State/UT and Central Tax administrations– There is always a conflict of interest and interference between governments. Even State Governments, especially those headed by different political parties, clash with the Central Government and issue their own circulars. Example: Maharashtra had issued Trade Circular regarding withdrawal of deemed adoption of GST circulars issued by CBIC. The state government of Maharashtra clearly indicated that they will have parallel set clarifications on the same matters, which will supersede the clarifications issued by the Central government.

Conclusion

- Despite extremely challenging initial years and the pandemic, India's net direct tax collections doubled to more than Rs 1.85 lakh crore in 2021.

- Going forward, the government's efforts to further liberalize GST norms, anti-profiteering measures, digitalization of tax records and proceedings, exchange of data between CBDT and CBIC, simplification of procedures, and lower tax slabs are expected to build a formidable business ecosystem.

- The ease of doing business, growth in manufacturing, increased margins, and the creation of employment opportunities for the country's growing young population will have a positive impact on the tax collections also.

https://epaper.thehindu.com/Home/ShareArticle?OrgId=G359R502B.1&imageview=0