Disclaimer: Copyright infringement not intended.

Context

- Reserve Bank of India (RBI) announced a 40-basis-point hike in the key Repo Rate - the key lending rate.

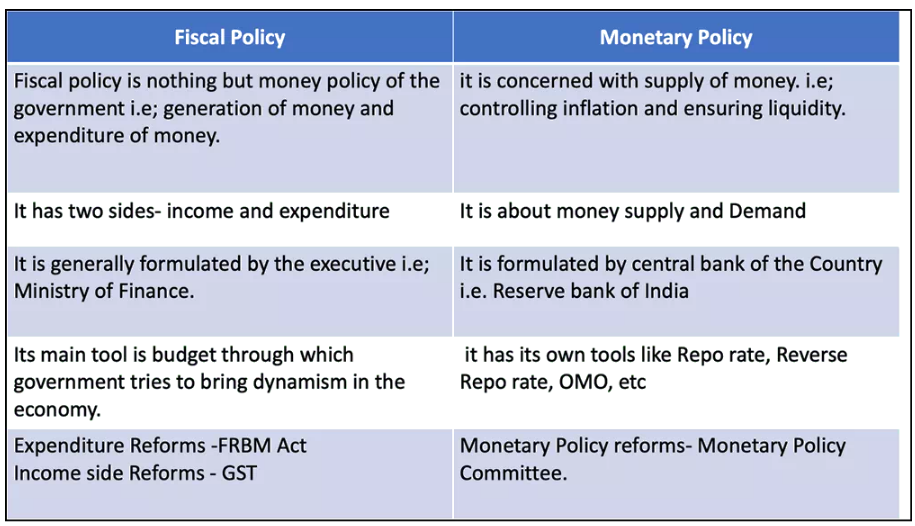

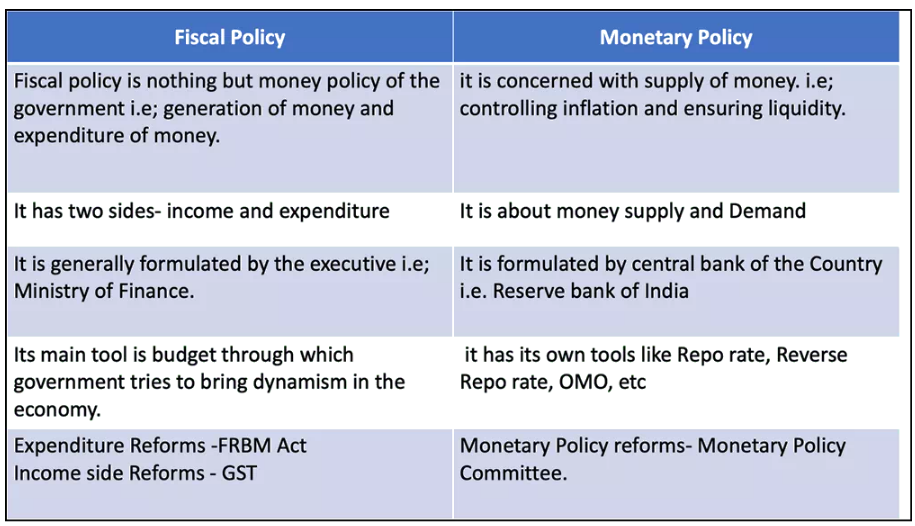

BACKGROUND

Monetary policy

- It is the macroeconomic policylaid down by the central bank-RBI.

- Monetary policy is a set of tools that a nation's central bank has available to promote sustainable economic growth by controlling the interest rate and the overall supply of money that is available to the nation's banks, its consumers, and its businesses.

- It is the demand side economic policy that is used by the government of a country to achieve macroeconomic objectives like inflation, consumption, growth and liquidity.

- In India, monetary policy of the Reserve Bank of India is aimed at managing the quantity of money in order to meet the requirements of different sectors of the economy and to increase the pace of economic growth.

