Disclaimer: Copyright infringement not intended.

In News:

- Microfinance institutions hailed the RBI's Regulatory Framework for Microfinance Loans Directions, 2022'.

- They said that these guidelines will further deepen the penetration of micro-credit in the country.

Microfinance Institutions

- Microfinance institutions (MFIs) are financial companies that provide small loans to people who do not have any access to banking facilities.

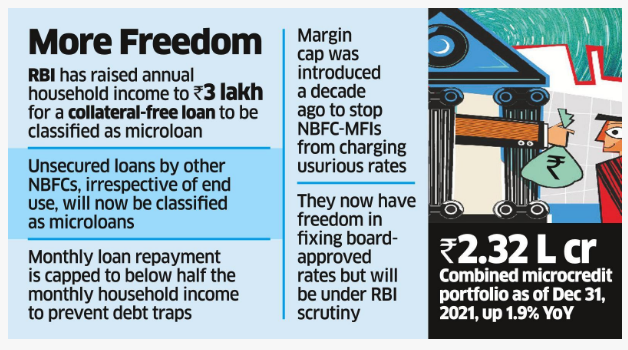

- In India, a microfinance loan is defined as a collateral-free loan given to a household having an annual income of up to Rs 3 lakh. (Recently revised by RBI. Earlier it was Rs 1 Lakh)

- Example of MFIs: Bandhan Bank Limited, Ujjivan Small Finance Bank, Annapurna Finance Pvt. Ltd, Muthoot Microfin Limited, CreditAccess Grameen Limited, Sonata Finance Private Limited etc.

- The different types of institutions that offer microfinance are:

- Credit unions

- Non-governmental organisations

- Commercial banks

Some government banks also offer microfinance to the eligible categories of borrowers.

Although most microfinance institutions target the eradication of poverty as their primary motive, some of the new entrants are focused on the sale of more products to consumers.

Goals of Microfinance Institutions

- Microfinance institutions have been gaining popularity in the recent years and are now considered as effective tools for alleviating poverty. The primary goals of microfinance institutions are the following:

- Transform into a financial institution that assists in the development of communities that are sustainable.

- Help in the provision of resources that offer support to the lower sections of the society. There is special focus on women in this regard, as they have emerged successful in setting up income generation enterprises.

- Evaluate the options available to help eradicate poverty at a faster rate.

- Mobilize self-employment opportunities for the underprivileged.

- Empowering rural people by training them in simple skills so that they are capable of setting up income generation businesses.

|

As per World Bank data, close to 1.7 billion people across multiple countries do not have access to basic financial services. This is where microfinance institutions play a major role.

|

Groups Organized by Microfinance Institutions in India

- There are several types of groups organised by microfinance institutions for offering credit, insurance, and financial training to the rural population in India:

- Joint Liability Group (JLG)

- This is usually an informal group that consists of 4-10 individuals who seek loans against mutual guarantee. The loans are usually taken for agricultural purposes or associated activities. Farmers, rural workers, and tenants fall into this category of borrowers. Each individual in a JLG is equally responsible for the loan repayment in a timely manner. This institution does not need any financial administration, as it is simple in nature.

- Self Help Group (SHG)

- A Self Help Group is a group of individuals with similar socio-economic backgrounds.

- These small entrepreneurs come together for a short duration and create a common fund for their business needs. These groups are classified as non-profit organisations. The group takes care of the debt recovery.

- There is no requirement of a collateral in this kind of group lending. The interest rates are generally low as well.

- Several banks have had tie-ups with SHGs with a vision to improve financial inclusion in the rural parts of the country.

- The NABARD SHG linkage programme is noteworthy in this regard, as several Self Help Groups are able to borrow money from banks if they are able to present a track record of diligent repayments.

- Grameen Model Bank

- The Grameen Model was the brainchild of Nobel Laureate Prof. Muhammad Yunus in Bangladesh in the 1970s.

- It has inspired the creation of Regional Rural Banks (RRBs) in India.

- The primary motive of this system is the end-to-end development of the rural economy.

- However, in India, SHGs have been more successful as MFIs when compared to Grameen Banks.

- Rural Cooperatives

- Rural Cooperatives were established in India at the time of Indian independence. The resources of poor people were pooled in and financial services were provided from this fund.

- However, this system had complex monitoring structures and was beneficial only to the creditworthy borrowers in rural India. Hence, this system did not find the success that it sought initially.

