Description

Disclaimer: Copyright infringement not intended.

Context

- The scrap steel industry, which sources its raw materials mostly from unorganized scrap dealers, has sought rationalisation in GST structure through a ‘Reverse Charge Mechanism’ where the liability to pay tax would be on manufacturers.

.jpeg)

What is Reverse Charge Mechanism?

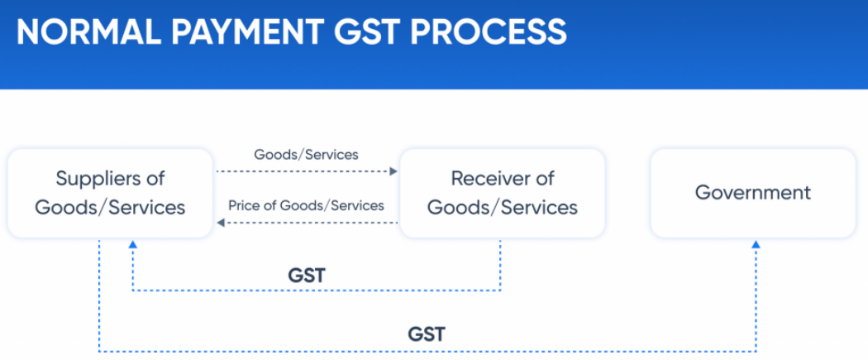

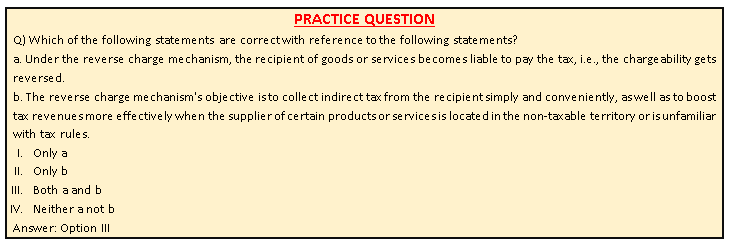

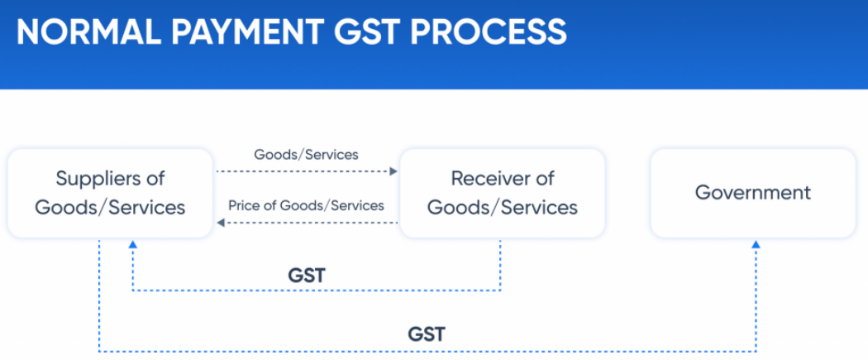

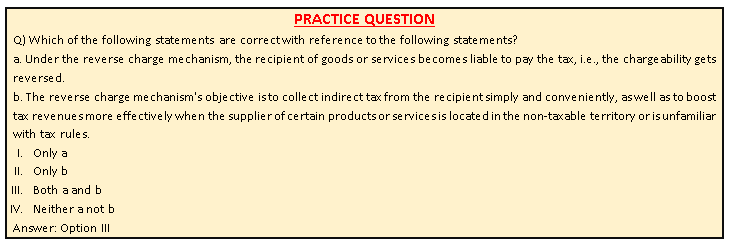

- Typically, the supplier of goods or services pays the tax on supply. Under the reverse charge mechanism, the recipient of goods or services becomes liable to pay the tax, i.e., the chargeability gets reversed.

- The objective of shifting the burden of GST payments to the recipient is to widen the scope of levy of tax on various unorganized sectors, to exempt specific classes of suppliers, and to tax the import of services (since the supplier is based outside India).

- Only certain types of business entities are subject to the reverse charge mechanism.

GST rate under RCM

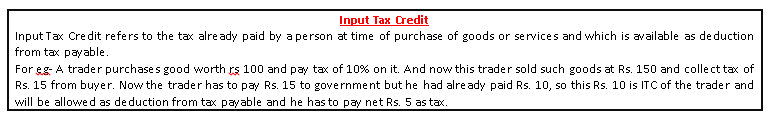

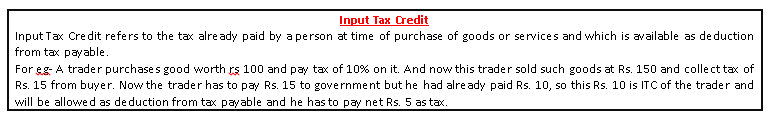

- A GST rate of 5% or 12% is applied depending on whether the service provider, i.e. the Goods Transport Agency, is eligible for Input Tax Credit (ITC) (GTA).

The Purpose of the Reverse Charge

The reverse charge mechanism's objective is to collect indirect tax from the recipient simply and conveniently, as well as to boost tax revenues more effectively when the supplier of certain products or services is located in the non-taxable territory or is unfamiliar with tax rules

https://www.deccanherald.com/business/business-news/scrap-steel-industry-seeks-reverse-charge-mechanism-in-gst-1192073.html