Disclaimer: Copyright infringement not intended.

Context

- The GST Council in its 49th meeting accepted the Group of Ministers’ (GoM) recommendations on the long pending constitution of GST Appellate Tribunal in the country with some modifications.

Overview

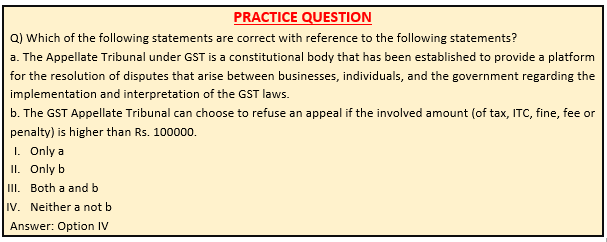

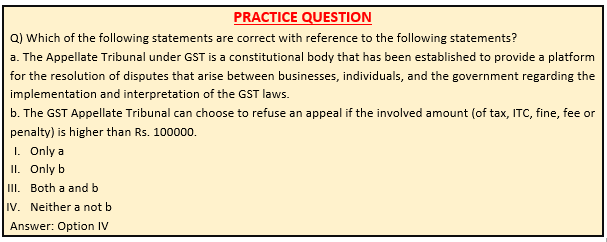

- The Appellate Tribunal under GST is a quasi-judicial body that has been established to provide a platform for the resolution of disputes that arise between businesses, individuals, and the government regarding the implementation and interpretation of the GST laws.

- The Tribunal operates as an appellate authority that hears appeals against the decisions and orders of the lower authorities.

- Under GST, if a person is not satisfied with the decision passed by any lower court, an appeal can be raised to a higher court, the hierarchy for the same is as follows (from low to high):

-

- Adjudicating Authority

- Appellate Authority

- Appellate Tribunal

- High Court

- Supreme Court.

.jpeg)

What is GST Appellate Tribunal?

- The GST Appellate Tribunal (GSTAT) or simply the Appellate Tribunal is the second appeal forum under GSTe. for any dissatisfactory order passed by the First Appellate Authorities, an application for revision of the same can be raised to the National Appellate Tribunal.

- The National Appellate Tribunal is also the first common forum to resolve disputes between the centre and the states.

- Being a common forum, it is the duty of the GST Appellate Tribunal to ensure uniformity in the redressal of disputes arising under GST.

Powers of the Appellate Tribunal under GST

- As per the Code of Civil Procedure, 1908, the GST Appellate Tribunal holds the same powers as the court and is deemed Civil Court for trying a case.

- The Appellate Tribunal has been granted the powers to hear appeals and to pass orders and directions, including those for the recovery of amounts due, for the enforcement of its orders, and for the rectification of mistakes.

- The Tribunal also has the power to impose penalties, revoke or cancel registrations, and take such other measures as may be necessary to ensure compliance with the GST laws.

Jurisdiction of the Appellate Tribunal under GST

- The jurisdiction of the Appellate Tribunal extends to all cases where an appeal has been filed against an order, decision, or direction of a lower authority under the GST laws.

- The Tribunal has the power to hear and resolve disputes related to the assessment of taxes, determination of liability, imposition of penalties, and other matters related to the implementation and interpretation of the GST laws.

Constitution of the GST Appellate Tribunal

The GSTAT has the following structure:

- National Bench: The National Appellate Tribunal is situated in New Delhi, and constitutes a National President (Head) along with 2 Technical Members (1 from the Centre and one State each).

- Regional Benches:On the recommendations of the GST Council, the government can constitute (by notification) an ‘N’ number of Regional Benches, as required. As of now, there are 3 Regional Benches (situated in Mumbai, Kolkata, and Hyderabad) in India, wherein each bench constitutes a Judicial Member and 2 Technical Members(for Centre and State each).

- State Bench and Area Bench: The Government, on the recommendations of the GST council, has notified the a number of State Benches.

Furthermore, on receipt of a request from any State Government, the government can constitute an ‘N’ number of Area Benches in that State, as may be recommended by the Council. Every State Bench and Area Bench of the Appellate Tribunal shall consist of a Judicial Member, one Technical Member (Centre), and one Technical Member (State) and the State Government may designate the senior most Judicial Member in a State as the State President.

P.S: The qualifications, eligibility and appointment of the National President, Judicial and CGST Members will be as per the recommendations of the Council.

Appealing to the GST Appellate Tribunal (GSTAT)

- Any person, who is unhappy with the decision of the First Appellate Authority,can raise an appeal for the revision of the order to the GST Appellate Tribunal (Appellate Tribunal). However, the application will be valid only if it is raised within a time span of 3 months from the date of appeal along with the FORM GST APL-05 and applicable fees.

- In the appeal, the appellant is required to provide grounds of appeal and a form of verification, along with the hard copy of the appeal and a certified copy of the decision before the Appellate Authority within 7 days of filing the appeal electronically. Once the appeal is filed, an acknowledgement indicating the appeal number will be issued in Form GST APL 02.

Procedure for filing an appeal with the Appellate Tribunal under GST

The procedure for filing an appeal with the Appellate Tribunal involves the following steps:

- The aggrieved party must file a written appeal with the Tribunal within 30 days of the receipt of the order, decision, or direction of the lower authority.

- The appeal must be accompanied by a copy of the order, decision, or direction being appealed against and the necessary fees.

