Disclaimer: Copyright infringement not intended.

Context

- The Insolvency and Bankruptcy Board of India notified the Insolvency and Bankruptcy Board of India (Grievance and Complaint Handling Procedure) (Amendment) Regulations, 2022 and the Insolvency and Bankruptcy Board of India (Inspection and Investigation) (Amendment) Regulations, 2022 to amend the Insolvency and Bankruptcy Board of India (Grievance and Complaint Handling Procedure) Regulations, 2017 and the Insolvency and Bankruptcy Board of India (Inspection and Investigation) Regulations, 2017.

Details

- The mechanism of complaint/ grievance redressal and subsequent enforcement action has been amended to have expeditious redressal and also to avoid placing undue burden on the service providers. To curtail such delays and to ensure expeditious and result oriented enforcement mechanism, the Amendment Regulations provides for following:

- Revisions in various timelines related to enforcement process provided in the (Grievance and Complaint Handling Procedure) Regulations, 2017 and (Inspection and Investigation) Regulations, 2017 for addressing the issue of delay in present mechanism.

- Effective participation of IPAs in regulating the IPs through examination of grievances received against IPs.

- Intimation to Committee of Creditor (CoC)/ Adjudicating Authority (AA) about the outcome of Disciplinary Committee (DC) order.

The Amendment Regulations are effective from 14th June, 2022.

What do we mean by Insolvency?

- Insolvency refers to a state where the company is not able to generate revenue to pay off their debts and payments that are incurred by the company in due course of time.

- Bankruptcy happens when the court determines insolvency and recognizes insolvency by passing orders for its resolution.

- An insolvency law is designed to address a situation in which a debtor is no longer able to pay its debts to its creditors generally (rather than individually) and, in that context, provides a mechanism that will provide for the equitable treatment of all creditors. It is a recovery mechanism for the creditors of a corporate debtor.

- Earlier various Acts such as the Company’s Act of 1956, the Scrutinization and Reconstruction of Insolvency and Enforcement of Security Interest Act 2002 (SARFAESI), etc., governed the Companies Insolvency Act.

- After that, the Insolvency and Bankruptcy Code was introduced in 2016 to put insolvency laws in one frame.

Insolvency and Bankruptcy Code (IBC) 2016

- The Bankruptcy Legislative Reforms Committee under the leadership of TK Viswanathan projected the IBC.

- Insolvency and Bankruptcy Code 2016 was implemented through an act of Parliament.

What was the need for IBC in 2016?

- In the last several years, the banking sector had been plagued by growing Non Performing Assets on account of various reasons.

- As of 2015, insolvency resolution in India took 4.3 years on an average. This was higher when compared to other countries such as United Kingdom (1 year) and United States of America (1.5 years).

- A robust, modern and sophisticated insolvency framework was therefore, established with the enactment of the Insolvency and Bankruptcy Code, 2016 (IBC).

- Thus, IBC was enacted with a view to resolve the insolvency cases in a short period which is undertaken by the insolvency.

- The code envisaged to form a new institutional structure with a regulator, financial condition experts, data utilities and assessment mechanisms that can enhance the formal financial condition resolution method and liquidation.

What does the IBC aim to do?

- IBC applies to companies, partnerships and individuals. It provides for a time-bound process to resolve insolvency.

- When a default in repayment occurs, creditors gain control over debtor’s assets and must take decisions to resolve insolvency. Under IBC debtor and creditor both can start 'recovery' proceedings against each other.

- Introduction of this Code has done away with overlapping provisions contained in various laws –

- Sick Industrial Companies (Special Provisions) Act, 1985

- The Recovery of Debts Due to Banks and Financial Institutions Act, 1993

- The Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002

- The Companies Act, 2013.

- Before the enactment of this Code, there were multiple agencies dealing with the matters relating to debt, defaults, and insolvency which generally lead to delays, complexities and higher costs in the process of Insolvency resolution.

