Description

Disclaimer: Copyright infringement not intended.

Context

- The National Highways Authority of India (NHAI) plans to offer at least two highway upgradation projects to private players using the build-operate-transfer (BOT) model during the current quarter.

- The BOT (toll) model was the preferred model for road projects, accounting for 96% of all projects awarded in 2011-12.

Project categories

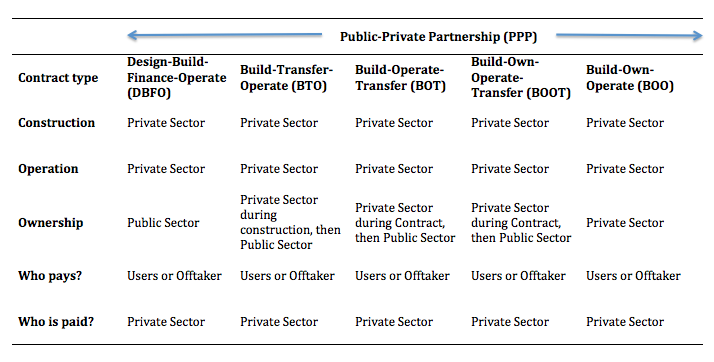

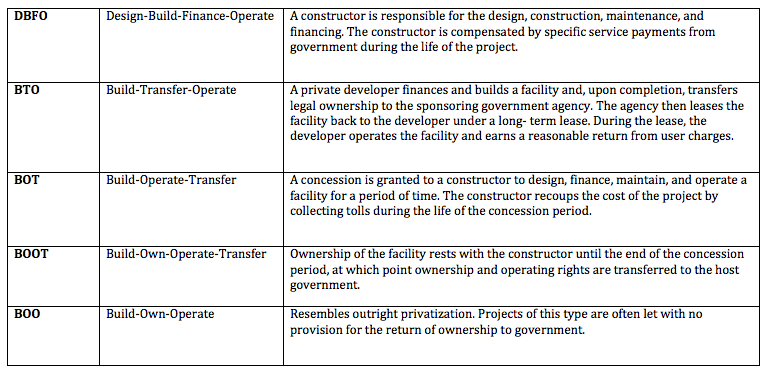

- There are acronyms of various different categories of projects.

- An understanding of these categories is important to differentiate between different types of projects, and the way accountability devolves between owner, developer and contractor.

- Project grouping based on Contracting/execution philosophy

- Forms of projects, classified on patterns of Ownership and Financing

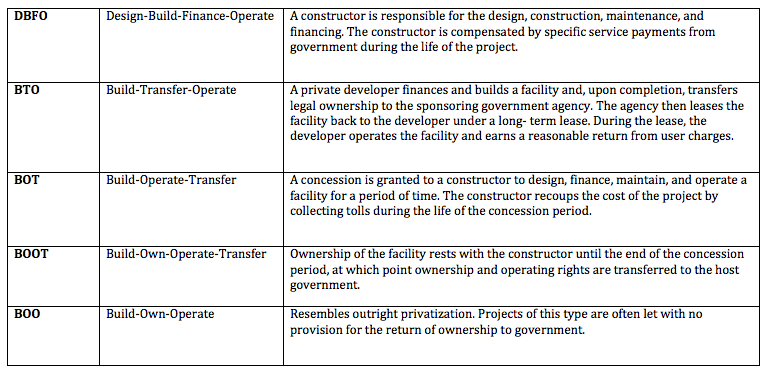

- BOT - Build Operate Transfer

- BOOT - Build Own Operate Transfer

- LOT-Lease, Operate and Transfer

- DBFO - Design Build Finance Operate

- HAM-Hybrid Annuity Model

- Project Grouping

PPP

- A public–private partnership (PPP, 3P, or P3) is a cooperative arrangement between two or more public and private sectors, typically of a long-term nature.

- In other words, it involves government(s) and business(es) that work together to complete a project .

