Description

Copyright infringement not intended

Context:

- Finance Minister Nirmala Sitharaman has urged the World Bank’s private sector investment arm, the International Finance Corporation (IFC), to increase lending to India to more than $2 billion in the next two years and to $3-3.5 billion over the next three-four years.

- Makhtar Diop, Managing Director of IFC, who met Ms. Sitharaman, said the corporation would adopt ‘a proactive approach’ to scale up its India investments and would extend financing to micro, small and medium enterprises (MSMEs) in order to bolster the country’s ‘effort to become a manufacturing hub’.

What Is the World Bank?

- The World Bank is an international organization dedicated to providing financing, advice, and research to developing nations to aid their economic advancement. It is headquartered in Washington, D.C.

- The bank predominantly acts as an organization that attempts to fight poverty by offering developmental assistance to middle- and low-income countries.

Historical Overview

- The World Bank was established in July 1944 at the Breton Woods Conference which was pursuing three goals:

- facilitate reconstruction, which led to the creation of IBRD (International Bank for Reconstruction and Development)

- ensure financial and monetary stability, which led to the creation of IMF

- restore and expand trade, an objective which has been more difficult to achieve. It started with the GATT and it is only in 1995 that the WTO was created.

- Thus, the World Bank was established in 1944 to help rebuild Europe and Japan after World War II. Its official name was the International Bank for Reconstruction and Development (IBRD). When it first began operations in 1946, it had 38 members. Today, most of the countries in the world are members.

- The World Bank has expanded to become known as the World Bank Group with five cooperative organizations, sometimes known as the World Banks.

|

Bretton Woods Agreement

The Bretton Woods Agreement was negotiated in July 1944 by delegates from 44 countries at the United Nations Monetary and Financial Conference held in Bretton Woods, New Hampshire. Thus, the name “Bretton Woods Agreement. The Bretton Woods system of monetary management established the rules for commercial and financial relations among the United States, Canada, Western European countries, Australia, and Japan after the 1944 Bretton Woods Agreement. Under the Bretton Woods System, gold was the basis for the U.S. dollar and other currencies were pegged to the U.S. dollar’s value. The Bretton Woods System effectively came to an end in the early 1970s when President Richard M. Nixon announced that the U.S. would no longer exchange gold for U.S. currency.

|

Two major Goals

Currently, the World Bank has two stated goals that it aims to achieve by 2030.

- The first is to end extreme poverty by decreasing the number of people living on less than $1.90 a day to below 3% of the world population.

- The second is to increase overall prosperity by increasing income growth in the bottom 40% of every country in the world.

How the World Bank is organized?

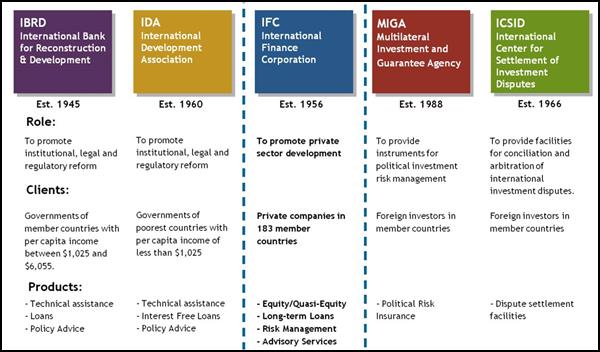

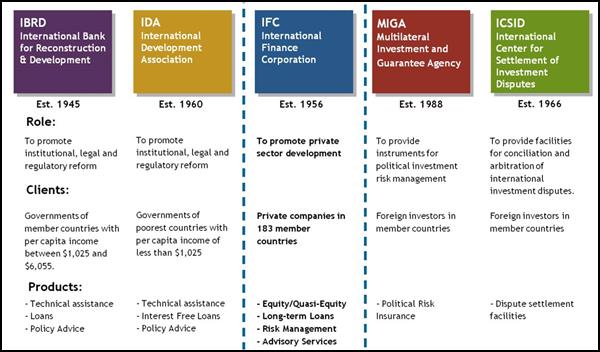

The World Bank has created new organizations within itself that specialize in different activities. All these organizations together are called the World Bank Group. It consists of:

- IBRD lends to low- and middle-income countries;

- International Development Association (IDA) lends to low-income countries;

- International Finance Corporation (IFC) lends to the private sector;

- Multilateral Investment Guarantee Agency (MIGA) encourages private companies to invest in foreign countries; and

- International Centre for Settlement of Investment Disputes (ICSID) helps private investors and foreign countries work out differences when they don't agree.