Key Objectives of the Code

- To consolidate and amend the laws relating to re-organization and insolvency resolution of corporate persons, partnership firms, and individuals.

- To fix time periods for execution of the law in a time-bound settlement of insolvency (i.e. 180 days).

- To maximize the value of assets of interested persons.

- To promote entrepreneurship

- To increase the availability of credit.

- To balance all stakeholder’s interest (including alteration). Balance to be done in the order of priority of payment of Government dues.

- To establish an Insolvency and Bankruptcy Board of India as a regulatory body for insolvency and bankruptcy law.

- To establish higher levels of debt financing across a wide variety of debt instruments.

- To provide painless revival mechanism for entities.

- To deal with cross-border insolvency.

- To resolve India’s bad debt problem by creating a database of defaulters.

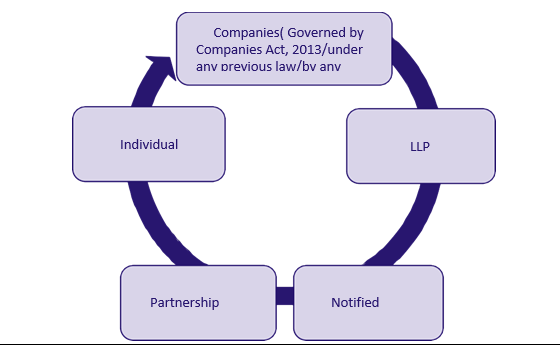

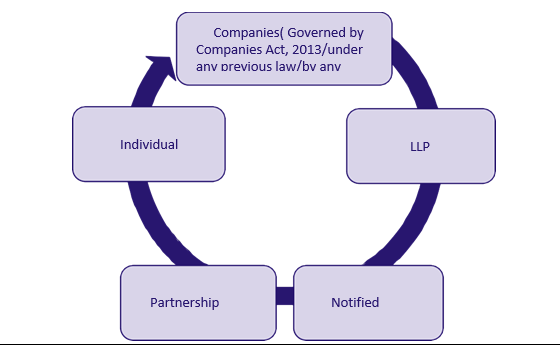

Applicability of the Code

The provisions of the Code shall apply for insolvency, liquidation, voluntary liquidation or bankruptcy of the following entities:-

- Any company incorporated under the Companies Act, 2013 or under any previous law.

- Any other company governed by any special act for the time being in force, except in so far as the said provision is inconsistent with the provisions of such Special Act.

- Any Limited Liability Partnership under the LLP Act 2008.

- Any other body being incorporated under any other law for the time being in force, as specified by the Central Government in this regard.

- Partnership firms and individuals

The Code creates various institutions to facilitate resolution of insolvency. These are as follows:

- Insolvency Professionals

- Insolvency Professional Agencies

- Information Utilities

- Adjudicating authorities

- Insolvency and Bankruptcy Board

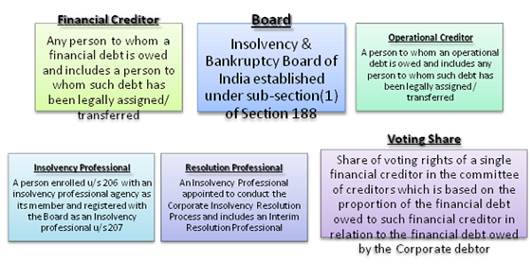

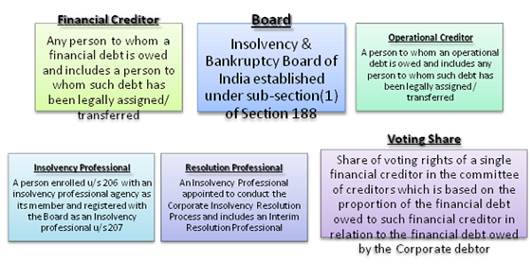

Few Important Definitions under the Code for Corporate Insolvency

Pillars of Insolvency and Bankruptcy Code, 2016

Insolvency and Bankruptcy Board of Republic of India

The implementation and operation of the board come under the body Insolvency and Bankruptcy Board of Republic of India. It is created by the IBC as a restrictive yet superior body. The matters with respect to IBC are handled by this board and control, not just the profession but also the processes. The board plays a pivotal role for implying the code which amends laws of conversion of insolvent companies.