- The RBI implements the monetary policy through open market operations, bank rate policy, reserve system, credit control policy, moral persuasion and through many other instruments.

- Using any of these instruments will lead to changes in the interest rate, or the money supply in the economy.

Types of Monetary Policy

Expansionary Monetary Policy

- This is a monetary policy that aims to increase the money supply in the economy by decreasing interest rates, purchasing government securities by central banks, and lowering the reserve requirements for banks.

- An expansionary policy lowers unemployment and stimulates business activities and consumer spending.

- The overall goal of the expansionary monetary policy is to fuel economic growth. However, it can also possibly lead to higher inflation.

Contractionary Monetary Policy

- The goal of a contractionary monetary policy is to decrease the money supply in the economy.

- It can be achieved by raising interest rates, selling government bonds, and increasing the reserve requirements for banks.

- The contractionary policy is utilized when the government wants to control inflation levels.

Objectives of Monetary Policy

- The primary objectives of monetary policies are the management of inflation or unemployment, and maintenance of currency exchange rates - Fixed vs. Pegged Exchange Rates.

- Foreign currency exchange rates measure one currency's strength relative to another.

- The strength of a currency depends on a number of factors such as its inflation rate, prevailing interest rates in its home country, or the stability of the government, to name a few.

Inflation

- Monetary policies can target inflation levels. A low level of inflation is considered to be healthy for the economy. If inflation is high, a contractionary policy can address this issue.

Read about inflation here: https://www.iasgyan.in/blogs/inflation-all-you-need-to-know

Unemployment

- Monetary policies can influence the level of unemployment in the economy.

- For example, an expansionary monetary policy generally decreases unemployment because the higher money supply stimulates business activities that lead to the expansion of the job market.

Currency exchange rates

- Using its fiscal authority, a central bank can regulate the exchange rates between domestic and foreign currencies.

- For example, the central bank may increase the money supply by issuing more currency.

- In such a case, the domestic currency becomes cheaper relative to its foreign counterparts.

Monetary Policy Tools

- To control inflation, the Reserve Bank of India needs to decrease the supply of money or increase cost of fund in order to keep the demand of goods and services in control.

