Description

Disclaimer: Copyright infringement not intended.

Context

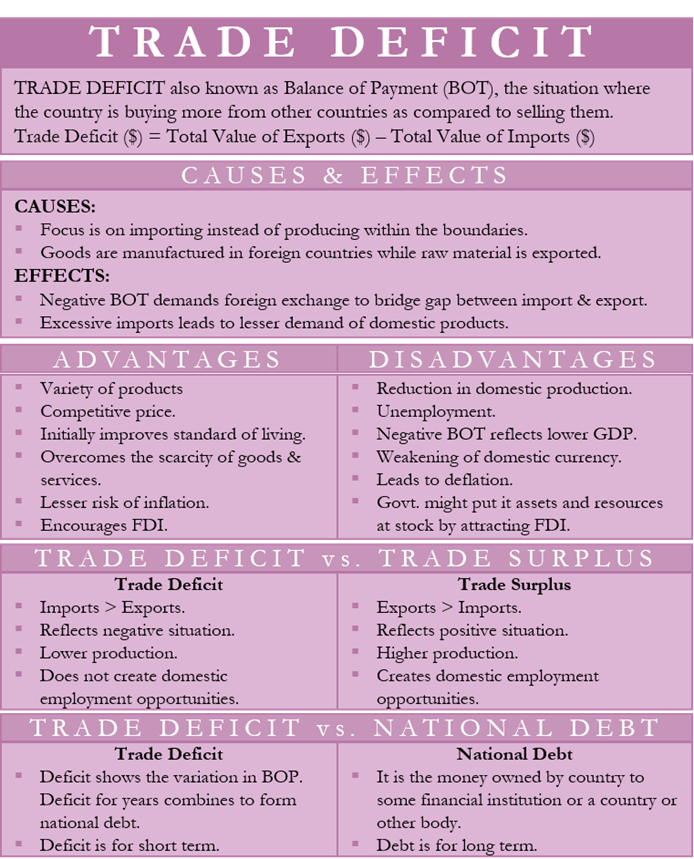

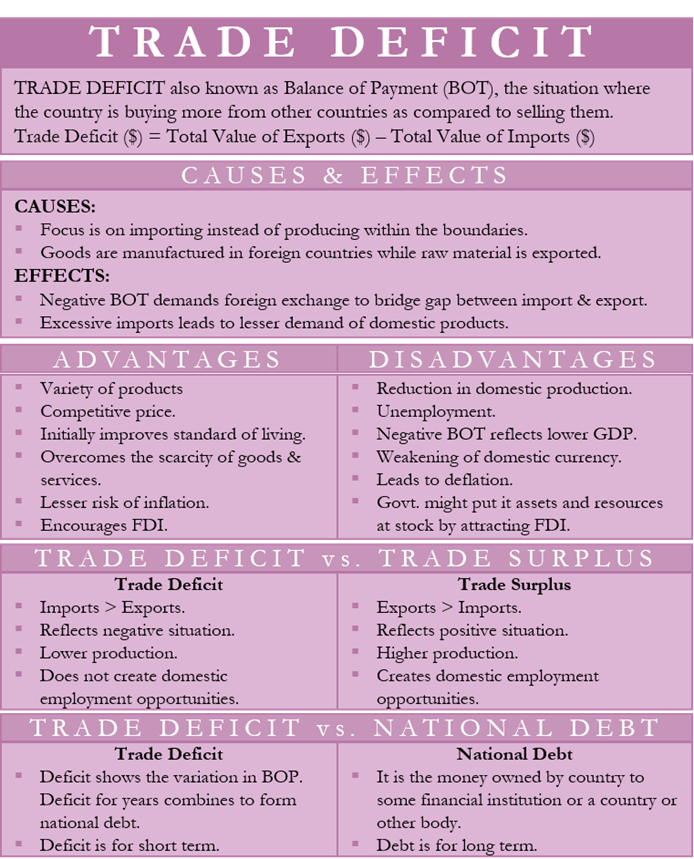

- India’s goods exports declined for the second successive month in March, falling a sharp 13.9% to $38.38 billion while imports dipped 7.9% to $58.11 billion.

Recent Trends: Further details

- Total goods exports in 2022-23 rose 6.03% to $447.46 billion, while the import bill surged by a steeper 16.5% to $714 billion.

- The goods trade deficit rose almost 40% to over $266 billion in 2022-23, compared to $190 billion in 2021-22.

- Despite the global headwinds [Russia-Ukraine War, U.S Fed rate hikes etc], India has surpassed its 2022-23 target of $750 billion dollars to hit $770.18 billion, which is $94 billion higher than last year’s record exports.

Export Items: Performance

- India’s uptick in outbound shipments was largely led by petroleum, up 27% to $94.5 billion, followed by electronics goods that rose 7.9% to $23.6 billion.

- The other three of India’s top five export items registered insignificant growth - Rice (up 1.5%), chemicals (1%), and drugs and pharmaceuticals (0.8%). Petroleum exports now account for 21.1% of total exports, up from 16% in 2021-22.

- Engineering goods, India’s mainstay in goods exports in recent years, shrank 5.1% to $107 billion, bringing down their share in total exports from $26.6% to 23.9%.