National Company Law Appellate Tribunal

The proceedings concerning this code under insolvency law come under the NCLT, which is the adjudicating authority. This authority functions as a forum that undertakes the resolution of the insolvency cases. An appeal under the NCLT can be quashed, or a stay can be initiated against that order. NCLAT is the place where the appeals can be made under NCLT. The appeal against the order of NCLAT can be made in the Supreme Court, which is the highest court of authority.

Insolvency Professional

The IBC provides for a group of professionals called as the insolvency professional, who oversees various aspects of the insolvency resolution. An additional body of corporate called the Insolvency Professional Agencies is incorporated to regulate the work of the Insolvency Professionals. Those practitioners that practice individually are required to be enrolled with the IPAs’ scepter to control and develop the role of the insolvency professionals.

Information Utilities

With the information utilities under the IBC, 2016, gathering and passing the information from creditors to corporate was made possible. Currently, the financial data of creditors can be obtained from the income tax department only.

The information utilities under the IBC, 2016, are aimed at fulfilling the gap of gathering and passing the information from creditors to corporate. Only the Insolvency and Bankruptcy Board of Republic of India has the authority to license Information Utilities and can exercise the power to control them and has the authority to provide access to the information.

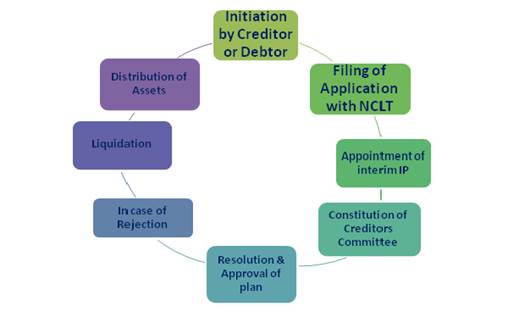

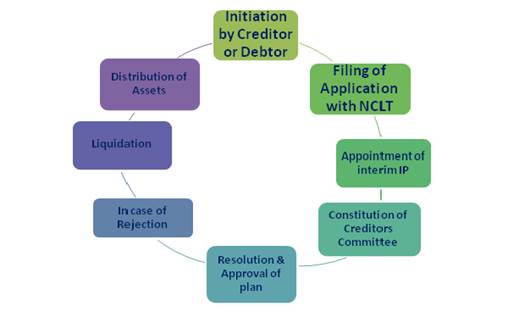

Key Steps of Insolvency code

What is the timeframe for completion of the exercise under the Code?

- Companies have to complete the entire insolvency exercise within 180 days under IBC. The deadline may be extended if the creditors do not raise objections on the extension.

- For smaller companies including startups with an annual turnover of Rs 1 crore, the whole exercise of insolvency must be completed in 90 days and the deadline can be extended by 45 days. If debt resolution doesn't happen the company goes for liquidation.

Who regulates the IBC proceedings?

- Insolvency and Bankruptcy Board of India (IBBI) has been appointed as a regulator and it can oversee these proceedings. IBBI has 10 members; from Finance Ministry and Law Ministry the Reserve Bank of India.

Who facilitates the insolvency resolution?

- A licensed professional administer the resolution process, manage the assets of the debtor, and provide information for creditors to assist them in decision making.

Who adjudicates over the proceedings?

- The proceedings of the resolution process will be adjudicated by the National Companies Law Tribunal (NCLT), for companies and the Debt Recovery Tribunal (DRT) for individuals.

