Disclaimer: Copyright infringement not intended.

Context

.jpg)

Details

Implications

|

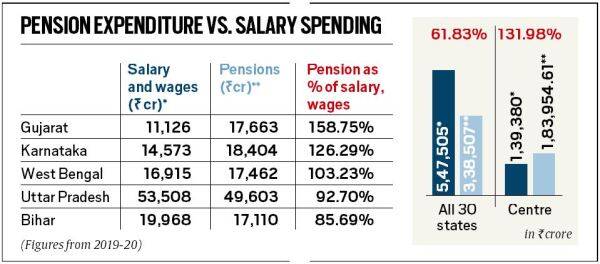

Revenue Expenditure and Committed Expenditure Revenue expenditure is for the normal running of Government departments and various services, interest payments on debt, subsidies, etc. Broadly the expenditure which does not result in creation of assets for Government of India is treated as revenue expenditure. Committed expenditure of the Government under Revenue head mainly consists of interest payments (` 8,190.70 crore), expenditure on salaries and wages, pensions and subsidies. |

© 2025 iasgyan. All right reserved