- The public and private stakeholders sign up to jointly develop, finance, execute and operate a (mostly) infrastructure project, and thus an entity called concessionaire is created (sometimes also called an SPV - special purpose vehicle).

- The contract demarcates the responsibilities of the two partners, and in most cases, the public partner assumes the preparatory works like land acquisition, statutory approvals, political resolution of issues, etc., in addition to overall tracking of the work to be done by the private partner.

- The public partner may or may not be bringing in any hard equity other than land, etc.

- The private agency invests money, obtains financing, executes the project and runs the assets thus created for a pre-defined period of time in order to realize a return on its financial investments.

|

PPPs have become attractive to governments as an off-budget mechanism for infrastructure development as:

· They can enhance the supply of much-needed infrastructure services.

· They may not require any immediate cash spending.

· They provide relief from the burden of the costs of design and construction.

· They allow transfer of many project risks to the private sector.

· They promise better project design, choice of technology, construction, operation and service delivery

|

Engineering, Procurement and Construction (EPC) Model:

- Under this model, the cost is completely borne by the government.

- Government invites bids for engineering knowledge from the private players.

- Procurement of raw material and construction costs are met by the government.

- The private sector’s participation is minimum and is limited to the provision of engineering expertise.

- A difficulty of the model is the high financial burden for the government.

- EPC Contractor (private entity) is made responsible for all the activities from design, procurement, construction, to commissioning and handover of the project to the Government.

- This is a PPP model for the development of infrastructure projects especially highways.

EPCM

- EPCM stands for Engineering, Procurement and Construction Management.

- Simply put, EPCM is a way of working on an engineering project which lets the project owner (say Government) stay in complete control of their project while engineering consultants (Private entities) manage the process from start to finish.

- This means the private entities take care of all the stages of engineering: including planning, complex engineering requirements, co-ordinating all contractors and vendors etc. on the client’s behalf and providing a single point of contact.

EPC VS EPCM

- EPC stands for Engineering, Procurement and Construction… so the crucially missing element is the “M” for “Management”. Simply put, this is because EPC is not a service in the same way that EPCM is.

- So this means with an EPC contract, the private entity will completely handle the Government’s project from start to finish, however, the Government effectively relinquishes control of the project from the moment the contract is signed. So the private entities then have complete ownership of the project until project completion, and they make all the decisions, with no involvement of the Government..

- But in EPCM contractors keep in touch and update the Govt. regarding the progress of commissioning of the project.

EPCI

- EPCI stands for Engineering, Procurement, Construction and Installation.

- This terminology is used for Off-Shore setups/Constructions.

- In an EPCI contract, the contractor will design the structure/equipments, procure the required materials for its construction, will provide the necessary transportation of the structure and sets it up at an off-shore site.

- The points and terminologies are much similar to an EPC contract.

LSTK (Lump sum Turnkey) or Turnkey Project

- One of the special modes of carrying out international business is a turnkey project.

- The turnkey projects meaning, a contract under which a firm agrees to fully design, construct and equip a manufacturing/ business/ service facility and turn the project over to the purchaser when it is ready for operation for remuneration.

- The term turn-key project (Turn-key delivery) describes a project (or the delivery of such) in which the supplier or provider is responsible to the client for the entire result of the project and presents it to the client completely finished and ready to use.

- Project Classification

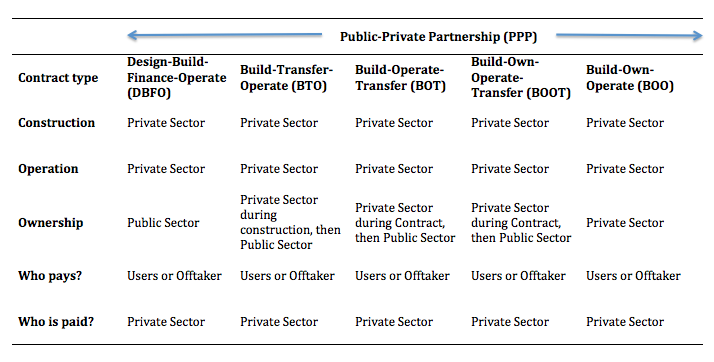

Build Operate and Transfer (BOT) Model:

- The private partner is responsible to design, build, operate (during the contracted period) and transfer back the facility to the public sector.