- The courts approve initiating the resolution process, appointing the insolvency professional and giving nod to the final decision of creditors.

- The Insolvency and Bankruptcy Board regulates insolvency professionals, insolvency professional agencies and information utilities set up under the Code.

What is the procedure to resolve insolvency under the Code?

- When a default occurs, the resolution process may be initiated by the debtor or creditor. The insolvency professional administers the process.

- The professional provides financial information of the debtor from the information utilities to the creditor and manage the debtor’s assets. This process lasts for 180 days and any legal action against the debtor is prohibited during this period.

Moratorium

- After the commencement of corporate insolvency resolution the NCLT orders a moratorium on the debtor’s operations for the period of 180 days. This is termed as a ‘calm period’ during which no judicial proceedings for recovery, enforcement of security interest, sale or transfer of assets, or termination of essential contracts can take place against the debtor..

What does the committee of creditors do?

- A committee consisting of the financial creditors who lent money to the debtor is formed by the insolvency professional.

- The creditors' committee decides the future of the outstanding debt owed to them. They may choose to revive the debt owed to them by changing the repayment schedule or selling the assets of the debtor to get their dues back.

- If a decision is not taken in 180 days, the debtor’s assets go into liquidation.

What happens under liquidation?

- If the debtor goes into liquidation, an insolvency professional administers the liquidation process. Proceeds from the sale of the debtor’s assets are distributed in the following order of order:

- First insolvency resolution costs, including the remuneration to the insolvency professional,

- Second secured creditors, whose loans are backed by collateral and

- Third dues to workers, other employees, forth unsecured creditors.

TIMELINE (AS STIPULATED IN THE CODE)

|

Particulars

|

Timelines(days)

|

|

Filing of Insolvency application – Details of what needs to be mentioned in the application has been specified

|

X

|

|

Adjudicating Authority- admission or rejection of application –

Before rejecting an application, the Adjudicating Authority shall give a notice to the applicant to rectify the defect in the application within 7 days. If admitted, Adjudicating Authority to declare moratorium upon admission.

|

X+14

|

|

Insolvency Resolution Professional appointment

|

(X+14) + 14

|

|

Constitution of Committee of Creditors

Appointment of final resolution professional

|

(X+14) + 14 + 10

|

|

Submission of Resolution plan

If approved- Moratorium ceases to have effect

If rejected- Initiation of Liquidation

Insolvency Resolution Process Completion

|

(X+14) + 180

|

|

Insolvency Resolution Process Extension

|

(X+14) + 180 +90

|

- Thus, the process has to be compulsorily completed with 330 days including the extensions granted. The Section further provides for an extension of 90 days for proceedings that go beyond 330 days due to unavoidable delays.