- Non-oil exports, contracted 0.5%, and if electronics exports were excluded too, goods shipments were 2.8% lower than 2021-22, which economists called a red flag.

- Important segments like engineering and gems and jewelry witnessed negative growth.

Import Trends

Russia

- India’s imports from Russia grew almost 370% to over $46 billion in 2022-23. Russia’s share in import leaped from 1.6% in 2021-22 to 6.5% last year, making it the fourth largest import source nation for India, behind China, UAE and the USA.

China

- China’s share of goods imports dipped to 13.8% in 2022-23 from 15.4% in 2021-22.

- However, imports from the country still grew 4.2% to reach $98.5 billion last year, while exports to China fell 28% to just $15.3 billion. Indian shipments to China now account for just 3.4% of total exports, from over 5% in 2021-22.

Petroleum

- Petroleum imports jumped about 30% to nearly $210 billion in 2022-23.

Coal

- Coal imports grew at a faster 57% to touch almost $50 billion.

Gold

- Gold imports, fell around 24% to $35 billion as global prices for the metal surged and the Rupee turned weaker.

Country comparison

- The USA remained India’s top export destination, followed by UAE, while Netherlands emerged as the third largest goods buyer, displacing China to the fourth position in 2022-23.

- Netherlands’ share of Indian exports jumped from under 3% in 2021-22 to 4.7%, recording a staggering 66.6% uptick year-on-year.

- Bangladesh and Hong Kong remained in India’s top 10 export markets, although the value of shipments to their shores contracted 27.8% and 9.9%, respectively.

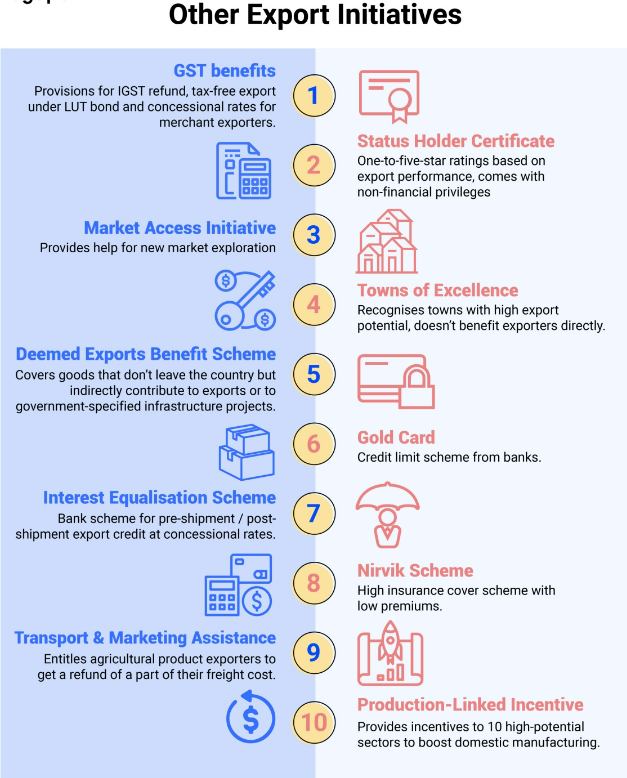

The government has set a two trillion-dollar target for goods and services exports by 2030 under the new Foreign Trade policy.

.jpg)

India’s Recent Trade Policy

- The government unveiled its new Foreign Trade Policy (FTP) which came into force on 1 April, 2023.

- The previous policy, launched in 2015, had to be extended several times due to the pandemic and geo-political developments.

What is the significance of FTPs?

- Under the Foreign Trade Development and Regulation Act, 1992, the government is required to formulate, implement and monitor trade policies to boost exports, facilitate imports and maintain a favourable balance of payments.

- The first five-year export-import (EXIM) policy of 1992 and the second in 1997-2002 aimed to remove many of the post-independence trade protectionist measures and promote India’s integration with the global economy.

- In 2004, the EXIM Policy was renamed FTP to adopt a comprehensive approach to India’s foreign trade. Later, FTPs were issued for 2009-14 and 2015-20.

Did the previous FTP meet its objectives?

- FTP 2015-20 aimed to boost India’s exports from $465 billion in 2013-14 to $900 billion by 2019-20.

- It introduced a new merchandise export from India scheme to provide rewards to exporters to offset infrastructural inefficiencies and associated costs and a services export from India scheme to encourage the exports of notified services.

- At the conclusion of the policy’s initial term in 2019-20, exports of goods and services reached $526.55 billion.

- Export momentum was derailed in 2020-21 by the pandemic and geopolitical tensions.

What is the duration of FTP 2023?

- The government has broken away from the conventional practice of setting a five-year cycle. The new policy is intended to be responsive to changing circumstances and will be modified as and when required.

- Additionally, the government will consistently gather input from relevant stakeholders to enhance and revise the policy.

What are its key thrust areas?

