Description

Disclaimer: Copyright infringement not intended.

Context

- Union Minister for Finance and Corporate Affairs Smt. Nirmala Sitharaman chaired a meeting with heads of Public Sector Banks and Regional Rural Banks (RRBs) to review Operational & Governance reforms in RRBs.

Regional Rural Banks

About

- Regional Rural Banks (RRBs) are government owned scheduled commercial banks of India that operate at regional level in different states of India.

Establishment

- Regional Rural Banks were established under the provisions of an ordinance passed on 26 September 1975 and the RRB Act 1976 to provide sufficient banking and credit facility for agriculture and other rural sectors.

- As a result, five RRBs were set up on 2 October 1975 on the recommendations of the Narsimha Committee on Rural Credit, during the tenure of Indira Gandhi's government.

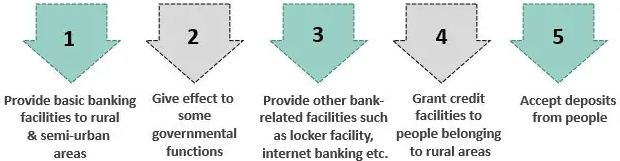

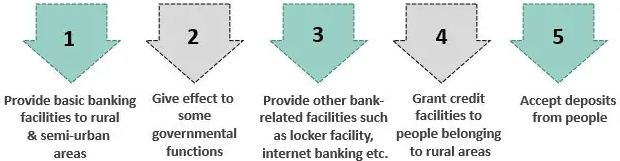

Objectives of RRB

RRBs were set up with the following set of objectives.

- To overcome the credit gaps that is prevailing in rural areas.

- To restrict the flow of cash from rural to urban areas by adopting necessary policies and measures.

- To generate employment opportunities in rural areas.

- To provide basic banking facilities to rural and semi-urban areas.

- To give effect to some governmental functions such as disbursal of wages under MGNREGA policy.

- To provide other bank-related facilities such as locker facility, internet banking, mobile banking, debit a credit card, etc.

- To grant credit facilities to people belonging to rural areas such as small farmers, artisans, small entrepreneurs, and so on.

- To accept deposits from people.

Ownership

- The RRBs are jointly owned by the central government, state government, and the sponsoring bank with 50%, 15%, and 35% shareholding respectively.

First RRB

- Prathama Bank, with head office in Moradabad, Uttar Pradesh was the first RRB.

Ministry

- These banks are under the ownership of Ministry of Finance , Government of India.

Mandate

- They were created to serve rural areas with basic banking and financial services. However, RRBs also have urban branches.

Area of operation

- The area of operation is limited to the area notified by the government of India covering, and it covers one or more districts in the State.

Working

- These banks, overall affairs are managed by a Board of Directors, which consists of one Chairman, three directors as nominated by the Central Government, maximum of two directors as nominated by the concerned State Government, and a maximum of three directors as nominated by the sponsor bank.

Management

- Management of each RRB is vested in a nine-member board of directors, headed by a Chairman, appointed by the Government of India. While discharging their functions, they have to cover the commercial angle, and at the same time, follow the directive principle issued by the Government. For example, they can appoint officers and employees, but their salary structure is prescribed by the Government according to the one existing in the state where the bank is located.

RRB Amendment Act, 1987

After the RRB Amendment Act, 1987, the following changes have come into force:

- The authorized capital was raised from Re 1 to Rs Five crores.

- The chairman is to be appointed by the concerned sponsor bank in consultation with National Bank for Agriculture and Rural Development (hereafter referred to as NABARD).

- Sponsor banks have to subscribe to the share capital as well as impart training to the personnel and provide managerial and financial assistance for the first five years of its functioning.

- The amalgamation of two or more RRBs can be done with the consultation of NABARD, concerned state government, and the sponsor bank.

- Sponsor banks are empowered to monitor the progress of their RRBs from time to time, to conduct inspections, internal audits, and to suggest measures to RRBs wherever necessary.

- From 5th July 2007, RBI has allowed RRBs to accept foreign currency deposits from NRIs and persons of Indian origin.

Functions

RRBs perform various functions such as:

- Providing banking facilities to rural and semi-urban areas,

- Carrying out government operations like disbursement of wages of MGNREGA workers and distribution of pensions,

- Providing para-banking facilities like locker facilities, debit and credit cards, mobile banking, internet banking, and UPI services.

Importance of RRBSs

- The importance of Regional rural Banks lies in the fact that they have been able to uplift the rural sections of the society by catering to their banking and financial needs.

