Description

Disclaimer: Copyright infringement not intended.

Context

- The banking sector has witnessed improved financial parameters despite the COVID-19 pandemic,” the RBI observed in its annual report.

- There is, however, a need to be watchful of the credit behavior of the restructured advances and possibility of increased slippages arising from sectors that were relatively more exposed to the pandemic,” the RBI warned.

About RBI

- RBI is India's central bank and regulatory body responsible for regulation of the Indian banking system.

- It is under the ownership of Ministry of Finance, Government of India.

- It is responsible for the issue and supply of the Indian rupee.

- It also manages the country's main payment systems and works to promote its economic development.

- Bharatiya Reserve Bank Note Mudran is one of the specialised divisions of RBI through which it prints & mints Indian bank notes and coins.

- RBI established the National Payments Corporation of India as one of its specialized division to regulate the payment and settlement systems in India.

- Deposit Insurance and Credit Guarantee Corporation was established by RBI as one of its specialized division for the purpose of providing insurance of deposits and guaranteeing of credit facilities to all Indian banks.

- Until the Monetary Policy Committee was established in 2016, it also had full control over monetary policy in the country.

- It commenced its operations on 1 April 1935 in accordance with the Reserve Bank of India Act, 1934.

- Following India's independence on 15 August 1947, the RBI was nationalized on 1 January 1949.

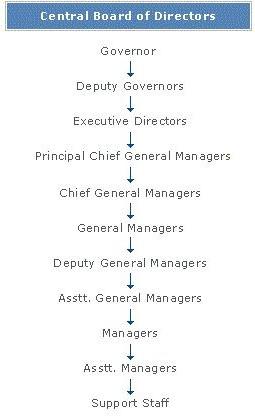

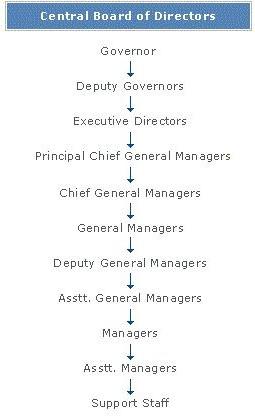

- The overall direction of the RBI lies with the 21-member central board of directors, composed of: the Governor; Four deputy governors; two Finance ministry representatives (usually the Economic Affairs Secretary and the Financial Services Secretary); ten government-nominated directors; and four directors who represent local boards for Mumbai, Kolkata, Chennai, and Delhi. Each of these local boards consists of five members who represent regional interests and the interests of co-operative and indigenous banks.

- RBI is a member bank of the Asian Clearing Union. The bank is also active in promoting financial inclusion policy and is a leading member of the Alliance for Financial Inclusion (AFI).

- On 12 November 2021, two new schemes were launched: RBI Retail Direct Scheme and the Reserve Bank Integrated Ombudsman Scheme.

- The RBI Retail Direct Scheme is targeted at retail investors to invest easily in government securities. According to RBI, the scheme will allow retail investors to open and maintain their government securities account free of cost.

- The RBI Integrated Ombudsman Scheme aims to further improve the grievance redress mechanism for resolving customer complaints against entities regulated by the central bank. The RBI makes it mandatory for all the banks in India to have a safe box in their own respect strong room. However, exception is given to the Regional Banks and the SBI branches located in the rural areas but a strong room is compulsory.

Legal Framework of RBI

The Reserve Bank of India comes under the following laws:

- Reserve Bank of India Act, 1934

- Public debt act, 1944

- Government Securities Regulations, 2007

- Banking Regulation Act, 1949

- Foreign Exchange Management Act, 1999

- Securities and Restructuring of Financial Assets Implementation of the Security Interest Act, 2002

- Credit Information Companies (Regulation) Act, 2005

- Payment and Settlement Systems Act, 2007

Main Functions

Monetary Authority

- Formulates, implements and monitors the monetary policy.

- Objective: maintaining price stability while keeping in mind the objective of growth.

Regulator and supervisor of the financial system

- Prescribes broad parameters of banking operations within which the country's banking and financial system functions.

- Objective: maintain public confidence in the system, protect depositors' interest and provide cost-effective banking services to the public.

Manager of Foreign Exchange

- Manages the Foreign Exchange Management Act, 1999.

- Objective: to facilitate external trade and payment and promote orderly development and maintenance of foreign exchange market in India.

Issuer of currency

- Issues, exchanges and destroys currency notes as well as puts into circulation coins minted by Government of India.

- Objective: to give the public adequate quantity of supplies of currency notes and coins and in good quality.

Developmental role

- Performs a wide range of promotional functions to support national objectives.

Regulator and Supervisor of Payment and Settlement Systems

- Introduces and upgrades safe and efficient modes of payment systems in the country to meet the requirements of the public at large.

- Objective: maintain public confidence in payment and settlement system.

Related Functions

- Banker to the Government: performs merchant banking function for the central and the state governments; also acts as their banker.

- Banker to banks: maintains banking accounts of all scheduled banks.

Offices

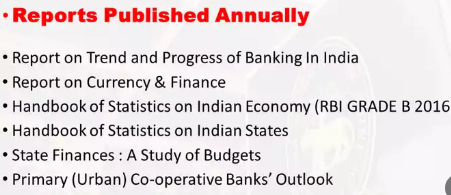

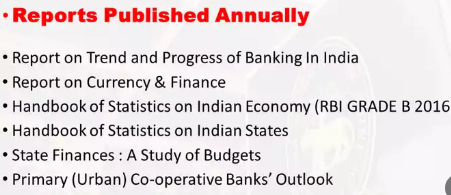

Reports published by RBI

https://epaper.thehindu.com/Home/ShareArticle?OrgId=GU79S12IC.1&imageview=0

1.png)