Description

Disclaimer: Copyright infringement not intended.

Context

- Higher food prices nudged up India's annual retail inflation.

- India's retail inflation surged dramatically in January to 6.52 percent, according to the data released by the Ministry of Statistics and Programme Implementation.

Retail inflation

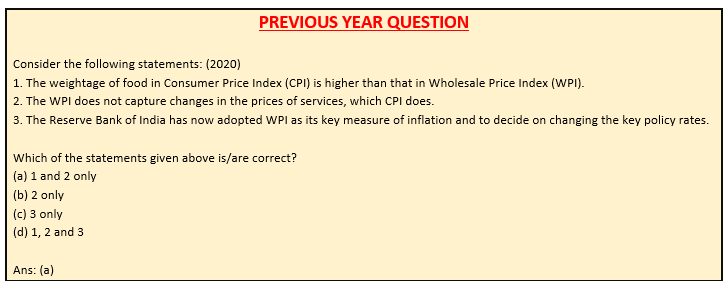

- Retail inflation tracked by the Consumer Price Index (CPI) measures the changes in prices from a retail buyer's perspective.

- Wholesale inflation on the other hand is tracked by the Wholesale Price Index (WPI), measures inflation at the level of producers.

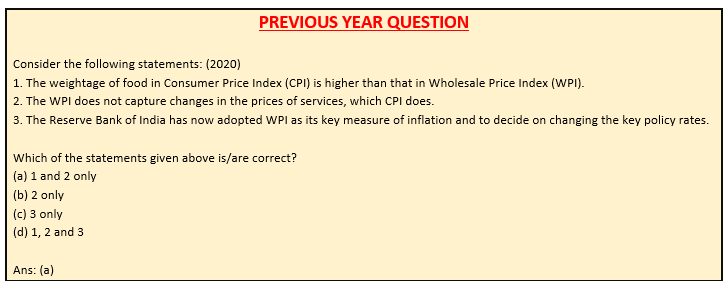

Consumer Price Index (CPI)

- Consumer Price Index (CPI) measures the inflation at retail level.

- Consumer Price Index (CPI) is a measure of change in retail prices of goods and services consumed by people in a given area with reference to a base year. CPI is calculated for a fixed list of items including food, housing, apparel, transportation, electronics, medical care, education, etc. The price data is collected periodically, and thus, the CPI is used to calculate the inflation levels in an economy.

.jpeg)

The main uses of CPI are the following:

- It is widely considered as a barometer of inflation.

- Tool for monitoring price stability.

- The Reserve Bank of India is now using CPI(Combined) as the as the benchmark for its monetary policy tools like Repo Rate, Reverse Repo Rate.

- According to the Agreement on Monetary Policy Framework signed between the Government and the RBI in 2015 the sole objective of the RBI is price stability and the Consumer Price Index (Combined) is measured as the target inflation.

Consumer Price Index compiled for four groups of consumers in India:

- CPI for Industrial workers CPI(IW)

- Consumer Price Index for Urban Non-Manual Employees (UNME)

- CPI for Agricultural Labourers CPI(AL)

- CPI for Rural Labourers CPI(RL)

- While the Ministry of Statistics and Program Implementation collects CPI (UNME) data and compiles it, the remaining three are collected by the Labour Bureau in the Ministry of Labour.

Inflation Targets

- Targeted consumer price index (CPI) inflation rate is= 4%

- Upper tolerance limit of inflation is= Target inflation rate + 2% = (4% + 2%) =6%

- Lower tolerance limit of inflation is= Target inflation rate – 2% = (4% – 2%) =2%

- Targeted consumer price index (CPI) inflation rate period from = April 1, 2021

- Targeted consumer price index (CPI) inflation rate period up to = March 31, 2026

Monetary policies can target inflation levels. A low level of inflation is considered to be healthy for the economy. If inflation is high, a contractionary policy can address this issue.

Recent Trends in Retail Inflation

- Inflation ran above the upper tolerance limit of 6% for the first 10 months of 2022 but fell below it in the last two months, largely because of a fall in food inflation.

- January's 52% rise on an annual basis as against 5.72 percent in December last year -- much higher than expected -- has been partly fuelled by rising food prices, which account for nearly 40 percent of the Consumer Price Index (CPI) basket.

- The prices of cereals and milk continued to rise. The previous high was 6.77% in October.

Steps being taken to control Inflation

- The RBI is expected to keep inflation within a band of 2-6 per cent. It has been raising lending rates to control inflation.

- Last week, the Monetary Policy Committee (MPC) of the Reserve Bank of India hiked the Key Policy Rate-the Repo rate or the rate at which the RBI lends funds to banks, by 25 basis points to 6.50 per cent in a bid to rein in retail inflation.

Read: https://www.iasgyan.in/daily-current-affairs/repo-rate-hike#:~:text=Context%3A,to%20rein%20in%20retail%20inflation.

Closing Remarks

- In the recent monetary policy announcement, Reserve Bank of India (RBI) Governor Shaktikanta Das said that in FY23, the inflation is expected to grow at 6.5%. In FY24, it is expected to fall to 5.3%.

- CPI inflation for January is a negative surprise and will make the job of RBI's MPC (Monetary Policy Committee) more challenging. However, higher food prices will act as the tailwind for farmers and augurs well for rural demand, which has been languishing for many months.

Must-Read Articles:

Inflation: https://www.iasgyan.in/daily-current-affairs/inflation-29

Monetary Policy Committee: https://iasgyan.in/daily-current-affairs/monetary-policy-committee-highlights

Key Economic Concepts: https://www.iasgyan.in/blogs/key-economic-concepts-back-to-basics

https://www.businesstoday.in/latest/economy/story/indias-retail-inflation-rises-to-652-in-january-370057-2023-02-13