- They provide loans for crops, other agricultural activities, for artisans and cottage industries, small businesses, etc. Further, they have also been advancing loan facilities to differently-abled persons and weaker sections of society.

- Reduce rural and urban gap by mobilizing financial resources and services to rural regions.

- Regional Rural Banks pave the way for inclusion of the marginal population like small farmers, Below Poverty Line (BPL) farmers and workers, small entrepreneurs, artisans, women, etc.

- Regional Rural Banks assist rural businesses by providing them short-term loans, insurance facilities, etc., and help to improve the role of entrepreneurship in rural areas.

- Providing assistance like loans, advances, insurance to agriculturists for farming inputs, equipment, processing, marketing activities, and cooperative societies helps in the growth of agriculture and the advancement of farmers. Many public and private sector banks do not deal with farmers and rural section due to their small financial needs, fewer incomes, etc. In such a case, there is a need for a separate banking system to protect the interests of these sectors.

- The RRBs look forward to covering underserved rural areas in terms of financial services and extending credit assistance.

- Help in the growth of cooperative societies, agricultural societies, etc.

- RRBs reduce farmers’ and the weaker sections’ dependency on traditional sources such as moneylenders who exploited them with a high rate of interests on loans.

Evaluation of RRBs by Narasimham Committee on the Financial System

- The working of RRBs was assessed by the Narasimham Committee on the Financial System. It observed that RRB has gained excellent ground in progressing different sorts of credit to the more fragile and under a particular area of the rustic culture. According to the ongoing RBI report,

"The RRBs have fared well in accomplishing the goal of giving access to weaker segments of the general public to institutional credit, yet the recuperation position of all isn't good."

- In spite of the fact that RRBs were set up so as to give a minimal effort option in contrast to the activity of a business bank offices, especially in the rustic regions yet the working of RRBs was not sufficient.

The Committee referenced three fundamental issues of RRBs:

- RRBs have a low acquiring limit due to such vast numbers of limitations put on the business attempted by these banks;

- With the ongoing honor of a council, the wages and pay sizes of RRBs would be like that of business banks, and in this manner, the general concept of ease option in contrast to the activity of business bank has been invalidated; and

- The very region of tasks of RRBs is additionally being used by the supporting banks by running their own country branches promoting specific abnormalities like duplication of administrations and uses control and organization.

Other reasons behind non-suitability of RRBs:

- RRBs can set up its branches for the most part in uneven and under-banked zones;

- The loaning activities of RRBs are mainly limited to target gathering made out of little borrowers of country and semi-urban territories; and

- The pace of intrigue charged by RRBs on their advance is nearly lower.

In a nutshell,

Weakness or the problems faced by RRBs:

Despite the fact that RRBs had a fast extension of the branch system and increment in the volume of business, these organizations experienced an extremely troublesome transformative procedure due to the following issues:

- The limited territory of tasks.

- High hazard because of presentation just to the objective gathering.

- Open discernment that RRBs are poor man's banks.

- Mounting misfortunes due to non-reasonable degree of activities in branches situated at poor asset regions.

- Switch over to limit venture banking as a turn-over procedure.

- Overwhelming dependence on support banks for speculation roads with low returns excepting exemptions, step-nurturing treatment from support banks.

- Weight of government appropriation plans and insufficient information of clients prompting low-quality resources.

- The genuine undermining of the Board by impulses to admire support banks, GOI, NABARD, and RBI for endless choices.

- RRB’s are facing the problem of inadequate finance. They are dependent on NABARD to collect finance for their further operation. Poor rural people are unable to save anything due to poverty and low per capita income. The low level of saving of these customer create obstacle for RRB’s to collect sufficient deposits.

- High overdues and poor recovery of loan is one of the biggest concern affecting the functioning of RRB’s. Reasons being poor access of granting loan, insufficient and untrained staff, unproductive or less productive use of credit, inadequate production, poor marketing facilities and improper channel of recovery system.

- There is also a problem of regional imbalance in banking facilities provided by RRB’s. They are creating this problem by concentrating their branches in some specific states and districts & loose other prospective group of customers. Many RRB’s are suffering from the problem of heavy loans because of low repaying capacity of their customer, untrained staff, low level of deposits and heavy sanction of loan without checking the creditworthiness of their customers.

- These banks have still not played a significant role in poverty alleviation of the country. Although various efforts have been made in this regard but lack of economic infrastructure, poor marketing strategies, poor knowledge of customers, low production, low awareness about savings have created many hurdles for RRB’s.

