Description

Disclaimer: Copyright infringement not intended.

Context

- Union Minister Dr Jitendra said, India is not reliant on China for accessing rare earth minerals.

What are Rare Earth Metals?

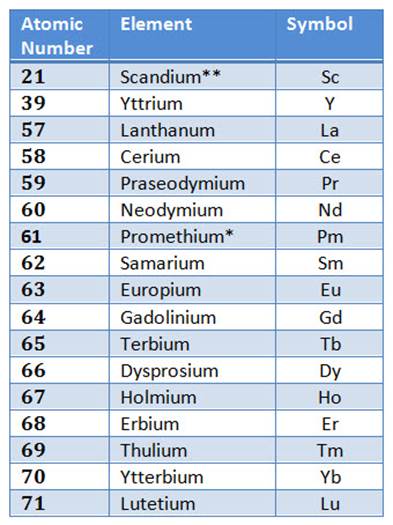

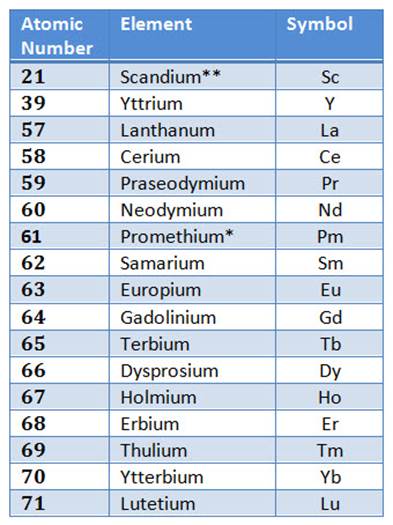

- Rare Earth Elements or Rare Earth Metals are a set of 17 chemical elements in the periodic table — the 15 lanthanides, plus scandium and yttrium, which tend to occur in the same ore deposits as the lanthanides, and have similar chemical properties.

- The 17 Rare Earths are cerium (Ce), dysprosium (Dy), erbium (Er), europium (Eu), gadolinium (Gd), holmium (Ho), lanthanum (La), lutetium (Lu), neodymium (Nd), praseodymium (Pr), promethium (Pm), samarium (Sm), scandium (Sc), terbium (Tb), thulium (Tm), ytterbium (Yb), and yttrium (Y).

- Despite their classification, most of these elements are not really “rare”. One of the Rare Earths, promethium, is radioactive.

What are Rare Earths used for?

- These elements are important in technologies of consumer electronics, computers and networks, communications, clean energy, advanced transportation, healthcare, environmental mitigation, and national defence, among others.

- Minerals like Cobalt, Nickel, and Lithium are required for batteries used in electric vehicles.

- REEs are an essential — although often tiny — component of more than 200 consumer products, including mobile phones, computer hard drives, electric and hybrid vehicles, semiconductors, flatscreen TVs and monitors, and high-end electronics.

- Scandium is used in televisions and fluorescent lamps, and yttrium is used in drugs to treat rheumatoid arthritis and cancer.

- Rare Earth elements are used in space shuttle components, jet engine turbines, and drones. Cerium, the most abundant Rare Earth element, is essential to NASA’s Space Shuttle Programme.

Dependence on China

- Some REEs are available in India — such as Lanthanum, Cerium, Neodymium, Praseodymium and Samarium, etc.

- Others such as Dysprosium, Terbium, and Europium, which are classified as HREEs, are not available in Indian deposits in extractable quantities.

- Hence, there is a dependence on countries such as China for HREEs, which is one of the leading producers of REEs, with an estimated 70 per cent share of the global production.

India’s Concern

- China has about 37 percent of known global REE reserves but produces about 60 per cent of global REE.

- India has about 6 percent of global REE reserves and produces a minuscule 1 percent of global supply.

- If India is not able to explore and produce these minerals, it will have to depend on a handful of countries, including China, to power its energy transition plans to electric vehicles. That will be similar to our dependence on a few countries for oil.

- Industry watchers say that the reason India would not have found a place in the MSP grouping is that the country does not bring any expertise to the table. In the group, countries like Australia and Canada have reserves and also the technology to extract them, and countries like Japan have the technology to process REEs.

Government’s Assertions

- In India, capacity and capabilities in terms of mining, processing, extraction, refining and production of high pure RE oxides is adequately available.

- The production of Monazite the primary source of rare earth mineral in India is around 4000 MT per annum.

