Description

Copyright infringement not intended

Picture Courtesy: slideserve.com

Context: The term “Loanable funds theory” is in the news.

Details

- According to the loanable funds theory, interest rates are the result of the supply and demand of funds in the loan market. This theory, developed by Swedish economist Knut Wicksell, applies not only to loans but also to other forms of credit, such as bonds.

Key Highlights

- According to the loanable funds theory, also known as the neo-classical theory of interest, the market for loanable funds determines the interest rates on loans.

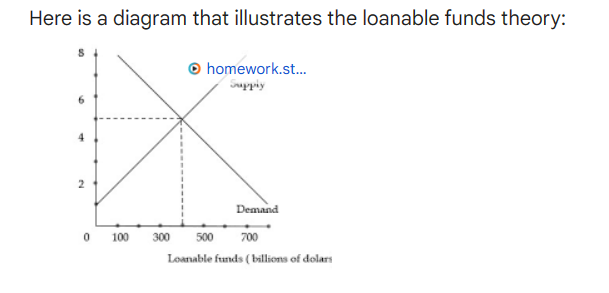

- This theory assumes that the interest rate is the price that equilibrates the supply of and demand for loanable funds.

- The supply of loanable funds comes from savers, such as households, who are willing to lend their money at a certain interest rate.

- The demand for loanable funds comes from borrowers, such as businesses and governments, who are willing to borrow money at a certain interest rate.

- The theory predicts that an increase in the supply of loanable funds will lower the market interest rate, while a decrease in the supply of loanable funds will raise the market interest rate. Conversely, an increase in the demand for loanable funds will raise the market interest rate, while a decrease in the demand for loanable funds will lower the market interest rate.

- The loanable funds theory explains how the interest rate is determined by the interaction of savers and borrowers in the credit market.

- According to this theory, savers are willing to lend their money to borrowers because they receive interest as compensation for postponing their consumption. The interest rate is the price that savers charge for lending their money.

- Borrowers, on the other hand, demand loans because they want to invest in productive projects that will yield a return higher than the interest rate. The interest rate is the cost that borrowers pay for using someone else's money.

- The market interest rate is the result of the equilibrium between the supply of savings and the demand for loans. At this interest rate, savers and borrowers are both satisfied and there is no excess or shortage of credit in the market.

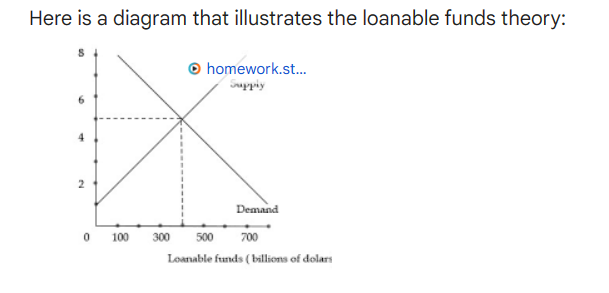

As given in the graph, the interest rate is determined by the intersection of the supply and demand curves for loanable funds. When the supply of loanable funds is greater than the demand for loanable funds, the interest rate will fall. When the demand for loanable funds is greater than the supply of loanable funds, the interest rate will rise.

Conclusion

- The loanable funds theory can be used to explain a number of economic phenomena, such as changes in interest rates, economic growth, and the business cycle. For example, if the supply of loanable funds increases, the interest rate will fall. This will lead to increased investment and economic growth. Conversely, if the demand for loanable funds increases, the interest rate will rise. This will lead to decreased investment and economic growth.

|

PRACTICE QUESTION

Q. According to the loanable funds theory, the interest rate is determined by:

A) The demand for and supply of money

B) The demand for and supply of loanable funds

C) The marginal productivity of capital

D) The marginal propensity to save

Answer: B

Explanation: The loanable funds theory is a theory of the market interest rate that considers all forms of credit, such as loans, bonds, or savings deposits, as loanable funds. The interest rate is determined by the equilibrium between the demand for and supply of loanable funds from various sources and for various purposes.

|

https://epaper.thehindu.com/ccidist-ws/th/th_delhi/issues/49662/OPS/GA7BM8KF6.1.png?cropFromPage=true