Disclaimer: Copyright infringement not intended.

Context

- Union Home and Cooperation Minister Amit Shah has said that the government will bring model by-laws to govern all Primary Agricultural Cooperative Societies (PACS) in the country.

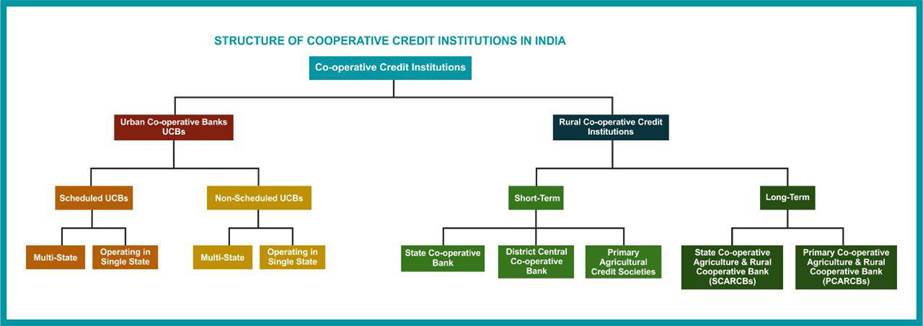

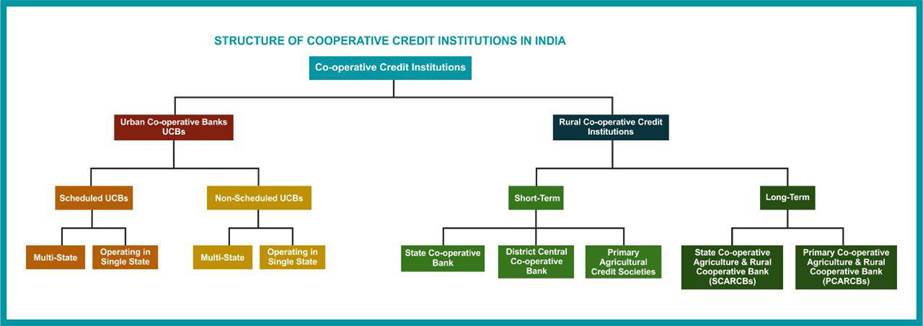

What are Primary Agricultural Credit Societies?

- PACS are the ground-level cooperative credit institutions that provide short-term, and medium-term agricultural loans to the farmers for the various agricultural and farming activities.

- It works at the grassroots gram Panchayat and village level.\

Features

- The Primary Agricultural Credit Societies are the association of persons, unlike in the case of the Joint Stock Companies, where there is just accumulation of capital.

- Primary Agricultural Credit Societies confers equal rights to all its members without considering their holding of share and their social standing.

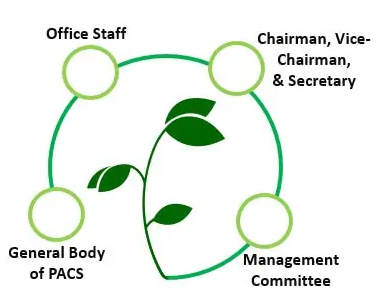

Organizational Structure

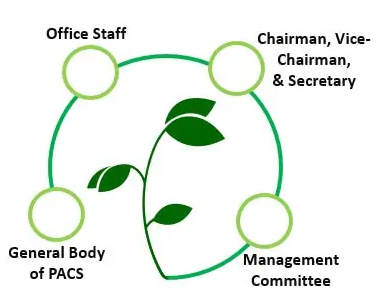

- General Body of PACS:Exercise the control over board as well as management.

- Management Committee:Elected by the general body to perform the work as prescribed by the society’s rules, acts, and by-laws.

- Chairman, Vice-Chairman, and Secretary:Work for the benefit of the members by performing their roles and duties as assigned to them.

- Office Staff:Responsible for performing day to day work.

