Description

Copyright infringement not intended

Picture Courtesy: www.outlookindia.com

Context: Brent crude surpasses $93/bbl, OPEC+ production restraint and declining US inventories drive prices near 2014 highs. Analysts anticipate ongoing tightness due to demand outpacing supply and geopolitical uncertainties elevating risk factors.

Key factors influencing crude oil prices

- Extended Oil Output Cuts: Saudi Arabia and Russia, two major oil-producing countries, extended their voluntary oil output cuts by a combined 1.3 million barrels per day (bpd) until the end of the year. This move tightened the global oil supply, leading to a surge in international crude prices.

- OPEC+ Cuts: In addition to Saudi Arabia and Russia's cuts, the Organization of Petroleum Exporting Countries and its allies (OPEC+) had previously agreed on production cuts running until the end of 2024. These cuts further reduced the global oil supply.

- Brent and WTI Prices: Brent crude futures were trading at $93.22 per barrel, and US West Texas Intermediate (WTI) crude futures were at $89.73 per barrel. These prices indicate the cost of oil in the international and US markets, respectively.

- US Dollar Strength: The US dollar hit a 10-month high, which can have a negative impact on oil prices. Since oil is priced in dollars, a stronger dollar makes it more expensive for importers using other currencies, potentially reducing oil demand.

- Central Bank Policies: The US Federal Reserve and the European Central Bank signalled their commitment to fighting inflation, suggesting that tight monetary policies may persist. Higher interest rates resulting from such policies can slow economic growth, which in turn can curb oil demand.

- Russian Export Ban: Russia had previously imposed a ban on gasoline and diesel exports, but it later softened this stance. Exports of certain products were allowed to proceed, which could influence the global oil supply.

- OPEC Demand Outlook: OPEC revised its global oil demand forecast for 2023 but still anticipated higher demand compared to 2022. The 2024 demand outlook was also reduced. These demand forecasts can impact oil prices as they reflect expectations for future consumption.

- Supply Shortfall: The market was facing a potential supply shortfall of more than 3 million barrels per day in the next quarter due to Saudi Arabia's extended output cuts. This shortfall was expected to be one of the largest deficits in over a decade.

