Description

.jpg)

Disclaimer: Copyright infringement not intended.

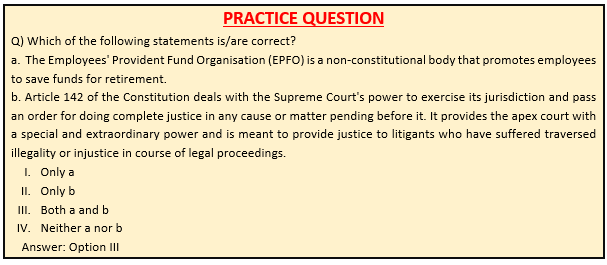

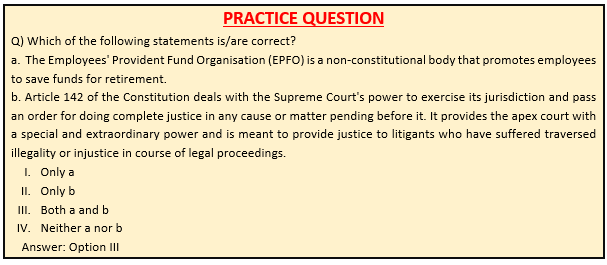

Context

- The Employees’ Provident Fund Organisation (EPFO) has issued guidelines to allow a section of its older members to opt for higher pension under the Employees’ Pension Scheme (EPS).

What is the pension structure that exists currently?

- The Employees’ Provident Funds and Miscellaneous Provisions Act, 1952 did not provide for a pension scheme. The EPS, administered by the EPFO, came into being in 1995. The pension fund was to comprise a deposit of 8.33% of the employers’ contribution towards the PF corpus.

- Both employees and employers contribute 12% of the employee’s basic salary, dearness allowance and retaining allowance, if any, to the EPF. The employee’s entire contribution goes to EPF, while the 12% contribution by the employer is split as 3.67% to EPF and 8.33% to EPS.

- The Government of India contributes 1.16% for an employee’s pension. Employees do not contribute to the pension scheme.

- At the time of introduction of EPS, the maximum pensionable salary was Rs 5,000 per month. This was subsequently raised to Rs 6,500 and, from September 1, 2014, to Rs 15,000. The pension contribution currently is 8.33% of Rs 15,000, that is, Rs 1,250 — unless the employee and employer have opted to contribute at actual basic salary exceeding the pensionable salary.

.jpeg)

Who gets pension under the EPS, and how much?

- The EPS provides employees with pension after the age of 58, if they have rendered at least 10 years of service and retired at age 58. If a member leaves employment between ages 50 and 57, they can avail early (reduced) pension.

- The monthly pension is computed according to this formula:

Monthly pension = pensionable salary x pensionable service / 70, based on a pro rata basis linked to maximum monthly pensionable salary of Rs 6,500 for pensionable service up to September 1, 2014, and Rs 15,000 thereafter.

- Under the pre-amendment scheme, the pensionable salary was computed as the average of the salary drawn during the 12 months prior to exit from membership of the pension fund. The 2014 amendments raised this to an average of 60 months prior to exit.

What were the 2014 amendments in EPS?

- The amendments of August 22, 2014 raised the pensionable salary cap to Rs 15,000 a month from Rs 6,500, and allowed members along with their employers to contribute 8.33% on their actual salaries (if it exceeded the cap) towards EPS.

- It gave all EPS members as on September 1, 2014 six months to opt for the amended scheme, extendable by another six months at the discretion of the Regional Provident Fund Commissioner.

- Members opting for pension linked to actual salaries exceeding the wage ceiling were required to contribute an additional 1.16% of their salary towards the pension fund.

- Those who did not exercise the option within the stipulated or extended period were deemed to have not opted for contribution over the pensionable salary cap and the extra contributions already made to the pension fund were to be diverted to the provident fund account of the member, along with interest.

MUST READ ARTICLE: https://www.iasgyan.in/daily-current-affairs/employee-pension-scheme

https://indianexpress.com/article/explained/explained-economics/what-is-the-higher-pension-option-offered-by-epfo-8461387/

.jpg)

.jpg)