Description

Copyright infringement not intended

Context: Recently a controversy erupted in parliament over the classification of a bill as a money bill.

Details

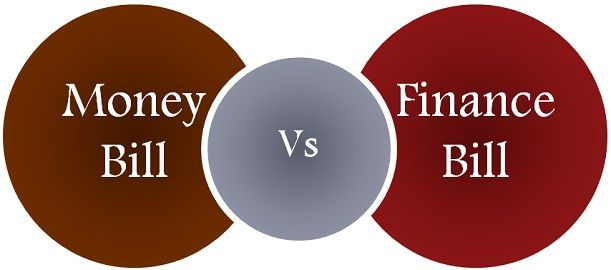

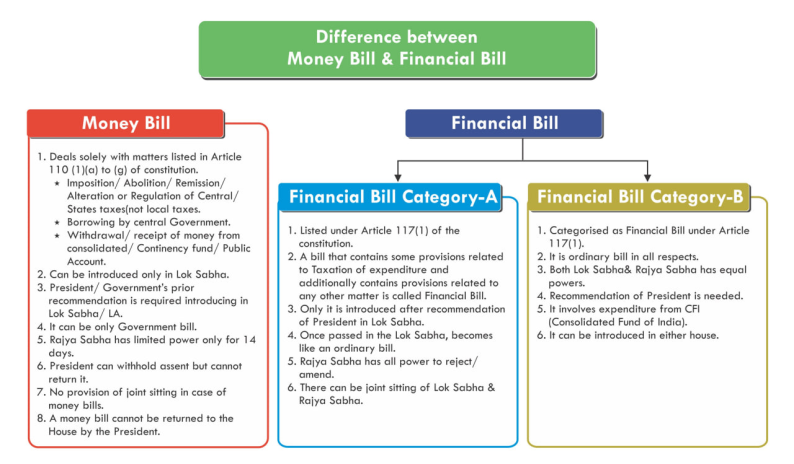

What is a Money Bill?

- A money bill is a special kind of bill that deals exclusively with matters related to taxation, borrowing, expenditure, or receipt of money by the government. According to Article 110 of the Constitution of India, a bill is deemed to be a money bill if it contains only provisions dealing with one or more of the following matters:

- The imposition, abolition, remission, alteration or regulation of any tax.

- The regulation of the borrowing of money or the giving of any guarantee by the government.

- The custody of the Consolidated Fund or the Contingency Fund of India, or the payment of money into or the withdrawal of money from any such fund.

- The appropriation of money out of the Consolidated Fund of India.

- The declaring of any expenditure to be expenditure charged on the Consolidated Fund of India or the increasing of the amount of any such expenditure.

- The receipt of money on account of the Consolidated Fund of India or the public account of India or the custody or issue of such money or the audit of the accounts of the Union or a State.

- Any matter is incidental to any of the matters specified above.

- A money bill can be introduced only in the Lok Sabha (the lower house) and only on the recommendation of the President. The Rajya Sabha (the upper house) cannot amend or reject a money bill. It can only make recommendations within 14 days, which the Lok Sabha may accept or reject.

- If the Rajya Sabha does not return the bill within 14 days, it is deemed to have been passed by both houses. The President can either give assent to a money bill or withhold assent, but cannot return it for reconsideration.

Why is a Money Bill Important?

- A money bill is important because it affects the finances and budget of the government and hence has a direct impact on the economy and welfare of the country. A money bill also reflects the priorities and policies of the government and shows how it plans to raise and spend public funds. A money bill also has a special status in terms of its passage and approval, as it cannot be blocked or delayed by the Rajya Sabha or the President.

How to Identify a Money Bill?

- Sometimes, it may not be clear whether a bill is a money bill or not, as it may contain provisions that are not directly related to money matters but are incidental or consequential to them. For example, a bill that provides for setting up a new authority or commission may also involve some expenditure from the Consolidated Fund of India. In such cases, the final authority to decide whether a bill is a money bill or not rests with the Speaker of the Lok Sabha. The Speaker's decision is final and binding and cannot be challenged in any court.

What is a Financial Bill?