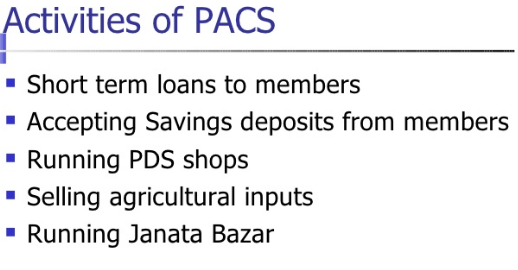

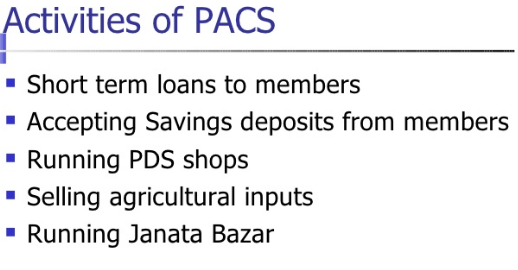

Functions of PACS

- To provide short and medium-term purpose loans to its members.

- Borrowing an adequate amount of funds from central financial agencies.

- Maintaining the supply of the hire light machinery for the agricultural purpose.

- Promotes savings habits among its members.

- To make the arrangement of supplying of the agricultural inputs. Example -seeds, fertilizers, insecticides, kerosene etc.

- It helps its members by providing marketing facilities that could enhance the sale of their agricultural products in the market at the proper prices.

Funds of Primary Agriculture Credit Societies (PACS)

A Primary Agriculture Credit Societies (PACS) can raise funds for carrying out its activities by following means:

- By way of share capital to be raised from members and indirect govt.

- Share capital contribution through the apex co-operative bank and the district central co-operative bank.

- Deposits from members

- Loans

- Donations

- Entrance fee

Significance

- Primary agriculture co-operative credit societies as financial institutions that play a very important role at the grass roots level in the development of local areas. They are multifunctional organizations that dispense a host of activities like banking, on out supplies, marketing produce and trading in consumers goods.

- Hence effective performance of primary agriculture co-operative credit societies is crucial.

- The first Primary agricultural Credit Society (PACS) was formed in the year 1904. Since then these societies have been playing a significant role in providing short-term and medium term credit to the farmers. Till early seventies, this was the only institutional credit agency available to the people in rural areas. The PACS functioning at the base of the co-operative banking system constitute the major retail outlets of short term and medium term credit to the rural sector.

The major deficiencies of the PACS and their credit are discussed briefly below:

- Organizational Weakness

At the primary level, the cooperative credit structure has twofold weaknesses:

(a) Inadequate coverage and

(b) Weak units.

- Though geographically, active PACS cover about 90% of 5.8 villages, there are parts of the country, especially in the north-east, where this coverage is very low. Further, the rural population covered as members is only 50% of all the rural households.

- This inadequacy of coverage itself is attributable to the financial and organizational weakness of individual PACS. In a sense, they are caught in a vicious circle: they are weak because of inadequate membership and they do not attract enough membership because they are weak. This vicious circle must be broken through policy measures of reorganization of PACS.

Why is the borrowing membership low in the PACS?

In the judgement of the Banking Commission, which still holds good, in most cases, one or more of the following reasons are responsible for the low borrowing membership:

(i) Defaults of members in loan repayment and inability of societies to raise resources,

(ii) Inability of the members to provide the prescribed security

(iii) Lack of up-to-date land records or inalienable rights to land or inability to produce sureties,

(iv) Ineligibility of certain purposes for loans

(v) Inadequacy of credit limits prescribed, and

(vi) Onerous conditions prescribed such as share capital contribution at 10 or 20 per cent of loans outstanding and compulsory thrift deposits.

- Inadequate Resources

- The resources of the PACS are much too inadequate in relation to the short-and medium-term credit needs of e rural economy. The bulk of even these inadequate funds come from higher financing agencies and not through owned funds of ‘societies or deposit mobilization by them.

- The resource-mobilization ‘Capacity of the PACS will improve substantially, if through reorganization and related measures, they are converted into strong and viable units. Then, they should be able to attract both more deposits and more loans from higher financing agencies.

