Description

GS PAPER II: Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

Context: State-owned Power Grid Corporation of India (PGCIL), the largest power transmission company, launched its infrastructure investment trust (InvIT), becoming the first public sector company to do so.

- PGInvIT has offered a price band of Rs 99-100 per unit for the public issue.

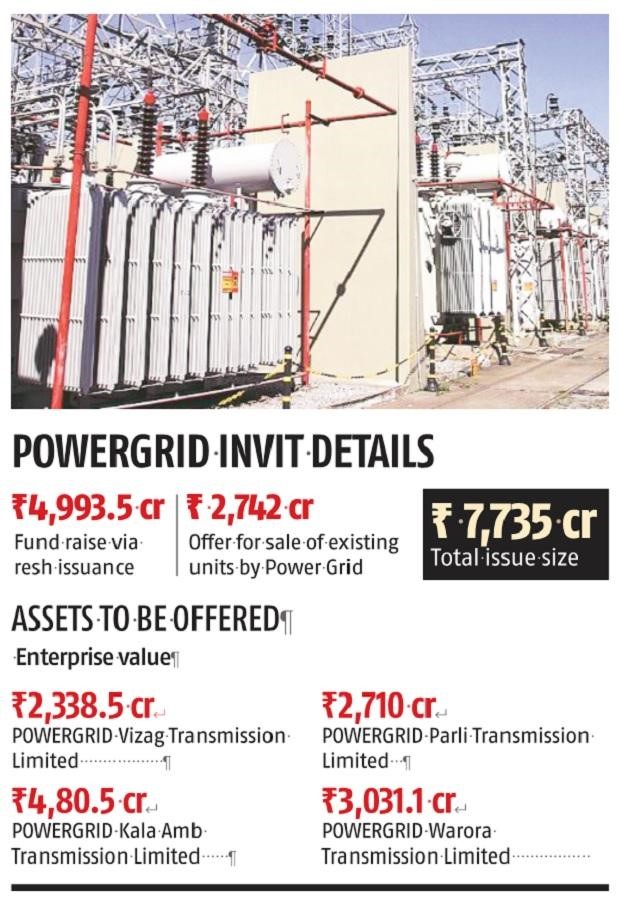

- The InvIT will raise Rs 4,993.5 crore as fresh issuance and PGCIL is also providing an offer for sale (OFS) of Rs 2,742 crore of existing units.

- The net proceeds will be used to provide loans to the initial portfolio assets for repayment or pre-payment of their debt, including any accrued interest, and for general purposes.

About Infrastructure Investment Trust (InvITs):

- An Infrastructure Investment Trust (InvITs) is like a mutual fund, which enables direct investment of small amounts of money from possible individual/institutional investors in infrastructure to earn a small portion of the income as return.

- InvITs work like mutual funds or real estate investment trusts (REITs) in features.

- InvITs can be treated as the modified version of REITs designed to suit the specific circumstances of the infrastructure sector.

- Sebi notified the Sebi (Infrastructure Investment Trusts) Regulations, 2014 on September 26, 2014, providing for registration and regulation of InvITs in India.

- The objective of InvITs is to facilitate investment in the infrastructure sector.

- InvITs can be established as a trust and registered with Sebi.

- An InvIT consists of four elements: 1) Trustee, 2) Sponsor(s), 3) Investment Manager and 4) Project Manager.

- The trustee, who inspects the performance of an InvIT is certified by Sebi and he cannot be an associate of the sponsor or manager.

- ‘Sponsors’ are people who promote and refer to any organisation or a corporate entity with a capital of Rs 100 crore, which establishes the InvIT and is designated as such at the time of the application made to Sebi, and in case of PPP projects, base developer.

- Promoters/sponsor(s), jointly, have to hold a minimum of 25 per cent for three years (at least) in the InvIT, excluding the situations where an administrative requirement or concession agreement needs the sponsor to hold some minimum percent in the special purpose vehicle.

- Investment manager is an entity or limited liability partnership (LLP) or organisation that supervises assets and investments of the InvIT and guarantees activities of the InvIT.

- Project manager refers to the person who acts as the project manager and whose duty is to attain the execution of the project and in case of PPP projects.

https://www.business-standard.com/article/companies/power-grid-launches-pginvit-could-offer-18-more-assets-in-future-121042600522_1.html