Disclaimer: Copyright infringement not intended.

Context

- The capital markets regulator Securities and Exchange Board of India (SEBI) recently proposed to review the role and accountability of trustees of mutual funds with an aim to protect unitholders’ interests. Besides, the regulators also put forward some recommendations to enhance the accountability of the board of asset management companies (AMC).

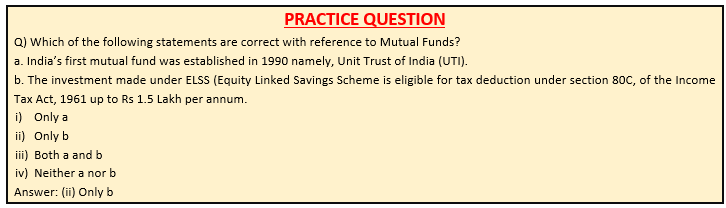

ALL ABOUT MUTUAL FUNDS

Introduction and History

- Traditionally, Indians have relied on real estate, gold, and bank fixed deposits for their investments. However, in the last two decades, mutual funds have emerged as an alternative and possibly superior investment option because mutual funds offer an opportunity to earn higher returns compared to these traditional investments.

- In addition, mutual funds offer easy access, liquidity (similar to bank deposits), more straightforward exits (as opposed to real estate investments), and remove investment management risk from the individual investor as professional fund managers manage them.

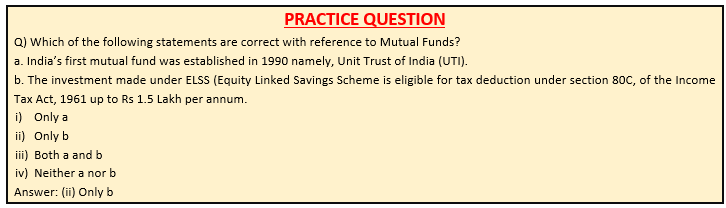

- A strong financial market with broad participation is essential for a developed economy. With this broad objective was established India’s first mutual fund in 1963, namely, Unit Trust of India (UTI), at the initiative of the Government of India and Reserve Bank of India ‘with a view to encouraging saving and investment and participation in the income, profits and gains accruing to the Corporation from the acquisition, holding, management and disposal of securities.

.jpeg)

What are Mutual Funds?

- A mutual fund is an investment vehicle that pools funds from investors and invests in equities, bonds, government securities, gold, and other assets.

- Companies that qualify to set up mutual funds, create Asset Management Companies (AMCs) or Fund Houses, which pool in the money from investors, market mutual funds, manage investments and enable investor transactions.

- Mutual funds are managed by sound financial professionals known as fund managers, who have the expertise in analyzing and managing investments. The funds collected from investors in mutual funds are invested by the fund managers in different financial assets such as stocks, bonds, and other assets, as defined by the fund’s investment objective.

- For the fund’s management, the AMC charges a fee to the investor known as the expense ratio. It is not a fixed fee and varies from one mutual fund to another. SEBI (Securities and Exchange Board of India) has defined the maximum limit of the expense ratio that can be charged on the basis of the total assets of the fund.

What is the role of Trustees?

- Mutual funds in India have a three-tiered structure – mutual fund, the trustees and the AMC.

- Board of trustees or trustee company holds the property of the mutual fund in trust for the benefit of the unit holders. They appoint an AMC to float schemes for the mutual fund and manage the funds mobilised under various schemes.

- They are also expected to exercise supervisory oversight over AMC and its activities so as to ensure that AMC acts in the interest of the unitholders.

Issues identified by SEBI

- According to SEBI, though mutual fund regulations provide for some restrictions to address few conflicts of interest, there are some areas where the Trustees need to pay attention.

- Some of the potential conflicts include:

- Investment by mutual fund (MF) schemes in public issues of its sponsor, its associates and/or group companies;

- Investment by MF schemes for fund raising activates by such companies where its sponsor, associates or group companies are appointed as merchant banker;

- Sponsor influencing voting by MF schemes in companies in which it has interest and MF availing services of its sponsor, associates and group companies at terms which are not at arm’s length.