How decisions are made?

Shareholding

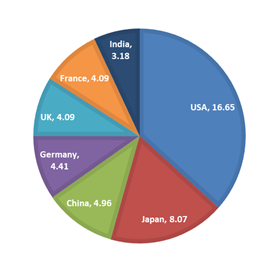

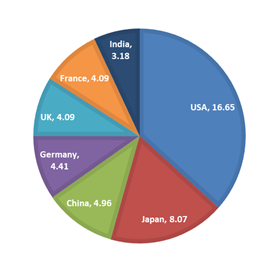

- The Bank is run like a giant cooperative, where its members are shareholders and is operated for the benefit of those using its services. The number of shares a country has is based roughly on the size of its economy.

- The United States is the largest single shareholder, followed by Japan, Germany, the United Kingdom, and France. The rest of the shares are divided among the other member countries.

Voting Power

Conditions

- To become a member of the Bank, a country must first join the International Monetary Fund (IMF).

- Membership in IDA, IFC and MIGA is conditional. A country has to first become a member of IBRD for that.

Governors

- A Board of Governors represents the Bank's government shareholders. Each member nation appoints a Governor and an Alternate Governor. Generally, these governors are country ministers, such as Ministers of Finance or Ministers of Development.

- The governors are the ultimate policymakers in the World Bank. They meet once a year at the Bank's Annual Meetings.

Executive Directors

- The Bank's 24 Executive Directors oversee the Bank's business, including approving loans and guarantees, new policies, the administrative budget, country assistance strategies, and borrowing and financial decisions.

- The five largest shareholders (France, Germany, Japan, the United Kingdom and the United States) appoint an executive director each, while other member countries are represented by 19 Executive Directors.

Loans and the World Bank

- The Bank lends money to middle-income countries at interest rates lower than the rates on loans from commercial banks.

- In addition, the Bank lends money at no interest to the poorest developing countries, those that often cannot find other sources of loans.

- Countries that borrow from the Bank also have a much longer period to repay their loans than commercial banks allow and don't have to start repaying for several years.

Source of money

- The Bank borrows the money it lends. This means it can borrow money at low interest rates from capital markets all over the world to then lend money to developing countries on very favorable terms.

- The Bank's financial reserves come from several sources -

- from funds raised in the financial markets,

- from earnings on its investments,

- from fees paid in by member countries,

- from contributions made by members (particularly the wealthier ones) and

- from borrowing countries themselves when they pay back their loans.

Mandate

- World Bank loans help countries:

- Supply safe drinking water

- Build schools and train teachers

- Increase agricultural productivity

- Manage forests and other natural resources

- Build and maintain roads, railways, and ports

- Extend telecommunications networks

- Generate and distribute energy

- Expand health care

- Modernize

- The Bank also tries to encourage investment and lending by countries, companies, and private investors.

- It also lends money to hire industry experts to help countries to reshape their economies to make them more efficient and productive.

Money isn’t the only type of support that the Bank provides. Often, it is the advice and experience the Bank's staff brings to a project or the environmental and social standards it applies that are also important.

Reports published by World Bank

- Ease of Doing Business

- World Development Report

- Global Economic Prospect (GEP) Report

- Logistics Performance Index

- Remittance Report

- Ease of Living Index

- India Development Update

- Universal Health Coverage Index

- The Service Trade Restriction Index

India and World Bank Group

- India is a member of four of the five constituents of the World Bank Group, International Bank for Reconstruction and Development (IBRD), International Development Association (IDA), International Finance Corporation (IFC) and Multilateral Investment Guarantee Agency (MIGA).

- India is not a member of ICSID (International Centre for Settlement of Investment Disputes).

- India has been accessing funds from the World Bank (mainly through IBRD and IDA) for various development projects.

- India is one of the founder members of IBRD, IDA and IFC. World Bank assistance in India started from 1948 when a funding for Agricultural Machinery Project was approved.