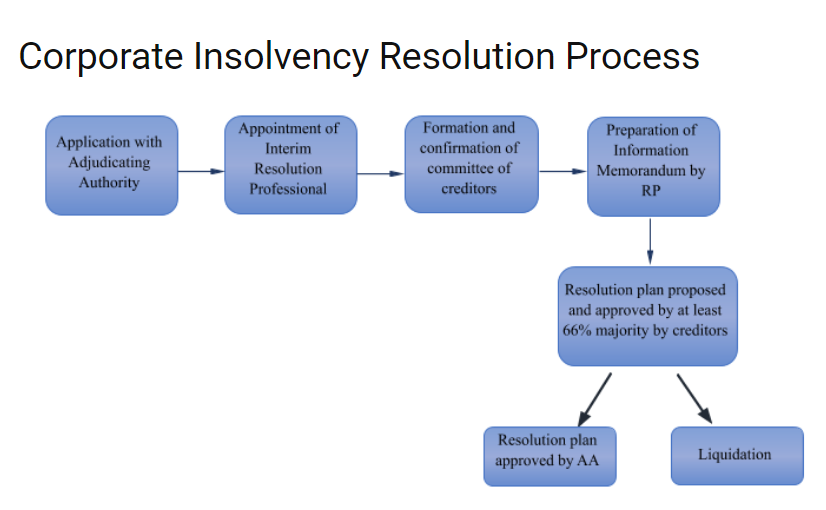

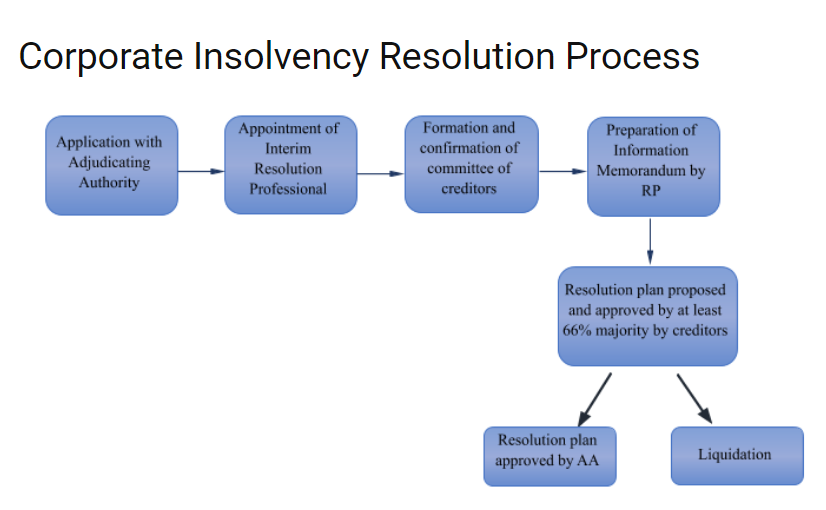

The simplified outline of the corporate insolvency resolution process under the Insolvency and Bankruptcy Code, 2016 is as below:

- When Loan Default occurs:

Either the borrower / the lender approach the adjudicating authority which is the NATIONAL COMPANY LAW TRIBUNAL (NCLT – in case of Company’s & LLP’s) or the Debt Recovery Tribunal (DRT – in case of individuals or partnership firms) for initiating the resolution process.

- Appointment of Interim Insolvency Professional (IP)

An Interim Insolvency Professional will be appointed by the Creditors to take control of the debtor’s assets and company’s operations, collect financial information of the debtor from the information utilities, ascertain the claim and to constitute a creditor’s committee.

- Decision of the Creditor’s Committee

Every item that requires the approval of the creditors in their committee meeting needs to be passed with a voting share percentage of 75%.

- Restructuring Process:

Upon passing of the resolution by the creditors committee, the committee shall decide on the restructuring process that could either be a revised repayment plan for the company or liquidation of the assets of the company. If no such decision is taken by the creditors in their meeting then, the debtor’s assets will be liquidated to repay the debt.

- Approval of the Tribunal / Liquidation

The resolution plan shall be sent to the NCLT for its approval and implementation thereafter. If the NCLT does not approve the resolution plan, then the liquidation process shall begin.

BENEFITS OF IBC

The IBC successfully remedies several shortcomings of the earlier insolvency resolution process, such as

Timely resolution of insolvency process

- The process of resolution is carried out in a time-bound manner, the business is transferred as an ongoing concern to the resolution applicant, thus ensuring nil loss to the economy due to stoppage of production or under-utilization of resources, and minimum loss of employment, revenues to government, local ecosystem and ancillary industries.

Certainty and clean title

- When insolvency is resolved through the Code, there is a certainty in the settlement of liabilities and ownership of assets. Since all liabilities including government dues are settled, the resolution applicant is vested with a clean and litigation-free business and assets, etc.

Prevents fraudulent activities by debtors

- Since the ownership and control of the business entity, its assets and business activities stand transferred from the debtor to an insolvency professional as soon as an application is admitted by the adjudicating authority, the debtor is preempted from indulging in any activity to defraud the creditors.

