Description

Copyright infringement not intended

Picture Courtesy: bondexchange.com

Context: The National Highways Authority of India (NHAI) recently organized a collaborative session involving stakeholders, including insurance companies, contractors, and industry experts, to accelerate the adoption of Insurance Surety Bonds for NHAI contracts.

Details

- The session aimed to explore the potential and address operational challenges for implementing Surety Bonds in place of Bank Guarantees. NHAI's call to insurance companies and contractors is to consider these bonds as an alternative for Bid Security and Performance Security Deposit, ensuring both cost efficiency and security for NHAI projects.

- Insurance Surety Bonds involve insurance companies providing financial guarantees, ensuring contractors fulfil their obligations as agreed.

- As India emerges as a major construction market and the infrastructure sector continues to grow, these bonds offer longer maturity terms and potential capital relief of Rs. 50,000 crore, supporting liquidity and capacity for bidders and concessionaires. This move aligns with India's ambition to become a $5 trillion economy, reinforcing National Highway Infrastructure development and its positive impact on the broader economy.

Insurance Surety Bonds

- Insurance Surety Bonds are financial instruments in which an insurance company assumes the role of a surety, guaranteeing that a contractor or party will fulfil their obligations as specified in an agreement. These bonds serve as an alternative to traditional Bank Guarantees (BGs) and provide a form of financial security for various contractual arrangements.

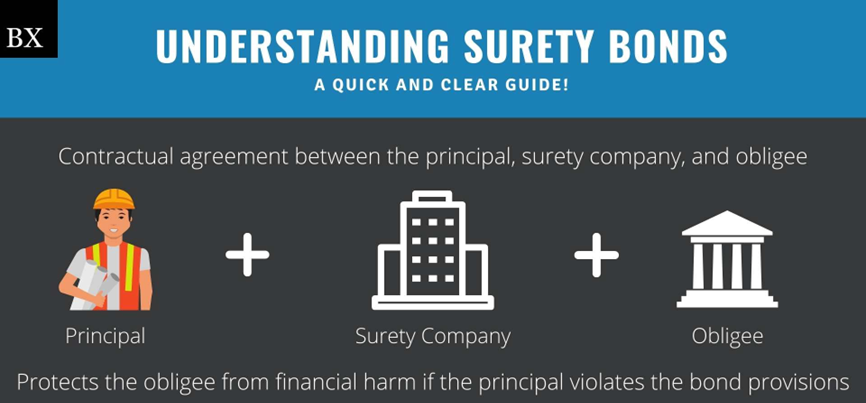

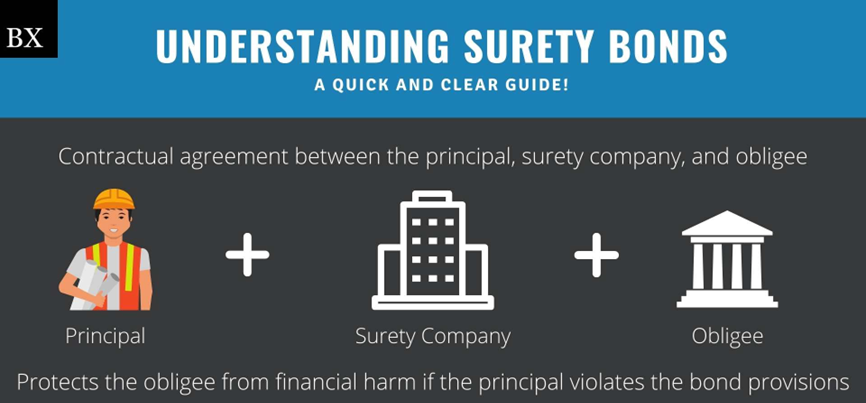

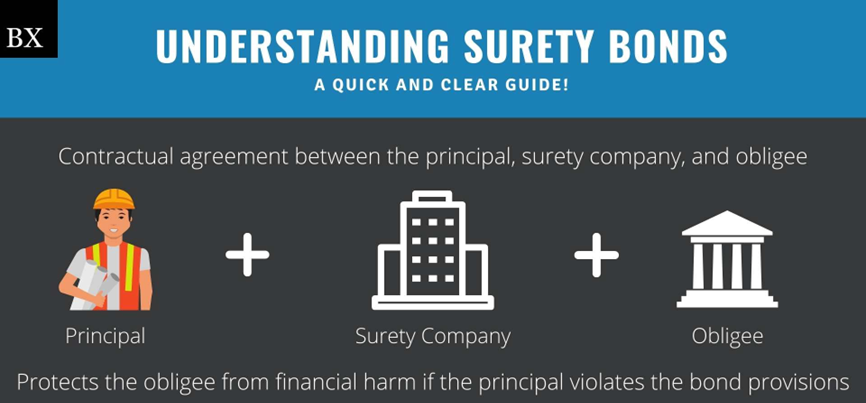

- Insurance Surety Bonds involve a three-party relationship: the principal (contractor or party performing the obligation), the obligee (the party to whom the obligation is owed), and the surety (the insurance company providing the guarantee). They ensure that the principal fulfils their contractual duties and obligations, and if they fail to do so, the surety steps in to provide compensation to the obligee.

- In many jurisdictions, including India, government authorities have acknowledged Insurance Surety Bonds as an equivalent option to traditional BGs for various purposes, such as bid security and performance guarantees.

Advantages

- Cost-Effective: Surety bonds often have lower upfront costs compared to traditional methods such as bank guarantees (BGs). This is because the premium paid for a surety bond is typically a fraction of the required bond amount. This can be particularly advantageous for businesses that want to conserve their capital and allocate resources more efficiently.

- Liquidity: By opting for surety bonds instead of tying up capital in bank guarantees, businesses can maintain better liquidity. Locked-up capital in BGs can limit a company's ability to invest in growth opportunities, cover operational expenses, or respond to unforeseen financial needs. Surety bonds free up capital that can then be used for various business endeavours.

- Longer Maturity: Surety bonds can have longer terms, providing a sense of stability for both the business and the obligee (the party requiring the bond). This can reduce the need for frequent renewals and administrative efforts to maintain the bond. Having a longer maturity period can also contribute to better financial planning and management for the business.

Overall, Insurance Surety Bonds provide a mechanism for parties involved in contracts to enhance trust, secure financial commitments, and facilitate project completion. They stand as a viable alternative to traditional bank-based guarantees, offering potential economic benefits and flexibility in the management of financial resources.

Must Read Articles:

Surety Bond Insurance: https://www.iasgyan.in/daily-current-affairs/surety-bond-insurance

|

PRACTICE QUESTION

Q. What are the alternative investment opportunities for infrastructure development in India, and what is their significance in addressing the country's infrastructure needs? What are the key challenges associated with these alternative investments, and what strategies can be employed to overcome them? Looking ahead, what is the way forward for expanding and optimizing alternative investments in India's infrastructure sector?

|

https://pib.gov.in/PressReleasePage.aspx?PRID=1951715