Description

Copyright infringement not intended

Picture Courtesy: www.ultranewstv.com

Context: The Union Finance and Corporate Affairs Minister emphasized that women entrepreneurs receive top priority under the Pradhan Mantri Mudra Yojana scheme, which provides financial assistance to beneficiaries, with a focus on inclusive coverage across the country.

Key Highlights

- The Union Finance and Corporate Affairs Minister had emphasized the priority accorded to women entrepreneurs under the Centre's flagship Pradhan Mantri Mudra Yojana scheme. The scheme aimed to provide financial assistance to beneficiaries, particularly focusing on empowering women through access to loans for small businesses.

- During the distribution of sanction letters to beneficiaries under the PM SVANidhi Se Samriddhi programme, she urged municipal officials to identify uncovered street vendors and facilitate their participation in the scheme. She highlighted the significance of this extension of the PM SVANidhi scheme, aiming to provide access to various Central government schemes for holistic socio-economic development.

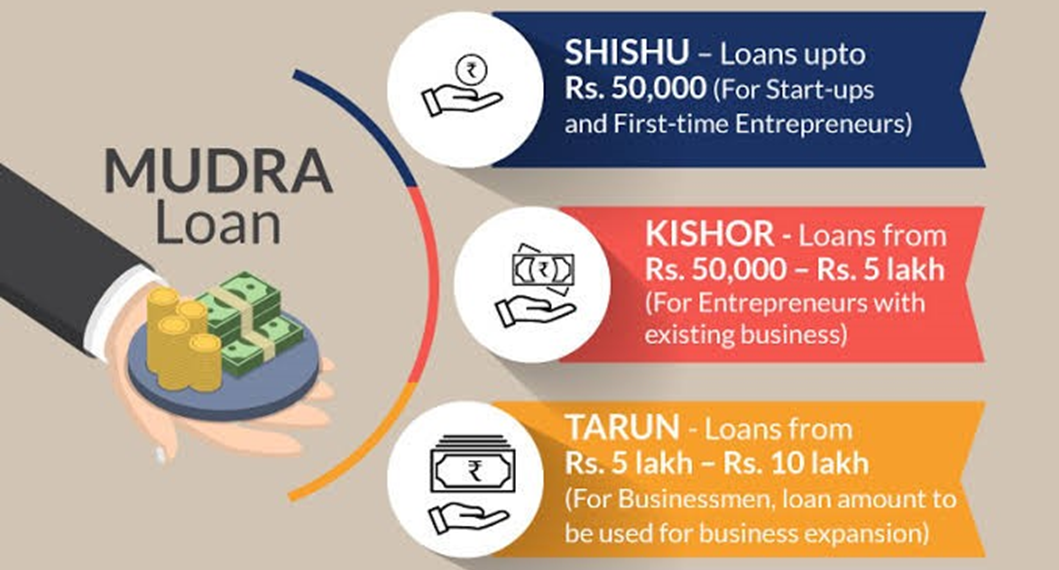

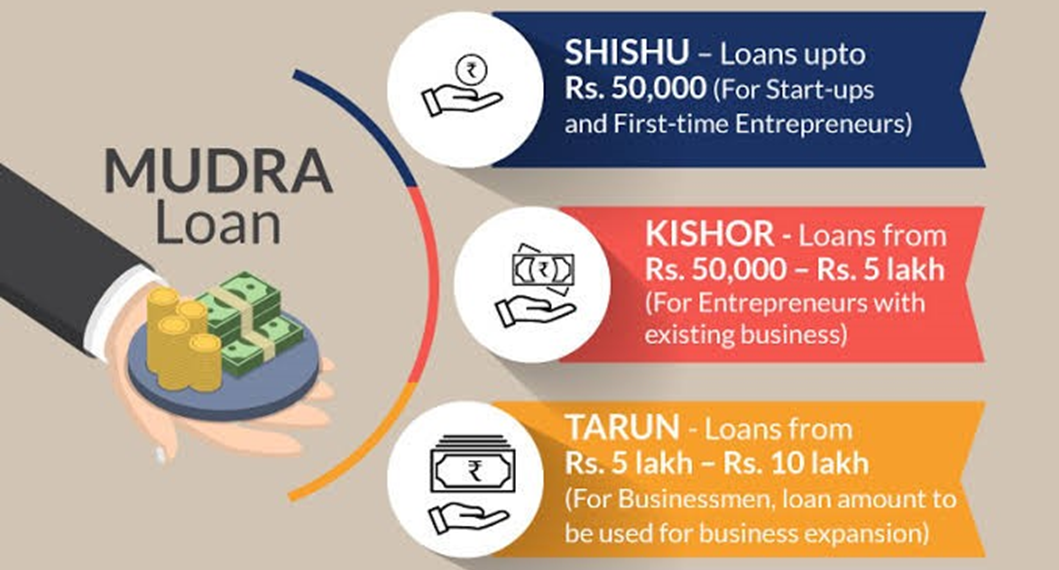

Pradhan Mantri Mudra Yojana (PMMY)

- Launched in 2015, PMMY aims to provide financial assistance to non-corporate, non-farm small/micro enterprises.

- The scheme offers loans up to ₹10 lakh to individuals looking to start or expand their businesses.

- The Union Minister emphasized the prioritization of women entrepreneurs under PMMY, with approximately 60 out of 100 beneficiaries being women. This indicates a deliberate effort to support and empower women in the business sector.

PM SVANidhi Se Samriddhi Program

- This is an additional component of the PM SVANidhi scheme, focused on facilitating access to eight Central government schemes for the socio-economic development of PM SVANidhi beneficiaries and their families.

- Specifically targets street vendors, providing them with loans and assistance to enhance their livelihoods and overall socio-economic well-being.

Technology and Middlemen Avoidance

- The Minister highlighted the significance of leveraging technology, specifically the JAM Trinity (Jan Dhan-Aadhaar-Mobile), to ensure direct benefit transfers.

- By using Aadhaar cards and facilitating the opening of bank accounts for beneficiaries, the government aims to eliminate middlemen and ensure that financial aid from the Centre reaches the intended recipients without any leakage.

Loan Disbursement and Empowerment

- The Minister stressed the distinction between entitlement and empowerment. While entitlement ensures awareness and access to schemes, empowerment aims to support beneficiaries in gradually growing their businesses and possibly becoming job creators.

- The scheme includes a progressive loan disbursement process where timely repayment leads to an increase in the loan amount, encouraging responsible financial behaviour among beneficiaries.

Government-Bank Collaboration and Local Impact

- Indian Overseas Bank played a crucial role in organizing events and disbursing loans in these districts, showcasing collaborative efforts between banks and the government to ensure the success of these initiatives.

- Local authorities, including District Collectors, were engaged to identify eligible beneficiaries and spread awareness about the schemes among street vendors.

Conclusion

- Overall, the government's focus appears to be on targeted financial inclusion, particularly for women and street vendors, using technology-driven approaches to ensure transparency and direct benefit transfers. The emphasis on empowerment indicates a broader vision of not just providing financial aid but fostering sustainable growth and entrepreneurship.

Must Read Articles:

Pradhan Mantri Mudra Yojana: https://www.iasgyan.in/daily-current-affairs/pradhan-mantri-mudra-yojana-46

|

PRACTICE QUESTION

Q. How has Pradhan Mantri Mudra Yojana (PMMY) facilitated financial inclusion for small businesses in India? What are the notable achievements and challenges encountered in its implementation? How has it contributed to the growth of entrepreneurship and employment opportunities?

|