Description

Disclaimer: Copyright infringement not intended.

Context

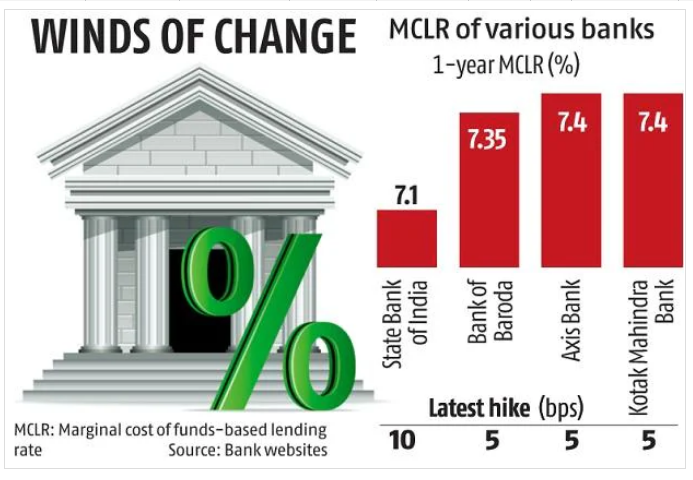

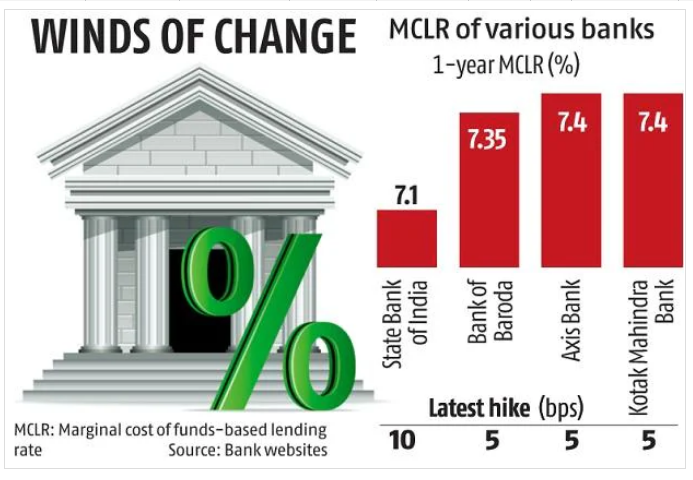

- SBI raised the MCLR by 10 basis points (bps) across tenures to 7.1% (from 7% earlier).

What is MCLR?

- MCLR (Marginal Cost of Funds Based Lending Rate) refers to the minimum interest rate below which financial institutions can’t lend, except in certain cases. Marginal cost of funds based lending rate defines the process used to determine the minimum home loan rate of interest.

- The MCLR method was introduced in the Indian financial system by the Reserve Bank of India in the year 2016. The MCLR system has replaced the base rate system that was introduced in the year 2010.

MCLR vs. Erstwhile Base Rate

- Earlier, when banks and financial institutions did lend on base rates, its prime customers used to get undue advantages.

For example, if the base rate of lending was 7%, certain financial institutions would lend to their prime customers at 7% or below. On the other hand, for ordinary customers, this rate of interest could have been 10-12%.

- Since base rate was a financial institution’s internal policy, this caused a huge monetary loss. Also, even after repo rate cuts by RBI, a lot of time was taken by financial institutions to lower their lending rates and pass the benefits to customers.

- Thus, RBI switched to the external benchmark linked lending rate (EBLR) system where lending rate is linked to benchmark rates like repo or Treasury Bill rates. Now renewal of credit limits and sanctioning of loans is now done as per MCLR norms.

Objectives of MCLR

The current Marginal Cost of Lending Rate (MCLR) aims to:

- Facilitate the implementation of the lending policy rates defined by the Indian Reserve Bank, and ensure that all Indian financial institutions comply fully.

- Bring the much-needed transparency in financial institutions while determining their interest rates.

- Pass the benefits of reduced interest rates to customers.

- Ensure availability of loans to customers that is fair to both customers as well as the lender.

- Under MCLR, it’s mandatory for banks to declare their overnight, 1-month, 3-month, 6-month, 1-year, and 2-year interest rates every month. Now as a borrower, one can know the MCLR rates of banks from their websites.