- The Tribunal will then issue a notice to the respondent, who must file a reply within 30 days.

- The Tribunal may then hold a hearing to resolve the dispute, during which both the aggrieved party and the respondent may present their arguments and evidence.

- The Tribunal will then pass an order or direction that resolves the dispute.

Fees

- The fee applicable on such appeal includes the full amount of tax, interest, fine, and/or penalty, as admitted by the appellant, from the original order, along with 20% of the total amount of tax in dispute.

Decisions of the GST Appellate Tribunal

- The Appellate Tribunal can confirm, modify or annul the order or decision or refer the case back to the First Appellate Authority or the Revisional Authority. The GSTAT can also refer the case back to the original adjudicating authority, with directions for a fresh decision after considering any additional evidence which comes to light

- In case of a difference of opinion, decision will be taken on basis of the majority. However, if the members are equally divided while taking a decision, they can refer the case to the National President or the State President, who can further refer the case to other benches. And the final decision will be taken on the basis of the cumulative majority of the original and the referred bench.

P.S: the Appellate Tribunal is required to pass the decision within 1 year from the date of filing the appeal. However, if the order is stayed by an order of a Court or Tribunal, the period of such stay shall be excluded from the 1 year period.

Communication of the Decision

- The Appellate Tribunal is required to communicate the order passed to both the appellant as well as the First Appellate Authority or the Revisional Authority. A copy of the order will also be sent to the jurisdictional commissioners of CGST and SGST.

- In case of the appeal to be in favour of the appellant, the previously benefitted party will also be notified in regards to the new decision. The Benefitted party will have the option to file a memorandum of cross-objections within 45 days of receiving the notice. This period may be extended for a further 45 days, in case there is sufficient cause for the same.

Amendment of the Decision

- The Appellate Tribunal can amend its order to rectify any apparent mistake within a period of 3 months from the date of the order. The mistake may either be noticed by the Appellate Tribunal itself or may be brought to its notice by the Commissioner or any other party.

- However, any amendment, which may potentially increase the tax liability or decrease the refund or theITC will be done only after a reasonable opportunity of being heard has been given to the concerned party.

Points to be noted

- The GST Appellate Tribunal can choose to refuse an appeal if the involved amount (of tax, ITC, fine, fee or penalty) is lower than Rs. 50,000.

- The GST Appellate Tribunal can adjourn the hearing of the appeal for a maximum 3 times. The reasons for adjournment must be recorded in writing.

- In case the fees deposited by the appellant need to be refunded (by an order of Appellate Authority/Tribunal) but is not refunded within 60 days timespan, an 18% interest will be payable on the refund (accounting from the date of payment). For further revision of order, the appellant can raise an appeal to the high court.

RECENT MODIFICATIONS DONE IN THE 49TH MEETING OF GST COUNCIL

- GoM has recommended one technical member on a 50:50 basis from the state and the centre, plus one judicial member.

- The modification was suggested that it should be two plus two. However, the decision-making will be only with at most one plus one or less than one, so the four won’t sit. So, this will allow both the states and centre to have a representative on the technical side the equal representation for the judicial member.

- The states will have a number of benches depending upon the density of businesses, though the GST council will approve it.

- No interest of the state will suffer in terms of location, number of representations and the benches.

- In addition, in a bid to plug the leakages and improve the revenue collection from the commodities like pan masala, gutkha, chewing tobacco, the Council approved the recommendations of the GoM.

GST Council

- It is a constitutional body for making recommendations to the Union and State Government on issues related to Goods and Service Tax.

- The GST Council is chaired by the Union Finance Minister and other members are the Union State Minister of Revenue or Finance and Ministers in-charge of Finance or Taxation of all the States.

- As per Article 279A of the amended Constitution, the GST Council that will be a joint forum of the Centre and the States.

- The Goods and Services Tax Council make recommendations to the Union and the States on—

- The taxes, cesses and surcharges levied by the Union, the States and the local bodies which may be subsumed in the goods and services tax;

- The goods and services that may be subjected to, or exempted from the goods and services tax;

- Model Goods and Services Tax Laws, principles of levy, apportionment of Goods and Services Tax levied on supplies in the course of inter-State trade or commerce under article 269A and the principles that govern the place of supply;

- The threshold limit of turnover below which goods and services may be exempted from goods and services tax;

- The rates including floor rates with bands of goods and services tax;

- Any special rate or rates for a specified period, to raise additional resources during any natural calamity or disaster;

- Special provision with respect to the States of Arunachal Pradesh, Assam, Jammu and Kashmir, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura, Himachal Pradesh and Uttarakhand; and any other matter relating to the goods and services tax, as the Council may decide.

- One-half of the total number of Members of the Goods and Services Tax Council shall constitute the quorum at its meetings.

- Every decision of the Goods and Services Tax Council shall be taken at a meeting, by a majority of not less than three-fourths of the weighted votes of the members present and voting

The Goods and Services Tax Council establish a mechanism to adjudicate any dispute —

- Between the Government of India and one or more States; or

- Between the Government of India and any State or States on one side and one or more other States on the other side; or between two or more States, arising out of the recommendations of the Council or implementation thereof

https://www.thehindu.com/business/Economy/gst-council-reaches-broad-consensus-on-setting-up-gst-appellate-tribunal-likely-to-be-included-in-finance-bill-2023/article66525069.ece