- Over-dues

- Large over-dues have become a big problem for the PACS. They check the circulation of loanable funds, reduce the borrowing as well as lending power of societies, and give them the bad image of the societies of defaulting debtors.

- are willful. Bigger landowners take undue advantage of their relatively stronger position in villages in both appropriating cheaper cooperative credit and not paying back their loans in time.

According to the Banking Commission, in most states, over-dues are due to:

- Indifferent management or mismanagement of societies;

- Unsound lending policies leading to over financing, or financing unrelated to actual needs, diversion of loans for other purposes;

- Vested interests and group politics in societies and willful defaults;

- Lack of adequate supervision over the use of loans by the borrowers and poor recovery effort;

- Lack of adequate control of banks (CCBs) over the primary societies;

- Lack of appropriate link between credit and marketing institutions;

- Failure to take prompt action against willful defaulters; and

- Uncertain agricultural prices.

- Inadequate and Restricted Credit

- Co-operative credit is inadequate in several senses.

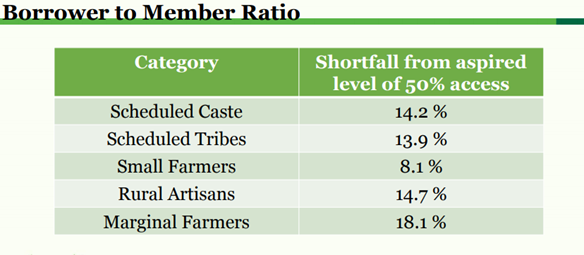

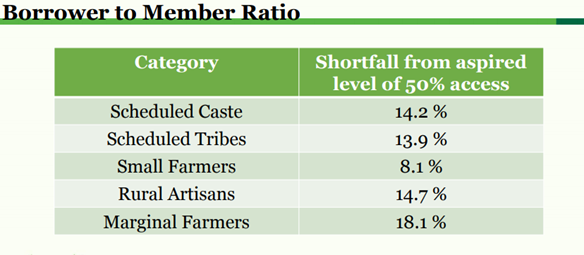

- First, the PACS provide credit to only a small proportion of the total rural population.

- Second, the societies do not provide full credit even for all productive agricultural activities.

- The credit given is confined mainly to crop finance (seasonal agricultural operations) and medium-term loans for identifiable purposes such as the digging of wells, installation of pump sets, etc.

- Most of the societies do not provide credit for other productive activities undertaken by the agriculturists. Even for approved productive activities, the credit given is usually not adequate to meet in full the need for credit. In most cases, non-agricultural credit needs even for productive purposes are not met at all Consumption loans are generally not given.

- Other Linked Inputs, Extension Service, and Marketing

- The provision of adequate and timely credit is only one of the necessary conditions for improving the productivity of farmers and others in villages. Additional facilities in the form of the supply of inputs (like better seeds, fertilizers, pesticides, etc.) extension and marketing service must also be provided to small and marginal farmers to enable them to make good use of the credit given to them.

- Already a step in this direction has been taken in the form of Farmers Service Societies (FSS) for small and marginal farmers. But what is required is not the proliferation of new forms of societies, as of revitalizing weaker societies into stronger units, most possibly by reorganizing them into larger-sized multi-purpose co-operatives.

In a nutshell, the Health of PACS

- 93367 PACS - 45241 Profit, 36695 in loss, 4116 – Dormant/ inactive

- Borrower to member ratio less than 50%.

- Of the total assets of Coop. Credit structure – 22% are with PACS

- Among three ST coop. credit structures- PACS are most dependent on borrowed funds

- Since 2010, share of non- agriculture loan through PACS has

- Increased at the cost of agricultural loans’

PACS have the network. PACS generally meet out only the short term credit requirements of its members

On the other hand,

- Due to uneconomic land holdings, majority of farmers unable to afford purchase of farm equipment

- New inventions and developments need to be brought to the farms ASAP

- Farmers resort to distress sale as they are in the need of immediate credit

- Adequate storage capacity is not available in the rural areas

- Presently, large number of PACS are rather small in size, to be viable.

