Description

Disclaimer: Copyright infringement not intended.

Context

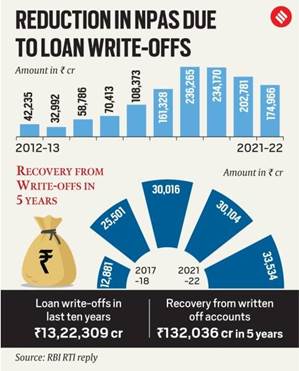

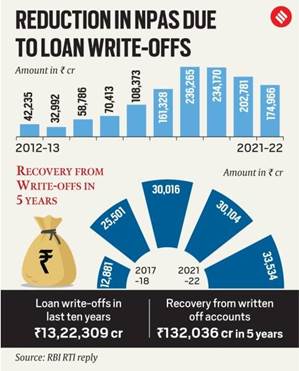

- AFTER WRITING off a huge amount of loans worth over Rs 10 lakh crore in the last five years, banks have been able to recover only 13 per cent of it so far.

- The mega write-off exercise has enabled banks to reduce their non-performing assets (NPAs).

Note:

Loan write-off refers to the situation when the lender has moved a particular loan's pending dues out of the “Assets” column and has reported this amount as a loss. This happens after the borrower has defaulted on the loan repayment, and there is a low chance of recovery.

About NPA

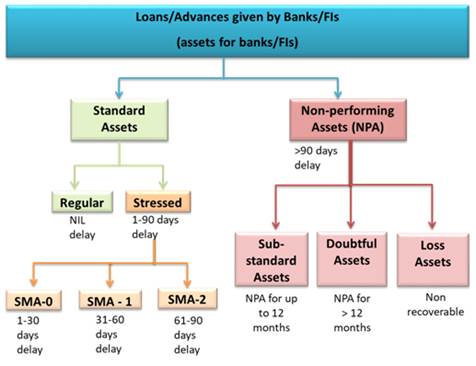

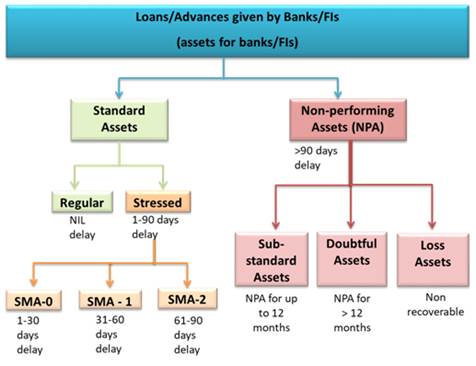

- NPA or Non Performing Assets are those kinds of loans or advances that are in default or in arrears.

- In simpler terms, if the customers do not repay principal amount and interest for a certain period of time, then such loans are considered as Non Performing Assets or NPA.

- In India, the timeline given for classifying the asset as NPA is 180 days.

- This is as against 45 to 90 days of international norms.

Types of NPAs

- Standard Assets:It is a kind of performing asset which creates continuous income and repayments as and when they become due. These assets carry a normal risk and are not NPA in the real sense of the word. Hence, no special provisions are required for standard assets.

- Sub-Standard Assets:Loans and advances which are non-performing assets for a period of 12 months, fall under the category of Sub-Standard Assets.

- Doubtful Assets:The Assets considered as non-performing for a period of more than 12 months are known as Doubtful Assets.

- Loss Assets:All those assets which cannot be recovered by the lending institutions are known as Loss Assets.

Impact of NPAs

- The crisis of NPAs in the Indian banking system is one of the foremost and the most formidable problems that had impacted the entire banking system.

Profitability

- NPAs impact profitability, banks stop to earn income on one hand and attract higher provisioning (set aside an amount in an organization's account) compared to standard assets on the other hand.

Capital Adequacy

- According to the Basel norms, banks are required to maintain adequate capital on risk-weighted assets. − Every increase in the NPAs level adds to risk-weighted assets which require banks to increase their capital.

Liability Management

- In the light of high non-performing assets, banks tend to lower the interest rates on deposits on one hand and likely to levy higher interest rates on advances. This may hamper economic growth.

Public confidence

- The credibility of the banking system is also affected greatly due to higher level NPAs because it has impacted the confidence of the general public of the society with respect to soundness of the banking system.

The banks then try to recover their loss by restructuring the loan or liquidating the assets or selling the loans to asset reconstruction companies at steep discounts.

How to Tackle NPAs: https://www.iasgyan.in/daily-current-affairs/non-performing-assets

https://indianexpress.com/article/business/banking-and-finance/in-last-5-years-rs-10-lakh-crore-in-write-offs-help-banks-halve-npas-8279845/