Description

Figure 2: No Copyright Infringement Intended

Context:

- India could be on the verge of a power crisis as the stock of coal held by the country’s thermal power plants has hit critically low levels.

- Many power plants are operating with zero reserve stock or with stocks that could last just a few days.

Issues of the Power Sector:

- the Distribution Companies or DISCOMs are in an extremely bad shape.

- Non-performing assets in power generating companies or GENCOs are mounting.

- The data released in the Power Finance Corporation Report on Performance of Power Utilities 2019-20, reveals that the GENCOs have a receivable of more than Rs 2.16 lakh crore from DISCOMs in 2019-20.

Performance of Discoms in recent years:

- The Aggregate Technical & Commercial (AT&C) losses have come down from 23.5% in FY 2016-17 to 21.83% in FY 2019-20.

- The gap between average cost of supply (ACS) and average revenue realised (ARR) narrowed down to Rs 0.28/kWh in 2019-20 from Rs 0.33/kWh in 2016-17.

- The annual Profit After Tax (PAT) figures being negative have also shown improvement from Rs.33,894 Cr in FY 2016-17 to Rs.32,898 Cr in FY 2019-20.

About the working of electricity sector:

Electricity Sector works in three stages.

Issues with Discoms:

Cross Subsidisation:

- In India, electricity price for certain segments such as agriculture and the domestic category (what we use in our homes) is cross-subsidised by the industries (factories) and the commercial sector (shops, malls).

- This affects the competitiveness of industry. While the government has started a process through which the extent of cross-subsidisation is gradually being reduced, this is easier said than done as states do not like to increase tariffs for politically sensitive constituents, such as farmers.

Aggregate Technical and Commercial (AT&C) Losses:

- The discoms suffer Aggregate Technical and Commercial (AT&C) Losses.

- Technical Loss: It is due to the flow of power in transmission and distribution system. Almost 25% of the power is lost, and never gets billed.

- Commercial Loss: It is due to the theft of electricity, deficiencies in metering, etc.

Gap Between Revenue realization and cost of supply:

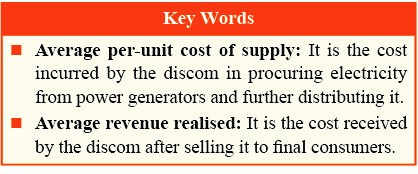

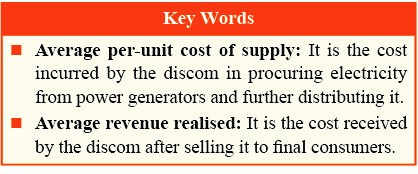

- The gap between the average per-unit cost of supply (ACS) and average revenue realised (ARR).

- The remaining 75% is sold at prices that are much lower than the discoms’ procurement costs.

- In almost every state, the increase in tariff rates is avoided because of the associated political costs.

- Therefore, political unwillingness is at the heart of commercial losses.

Debt of Discoms and Associated Problems:

- If we compare the 32 UDAY states and UTs between FY 2019 and FY 2020, the Power Finance Corporation (PFC)Report shows that while the average AT&C losses improved slightly from 22.4 per cent to 21.9 per cent, 14 of them were actually worse off.

- Consequently, most of the DISCOMs are still in trouble as fundamental issues have not been addressed.

- The DISCOMs do not have money for entering into new PPAs even though there is demand for power.

- India’s per capita consumption is still one-third of world average.

- Ironically, on account of the pricing structure, most of the DISCOMs lose more as they sell more.

- DISCOMs owe a huge amount to GENCOs and these are mounting by the day.

- The Plant Load Factor (PLF) of GENCOs is also getting adversely impacted because DISCOMs are unable to articulate the demand through new PPAs.

- GENCOs are in huge debt and debt servicing is becoming extremely difficult.

- A large part of this debt is likely to become Non-Performing Assets (NPA).

- This in turn will impact the banking industry that is already reeling under the burden of NPAs.

Way Forward:

- Coal production will have to grow at the rate (8-9 per cent) it grew during 2014-16. It can be done now as well by following the same strategy.

- The Union government will have to play the role of a facilitator by enabling and ensuring faster clearances.

- At the central level, they would primarily relate to environment and forest.

- Need to bring effective changes in the power sector too.

Government Steps to improve the functioning of Discoms:

- To tide over the liquidity problems of increasing DISCOM payables to Gencos arising out of the outbreak of COVID-19 lockdowns, the Government of India has launched a Liquidity Infusion scheme under which DISCOMs are already availing benefits under the scheme tied to reforms.

- The Government has also incentivised the DISCOMs to transform, reform and perform by linking 0.5% of the Additional borrowings linked to power sector reforms from FY 2022 to FY 2024.

- Apart from the above, the Government of India has also launched the Revamped Reforms-Based Results-Linked Scheme, which allows the States to create infrastructure tied to initiation of Reforms and achievement of Results for improving their financial sustainability and operational efficiencies.

- This scheme would be in operation till FY 2025-26, and includes a major component of prepaid Smart metering.

About Reforms Based Results Linked Scheme:

Targets:

- Reduction of AT&C (aggregate technical & commercial) losses to pan-India levels of 12-15% by 2024-25.

- Reduction of ACS-ARR gap (i.e. between the total cost of electricity and revenues generated from supplying power) to zero by 2024-25.

- Developing institutional capabilities for modern discoms.

- Improvement in the quality, reliability, and affordability of power supply to consumers through a financially sustainable and operationally efficient Distribution Sector.

- Implementation of the Scheme would be based on the action plan worked out for each state rather than a “one-size-fits-all” approach.

Key Objectives:

- The Scheme provides for annual appraisal of the DISCOM performance against predefined and agreed upon performance trajectories.

- The Scheme has a major focus on improving electricity supply for the farmers and for providing daytime electricity to them through solarization of agricultural feeders.

- A key feature of the Scheme is to enable consumer empowerment by way of prepaid Smart metering to be implemented in Public-Private-Partnership (PPP) mode.

- it is also proposed to take up System metering at Feeder and Distribution Transformer (DT) level with communicating feature simultaneously in PPP mode.