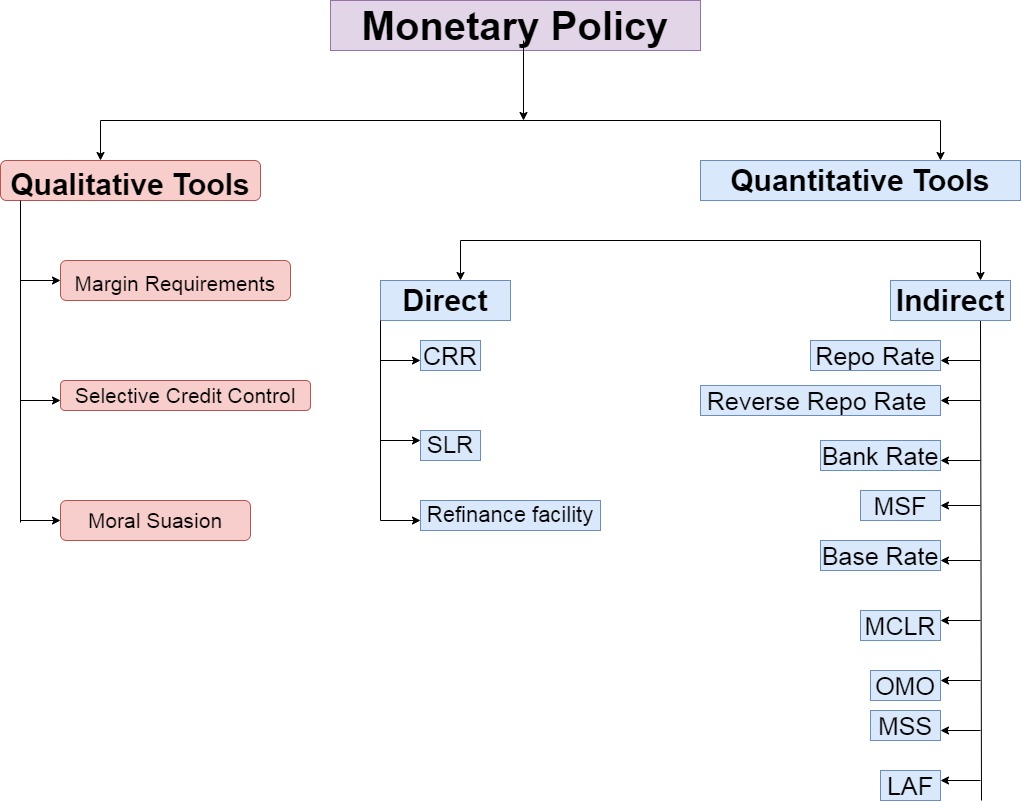

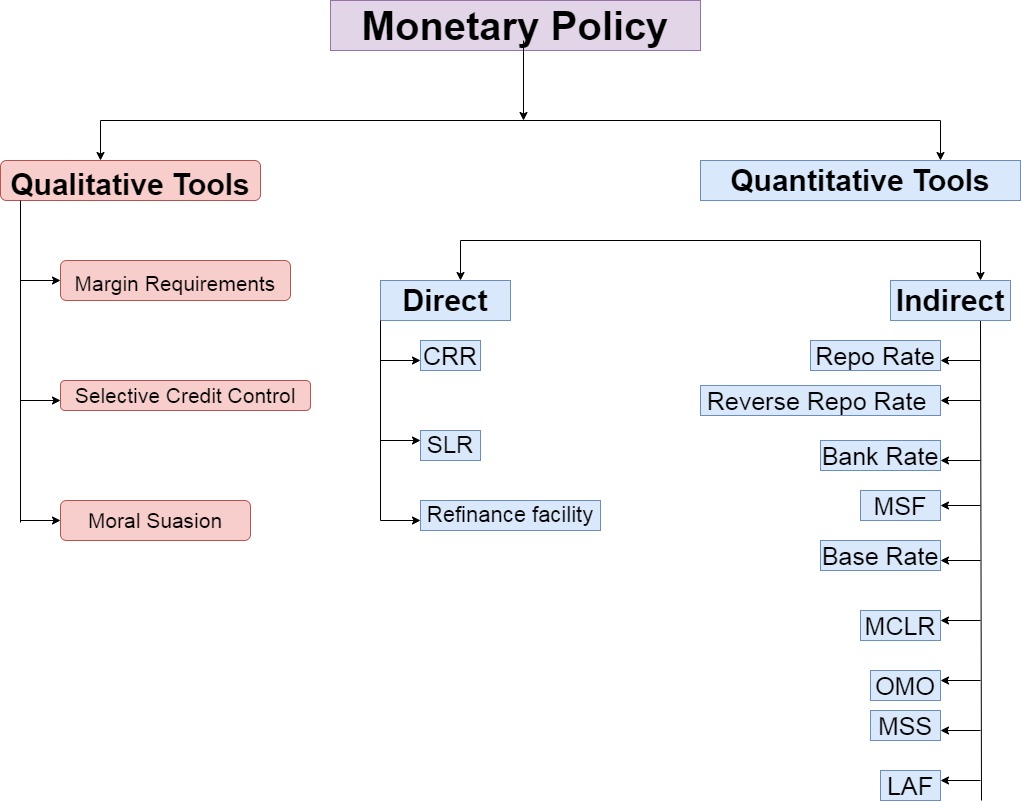

- RBI Monetary Policy instruments are divided into two category qualitative instruments and quantitative instruments.

QUANTITATIVE TOOLS

The tools applied by the policy that impact money supply in the entire economy, including sectors such as manufacturing, agriculture, automobile, housing, etc.

- Reserve Rate [CRR AND SLR]

- Banks are required to keep aside a set percentage of cash reserves or RBI approved assets. Reserve ratio is of two types:

- Cash Reserve Ratio (CRR) – Banks are required to set aside this portion in cash with the RBI. The bank can neither lend it to anyone nor can it earn any interest rate or profit on CRR.