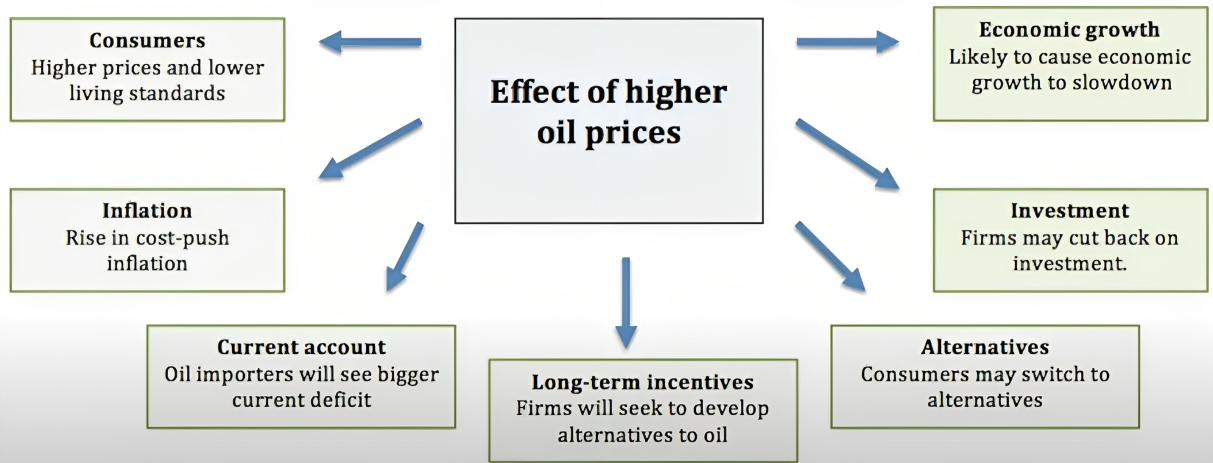

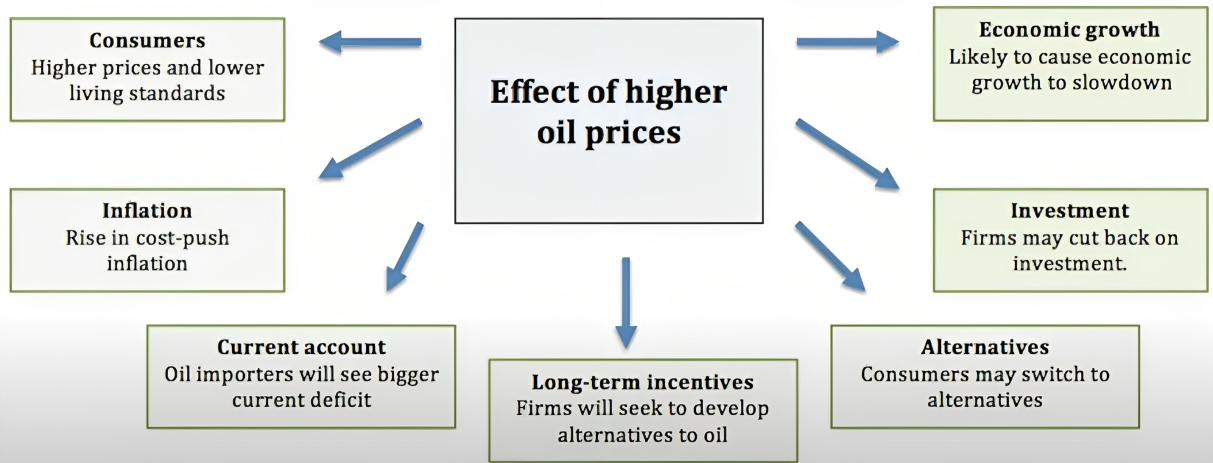

Rising oil prices can have a significant impact on the Indian economy

Current Account Deficit (CAD)

- Rising oil prices lead to higher import costs for crude oil, which India heavily relies on as a net oil importer. When the cost of importing oil increases, it contributes to a larger current account deficit. This deficit reflects the imbalance between India's earnings from exports and its expenditure on imports, particularly oil.

- A larger CAD puts pressure on the country's foreign exchange reserves, as India needs to pay for these imports in foreign currency (usually U.S. dollars). This, in turn, can weaken the country's currency value, affecting the exchange rate and making imports more expensive.

Inflation

- Elevated oil prices have a cascading effect on inflation in India. Higher oil prices result in increased transportation costs, impacting the entire supply chain.

- When transportation costs rise, businesses often pass these costs onto consumers by increasing prices for goods and services. This, in turn, fuels inflationary pressures, impacting the cost of living for citizens. Inflation can erode purchasing power and reduce the real income of individuals and households.

Fiscal Deficit

- To shield consumers from the full impact of oil price hikes, the Indian government often subsidizes certain petroleum products, such as diesel and cooking gas. These subsidies help keep consumer prices stable but strain the government's finances.

- As oil prices rise, the fiscal deficit may increase due to the government's higher subsidy burden. The fiscal deficit is the gap between government revenue and expenditure. A widening fiscal deficit can lead to increased government borrowing, which can have implications for interest rates and the overall health of public finances.

Trade Balance

- Rising oil prices mean that India needs to spend more on oil imports. This has a direct impact on the trade balance, which measures the difference between the value of exports and imports. When imports, particularly oil imports, increase due to higher prices, it can deteriorate the trade balance. A trade deficit, where imports exceed exports, can negatively impact the country's overall economic health and potentially weaken its exchange rate, making imports more expensive.

Energy Costs

- As oil prices rise, so do the costs of energy for industries, businesses, and households. This can have a direct impact on economic competitiveness. Businesses may face higher production costs, leading to reduced profitability. Households may see an increase in their energy bills, reducing disposable income. Higher energy costs can hamper economic growth by reducing both consumer spending and industrial production.

Monetary Policy

- The Reserve Bank of India (RBI) may need to adjust its monetary policy in response to inflationary pressures caused by rising oil prices. One of the tools the RBI uses is interest rates. If inflation rises due to higher oil prices, the RBI may consider increasing interest rates to control inflation. Higher interest rates can impact borrowing costs for businesses and individuals. It can also influence investment decisions and consumer spending patterns, potentially slowing economic growth.

Picture Courtesy: www.economicshelp.org

Steps Taken by India

Strategic Petroleum Reserves (SPR)

- India has been actively building strategic petroleum reserves (SPRs) as a strategic measure to enhance its energy security. These SPRs are large underground storage facilities for crude oil that can be tapped into during times of supply disruptions or sharp price spikes. By maintaining strategic reserves, India aims to reduce its vulnerability to sudden oil supply disruptions, whether due to geopolitical tensions or natural disasters.

Diversification of Energy Sources

- India is making significant investments in diversifying its energy mix by shifting towards renewable energy sources, such as solar and wind power. This diversification aims to reduce the country's heavy reliance on fossil fuels, including oil. By harnessing renewable energy, India not only mitigates the impact of oil price fluctuations but also contributes to environmental sustainability and energy independence.