- Problems of infrastructural weaknesses, operational inefficiencies etc.

Therefore, need to re-orient PACS which will make them sustainable and inspire confidence in their existing and potential members.

Way Ahead

- PACS need to be developed as a One Stop Shop for meeting all the needs of its member

- PACS have to look for new Business opportunities

- Provide much-needed forward and backward linkages.

- PACS can help transform agriculture into a more financially viable activity

- PACS as Multi Service Centers can help members to become self-reliant and promote rural entrepreneurship - facilitating increased income

- PACS as Multi Service Centers – can financially strengthen the members, by increasing their income through economic linkages with various sectors of rural economy -Doubling of income. (The recent decision by NABARD to develop 35,000 PACS into MSCs in mission-mode is a step in this direction.)

- PACS as MSC - Technology supported activities like Micro-ATMs and Wi-Fi Internet.

- Through Micro-ATMs, PACS members who stay far away from the PACS also can have access to banking services

- PACS as BCs can undertake various activities under financial inclusion and Aadhaar linkage of bank account.

- Potential for expansion of business through convergence with other stakeholders like Farmers Producer Organizations

- PACS can be provided direct exposure to best practices in various facets of agri-business through partnerships with leading Agricultural Universities / Institutes.

- The PACS are passing through a long phase of re-organization” which was formally started in early 1960’s, following the recommendation of the Committee on Co-operative Credit (1960). But progress to date has been very slow.

Currently the reorganization work is running along the following lines:

(a) The PACS are being reorganized so that every reorganized PACS covers a gross cropped area of 2000 hectares within a radius of 10 kms;

(b) Non-viable units are either amalgamated with reorganized societies or liquidated. But Compulsory amalgamation/liquidation is not easy, as it often meets with stiff resistance from local beneficiaries and functionaries and the state governments have hesitated using compulsion in the matter; and

(c) The setting up of new types of societies called Farmers Service Societies (FSS) and Large-Sized Multi-Purpose Societies (LAMPS) for tribal and hill areas.

The FSS, that are being organized since August 1975, are intended to cater particularly to the credit needs of the -weaker sections and provide integrated credit supplies, services and technical guidance to the farmers at one contact point. In the organization of these societies preference is being given to districts covered by special development programmes, such as ‘Small Farmers Development Agency (SFDA), Command Area Development Programme’ (CADP), ‘Drought Prone Areas Programme’ (DPAP), etc.

LAMPS are being organized in tribal and hill areas somewhat on the lines of FSS for providing all types of credit, viz., short-term, medium and long-term including that for meeting the social needs, agricultural and consumers” requisites, technical guidance in the intensification and modernisation of agriculture and arranging for the marketing of agricultural and minor forest produce. Both FSS and LAMPS are linked for financial accommodation either to a central co-operative bank or a commercial bank.

Their progress is understandably slow because of the difficulties in meeting certain essential prerequisites to the success of the new programme, viz., liquidation or amalgamation of other existing non-viable societies in the areas of FSS and LAMPS so as to provide the new units an exclusive area of operation, as also the provision of managerial and technical staff for them.

Conclusion

- PACS helps in fulfilling the financial requirements of its members, so their work should not be stopped due to the unavailability of the finances. It makes the loan requirements of farmers and thus helping them in growing their business.

- The resource-mobilisation ‘Capacity of the PACS will improve substantially if, through reorganization and related measures, they are converted into strong and viable units. Then, they should be able to attract both more deposits and more loans from higher financing agencies.

- What is required is to improve the effective coverage of societies by providing credit to increasing proportion of rural households, especially of weaker sections, to widen the range of eligible purposes for which credit is given, and then to meet an approved borrower’s entire credit needs. To realize this objective in practice, the societies must be made organizationally as well as financially strong along the lines already suggested above.

https://newsonair.gov.in/News?title=Govt-to-bring-model-by-laws-to-govern-all-Primary-Agricultural-Cooperative-Societies&id=445857