- Contrast this with the situation before, when the debtor continued to have control on business activities and assets, which enabled them to drag his feet, cause a delay by litigating endlessly, while fraudulently disposing off assets to defraud creditors, employees, government, etc.

Relief for bona fide debtors

- Prior to the IBC, the liabilities that remained unpaid after proceedings continued to haunt the debtors for the rest of their lives. However, resolution through the Code guarantees final settlement of all liabilities, thus freeing the bona fide debtors from debt traps and government liabilities.

Achievements of Insolvency and Bankruptcy Code

- Ease of doing business – due to the faster insolvency resolution process.

- Deepening of bond markets to increase confidence among the creditors of getting the money back from the debtors.

- Stronger institutional framework such as Insolvency and Bankruptcy board of India (IBBI), National Company Law Tribunal (NCLT) etc.

- Reduction in Non Performing Assets (NPAs) is one of the biggest achievements of Insolvency and Bankruptcy Code, 2016.

- The professionalization of process with the help resolution professional.

- 66 cases resolved after adjudication and realization of creditors around Rs 80,000 crore in resolution cases.

- Helped to resolve and cure 12 big companies like Electro-steel Steels, Bhushan Steel, Monnet Ispat & Energy, Amtek Auto.

- Many cases are settled outside the courts by using the Alternative resolution process.

- Companies pay up in anticipation of not being referred to NCLT after introduction of section 29(a). Bank receiving money from potential debtors who pay in anticipation of default.

- Defaulters know that if they will get into IBC they will be out of management of their company because of section 29(a), so the companies are clearing their NPAs.

- No political and governmental interference.

Major shortcomings of Insolvency and Bankruptcy Code

Non-execution of the process in set time frame

- The Code is a time-bound conclusion of proceedings and delivery of settlement. However, the lack of a supporting ecosystem makes it a difficult task. Resistive forces, cause significant delays in a time-bound execution.

- 2,600 cases that were closed by December 2021, 55% ended in liquidation while only 16% were completed with proper resolution plans approved by the lender.

- On average, over 700 days were taken in FY22 to complete a resolution process, against the stipulated deadline of 330 days.

- During the fourth quarter of FY22, the amount to be realised from the resolution process was lower than the liquidation value of assets.

Lack of coordination between parties involved

- Time and again, a lack of coordination between the parties in the process (creditors, stakeholders) is encountered which delays and stymies the insolvency proceedings.

Inexperienced insolvency professionals

- Since the Code and its prescribed procedures are new, understandably, the insolvency professionals, advocates and adjudicators lack experience, which causes significant delay in resolution proceedings.

- At times, due to this lack of experience, a company which could have been revived ends up liquidated.

Overburdening of courts

- As the number of NCLTs and NCLATs are limited, they are weighed down by a deluge of applications, naturally impeding the timely conclusion of proceedings. Thus it is time to double the number of benches of both the NCLT and NCLAT.

Threshold increase disadvantageous to operational creditors

- During the Covid-19 period, the threshold for applications under the Act was suddenly raised from Rs. 1 lakh to Rs. 1 crore. No doubt, the threshold of Rs. 1 lakh had been too small, but the arbitrary jump to Rs. 1 crore was extreme.

- It leaves a large section of operational creditors in a lurch. Such a jump may prove detrimental to the very purpose of the Code; instead, a gradational or incremental jump in threshold is advised.

- According to the Minister of State for Finance and Corporate Affairs there were 10,860 cases pending before the NCLT as of September 2019. The lack of sufficient NCLT benches and the quantity by which the cases under IBC are rising. The increasing pendency of the cases will defeat the purpose of the quick resolution process.

The reasons for such clogging are obvious:

- Rising financial stress in the economy leading to more cases being filed and

- Lack of adequate resolution professionals

- Information asymmetry as resolution applicants often don't have information which is complete, robust and correct and

- Delays caused by multiple appeals and contradictory verdicts at different levels.