Fuel Price Reforms

- The Indian government has implemented gradual fuel price reforms, moving towards market-based pricing for petroleum products. Historically, fuel prices in India were heavily subsidized, with the government bearing a significant portion of the cost. However, these subsidies strained the government's budget and posed challenges during periods of high oil prices. By allowing fuel prices to respond more directly to international oil price fluctuations, the government aims to reduce the fiscal burden associated with subsidies and promote market efficiency.

Energy Efficiency Promotion

- India has initiated various energy efficiency measures in industries, transportation, and households. Promoting energy-efficient technologies and practices helps mitigate the impact of rising oil prices on energy costs. This includes the adoption of energy-efficient appliances, improved industrial processes, and the development of energy-efficient transportation systems. Energy efficiency measures not only reduce costs but also contribute to environmental sustainability.

Bilateral Agreements

- India has actively pursued bilateral agreements with oil-producing countries to secure stable oil supplies and prices. These agreements can include long-term contracts, preferential pricing, and assurances of a stable supply of crude oil. By forging such agreements, India seeks to minimize the volatility in its oil supply and protect itself from abrupt price spikes in the global oil market.

Challenges

Political Sensitivity

- Fuel prices are highly politically sensitive in India. Any significant increase in fuel prices, whether due to international oil price fluctuations or government policy changes, can lead to public outrage and protests. This political sensitivity stems from the fact that fuel costs affect the daily lives of millions of Indian citizens. Balancing the need for economic stability and fiscal responsibility with public sentiment regarding fuel prices is a complex challenge for Indian policymakers.

Fiscal Constraints

- The Indian government has historically subsidized fuel prices to shield consumers from the full impact of rising oil prices. However, these subsidies impose a significant fiscal burden on the government's budget. Subsidy expenditures divert resources away from other critical development programs, such as infrastructure, healthcare, and education. Managing fiscal constraints while ensuring energy affordability for citizens is a delicate balancing act for the government

Infrastructure Investment

- Transitioning to renewable energy sources, such as solar and wind power, requires substantial infrastructure investment and time. Developing the necessary infrastructure, including renewable energy generation capacity, energy storage solutions, and a modernized energy grid, is a resource-intensive endeavour. Additionally, the adoption of renewable energy technologies and practices often involves transitioning and retraining the workforce. Addressing these infrastructure challenges while meeting the growing energy demands of a rapidly developing nation like India is a significant long-term undertaking

.jpg)

Way Forward to navigate the challenges posed by rising oil prices

Energy Transition

- Continuing efforts to transition towards renewable energy sources is crucial for India's long-term energy security and environmental sustainability. This transition involves expanding renewable energy capacity, investing in research and development of clean technologies, and incentivizing the adoption of clean energy practices across industries and households. Moreover, promoting energy conservation and efficiency should complement this transition to reduce overall energy consumption

Economic Diversification

- Encouraging economic diversification beyond oil-dependent sectors is essential for India's economic resilience. By promoting the growth of non-oil industries, such as technology, manufacturing, and services, India can reduce its vulnerability to oil price fluctuations. Diversification can also create job opportunities, stimulate innovation, and foster economic growth in sectors less reliant on oil imports.

Enhanced Diplomacy

- Strengthening diplomatic ties with major oil-producing countries is critical for securing stable oil supplies and prices. By engaging in strategic dialogues and partnerships, India can work to ensure a steady flow of oil imports, negotiate favourable terms, and minimize the impact of geopolitical tensions on energy security. Additionally, diversifying sources of oil imports can reduce dependence on a single supplier, enhancing energy resilience.

Public Awareness

- Educating the public about the benefits and challenges of energy transition is vital for garnering support for sustainable energy policies. Public awareness campaigns can help citizens understand the importance of reducing reliance on fossil fuels, the potential for job creation in the renewable energy sector, and the positive environmental impacts. An informed and engaged citizenry can encourage policymakers to prioritize clean energy initiatives and reforms.

Conclusion

- Rising oil prices present multifaceted challenges to the Indian economy, but the country has been taking steps to mitigate these challenges through strategic reserves, diversification, and market-based pricing reforms. The way forward involves continued efforts in energy transition, economic diversification, and diplomatic strategies to ensure energy security and stability in the face of fluctuating oil prices.

Must Read Articles:

RISE IN OIL PRICES AND ITS IMPACT: https://www.iasgyan.in/daily-current-affairs/rise-in-oil-prices-and-its-impact

Crude Oil Prices: https://www.iasgyan.in/daily-current-affairs/crude-oil-prices

OPEC+: https://www.iasgyan.in/daily-current-affairs/opec-9

|

PRACTICE QUESTION

Q. How is India addressing the challenges posed by rising oil prices, and what steps has the country taken to enhance its energy security and economic resilience in the face of fluctuating oil prices?

|