Description

Disclaimer: Copyright infringement not intended.

Context:

- RBI has extended the deadline for banks to renew locker agreements with existing locker customers in a phased manner to December 31, 2023.

Background:

- A New Bank Locker Rule has come into effect from January 1, 2023, according to a Reserve Bank of India (RBI) notification.

- Over the past few days, many Banks have sent text messages to customers to renew their safe deposit locker agreements. As part of this, existing locker depositors were required to furnish proof of eligibility for a renewed locker arrangement. Additionally, they were required to sign a renewal agreement by December 31, 2022.

- While some customers have received messages regarding the bank locker agreement from their lenders, others are saying that they haven't got any such instructions from their banks. This, indeed, leaves a question mark on the consequences for such locker-holders as the deadline has already lapsed.

- It is in this context, that RBI has extended the deadline for banks to renew locker agreements with existing locker customers in a phased manner to December 31, 2023.

- RBI has asked banks to inform all their existing locker customers about the renewal requirement by April 30, 2023.

- Banks will have to ensure that at least 50 percent of their existing locker customers have renewed agreements by June 30 and 75 percent by September 30, 2023.

Locker Agreement:

- At the time of allotment of the locker to a customer, the bank shall enter into an agreement with the customer to whom the locker facility is provided, on a paper duly stamped.

- A copy of the locker agreement in duplicate signed by both parties shall be furnished to the locker- hirer to know his/her rights and responsibilities. Original Agreement shall be retained with the bank’s branch where the locker is situated.

Model Locker Agreement framed by Indian Bank’s Association’s

Here are some of the new locker rules that came into effect on January 1, 2022.

SMS and email alerts about locker access and operation

- Before the end of the day, banks must send an email and SMS alert to the customer's registered email address and mobile number as confirmation, informing them of the date, time, and potential recourse in the event of unauthorised locker access.

When the bank will compensate customers

- Banks will be eligible to pay in case of any loss of locker content resulting from the bank's negligence, according to the new RBI standards.

- The RBI notification says: "It is the responsibility of banks to take all steps for the safety and security of the premises in which the safe deposit vaults are housed. It has the responsibility to ensure that incidents like fire, theft/ burglary/ robbery, dacoity, building collapse do not occur in the bank's premises due to its own shortcomings, negligence and by any act of omission/commission. As banks cannot claim that they bear no liability towards their customers for loss of contents of the locker, in instances where loss of contents of locker are due to incidents mentioned above or attributable to fraud committed by its employee(s), the banks' liability shall be for an amount equivalent to one hundred times the prevailing annual rent of the safe deposit locker."

When the bank will not compensate

- The bank will not be liable for any damage or loss of locker contents caused by natural calamities or acts of God such as earthquakes, floods, lightning, or thunderstorms, or any act attributable to the customer's sole fault or negligence, according to the revised guidelines. Banks, on the other hand, must take reasonable precautions with their locker systems in order to secure their facilities from such disasters.

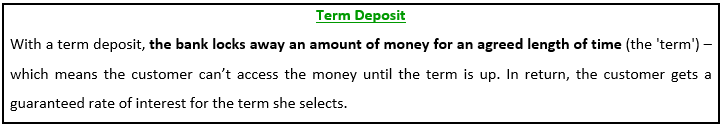

- Banks will continue to accept term deposits in order to collect locker rent.

.jpeg)

- In banks, it is common to practice to get a significantly higher term deposit than is required to recover the annual locker rental. The new guideline clarifies this stance.

- To ensure prompt payment of locker rent, banks are allowed to obtain a Term Deposit, at the time of allotment, which would cover three years' rent and the charges for breaking open the locker in case of such eventuality.

- Banks, however, shall not insist on such Term Deposits from the existing locker holders or those who have satisfactory operative account. The packaging of allotment of locker facility with placement of term deposits beyond what is specifically permitted above will be considered.

Transfer of content if the account holder dies

- If the sole locker hirer nominates an individual to receive the contents of the locker in the event of his death, the banks shall give such nominee access to the locker with the liberty to remove the contents, after verification of the death certificate and satisfying the identity and genuineness of such individual approached.

- If the locker was hired jointly with instructions to operate it under joint signatures and the locker hirer(s) nominates any other individual(s), the bank shall give access to the locker and the liberty to remove the contents jointly to the survivor(s) and the nominee(s).

https://indianexpress.com/article/explained/bank-locker-agreements-rbi-extend-deadline-8400944/#:~:text=RBI%20has%20extended%20the%20deadline,requirement%20by%20April%2030%2C%202023.