Disclaimer: Copyright infringement not intended.

Context

What is Inflation?

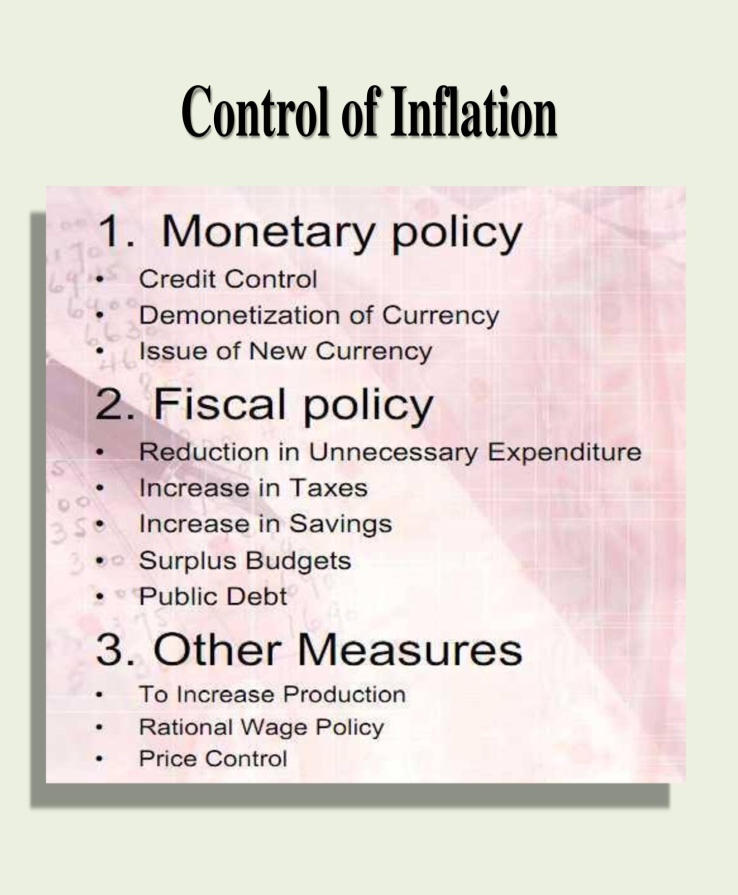

Measures to control Inflation

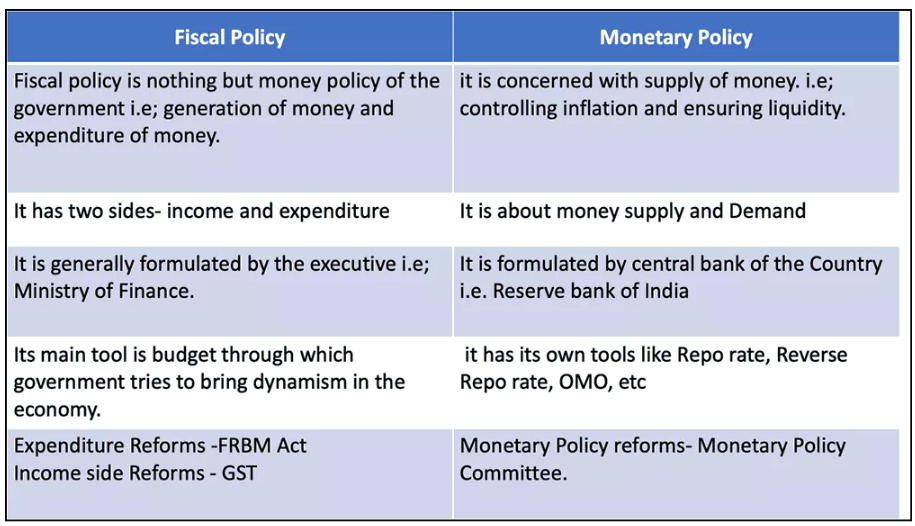

Role of RBI in controlling Inflation: Using Monetary Policy

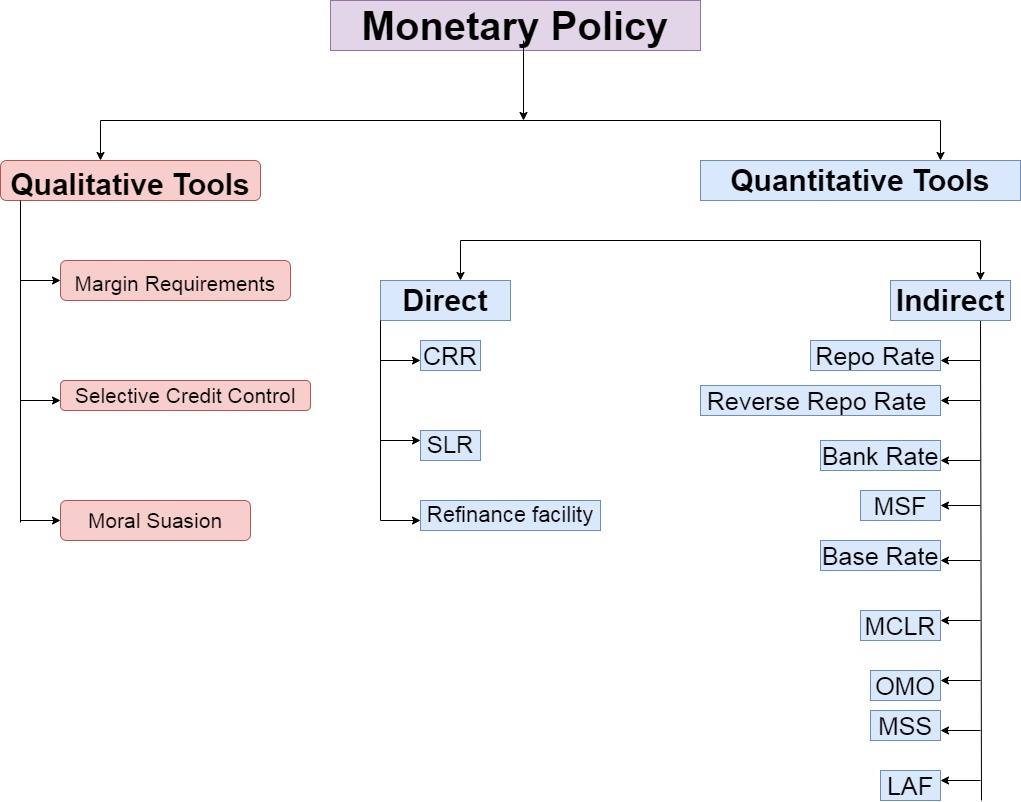

Monetary policy

The tools applied by the policy that impact money supply in the entire economy, including sectors such as manufacturing, agriculture, automobile, housing, etc.

Bank rate is used to prescribe penalty to the bank if it does not maintain the prescribed SLR or CRR.

|

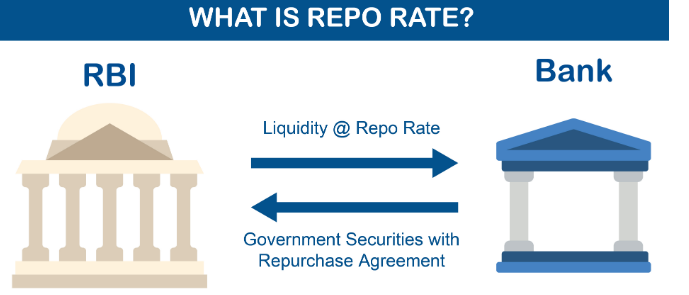

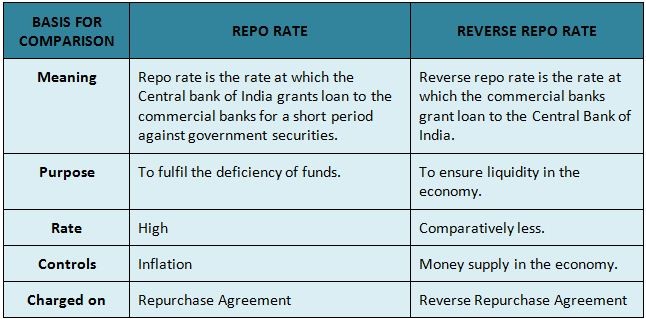

Decoding Repo Rate Specifically, the RBI defines the repo rate as the fixed interest rate at which it provides overnight liquidity to banks against the collateral of government and other approved securities under the liquidity adjustment facility (LAF). In other words, when banks have short-term requirements for funds, they can place government securities that they hold with the central bank and borrow money against these securities at the repo rate. Since this is the rate of interest that the RBI charges commercial banks such as State Bank of India and ICICI Bank when it lends them money, it serves as a key benchmark for the lenders to in turn price the loans they offer to their borrowers.

Why is the repo rate such a crucial monetary tool? When government central banks repurchase securities from commercial lenders, they do so at a discounted rate that is known as the repo rate. The repo rate system allows central banks to control the money supply within economies by increasing or decreasing the availability of funds.

