Description

Copyright infringement not intended

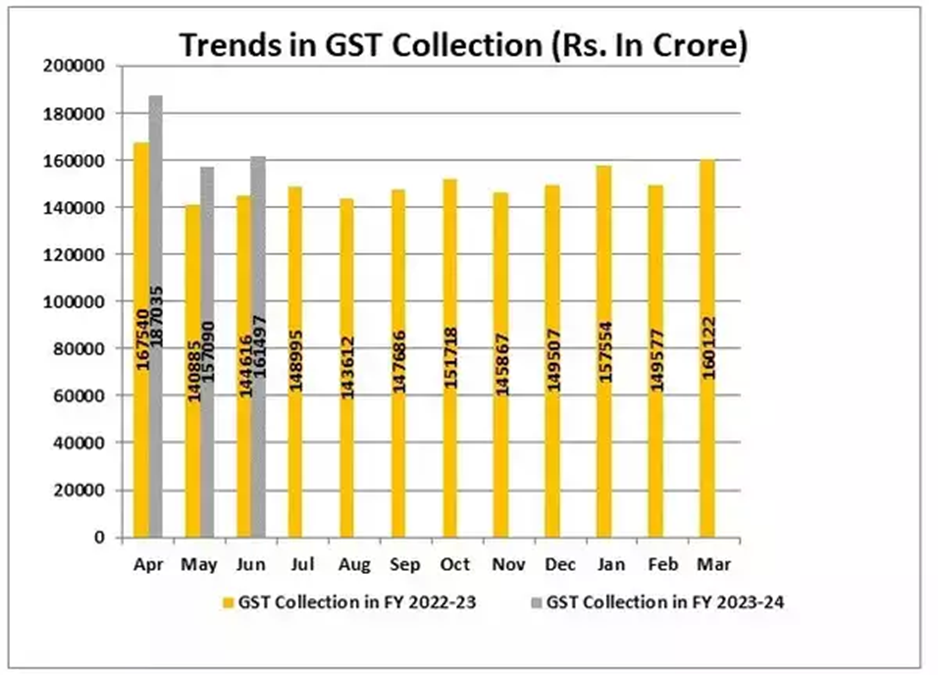

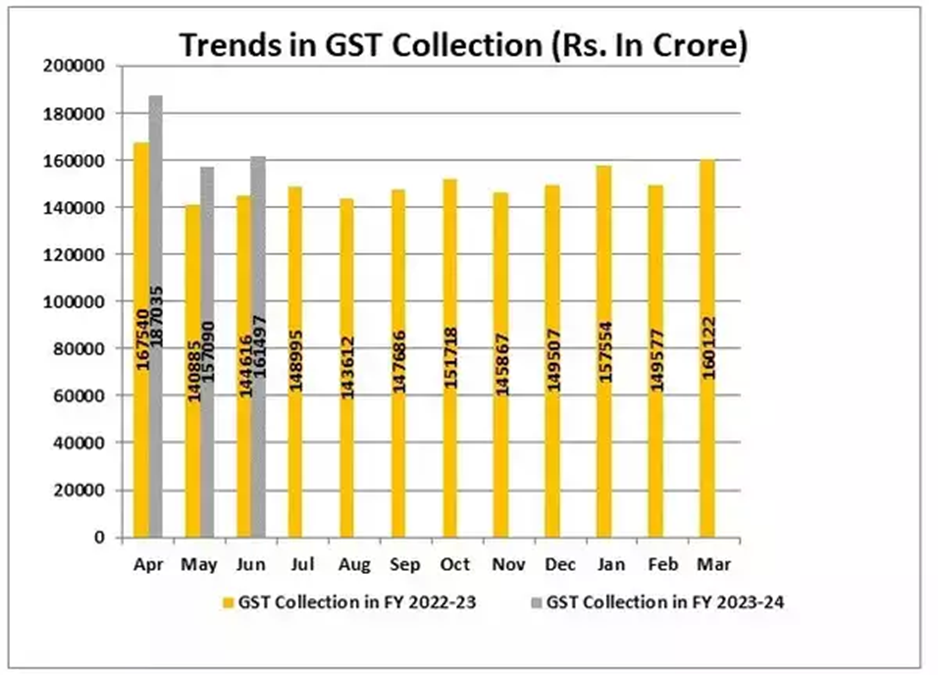

Context: The Union finance ministry announced that the gross GST revenue collected in June 2023 was Rs 1,61,497 crore, which is 12% higher than in June 2022.