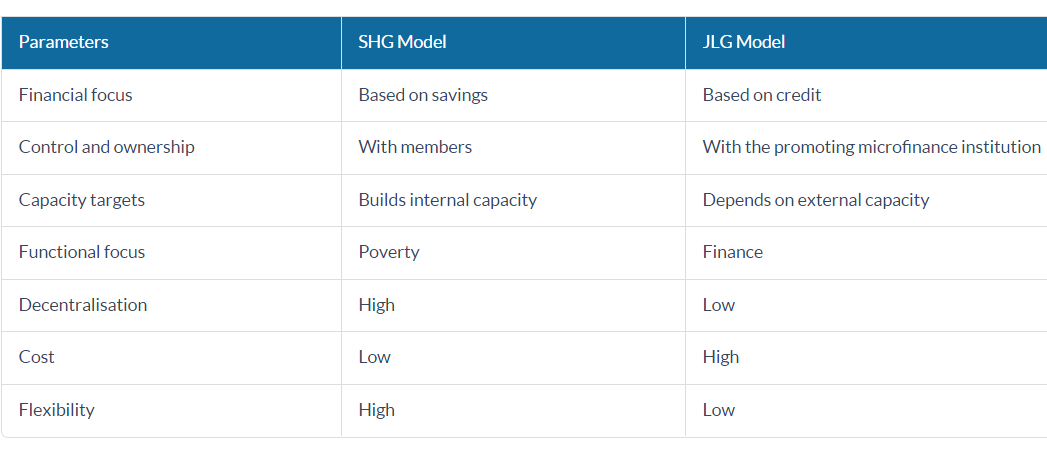

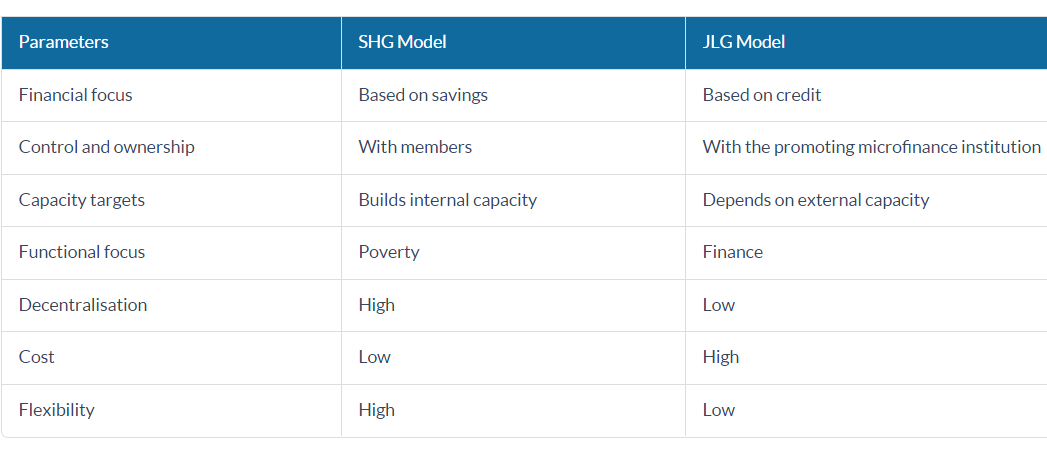

SHG vs JLG

|

Trivia

Microfinance institutions have a presence in 615 districts in India. The regional distribution is as follows:

North-East and East – 37%

South – 25%

North – 14%

West – 15%

Central India – 9%

As of May 2021, the Reserve Bank of India (RBI) had registered 94 non-banking financial companies (NBFC) to run microfinance institutions (MFI).

In 1974, SEWA (Self-Employed Women's Association) Bank, a cooperative bank, was established in Ahmedabad; as one of the first modern-day microfinance institutions in the country.

|

Regulations for MFIs

- The regulations pertaining to MFIs are usually based on their statuses.

- A microfinance bank will be required to adhere to all banking regulations like traditional banks.

- Cooperatives and NGOs will not be expected to comply with the same regulations. However, they may be regulated by similar oversight authorities.

Traditional Banks versus Microfinance Institutions

MFIs, more often than not, function on a unique operating model when compared to traditional lending institutions.

- Evaluation of eligibility - When loans are provided by microfinance institutions, the eligibility of a borrower is not scrutinised on the bases of stong financial guarantees like traditional bank loans. Mainstream banks assess the salary and assets of a loan applicant before granting the loan. Microfinance banks rely more on the “human” criteria If the loan helps in the setup of a new activity that brings income to the borrower, the chances of it being sanctioned are high. The viability evaluation is primarily based on social and human criteria such as experience in the field, competence, and motivation. The viability of the project is also considered.

Before the microloan is sanctioned, a committee examines the requests and evaluates the borrower’s capability to repay.

- Group solidarity as guarantee - For instance, when investing in mutual funds, each borrower serves as a guarantor for each of the other members in the group. i.e., a kind of social guarantee. Self-help groups are examples of the same.

