Description

Disclaimer: Copyright infringement not intended.

Context

- India’s largest financial institution, Life Insurance Corporation (LIC), is getting listed on the stock exchanges with a Rs 21,000 crore initial public offering (IPO) next month. LIC manages around Rs 40 lakh crore of public money.

Details

- LIC priced its IPO, the largest in the history of the capital market despite a reduction in size, at Rs 902-949 per share.

- LIC has offered a discount of Rs 60 for policyholders and Rs 45 for retail investors and employees.

IPO

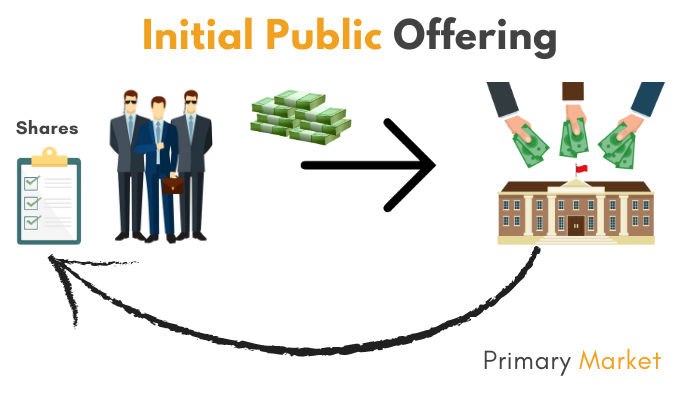

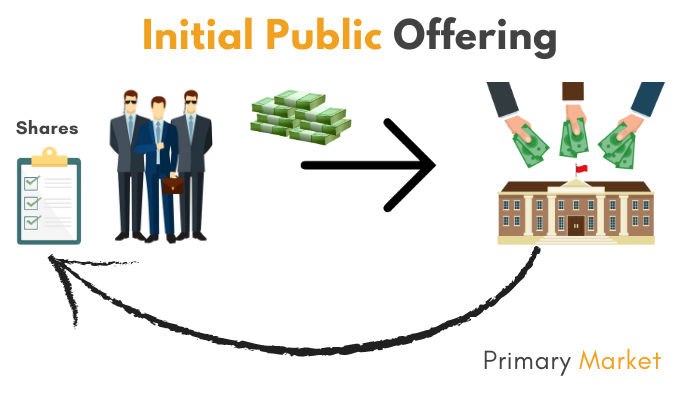

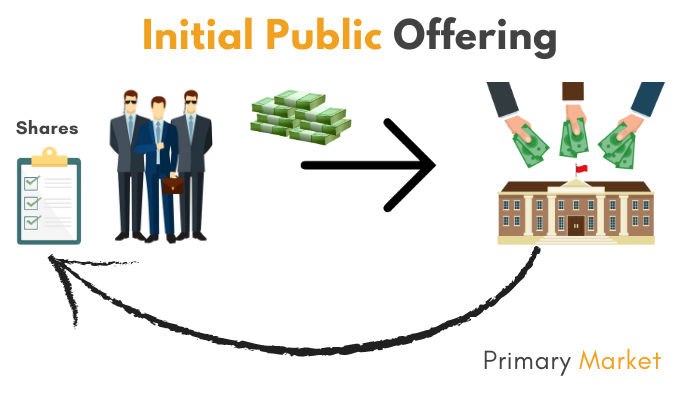

- An IPO or initial public offering is the process by which a privately held company, or a company owned by the government such as LIC, raises funds by offering shares to the public or to new investors.

- An unlisted company (A company which is not listed on the stock exchange) announces initial public offering (IPO) when it decides to raise funds through sale of securities or shares for the first time to the public.

- In other words, IPO is the selling of securities to the public in the primary market. A primary market deals with new securities being issued for the first time.

- Following the IPO, the company is listed on the stock exchange.

- After listing on the stock exchange, the company becomes a publicly-traded company and the shares of the firm can be traded freely in the open market.

|

While coming with an IPO, the company has to file its offer document with the market regulator Securities and Exchange Board of India (SEBi).

The offer document contains all relevant information about the company, its promoters, its projects, financial details, the object of raising the money, terms of the issue, etc.

|

IPO-Source of Fund for a Company

- The Capital market represents the “Primary Market” and the “Secondary Market.

- The capital market has two interdependent and inseparable segments, the new issuers (the primary market) and stock (secondary) market.

- The primary market is used by issuers for raising fresh capital from the investors by making initial public offers or rights issues or offers for sale of equity or debt.