- A financial bill is a bill that contains some provisions related to taxation, borrowing, expenditure, or receipt of money by the government, but also contains other matters that are not related to these subjects. According to Article 117 of the Constitution of India, there are two types of financial bills:

- Financial Bill Type I: This is a bill that contains provisions related to taxation, borrowing, expenditure, or receipt of money by the government, but also contains other matters that are not covered under Article 110. Such a bill can be introduced only in the Lok Sabha and only on the recommendation of the President. However, unlike a money bill, it can be amended or rejected by either house. The President can either give assent to such a bill, withhold assent, or return it for reconsideration.

- Financial Bill Type II: This is a bill that does not contain any provisions related to taxation, borrowing, expenditure, or receipt of money by the government, but affects the meaning or operation of any law that deals with these subjects. Such a bill can be introduced in either house and does not require the recommendation of the President. However, it cannot be passed by either house unless the President has given his prior approval. The President can either give assent to such a bill, withhold assent, or return it for reconsideration.

Why are Financial Bills Important?

- Financial bills are important because they deal with the financial matters of the country and affect the revenue and expenditure of the government. They also have implications for the fiscal policy and the economic development of the country. Financial bills are different from money bills, which deal exclusively with taxation, borrowing, expenditure, or receipt of money by the government and are subject to special procedures under Article 110 of the Constitution.

How are Financial Bills Passed?

- Financial bills are passed by following the normal legislative procedure applicable to ordinary bills. They have to be passed by a simple majority of both houses separately. However, there are some differences between the two types of financial bills:

- Financial Bill Type I: This type of bill can be introduced only in the Lok Sabha and only on the recommendation of the President. The Rajya Sabha can amend or reject such a bill within 14 days. If the Rajya Sabha does not return the bill within 14 days or returns it with amendments, the Lok Sabha can either accept or reject the amendments. If there is a deadlock between the two houses, a joint sitting can be convened to resolve it.

- Financial Bill Type II: This type of bill can be introduced in either house and does not require the recommendation of the President. However, it cannot be passed by either house unless the President has given his prior approval. The Rajya Sabha can amend or reject such a bill within 14 days. If the Rajya Sabha does not return the bill within 14 days or returns it with amendments, the Lok Sabha can either accept or reject the amendments. If there is a deadlock between the two houses, a joint sitting cannot be convened to resolve it.

Why distinction between money bills and financial bills matter?

- Money bills give more power to the Lok Sabha and reduce the role of the Rajya Sabha in fiscal matters. This reflects the principle that taxation and expenditure should be decided by the representatives of the people who pay taxes and bear public expenditure.

- Money bills also give more power to the executive branch and reduce the scope for parliamentary scrutiny and debate on fiscal matters. This is because money bills are introduced on the recommendation of the President (who acts on the advice of the Cabinet) and cannot be amended or rejected by either house without affecting their passage.

- Financial bills allow for more flexibility and diversity in fiscal legislation and enable both houses to have a say in fiscal matters that are not exclusively related to money. This allows for more deliberation and consultation on fiscal issues that may have wider implications for policy and governance.

- Financial bills also allow for more coordination and cooperation between the Union and State governments in fiscal matters that affect both levels. This is because financial bills that affect taxation, borrowing, expenditure, or receipt of money by both levels require prior approval from both levels before they can be passed by Parliament.

Conclusion

- Money bills and financial bills are two types of bills that deal with fiscal matters in different ways. Money bills deal exclusively with matters related to money and give more power to the Lok Sabha and the executive branch. Financial bills deal with other matters that are related to or affect fiscal matters and give more scope for both houses and both levels of government to participate in fiscal legislation. Understanding the difference between these two types of bills can help us appreciate the nuances and complexities of the budgetary process and the federal structure of India.

Must-Read Articles:

FINANCE BILL: https://www.iasgyan.in/daily-current-affairs/finance-bill

|

PRACTICE QUESTION

Q. What are the distinctive features that define a Money Bill in parliamentary systems like India, and why is it considered a significant legislative instrument? In the context of its importance, what challenges can arise during the handling of Money Bills, and what strategies could be adopted to address these challenges and pave a constructive way forward?

|

https://indianexpress.com/article/explained/explained-politics/money-bills-vs-financial-bills-what-are-the-differences-what-the-court-has-ruled-8875134/