- From 2016 to 2021 (up to June 2021 for which IBBI data is available), a total of 4,541 cases of Corporate Insolvency Resolution Process (CIRP) were admitted.

- Until June 2021, just 20% of the admitted debt claims, is realisable or realised — a net loss or haircut of 80% debt. The earlier debt resolution process under the Sick Industrial Companies (Special Provisions) Act of 1985 (under which Industrial and Financial Reconstruction (BIFR) functioned) had a recovery rate of 25% – a far better performance in comparison.

- A very large number of CIRP cases are ending with liquidation, where settlement leads to outright closure of businesses, causing job losses, and debtors getting a pittance. Of the 4,541 CIRP cases, 29.7% have already gone into liquidation. While there is no data on the resultant job losses, debtors have lost (haircut) 95% of their loans.

- The two together – loss of credit and loss of business and jobs – mean the economy is getting hurt, something which the IBC seeks to prevent.

- Instead of settling the cases in 180 days, as its mandate, the IBBI data shows 80% of cases have crossed the limit, with 75% of cases taking more than 270 days.

- The Parliamentary Committee on Finance examined the IBC’s performance and submitted its report in August 2021.

- It expressed serious concerns about low recovery and long delays. It stressed that the “fundamental aim of this statute (IBC) is to secure creditor rights”, and “greater clarity of purpose” is needed for this “particularly considering the disproportionately large and unsustainable “haircuts” taken by financial creditors over the years”.

- It also asked to fix a benchmark for the quantum of haircuts in line with global standards.

Poor recovery Rate

- Recoveries by financial creditors under the Insolvency and Bankruptcy Code (IBC) have dropped significantly in the past two years owing to the pandemic, resulting in larger haircuts for them.

- As of March 2022, financial creditors have recovered 33 per cent of the amount admitted as claims.

- It was 39.3 per cent as of March 2021, and as high as 46 per cent till March 2020, according to the Insolvency and Bankruptcy Board of India (IBBI) data.

- Further, on a quarterly basis, realisation by financial creditors as a percentage of their admitted claims in Q4FY22 dropped to as low as 10 per cent.

- The haircut for cases resolved in Q4FY22 was high at 90 per cent.

- The number of new cases admitted under the insolvency process has also gone down in FY22, with only 834 cases admitted as against 2,000 cases in FY20.

- Experts reckon the pandemic-induced slowdown in the economy and delays in the resolution process are the root cause behind the drop in realization.

Amendments

- The Insolvency and Bankruptcy Code (Amendment) Bill, 2021, passed by Lok Sabha has proposed ‘pre-packs’ as an insolvency resolution mechanism for Micro, Small and Medium Enterprises (MSMEs). The Bill will replace The Insolvency and Bankruptcy Code (Amendment) Ordinance, 2021.

What are ‘pre-packs’?

- A pre-pack envisages the resolution of the debt of a distressed company through a direct agreement between secured creditors and the existing owners or outside investors, instead of a public bidding process.

- This system of insolvency proceedings has become an increasingly popular mechanism for insolvency resolution in the United Kingdom and Europe over the past decade. Under the pre-pack system, financial creditors will agree to terms with the promoters or a potential investor, and seek approval of the resolution plan from the National Company Law Tribunal (NCLT).

- The approval of at least 66 per cent of financial creditors that are unrelated to the corporate debtor would be required before a resolution plan is submitted to the NCLT. The NCLTs will be required to either accept or reject an application for a pre-pack insolvency proceeding before considering a petition for a CIRP.

How are pre-packs better than CIRP?

- One of the key criticisms of the CIRP has been the time it takes for resolution. At the end of March 2021, 79 per cent of the 1,723 ongoing insolvency resolution proceedings had crossed the 270-day threshold. A major reason for the delays is the prolonged litigation by erstwhile promoters and potential bidders.