- Training programmes – Unlike traditional banks, MFIs are liable to building bonds with the beneficiaries of microloans. They also offer strong support to the borrowers. Since the motive is to help borrowers succeed in their projects, MFIs also undertake training programmes that focus primarily on educating beneficiaries on the budgeting of projects.

- Flexible repayment schedules – MFIs usually configure the repayment method for microloans in such a way that is suits the financial capabilities of the target customer base. Thus, there are MFIs that are likely to provide loans with weekly repayment dates, unlike traditional banks.

- Flexible credit schemes – Microlending has products that are usually adapted to suit the repayment capabilities of borrowers. This is one of the main differences between a traditional lender and an MFI.

How are MFIs Funded?

Microfinance Institutions get funding from several sources, such as:

- Member and customer deposits – This is applicable to MFIs that are organised as mutual funds, cooperatives, and microfinance banks offering savings products.

- Subsidies and grants – Grants are more prominent when the MFI is just being set up.

- Own capital – The microfinance institution’s own finance/capital accounts for a part of the funding extended to borrowers.

- Loans from partner banks – This is the primary source of funding for an MFI.

- Funding received from public investors – Bilateral or multilateral organisations offer funds to MFIs. This is a source of long-term funding for the MFI.

- Funding received from private investors – These funds are supplied directly to the MFI or through investment funds that specialise in microfinance. This is also a source of long-term funding for the MFI.

Challenges Faced by MFIs in India

- Cost of outreach - reaching the unbanked populations of the world means servicing small loan amounts and servicing remote and sparsely populated areas of the planet, which can be dangerously unprofitable without high rates of process automation and mobile delivery.

- Lack of scalability - smaller microfinance systems often struggle to preserve the profitability and performance in these markets, as Financial Institutions experience high growth rates that result from getting the service delivery right. This results in thwarting the growth of these organizations.

- Quality of SHGs (Self Help Groups) - Due to the fast growth of the SHG-Bank Linkage Programme, the quality of MFIs has come under stress. This is due to various reasons such as:

- The intrusive involvement of government departments in promoting groups

- Diminishing skill sets on part of the MFIs members in managing their groups.

- Changing group dynamics.

- Geographic Factors - Around 60% of MFIs agree that the Geographic factors make it difficult to communicate with clients of far-flung areas which create a problem in growth and expansion of the organization.

- Diverse business models - Supporting the very wide range of features and lending activities is difficult and requires a considerable amount of cost and efforts.

- High Transaction Cost - High transaction cost is a big challenge for microfinance institution. The volume of transactions is very small, whereas the fixed cost of those transactions is very high.

- KYC and security challenges – The customers serviced by Microfinance instructions are usually the ones having none or very limited official identification or able to provide tangible security, this makes it extremely difficult for institutions to offer any banking services.

- Limited budgets – Making provisions for large upfront investments is not possible for most of the MFIs which limits their capability to purchase world-class banking solutions that can help them fulfil their requirements and support their growth targets.

- Unfavorable policies: Although microfinance institutions have been profitable in India, there have been regulations and populist politics that have proved to be unfavourable to them.

- Easily affected: The small size of these institutions implies that they will be affected by small adverse developments resulting in fragile finances.

- Funding: Banks usually have multiple products and an assured deposit structure. On the other hand, micro lending institutions are highly dependent on the market for funding. This means that at the smallest of events affecting business, MFIs could find it difficult to procure financing.

- Over-dependence of the banking system: Additionally, banks today have a presence in the microlending space and they are also partnering with MFIs through strategic stakes. MFIs are also finding it difficult to grow independently without any support from anchor investors. There are many MFIs that included NGO-run units and societies. Non-banking finance companies – microfinance institutions (NBFC-MFIs) had also been registered with the Microfinance Institutions Network (MFIN).

- Overborrowing: The biggest risk looming over the microfinance industry today is the tendency to overborrow on the part of loan seekers. The fact that 20% to 30% of loan applications are now being rejected by MFIs is attributed to the excess borrowing witnessed in the industry.

- Missing of Targets: It is a common mistake by the MFIs to neglect the urban poor; they primarily try to focus on the rural poor.

- Loan Default: Risk management remains inefficient. Plus, late payments are almost 70% in MFIs, which further creates a hurdle for the institution's working capital and profit.

|

As per RBI regulations, the total microloan amount that a single loan seeker can avail should not exceed Rs.60,000 in the initial cycle. In the subsequent cycles, the amount should not be above Rs.1 lakh. The borrower is also not allowed to approach more than two microfinance institutions for the same. As part of self-regulation, MFIN increased the lending bar to Rs.80,000 as there was a huge demand for loans.

|

- High rates of interest charged by lenders: MFIs have a high rate of interest charged on the loans that amount to 12-30% of the principal amount. This leads to default.