- As on September 2022, Atomic Minerals Directorate for Exploration and Research (AMD) has established

- 13.07 million tonnes in-situ monazite (containing ~55-60% total Rare Earth Elements oxide) resource occurring in the coastal beach placer sands in parts of Kerala, Tamil Nadu, Odisha, Andhra Pradesh, Maharashtra and Gujarat and in the inland placers in parts of Jharkhand, West Bengal and Tamil Nadu.

- 7,37,283 tonne Rare Earth Elements Oxide (REO) in Ambadungar area, Chhota Udepur district, Gujarat.

- 36,945 tonnes REO in Bhatikhera area, Barmer district, Rajasthan.

- 2,000 tonnes of heavy mineral concentrate containing ~2% xenotime (a phosphate mineral of yttrium and rare earth elements) in the riverine placer deposits of Chhattisgarh and Jharkhand.

- Presently, AMD is carrying out a collection of xenotime-bearing heavy mineral concentrate in the unit established in Chhattisgarh and has a stockpile of 97.688 tonnes of xenotime-bearing heavy mineral concentrate.

India’s potential

- Large tracts of the Indian Ocean coastline from East Africa to Myanmar, Thailand, Indonesia, and Australia are host to rich REE-containing mineral sands. India has an extremely high possibility of discovery of new deposits along its coastline and hard rock carbonatites that exist all over the peninsula.

- Availability of such reliable raw material sources would naturally inspire the setting up of downstream industries of refining, value addition, manufacture of Rare Earth Permanent Magnets, and other high-value and high-technology products.

- Reliable domestic supply of these products would be a major attraction to further high-value industries such as electronics, defense, electric vehicles, and many others.

- India is, therefore, in a unique position of giving the comfort of producing “Non-Chinese” REE ore that could command a “reliable supplier” premium in the western high-tech electronics and defense industry.

- This would provide a boost to Make in India and Atmanirbhar Bharat initiatives.

.jpg)

Going Forward

Fertile Ecosystem for Junior Explorers

- Experts opine that the policy of revenue maximization through auctions is a major cause of this sustained imbalance. Globally mineral discoveries are done by small companies called junior explorers.

- Indian policy initiatives have been less than successful in creating a fertile ecosystem for this sector. So, this needs to be the focus.

Progressive Mineral Exploration Policy Reform

- Globally, several major economies have successfully premised major components of their growth on miner exploration. Such examples of proven track records of success can be a template for a progressive mineral exploration policy reform in India.

- Rapid progressive movement in mineral exploration policy might incentivize enhanced exploration investment in the private sector and pave the way for rapid mineral discoveries.

Encouraged to form such junior exploration businesses in the Indian Ocean Region

- India, with its large land mass, well-developed geological data and highly trained geologists, and excellent infrastructure has all the ingredients available to be naturally successful.

- Indian companies can be encouraged to form such junior exploration businesses in the Indian Ocean Region to prospect for REEs and feed value-added products into Indian market. Most governments in this region have mining and exploration-friendly policies and welcome investment.

Leverage India’s unique strategic network

- India has strong historical, cultural, business, and Diaspora links in this region that has developed over centuries of trade and migration. No other country enjoys such a unique strategic network anywhere in the world. This is a unique strength that can be leveraged to meet the critical metal requirements of the country.

- Indian companies are already leveraging these links and goodwill for current trade and business promotion and the same can be used for securing REE concessions in the region by Indian companies.

Leveraging the large private sector networks

- In the Indian Ocean Region, the mineral industry largely exists in the private sector while the governments prefer to stay in a regulatory role. REEs, therefore, would largely be explored, mined, processed, and developed in the private sector. Unlike in India, most other jurisdictions treat REEs like any other mineral.

- Mineral exploration rights, and even the detailed mineral inventory information is largely in the private sector and government databases are often archival and outdated. Government to Government initiatives would therefore meet only with partial success.

- Leveraging the large private sector networks of Diaspora and cultural soft power ties with support and encouragement by the government has the potential to create a huge and diversified supply chain network not just in the REE space but over the entire spectrum of strategic metals security for India.

Supporting Indian-owned companies

- Indian missions in the Indian Ocean Region enjoy huge goodwill in the Diaspora and have the potential to lead, coordinate and encourage such networks.

- Engaging with the few Indian-owned companies that are already operating in this space and supporting them would be a major step in strategic metals security for India.

.jpg)

https://pib.gov.in/PressReleasePage.aspx?PRID=1883492

.jpg)