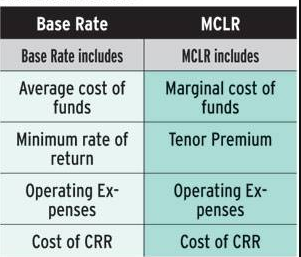

Components of MCLR/How is MCLR Rate Calculated?

Following are the Components that make up the marginal costs. Banks and financial institutions calculate MCLR rate against the following:

- Marginal cost of funds which comprises of marginal cost of borrowings and return on net worth.

- Negative carry on account of cash repo rate which is the cost banks incur to keep reserves with RBI.

- Operating costs incurred by the banks.

- Tenor premium which is the higher interest that can be charged for long term loans.

Basis of charging MCLR

Marginal costs are charged based on the following factors as per the RBI guidelines:

- Interest rate offered on deposits including savings, term, and current and foreign currency deposits.

- Return on net worth.

- Borrowings meaning the repo rate, short term interest rate, and the long term interest rate.

The Marginal Cost of Funds will be based on these components. 92% of the MCLR is determined by the marginal cost of funds, deposit rate and repo rate. The return on net worth will comprise of 8%.

What kind of loans will be linked to the MCLR?

- All floating rate loans that are sanctioned from April 1st, 2016, will be based on the MCLR. For credit renewal as well, the MCLR will apply. Floating rate loans include:

- Home loans

- Loans against property

- Corporate term loan

- The MCLR is relevant only to banks. So any loan with a floating interest rate sanctioned from a bank will be linked to the MCLR. Some banks have also linked their auto loans and educational loans.

Exemptions under MCLR

- MCLR is applicable to almost all loans except fixed rate home loans, car loans and personal loans.

- Loans that fall under Government Schemes where the banks are directed to charge a certain rate of interest are also exempt from MCLR.

- MCLR is applicable only to banks. So loans that are taken from finance companies and houses will not fall under this system. The Non-Banking Financial companies include LIC Housing Finance, Dewan Housing (DHFL), HDFC, Indiabulls etc.

Note: A GST rate of 18% is applicable on banking services and products. This includes credit card payments, fund transfer, ATM transactions, processing fees on loans etc.

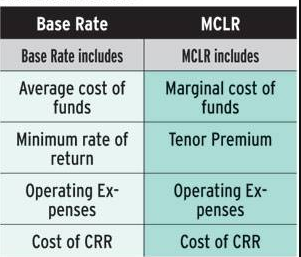

Difference between MCLR and Base Rate

|

Base Rate System

|

MCLR

|

|

The rates of interest for loans were determined by base rates.

|

Borrowers enjoy Repo Rate benefits through the Reserve Bank of India’s MCLR system.

|

|

The calculation for the base rate depends on certain factors like the rate of bank deposits, earnings, bank’s operating costs, etc.

|

MCLR relies on certain factors like Cash Reserve Ratio (CRR), the marginal cost of funds, a premium on loan tenor, operating costs, etc.

|

|

REPO rates set by the Reserve Bank of India (RBI) were not mandatory. Banks did not always comply.

|

For the MCLR system, the REPO rate changes are compulsory.

|

|

Banks could choose to change the base rate quarterly at their discretion.

|

The MCLR rates vary for varied loan tenors.

|

|

There was an absence of transparency and accountability on the financial institutions’ part.

|

There is increased transparency and accountability.

|

MCLR is a better way to regulate bank lending rates because:

- It facilitates the effective transmission and application of policy rates set by the Indian Reserve Bank.

- Financial regulation in India is harmonized thereby providing equity in the lending rates.

- It ensures that the benefits of the Indian Reserve Bank’s interest rate cuts are available to borrowers.

- It leads to a reduction in the Equated Monthly Installments (EMIs) on any loan.

How a hike in REPO rate affects MCLR rate?

- In the advent of a hike in the repo rate, it will also impact lenders’ MCLR rate. Lenders will push up their MCLR rate that will translate to a spike in interest rates and EMIs. However, this hike will be applicable only to floating interest rates and not fixed interest rates.

- MCLR will lead to an increase in loan EMI. If the RBI increases the REPO interest rates the MCLR rates will rise, forcing financial institutions, banks included, to increase their lending rates.

- This may cause increased rates of interest on loans and the EMIs that accompany the loans.

https://indianexpress.com/article/explained/what-the-increase-in-mclr-means-for-you-your-loan-7877241/