Note: It is in this context that under RBI’s new regulations 2022, it has allowed microfinance lenders to fix interest rates on loans with a rider that those should not be usurious for the borrowers. And these shall be subjected to supervisory scrutiny by the Reserve Bank.

No doubt, microfinance institutions have shown impressive growth and have been instrumental in the cause of financial inclusion, but a lot remains to be achieved.

Solutions

- Proper Regulation - When the microfinance was in its emergent stage, and individual establishments were allowed to have innovative, operational models, a non- restrictive surrounding wasn't a big concern. However, now the institution needs restrictions that protect the interest of stakeholders and promotes growth.

- Field superintendence - This can keep an eye on the performance of ground employees of MFIs and their loan recovery practices.

- Focus on rural poor - Instead of reducing the initial cost at places where there are MFIs, these institutions could start targeting the rural poor and establish new branches over the areas.

- Complete variety of product - This will help in diverting the dependency of people from the commercial banks.

- Transparency of interest rates - The MFIs should abide by an actual Interest rate on the products and amounts which should be mentioned to the customers.

- Technology to scale back overhead - MFIs ought to use new technologies and IT tools & applications to scale back their operational costs. Microfinance institutions should be inspired to adopt cost-cutting measures to scale back their operating costs.

- Different sources of fund - In the absence of adequate funds, the expansion and the reach of MFIs become restricted and to beat this downside, MFIs could hunt for alternative sources for funding their loan portfolio.

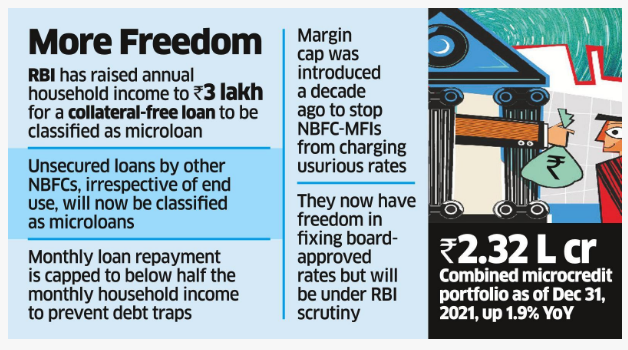

Provisions of Reserve Bank of India (Regulatory Framework for Microfinance Loans) Directions, 2022'

- A collateral-free loan that can be given by MFI to a household is the one having an annual income of up to Rs 3 lakh. (Earlier it was Rs 1 Lakh).

- Each regulated entity (RE) should put in place a board-approved policy regarding pricing of microfinance loans.

- In the past, the central bank used to announce the rates on quarterly basis.

- Interest rates and other charges/ fees on microfinance loans should not be usurious. These shall be subjected to supervisory scrutiny by the Reserve Bank.

- Each RE has to disclose pricing-related information to a prospective borrower in a standardized simplified factsheet.

- Any fees to be charged to the microfinance borrower by the RE and/ or its partner/agent shall be explicitly disclosed in the factsheet.

- The borrower shall not be charged any amount which is not explicitly mentioned in the factsheet.

- There should be no pre-payment penalty on microfinance loans.

- Penalty, if any, for delayed payment shall be applied on the overdue amount and not on the entire loan amount.

- Regarding limit on loan repayment obligations of a household, each RE should have a board-approved policy regarding the limit on the outflows on account of repayment of monthly loan obligations of a household as a percentage of the monthly household income. This shall be subject to a limit of maximum 50 per cent of the monthly household income.

- There should also be a standard form of loan agreement for microfinance loans in a language understood by the borrower.

- Under the earlier guidelines, an NBFC that does not qualify as a non-banking financial company - microfinance institution (NBFC-MFI), cannot extend microfinance loans exceeding 10 percent of its total assets. The maximum limit on microfinance loans for such NBFCs (NBFCs other than NBFC-MFIs) now stands revised at 25 percent of the total assets.

Significance of the recent new regulations

- The harmonised regulations will usher in a new era/beginning for the microfinance sector where a common regulatory framework will be applicable to all REs of RBI.

- Besides creating a level playing field, the framework will address issues of over indebtedness and multiple lending which were of paramount concerns for the sector.

- The revision of the income cap to Rs 3 lakh will expand the market opportunity and interest rate cap removal will promote risk-based underwriting.

- The framework for microfinance loans announced by the RBI will further help deepen penetration of micro-credit in the country.

- This harmonized regulatory framework for different types of lenders, will encourage healthy competition and enabling customers to make an informed choice regarding their credit needs.

- The new framework will help scale the industry further, ensure better risk mitigation and financial inclusion.

https://www.business-standard.com/article/finance/mfis-welcome-rbi-s-regulatory-framework-for-microfinance-loans-122031401235_1.html