The rise in international trade has led to cross-border insolvency issues, necessitating effective regulation. India's insolvency laws, including the IBC, have not been updated, and the National Company Law Tribunal (NCLT) lacks authority to enforce foreign insolvency judgments. The adoption of the UNCITRAL Model Law and Judicial Insolvency Network could improve coordination and efficiency.

Copyright infringement not intended

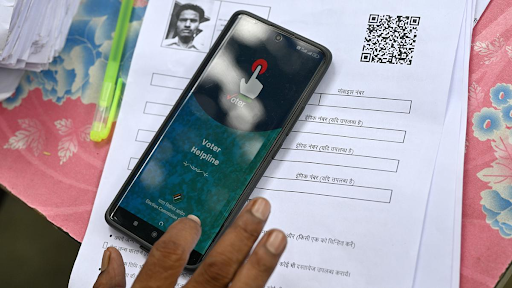

Picture Courtesy: THE HINDU

The growth of international trade contributed to the cross-border insolvency problems, which require effective regulation.

The first insolvency law in India was the Indian Insolvency Act of 1848, followed by the Presidency-Towns Insolvency Act in 1909 and the Provincial Insolvency Act in 1920.

The insolvency laws during the colonial era provided a framework for addressing domestic insolvencies, however, they were not qualified to manage cross-border insolvency cases.

The insolvency laws remained largely unchanged, even though the Third Law Commission (1964) recommended their modernization, however, they were not updated to meet the growing needs of a globalized economy.

The Eradi Committee (2000), Mitra Committee (2001), and Irani Committee (2005) advocated for insolvency law reform and adoption of the United Nations Commission on International Trade Law (UNCITRAL) Model Law on Cross-Border Insolvency 1997.

The Insolvency and Bankruptcy Code (IBC) was introduced in 2016 to address domestic insolvency issues streamline the insolvency process and improve the business environment in India.

Sections 234 and 235 of the Insolvency and Bankruptcy Code (IBC) were introduced to manage cross-border insolvency. However, these sections have not been operationalised.

The National Company Law Tribunal (NCLT) addresses insolvency matters under the IBC, but it lacks the power to recognise or enforce foreign insolvency judgments. This limitation prevents the NCLT from addressing cross-border insolvency cases fully. Even though Rule 11 of the NCLAT Rules (2016) could allow the NCLT to exercise inherent jurisdiction, it hasn’t been implemented in IBC matters.

Since there is no formal framework for cross-border insolvency, Indian courts often rely on ad hoc solutions. While these protocols help in specific cases, such as the Jet Airways case (2019), they are temporary and raise transaction costs, delay resolutions, and often reduce the value of the debtor’s assets.

Communication between Indian and foreign courts in insolvency matters is still slow and inefficient. The traditional method of issuing letters of request is not quick or transparent enough, which creates additional delays and uncertainty for stakeholders.

India has not adopted the UNCITRAL Model Law on Cross-Border Insolvency. This lack of a clear framework for recognising foreign insolvency proceedings leads to inconsistent judicial decisions, as courts often depend on discretionary powers or general principles of comity.

The adoption of the UNCITRAL Model Law will provide India with a globally recognised and structured framework for cross-border insolvency to ensure more predictable outcomes, increase case resolution efficiency, and boost investor confidence in the insolvency system.

Implementing the Judicial Insolvency Network (JIN) Guidelines and Court-to-Court Communication Process will improve coordination between Indian and foreign courts to minimise delays, improve transparency, and streamline the process of resolving cross-border insolvency cases.

The National Company Law Tribunal (NCLT) currently lacks the authority to recognize or enforce foreign judgments, therefore there is a need to expand the NCLT’s powers to allow the NCLT to comprehensively address cross-border insolvency issues, and improve its effectiveness.

Must Read Articles:

INSOLVENCY AND BANKRUPTCY CODE

Source:

|

PRACTICE QUESTION Q.Critically analyze the effectiveness of the Insolvency and Bankruptcy Code (IBC), 2016. (150 words) |

© 2025 iasgyan. All right reserved