- World Bank resident mission was established in India in 1957.

Projects

Some World Bank funded projects in India include:

- Skill India Mission

- Clean India Mission

- National Ganga River Basin Project

- Pradhan Mantri Gram Sadak Yojana

- The National Rural Livelihoods Project

- Integrated Child Development Services (ICDS)

- National AIDS Control Support Project

- MSME Growth Innovation and Inclusive Finance Project

- Sarva Shiksha Abhiyan (SSA)

- Green National Highways Corridor Project

- National Nutrition Mission etc

Significance of World Bank

Poverty reduction

- Progress towards poverty reduction has been significant over the years. Income per person has doubled. Life expectancy has increased.

- The World Bank is the world’s single largest provider of external funding for education" and it is "the largest external funding source for health.

Good Governance & fight against corruption

- The World Bank created a number of "products", such as a code of investment, a forestry code and a mining code, which can be used to fight against corruption and to check good governance.

Debt relief

- Another global issue that the Bank has been addressing is debt relief.

- In 1996, the World Bank and the IMF launched the Heavily Indebted Poor Countries (HIPC) Initiative to provide debt relief to the world’s poorest and most heavily indebted countries. It ensures that the savings from debt relief are directed into areas such as health and education which are proven poverty-fighting programs.

- In 2005, at their summit in Gleneagles, G8 leaders initiated the Multilateral Debt Relief Iniatiative (MDRI). Full debt cancellation will be provided by IDA, IMF, and AfDF to countries that have reached their completion point under the Enhanced HIPC Initiative.

Inclusion of the poor

- A central point in all the actions of World Bank is putting the poor at the centre of development.

Largest research centers in development

- The Bank is also one of the world's largest research centers in development. It has specialized departments that use this knowledge to advise countries in areas like health, education, nutrition, finance, justice, law and the environment.

Stabilizing Assistance

- The role of the Bank in conflict-afflicted countries cannot be emphasized enough. It supports international efforts to assist war-ravaged populations, resume peaceful development, and prevent relapse into violence.

Funds India’s growth

- Currently, the World Bank's support to India is spread over 127 active projects with a combined worth of over $28 billion.

Criticisms of the World Bank

- Creating a climate where high levels of lending are deemed to be good.

- Advocating disability adjusted life years as a health measure.

- Disregard for the environment and indigenous populations.

- Evaluating health projects by looking at economic outcome measures

- Insufficient evaluation of projects

- Lack of sustainability of projects

- Poor evidence base for policies

- Promoting private health care

- Forcing countries to adopt structural adjustment for their economies

- User charges

- Voting power remains severely imbalanced in favor of the US, European countries and Japan. This leads to under-representation of Global South.

- The bank makes the loan conditional on the implementation of its Structural Adjustment Programme, such as fiscal consolidation and liberalization. Structural adjustment loans are a mechanism of forcing free market economics on countries through coercion.

- Largest shareholders dominate vote and polices undermining democratic ownership

- One-size-fits-all approach where neo liberal policies like liberalization, privatization and free market capitalism is forced upon all countries of the world.

- Lack of public disclosure on investments made+ lack of evaluation of its operations lead to Opaque decision-making

- Its fossil fuel projects and mega-infrastructure projects such as dams undermine climate goals and global efforts towards sustainable development.

- World Bank has also proved unable to redefine its purpose as a lending and developmental institution in light of the emergence of non-traditional lenders such as China.

Way Ahead

- Deep reforms of the World Bank are necessary as part of rethinking the current world order, and giving rising powers and developing countries a meaningful voice in this institution.

- The Bank needs to create space for reflection on the purpose of the multilateral body, the substantive role it should play in the future, the need to strengthen inclusive multilateralism, and the actions needed to bolster the position of emerging economies and developing countries.

- Head of the body should be selected on merit. That would signal an important departure from the past.

- There is a desperate need for these institutions to be more transparent, represent and speak for countries which don't get adequate representation. This would ensure an equitable distribution of resources, more concern for equitable development for growth.

https://epaper.thehindu.com/Home/ShareArticle?OrgId=GRPAA1JM7.1&imageview=0