What has the SEBI recently proposed?

System-Level Checks

- SEBI has recommended that the trustees will be responsible for taking steps so that there are system-level checks in place to prevent fraudulent transactions.

Take help of audit, legal firms and merchant bankers

- To ensure that they focus on their core responsibilities, SEBI has proposed that the trustees should take help of audit, legal firms and merchant bankers for carrying out due diligence on their behalf.

Amend regulations

- SEBI has also recommended amending certain regulations for AMC and also include additional clauses to enhance the role, responsibility, and accountability of the board of AMC.

Unit Holder Protection Committee

- The markets regulator also proposed the constitution of a ‘Unit Holder Protection Committee’ (UHPC) by board of AMC.

- This will help in an independent review mechanism for the decisions of AMC from the perspective of the unit holders’ interest, across all products and services.

Convert into a Trustee Company

- In order to strengthen governance and for financial independence, SEBI also suggested that all the existing trustees with board of trustees structure should convert into a trustee company in the next one year.

How will it benefit unit holders/Investors?

- SEBI said with increasing scale and reach of the mutual fund industry, trustees’ role in respect of unitholders’ protection assumes even greater significance. Once finalised, the trustees will ensure that the AMCs act in a manner which is not skewed in favour of AMC’s stakeholders.

- The key areas of their focus will be fairness of fees and expenses charged by the AMC and misconduct including market abuse / misuse of information by the AMC or AMC employees or distributors. The trustees will ensure that there is no mis-selling of mutual fund schemes to increase asset under management (AUM) and valuation of the AMC.

FURTHER DETAILS ON MUTUAL FUNDS

Types of Mutual Funds

- The Securities and Exchange Board of India (SEBI) has classified mutual funds based on where they invest.

Classification on the basis of the structure

- Open-ended funds are mutual funds that allow you to invest and redeem investments at any time, i.e. they are perpetual in nature. They are liquid in nature and don’t come with a specific investment period.

- Close-ended schemes have a fixed maturity date. You can only invest at the time of the new fund offer and redemption can only be done on maturity. You cannot purchase the units of a close-ended mutual fund whenever you please.

Classification on the basis of asset classes:

Equity Mutual Funds

Equity Mutual Funds invest at least 65% of their assets in stocks of companies listed on the stock exchange. They are more suitable as long-term investments (> 5 years) as stocks can be volatile in the short term. They have the potential to offer higher returns but also come with high risk. Here are a few types of equity mutual funds–

- Large-cap Funds invest at least 80% of their portfolio in stocks of large-cap companies i.e. the companies that are ranked in the first 100 in the list of stocks prepared by AMFI depending on market capitalization [Association of Mutual Funds of India (AMFI) is the industry body representing mutual funds and is tasked with protecting and promoting the interests of mutual funds as well as unitholders.]

- Mid-cap Funds invest at least 65% of their portfolio in stocks of mid-cap companies i.e. the companies that are ranked between the 101st and 250th based on their market capitalization

- Small-cap Funds invest at least 65% of their portfolio in stocks of small-cap companies i.e. the companies that are ranked 251st and above based on their market capitalization

- ELSS (Equity Linked Savings Scheme) is a tax-saving equity mutual fund. It invests at least 80% of its portfolio in stocks. The investment made under ELSS is eligible for tax deduction under section 80C, of the Income Tax Act, 1961 up to Rs 1.5 Lakh per annum. ELSS also comes with a lock-in of 3 years from the date of investment.

- Multi-cap Funds these funds invest in stocks of any companies across all market capitalization, namely, large-cap, mid-cap, and small-cap stocks. There is no investment limit defined by SEBI at the market capitalization level.

- International Funds are schemes that invest equity of companies listed outside India. The objective of these funds is to provide an element of geographical diversification to investors and counter the volatility of Indian markets as foreign markets do not necessarily move in sync with Indian markets.