Details

- The gross GST revenue consists of;

- Rs 31,013 crore of CGST

- Rs 38,292 crore of SGST

- Rs 80,292 crore of IGST (including Rs 39,035 crore collected on import of goods)

- Rs 11,900 crore of cess (including Rs 1,028 crore collected on import of goods).

- This is the fourth time that the gross GST collection has exceeded Rs 1.60 lakh crore

Reasons for the Increase in GST Revenue

Improvement in economic activity

- One of the main reasons for the increase in GST revenue is the improvement in economic activity and consumption demand as the vaccination drive has picked up pace and restrictions have been eased.

- According to the Ministry of Finance, the GST revenues for June 2023 are 12% higher than the GST revenues in the same month last year, which indicates a recovery from the impact of the second wave of COVID-19.

- The GST revenues for June 2023 are higher than the average of GST revenues in the last three months, which shows a positive trend in growth.

Enhanced compliance

- Another reason for the increase in GST revenue is the enhanced compliance and anti-evasion measures taken by the government.

- The government has introduced several reforms such as e-invoicing, e-way bills, Aadhaar authentication, data analytics, and artificial intelligence to plug leakages and prevent tax evasion.

- The government has also taken strict action against fake invoice frauds and bogus firms.

An increase in GST revenue is significant for several reasons

- It reflects the resilience and robustness of the Indian economy, which has bounced back from the adverse effects of COVID-19.

- It provides much-needed fiscal space for both the Centre and the States to meet their expenditure commitments and support economic recovery.

- It enhances the credibility and stability of the GST system, which is one of the most ambitious and complex indirect tax reforms in India's history.

However, there is still scope for further improvement in the GST system to make it more efficient, equitable, and transparent.

Some of the areas that need attention are:

Simplification of GST rates and slabs

- The current GST structure has multiple rates and slabs ranging from 0% to 28%, with several exemptions and cesses. This creates confusion, distortion, and litigation among taxpayers and tax authorities.

- The rationalization of GST rates and slabs would reduce compliance costs, improve tax buoyancy, and eliminate classification disputes.

Harmonization of GST laws and procedures

- The current GST system has dual administration by both the Centre and the States, which leads to duplication, divergence, and complexity in GST laws and procedures.

- A harmonization of GST laws and procedures would ensure uniformity, consistency, and ease of doing business across India.

Expansion of GST base

- The current GST system excludes some key sectors such as petroleum products, alcohol, electricity, real estate, and health care from its ambit. This reduces the potential revenue from GST and creates cascading effects on other sectors.

- An expansion of the GST base would broaden the tax base, increase revenue collections, and improve efficiency.

Strengthening of GST Council

- The GST Council is a constitutional body that comprises representatives from both the Centre and the States. It is responsible for making decisions on all matters related to GST. The GST Council has played a vital role in ensuring consensus and cooperation among all stakeholders in implementing GST.

- However, there have been instances of disagreements and delays in resolving contentious issues such as compensation to States, dispute resolution mechanism, and revenue-sharing formulas.

- A strengthening of the GST Council would enhance its effectiveness, accountability, and responsiveness.

Conclusion

- The increase in gross GST revenue is a welcome sign for India's economic recovery and fiscal health. However, it should not lead to complacency or overconfidence. There is still a need for constant vigilance, innovation, and reform to make GST a truly transformative tax system that benefits all stakeholders.

Must-Read Articles:

GST: https://www.iasgyan.in/daily-current-affairs/gst-31

|

PRACTICE QUESTION

Q. Which of these is not a component of GST in India?

1. Central GST (CGST)

2. State GST (SGST)

3. Integrated GST (IGST)

4. Union GST (UGST)

How many of the above code is/are correct?

A) Only 1

B) Only 2

C) Only 3

D) All

Answer: C

Explanation: UGST is not a component of GST in India. The components of GST are CGST, SGST and IGST. CGST is collected by the central government, SGST by the state governments and IGST by the central government on inter-state supplies.

|

https://timesofindia.indiatimes.com/business/india-business/gst-grows-12-to-over-rs-1-61-lakh-crore-in-june/articleshow/101415501.cms