Disclaimer: Copyright infringement not intended.

Context:

Read about REPO Rate: https://www.iasgyan.in/daily-current-affairs/repo-rate#:~:text=THE%20RECENT%20SUDDEN%20RISE%20IN,rate%20now%20stands%20at%205.40%25

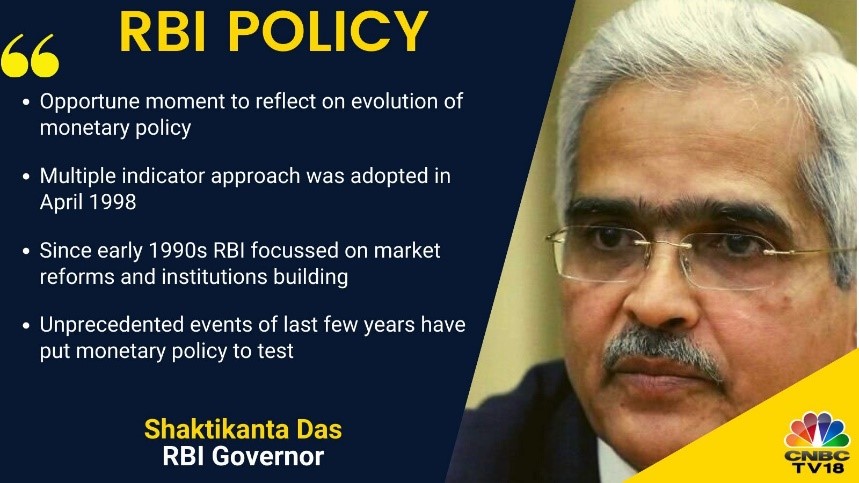

Recent Hike in Repo Rate:

Implications

Inflation forecast:

© 2025 iasgyan. All right reserved