- Lack of proper co-ordination between RRB’s and other financial institution like commercial banks, NABARD and other co-operative bank has badly affected the performance of these banks.

- Slow progress: The progress of RRBs is not up to the expectation and is slow when comparing with other types of banks because of many restrictions on their operations. For example till 1996, RRBS were permitted to lend only under priority sector schemes.

- The basic objective of RRBs was to provide credit facilities to poor and weaker sections of society, i.e., to small and marginal farmers and other weaker sections. They were originally having limited scope to invest their surplus funds freely.

- A crucial practical difficulty experienced in their working by the RRBs is the urban orientation of their staff which is rarely inclined to serve in rural areas. There is no true local involvement of the bank staff in the village where they serve. Lack of training facility concerning these areas also affects the growth of RRBs.

- Delay in decision making: The RRBs are controlled directly and indirectly by various agencies, i.e., the sponsoring bank, NABARD, RBI, besides Central Government. Thus, it takes long time to take decisions on some important issues. This, in turn affects the progress of RRBs. However, since end 1997, the operational responsibility of RRBs has been passed on to sponsor bank.

- Difficulties in deposit mobilization: The RRBs are aiming at catering to the needs of poor and are not serving the needs of the rich. So, the RRBs are not able to attract the deposit from that potential sector.

- The capital adequacy is the very basis to financial soundness. There is capital inadequacy in RRBs as most of the RRBs have huge losses in their 3alance Sheet eating away all the Capital of RRBs.

- Haste in branch expansion programme in many cases has resulted in lopsidedness due to lack of co-ordination. In several cases, it could not be ensured that the branches of the RRBs are opened at centres where no commercial or co-operative banking facilities were provided.

Amalgamation

- Government of India with a view to improve the operational viability and efficiency of RRBs, initiated the process of Structural Consolidation by amalgamating RRBS. The amalgamated RRBs were expected to provide better customer service with improved infrastructure, expanding area of operation with combined network, Improved technology with innovative IT, improvement of combined workforce, strategic marketing efforts. etc.

- Thus, RRBs periodically go through a process of amalgamation. In 2013, 25 RRBs were amalgamated into 10 RRBs, totaling 67 RRBs.

- In March 2016, there were 56 RRBs, covering 525 districts with a network of 14,494 branches. At present, there are 43 RRBs in India.

Improvements needed in the working of RRB

- The unique role of RRB in providing credit facilities to weaker sections in the villages must be preserved. The RRB should exist as rural banks of the rural poor.

- The RRB may be permitted to lend up to 25% of their total advances to the richer section of the village society.

- The State Government should also take keen interest in the growth of RRB.

- Participation of local people in the equity share capital of the RRB should be allowed encouraged.

- Local staff may be appointed as far as possible.

- Cooperative societies may be allowed to sponsor or co-sponsor with commercial banks in the establishment of the RRB.

- A uniform pattern of interest rate structure should be devised for the rural financial agencies.

- The RRB must strengthen effective credit administration by way of credit appraisal, monitoring the progress of loans and their efficient recovery.

- The credit policy of the RRB should be based on the group approach of financing rural activities.

- The RRB may initiate certain new insurable policies like deposit-linked cattle and other animals insurance policy, crop insurance policy or the life insurance policy for the rural depositors.

- The RRB may relax their procedure for lending and make them easier for village borrowers.

- Co-ordination between district level development planning and district level credit planning is also required in order to chart out the specific role of the RRB as a development agency of the rural areas.

- Steps needed for opening more branches in more fragile and remote zones of the state.

- Profitability can be improved by controlling the expenses and expanding the salary.

- The RRBs must be cautious and diminish the working costs since it has been found from our examination that these costs have expanded the absolute consumption of the banks.

- The RRB must reinforce successfully credit organization by method for credit examination, observing the advancement of advances and their productive recuperation.

Conclusion

- RRBs should not confine their operations only in agriculture sector but also provide benefits to small entrepreneurs, village and cottage industries and small farmers. And they should establish proper co-ordination with other institutional financing agencies, co-operative banks, commercial banks and local participants to enhance their capability and exploit untapped rural market.

- Rural banks need to remove lack of transparency in their operation which leads to unequal relationship between banker and customer.

- Banking staff should interact more with their customers to overcome this problem.

- Banks should open their branches in areas where customers are not able to avail banking facilities due to underdeveloped transport and communication facilities.

- In this competitive era, RRBs have to concentrate on speedy, qualitative and secure banking services to retain existing customers and attract potential customers.

https://www.pib.gov.in/PressReleasePage.aspx?PRID=1839953

1.png)