- The private sector partner is expected to bring the finance for the project and take the responsibility to construct and maintain it.

- In return, the public sector will allow it to collect revenue from the users.

- The national highway projects contracted out by NHAI under PPP mode is an example.

LOT (Lease, Operate and Transfer)

- Under this type of PPPs, a facility which already exists and is under operation, is entrusted to the private sector partner for efficient operation, subject to the terms and conditions decided by mutual agreement.

- The contract will be for a given but sufficiently long period and the asset will be transferred back to the government at the end of the contract.

- Leasing a school building or a hospital to the private sector along with the staff and all facilities by entrusting the management and control, subject to pre-determined conditions could come under this category.

BOOT project

- This is a variation of the BOT model, except that the ownership of the newly built facility will rest with the private party during the period of contract.

- This will result in the transfer of most of the risks related to planning, design, construction and operation of the project to the private partner.

- The public sector partner will however contract to ‘purchase’ the goods and services produced by the project on mutually agreed terms and conditions.

- In the latter case (BOOT), however, the facility / project built under PPP will be transferred back to the government department or agency, after the private partner recovers its investment and reasonable return agreed to as per the contract.

Design, Build, Finance and Operate (DBFO) or Design, Build, Finance, Operate and Maintain (DBFOM)

- The private party assumes the entire responsibility for the design, construct, finance, and operate or operate and maintain the project for the period of concession.

- These are also referred to as “Concessions”.

- The private participant to the project will recover its investment and return on investments (ROI) through the concessions granted or through annuity payments etc.

- The public sector may provide guarantees to financing agencies, help with the acquisition of land and assist to obtain statutory and environmental clearances and approvals and also assure a reasonable return as per established norms or industry practice etc., throughout the period of concession.

Hybrid Annuity Model (HAM):

- In financial terminology hybrid annuity means that the government makes payment in a fixed amount for a considerable period and then in a variable amount in the remaining period.

- This hybrid type of payment method is called HAM in the technical parlance.

- Hybrid Annuity Model (HAM) has been introduced by the Government to revive PPP (Public Private Partnership) in highway construction in India.

- Launch of the new model is due to many problems encountered as associated with the existing ones.

- Large number of stalled projects are blocking infrastructure projects and at the same time adding to Non-Performing Assets (NPAs) of the banking system.

Cost sharing and rights in India

- In India, the new HAM is a mix of BOT Annuity and EPC models.

- As per the design, the government will contribute to 40% of the project cost in the first five years through annual payments (annuity).

- The remaining payment will be made on the basis of the assets created and the performance of the developer.

- Here, hybrid annuity means the first 40% payment is made as fixed amount in five equal installments whereas the remaining 60% is paid as variable annuity amount after the completion of the project depending upon the value of assets created.

- The balance 60 per cent is arranged by the developer.

- Here, the developer usually invests not more than 20-25 per cent of the project cost (as against 40 percent or more before), while the remaining is raised as debt.

- As the government pays only 40%, during the construction stage, the developer should find money for the remaining amount.

- There is no toll right for the developer.

- Under HAM, Revenue collection would be the responsibility of the National Highways Authority of India (NHAI).

Advantages

- It gives enough liquidity to the developer and the financial risk is shared by the government.

- While the private partner continues to bear the construction and maintenance risks as in the case of BOT (toll) model, he is required only to partly bear the financing risk.

- Government’s policy is that the HAM will be used in stalled projects where other models are not applicable.

https://indianexpress.com/article/india/for-new-projects-nhai-back-to-build-operate-transfer-model-8030062/

1.png)