- Statutory Liquidity Ratio (SLR) – Banks are required to set aside this portion in liquid assets such as gold or RBI approved securities such as government securities. Banks are allowed to earn interest on these securities, however it is very low.

- Open Market Operations (OMO):

- In order to control money supply, the RBI buys and sells government securities in the open market. These operations conducted by the Central Bank in the open market are referred to as Open Market Operations.

- When the RBI sells government securities, the liquidity is sucked from the market, and the exact opposite happens when RBI buys securities. The latter is done to control inflation. The objective of OMOs is to keep a check on temporary liquidity mismatches in the market, owing to foreign capital flow.

3. Market Stabilization Scheme (MSS)

[Policy Rates]

- Bank rate – The interest rate at which RBI lends long term funds to banks is referred to as the bank rate. However, presently RBI does not entirely control money supply via the bank rate. It uses Liquidity Adjustment Facility (LAF) – repo rateas one of the significant tools to establish control over money supply.

Bank rate is used to prescribe penalty to the bank if it does not maintain the prescribed SLR or CRR.

- Liquidity Adjustment Facility (LAF) – RBI uses LAF as an instrument to adjust liquidity and money supply. The following types of LAF are:

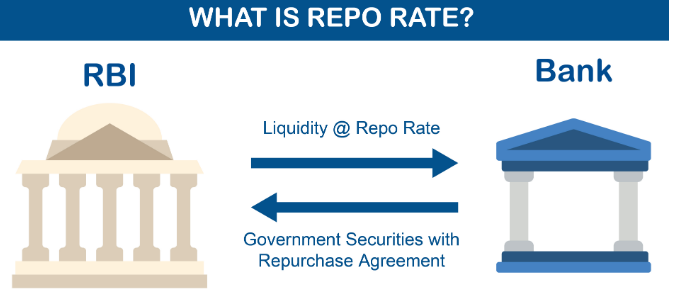

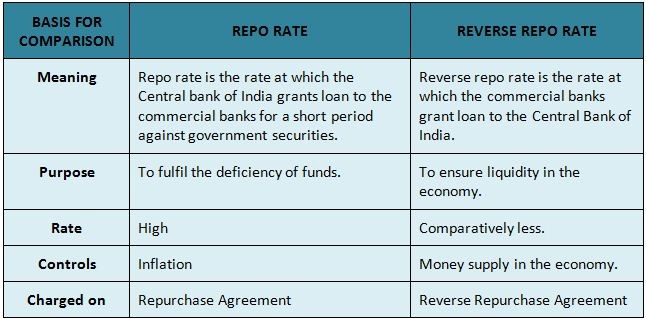

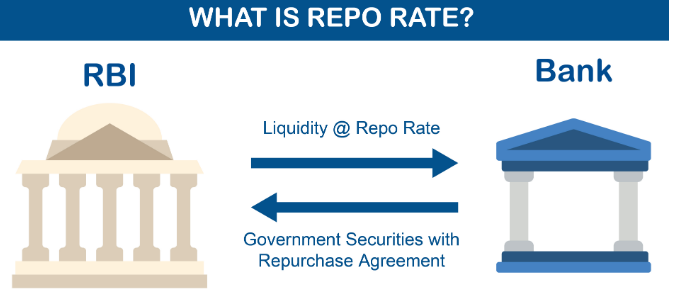

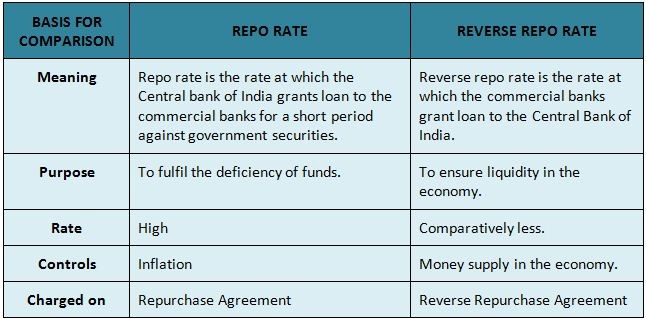

- Repo rate:Repo rate is the rate at which banks borrow from RBI on a short-term basis against a repurchase agreement. Under this policy, banks are required to provide government securities as collateral and later buy them back after a pre-defined time.

