Description

Disclaimer: Copyright infringement not intended.

Context

- The Monetary Policy Committee’s resolution stressed that the MPC would remain focused on withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth.

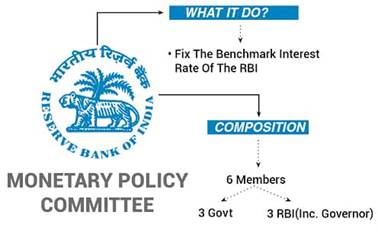

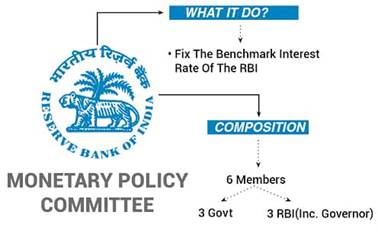

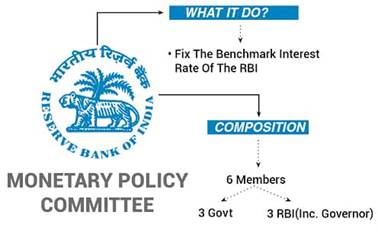

Monetary Policy Committee

- About:MPC is a government-constituted body of the RBI, which is responsible for framing the monetary policy of the country, using the tools like repo rate, reverse repo rate, bank rates etc.

- Proposal:Urjit Patel Committee was the first committee who proposed the Monetary Policy Committee (MPC).The first meeting of MPC was conducted on 3rd October 2016 in Mumbai.

- Mandate:Prime objective of RBI MPC is to determine the policy interest rate required to achieve the inflation target.

- Act:RBI Act, 1934 empowers the RBI to take Monetary Policy Decisions.

- Meetings:The meetings of the Monetary Policy Committee are held at least 4 times a year(specifically, at least once BIMONTHLY) and it publishes its decisions after each such meeting.

- Composition:The committee comprises six members - three officials of the Reserve Bank of India and three external members nominated by the Government of India.

The Governor of Reserve Bank of India is the chairperson ex officio of the committee.

- Term:each member has tenure of four years.

- Confidentiality:They need to observe a "silent period" seven days before and after the rate decision for "utmost confidentiality".

- Decision:Decisions are taken by majority with the Governor having the casting vote in case of a tie. MPC decisions are taken by voting, where a simple majority (4 out of 6) is necessary for a decision to be passed.

- Inflation targets:

Targeted consumer price index (CPI) inflation rate is= 4%

Upper tolerance limit of inflation is= Target inflation rate + 2% = (4% + 2%) =6%

Lower tolerance limit of inflation is= Target inflation rate – 2% = (4% – 2%) =2%

Targeted consumer price index (CPI) inflation rate period from = April 1, 2021

Targeted consumer price index (CPI) inflation rate period up to = March 31, 2026

Read: https://www.iasgyan.in/daily-current-affairs/monetary-policy

https://epaper.thehindu.com/Home/ShareArticle?OrgId=GVRA60F2A.1&imageview=0