- An active secondary market promotes the growth of the primary market and capital formation, since the investors in the primary market are assured of a continuous market where they have an option to liquidate their investments.

- A corporate may raise capital in the primary market by way of an initial public offer, rights issue or private placement.

- An Initial Public Offer (IPO) is the selling of securities to the public in the primary market. It is the largest source of funds with long or indefinite maturity for the company.

- When the company makes its first IPO to the public, the relationship is directly between the company and investors, and the money flows to the Company as its “Share Capital”.

- Shareholders thus become owners of the Company through their participation in the Company’s IPO and have ownership rights over the company.

- This is the largest source of funds for a company, which enables the company to create “Fixed Assets” which will be employed in the course of the business.

- The shareholders of the Company are free to exit their investment through the secondary market.

Types of IPOS

- There are two common types of IPO.

Fixed Price Offering

- Fixed Price IPO can be referred to as the issue price that some companies set for the initial sale of their shares.

Book Building Offering

- In the case of book building, the company initiating an IPO offers a 20% price band on the stocks to the investors. The interested investors bid on the shares before the final price is decided.

- Book Building is basically a process used in Initial Public Offer (IPO) for efficient price discovery. It is a mechanism where, during the period for which the IPO is open, bids are collected from investors at various prices, which are above or equal to the floor price. The offer price is determined after the bid closing date.

- As per SEBI guidelines, an issuer company can issue securities to the public though prospectus in the following manner:

- 100% of the net offer to the public through book building process

- 75% of the net offer to the public through book building process and 25% at the price determined through book building. The Fixed Price portion is conducted like a normal public issue after the Book Built portion, during which the issue price is determined.

In Book Building securities are offered at prices above or equal to the floor prices, whereas securities are offered at a fixed price in case of a public issue. In case of Book Building, the demand can be known everyday as the book is built. But in case of the public issue the demand is known at the close of the issue.

Importance

- IPO is used by small and medium enterprises, startups and other new companies to expand improve their existing business.

- An IPO is a way for companies to acquire fresh capital, which in turn can be used to finance research, fund capital expenditure, reduce debt and explore other opportunities.

- An IPO will also bring in transparency into affairs of the company since it will be required to inform financial numbers and other market-related developments on time to the stock exchanges.

- The company's investment in various equity and bond instruments will come under greater scrutiny after it gets listed.

- IPO of any company brings great deal of attention and credibility. Analysts around the world report on investment decisions of the clients.

Which companies can come out with an IPO?

- In order to protect investors, SEBI has laid down rules that require companies to meet certain criteria before they can go to the public to raise funds.

- Among other conditions,

- The company must have net tangible assets of at least Rs 3 crore,

- Net worth of Rs 1 crore in each of the preceding three full years, and

- It must have a minimum average pre-tax profit of Rs 15 crore in at least three of the immediately preceding five years.

Where do the proceeds of the IPO go?

- If the issue raises fresh capital, the proceeds of the IPO go to the company, and can be utilised for future growth, expansion, debt reduction, etc.

- If the issue involves offer for sale by promoters or existing investors, then the money goes to them and not to the company.

- In the case of LIC, the issue is an offer for sale by the government, and the IPO proceeds will go to the Government of India.

Who fixes the price of securities in an issue?

- The per-share price of the public issue is fixed by the issuer in consultation with the merchant banker.

- They arrive at the total valuation of the company based on parameters such as assets, revenues, profits, and future cash flow projections, and the total value of the company is then divided by the post-offer shares outstanding to arrive at the price of each share.

- The regulator, SEBI, does not play a role in price fixation.

What are the advantages of listing a company?

- It helps a company raise capital, and diversify and broaden its shareholder base.

- Listing provides an exit to existing investors of the company. A listed company can raise share capital for growth and expansion in the future through a follow-on public offering or FPO.

Who can invest in an IPO?

- There are various categories of investors who can invest in an IPO.

- Qualified institutional buyers (QIBs) is a category of investors that includes foreign portfolio investors (FPIs), mutual funds, commercial banks, insurance companies, pension funds, etc.

- All individuals who invest up to Rs 2 lakh in an issue are classified as retail investors. Retail investors investing above Rs 2 lakh are classified as high net worth individuals.

- One has to be 18 years of age to become an investor. A brokerage account is needed to invest, and you have to be at least 18 years old to have one.

https://indianexpress.com/article/explained/after-revised-pricing-should-you-invest-in-lics-ipo-7892264/