- Reverse Repo rate:It is the reverse of repo rate, i.e., this is the rate RBI pays to banks in order to keep additional funds in RBI. It is linked to repo rate in the following way:

Reverse Repo Rate = Repo Rate – 1

- Marginal Standing Facility (MSF) Rate:MSF Rate is the penal rate at which the Central Bank lends money to banks, over the rate available under the rep policy. Banks availing MSF Rate can use a maximum of 1% of SLR securities.

MSF Rate = Repo Rate + 1

QUALITATIVE TOOLS

Unlike quantitative tools which have a direct effect on the entire economy’s money supply, qualitative tools are selective tools that have an effect in the money supply of a specific sector of the economy.

- Margin requirements – The RBI prescribes a certain margin against collateral, which in turn impacts the borrowing habit of customers. When the margin requirements are raised by the RBI, customers will be able to borrow less.

- Moral suasion – By way of persuasion, the RBI convinces banks to keep money in government securities, rather than certain sectors.

- Selective credit control – Controlling credit by not lending to selective industries or speculative businesses.

Monetary Policy Committee

- About: MPC is a government-constituted body of the RBI, which is responsible for framing the monetary policy of the country, using the tools like repo rate, reverse repo rate, bank rates etc.

- Proposal: Urjit Patel Committee was the first committee who proposed the Monetary Policy Committee (MPC).The first meeting of MPC was conducted on 3rd October 2016 in Mumbai.

- Mandate: Prime objective of RBI MPC is to determine the policy interest rate required to achieve the inflation target.

- Act: RBI Act, 1934 empowers the RBI to take Monetary Policy Decisions.

- Meetings: The meetings of the Monetary Policy Committee are held at least 4 times a year(specifically, at least once BIMONTHLY) and it publishes its decisions after each such meeting.

- Composition: The committee comprises six members - three officials of the Reserve Bank of India and three external members nominated by the Government of India.

The Governor of Reserve Bank of India is the chairperson ex officio of the committee.

- Term: each member has tenure of four years.

- Confidentiality: They need to observe a "silent period" seven days before and after the rate decision for "utmost confidentiality".

- Decision: Decisions are taken by majority with the Governor having the casting vote in case of a tie. MPC decisions are taken by voting, where a simple majority (4 out of 6) is necessary for a decision to be passed.

- Inflation targets:

Targeted consumer price index (CPI) inflation rate is= 4%

Upper tolerance limit of inflation is = Target inflation rate + 2% = (4% + 2%) =6%

Lower tolerance limit of inflation is = Target inflation rate – 2% = (4% – 2%) =2%

Targeted consumer price index (CPI) inflation rate period from = April 1, 2021

Targeted consumer price index (CPI) inflation rate period up to = March 31, 2026

The Recent sudden rise in repo rate and other policy rates

- The Monetary Policy Committee of Reserve Bank of India, which met from 6-8 June 2022, has unanimously decided to hike the Repo Rate by 50 basis points to 4.90 %

- Consequently, Standing Deposit Facility Rate stands adjusted to 4.65% and Marginal Standing Facility rate and Bank Rate to 5.15%

- The MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth.

Inflation

Assuming normal monsoon in 2022 and average crude oil price of $105 per barrel in Indian basket, inflation is projected at 6.7% in 2022-23

Growth forecast

The MPC has observed that the global economy continues to grapple with multi-decadal high inflation and slowing growth, persisting geopolitical tensions and sanctions, elevated prices of crude oil and other commodities and lingering COVID-19 related supply chain bottlenecks.