- It has four pillars. These are:

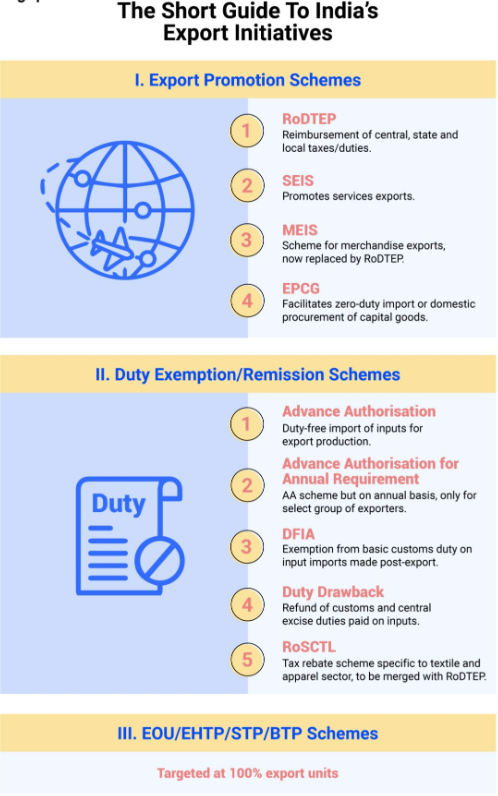

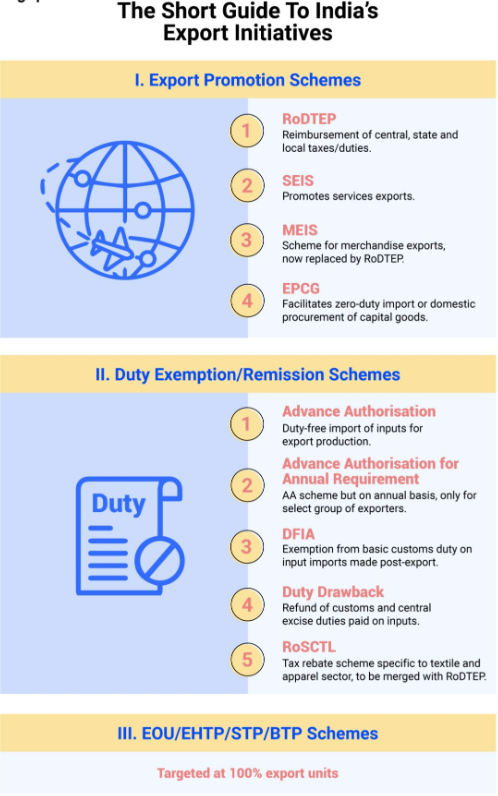

-

- Replacing the incentive-based system of promoting exports with remission and entitlement-based regimes;

- Facilitating enhanced collaboration among exporters, states, districts and indian missions;

- Reducing transaction costs and introducing e-initiatives for ease in business operations; and

- Developing additional export hubs.

- It also intends to simplify the export process for items falling under the Special Chemicals, Organisms, Materials, Equipment, and Technologies (SCOMET).

What are the goals and targets?

- The government aims to increase India’s overall exports to $2 trillion by 2030, with equal contributions from the merchandise and services sectors.

- The government also intends to encourage the use of the Indian currency in cross-border trade, aided by a new payment settlement framework introduced by the RBI in July 2022. This could be particularly advantageous in the case of countries with which India enjoys a trade surplus.

FOREIGN TRADE POLICY 2023: HTTPS://WWW.IASGYAN.IN/DAILY-CURRENT-AFFAIRS/FOREIGN-TRADE-POLICY-2023

Way Ahead

- While the growth trend in exports is laudable, the national and state-level export policies must be aligned for seamless export flows to maintain the pace going forward. To maintain the momentum, some of the key areas of focus are as follows:

-

- Active participation of states to strengthen export infrastructure: For smooth flow of trade, well-established facilities like air cargo, multimodal logistic hubs, ICDs, etc., are vital. Therefore, to drive India’s exports further, states must evaluate the sectoral-based interventions to improve infrastructure for cost-competitive exports.

- Mutually beneficial trade agreements: The new trade agreements must focus on sectors with higher complementarities and potential. In addition, FTA negotiation strategies must be aligned with the self-reliant strategy and the states must actively engage domestic stakeholders to bring their perspectives to the table.

- Trade Monitoring at the State level: To augment the country’s exports, it is imperative to continuously track and monitor progress of various parameters such as export growth trends, status of logistics and infrastructure facilities, progress of export action plans, progress against the gaps in indices of trades, etc at the state level. For this, a crystal-clear plan is to be developed for rigorous trade monitoring.

- With improved domestic capabilities and alignment of Government and industries’ objectives, India can become a global manufacturing powerhouse.

Trivia

READ: https://www.iasgyan.in/daily-current-affairs/indias-international-trade-32

|

PRACTICE QUESTION

Q. While the growth trend in India’s exports is laudable, the national and state-level export policies must be aligned for seamless export flows to maintain the pace going forward. Highlight some of the key areas of focus needed to make India - a global manufacturing powerhouse.

|

https://www.thehindu.com/business/Economy/indias-goods-exports-up-6-to-reach-44746-bn-in-2022-23-commerce-secretary/article66732532.ece