- Index Funds An Index Fund is a type of mutual fund that simply impersonates an index. So when you invest in index funds, fund managers deploy your money in the same companies and in the same proportion as the index they are tracking. For instance, an Index Fund tracking SENSEX will buy all the 30 stocks that are part of SENSEX, and it will do so in the same proportion. Whenever a stock is removed from SENSEX, the index fund will also remove it from its portfolio, And if some new stocks are added to the SENSEX, then the fund will also replicate the changes in its portfolio.

Debt Mutual Funds

Debt Mutual Funds primarily invest in fixed-income instruments like Government securities, corporate bonds, and other debt instruments. They are not affected by stock market volatility and hence, can offer more stable returns compared to equity mutual funds. The types of debt mutual funds are differentiated on the basis of the maturity period of the securities they hold. Let’s look at a few types of debt mutual funds- is

- Liquid Funds invest in debt securities and higher-rated securities which have a maturity period of fewer than 91 days. This makes them relatively less risky than most other categories because a lower maturity mitigates any interest rate volatility (which is the risk of loss resulting from a change in interest rates). Liquid funds are a good avenue for parking emergency funds alternative to bank savings accounts.

- Overnight Funds invest in securities with a maturity of one day. These funds come with low risks safety again because of shorter maturity periods, the interest rate risk is on the lower side. These are commonly used by corporates to park their funds.

- Money Market Funds invest mainly in government securities (known as treasury bills) and similar instruments, which are short-term with maturity periods less than one year. These funds are suitable for investors looking for stable and non-volatile funds as interest risk is less.

- Banking & PSU Funds invest at least 80% of their investment in debt securities of banks, public sector undertakings, municipal bonds, public financial institutions etc. They can be better suited for investors looking for short to medium-term investment tenure.

- Glit Funds invest a minimum of 80% in Government securities across maturity periods. The nature of investment makes it more suitable for a long-term investment as Government securities can be volatile in the short-term.

- Short Duration Funds invest in debt and other money market securities such that the average maturity of the portfolio is between 1-3 years. They are more suited for investors looking at an investment time frame of 1-3 years and moderate risk appetite.

[Macaulay Duration represents the time required to generate returns equal to your investment in bonds]

Hybrid Mutual Funds

Hybrid Mutual Funds invest in both equity and debt in varying proportions depending on the investment objective of the fund. Thus, hybrid funds give you diversified exposure to various asset classes. Hybrid funds are categorized on the basis of their allocation to equity and debt. Let us look at a few categories-

- Balanced Hybrid Funds can invest from 40%-60% in equity and 40%-60% in debt instruments. They aim to combine the advantage of growth derived from equity and that of protection from the debt allocation

- Aggressive Hybrid Funds are a type of hybrid funds that can invest 65-80% of their portfolio in equity and 20-35% in debt instruments. As a result of a greater allocation to equity, they prove to be riskier than the balanced hybrid category.

- Conservative Hybrid Funds invest at least 75-90% of their portfolio in debt securities and the remaining 10-25% in equity securities. Because of this allocation, they may prove to be relatively less risky than, say, an aggressive hybrid fund.

- Balanced Advantage Funds, also known as, dynamic asset allocation funds keep their investments in equity and debt dynamic in nature. As per the market movement, their allocation to both asset classes keeps changing so as to maximize the gains and minimize the risks.

What is the size of the mutual fund industry?

- Over the past decade, there has been a fivefold increase in the size of the mutual fund industrye. from the industry’s AUM of Rs 7.93 lakh crore in November 30, 2012, the AUM crossed the milestone of Rs 10 lakh crore in May 2014 and in the span of about three years it had crossed Rs 20 lakh crore in August 2017. The size of industry AUM crossed Rs 30 lakh crore in November 2020 and as of December 31, 2022 it stood at Rs 39.89 lakh crore----- around 5 fold increase in a span of 10 years.

https://indianexpress.com/article/explained/explained-economics/why-has-sebi-proposed-tightening-responsibilities-of-mutual-funds-trustees-8441006/