- The pre-pack in contrast, is limited to a maximum of 120 days with only 90 days available to stakeholders to bring a resolution plan for approval before the NCLT.

- Another key difference between pre-packs and CIRP is that the existing management retains control in the case of pre-packs; in the case of CIRP, a resolution professional takes control of the debtor as a representative of financial creditors. Experts note that this ensures minimal disruption of operations relative to a CIRP.

- Pre-packs are largely aimed at providing MSMEs with an opportunity to restructure their liabilities and start with a clean slate while still providing adequate protections so that the system is not misused by firms to avoid making payments to creditors.

- Currently, only corporate debtors themselves are permitted to initiate a PIRP after obtaining the approval of 66 per cent of their creditors.

- The pre-pack mechanism does however, allow for a ‘Swiss challenge’ to any resolution plan that provides less than full recovery of dues for operational creditors.

- Under the Swiss challenge mechanism, any third party would be permitted to submit a resolution plan for the distressed company, and the original applicant would have to either match the improved resolution plan or forego the investment.

Way Forward

- The most pressing need right now is to bring into force the pre-pack insolvency concept. Although this approach can be used in India for MSMEs now, the need of the hour is to allow players to use it for all corporate debtors. This will allow lenders to improve their rates of recovery.

- The next major step that must be taken soon is the adoption of the United Nations Commission on International Trade Law (UNCITRAL) model for cross border insolvency protocol and signing of treaties with the likes of UAE and UK to set up formal processes to be followed when a debtor has assets located in foreign countries.

- Statistics indicate that a majority of the liquidation happens in matters where the debtor's assets erode over time during a prolonged insolvency process. Hence, timeliness of insolvency resolution is key.

- The government needs to cater appropriate budgetary allocations to upskilling of insolvency professionals, improvement of tribunal infrastructure and digitization of the insolvency resolution process.

- Additionally, tax matters should be addressed. Carry forward of losses, in case of companies, in which the public are not substantially interested, should be allowed. Also, profits arising on write back of loan irrespective of its end-use i.e., capital assets or working capital, interest, and payables, should not be taxed.

- The bench strength for NCLT must be fortified further in order to address the many delays that are currently plaguing the IBC process.

- It’s important to have a benchmark for the quantum of the haircuts comparable to global standards so that the overall recovery rate is improved.

- Setup an Institute of Resolution Professionals similar to that of ICAI as a professional self-regulator for RPs for resolving the conflict of interest between the multiple regulators viz., IPA (Insolvency Professional Agencies) IBBI.

- Introduce a professional code of conduct for the Committee of Creditors(CoC) in order to eliminate the arbitrariness in exercise of discretion.

- Insolvency and Bankruptcy Board of India to frame guidelines for the selection of the RPs (Resolution Professionals) rather than leaving this to the discretion of the Committee of Creditors(CoC).

- Amend the IBC so that no post adhoc bids are allowed during the resolution process and the COC s discretion of accepting late and unsolicited resolution plans are effectively regulated.

- NCLT to accept the resolution plan within 30 days and transfer the control to a resolution process within this time frame of 30 days so that the defaulting owners do not have the scope to divert the funds leading to rapid value erosion.

- To appoint NCLT members who are at least honorable high court judges so that the judgment quality can be improved and the issue of judgments of NCLT being over turned by NCALT and Supreme Court can be addressed obviating the delay in resolution and recovery.

Final Thoughts

- The IBC has undoubtedly revived India's insolvency regime. Not only has it been successful in combating the growing threat of NPAs, but it has also benefited the economy in a variety of nuanced ways, including improving credit discipline.

- However, like any other law, IBC also has areas which can witness remarkable improvement. There is a long way ahead for Indian insolvency regime to meet standards of other mature global jurisdictions.

https://epaper.thehindu.com/Home/ShareArticle?OrgId=GRK9RFERC.1&imageview=0#:~:text=In%202016%2C%20the,were%20above%2090%25

1.png)