- Economic indicators for April –May indicate a broadening of the recovery in economic activity in India. Urban demand is recovering and rural demand is gradually improving. Merchandise exports posted robust double-digit growth for the fifteenth month in a row during May while non-oil non-gold imports continued to expand at a healthy pace, pointing to recovery of domestic demand.

- Real GDP growth for 2022-23 is estimated at 7.2%

Q1 - 16.2%

Q2 - 6.2%

Q3 - 4.1%

Q4 - 4.0%

- According to NSO provisional estimates released on May 31, India's GDP growth in 2021-22 is estimated at 8.7%, higher than pre-pandemic level.

Measures to benefit Cooperative Banks

- Taking into account the increase in housing prices since the limits were last revised and considering the customer needs, it has been decided to increase the existing limits on individual housing loans by cooperative banks. Accordingly, the limits for Tier I /Tier II UCBs shall stand revised from ₹30 lakh/ ₹70 lakh to ₹60 lakh/ ₹140 lakh, respectively. As regards RCBs, the limits shall increase from ₹20 lakh to ₹50 lakh for RCBs with assessed

- net worth less than ₹100 crore; and from ₹30 lakh to ₹75 lakh for other RCBs.

- Urban cooperative banks can now extend doorstep banking services to customers Will enable these banks to better meet the needs of their customers, especially senior citizens and differently abled persons-

- Rural cooperative banks can now extend finance to commercial real estate (loans to residential housing projects) within existing aggregate housing finance limit of 5% of total assets

Enhancement of limit on e-mandate transactions

- To further augment customer convenience and facilitate recurring payments like subscriptions, insurance premia and education fees of larger value, limit per transcation for e-mandate based recurring payments increased from Rs 5,000 to Rs 15,000

Enhancing scope of UPI payment system.

- Now, credit cards too can be linked with UPI platform, beginning with RuPay cards. This will provide additional convenience to users and enhance scope of digital payments. UPI has become the most inclusive mode of payment in India. Currently, over 26 crore unique users and 5 crore merchants are onboarded on the UPI platform.

Why has the RBI increased the repo rate?

- RBI has increased the repo rate due to rising inflation, geopolitical tensions, high crude oil prices, and shortage of commodities globally, which have impacted the Indian economy.

- Monetary policy action is aimed at containing inflation spike and re-anchoring inflation expectation. High inflation is known as detrimental to growth.

Impact

[Stock market]

- An increase in interest rates means an increase in savings and a reduction in the flow of capital to the economy, which results in slump in stock markets.

- The stock market and the interest rates have an inverse relationship. Every time the central bank increases the repo rate, it prompts companies to also cut back on the spending on the expansion, which leads to a dip in growth and affects the profit and future cash flows, resulting in a fall in stock prices.

[Loan and EMI Rates]

- The increase in repo rate will push banks and non-banking financial companies (NBFCs) to hike lending and deposit rates.

- This means the interest rates on loans will go up. Equated monthly installments (EMIs) on home, vehicle and other personal and corporate loans are likely to rise.

[Unequal impact]

- Capital-intensive sectors such as capital goods, infrastructure, etc, are more vulnerable to these changes due to high capital or debt on the books of these companies.

- While stocks of sectors like Information Technology (IT) or Fast-moving consumer goods (FMCG) usually see a lesser impact.

[Inflation]

- During high levels of inflation, RBI makes strong attempts to bring down the flow of money in the economy.

- One way to do this is by increasing the repo rate. This makes borrowing a costly affair for businesses and industries, which in turn slows down investment and money supply in the market.

- As a result, it negatively impacts the growth of the economy, which helps in controlling inflation.

https://indianexpress.com/article/explained/explained-why-did-rbi-hike-repo-rate-by-40-bps-and-crr-by-50-bps-7901070/

1.png)

Array

(

[0] => daily-current-affairs/hike-in-repo-rate-and-crr-8

[1] => daily-current-affairs

[2] => hike-in-repo-rate-and-crr-8

)