How does the repo rate work? Besides the direct loan pricing relationship, the repo rate also functions as a monetary tool by helping to regulate the availability of liquidity or funds in the banking system. For instance, when the repo rate is decreased, banks may find an incentive to sell securities back to the government in return for cash. This increases the money supply available to the general economy. Conversely, when the repo rate is increased, lenders would end up thinking twice before borrowing from the central bank at the repo window thus, reducing the availability of money supply in the economy. Since inflation is, in large measure, caused by more money chasing the same quantity of goods and services available in an economy, central banks tend to target regulation of money supply as a means to slow inflation.

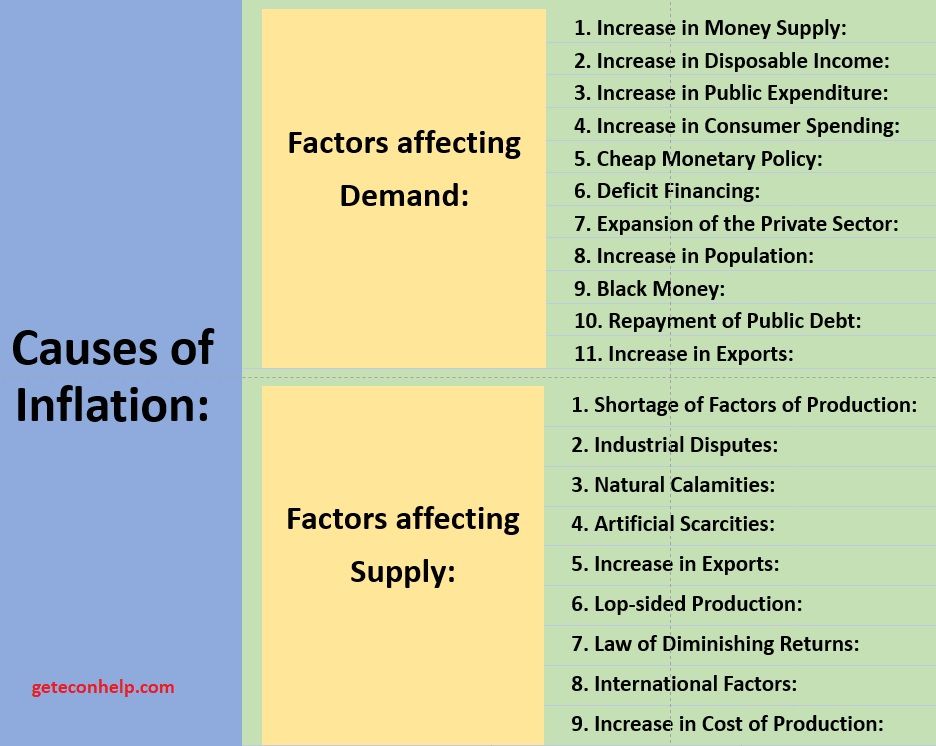

What impact can a repo rate change have on inflation? Inflation can broadly be: mainly demand driven price gains, or a result of supply side factors that in turn push up the costs of inputs used by producers of goods and providers of services, thus spurring inflation, or most often caused by a combination of both demand and supply side pressures. Changes to the repo rate to influence interest rates and the availability of money supply primarily work only on the demand side by making credit more expensive and savings more attractive and therefore dissuading consumption. However, they do little to address the supply side factors, be it the high price of commodities such as crude oil or metals or imported food items such as edible oils.

What other factors influence the repo rate’s efficacy? Repo rate increases impact the real economy with a lag. In February 2021, the RBI in its annual ‘Report on Currency and Finance’ observed that “the challenge of monetary policy is to minimize the transmission lag from changes in the policy rate to the operating target”, which in this case is the mandate to keep medium-term inflation anchored at 4%, and bound within a tolerance range of 2% to 6%. [The transmission lag is the time interval between the policy decision and the subsequent change in policy instruments. This is also a more serious obstacle for fiscal policy than for monetary policy. For frequent changes in bank rate there is no transmission lag in case of monetary policy] The RBI noted in the report that there were several channels of transmission, (a) ‘the interest rate channel; (b) the credit or bank lending channel; (c) the exchange rate channel operating through relative prices of tradables and non-tradables; (d) the asset price channel impacting wealth/income accruing from holdings of financial assets; and (e) the expectations channel encapsulating the perceptions of households and businesses on the state of the economy and its outlook’. These conduits of transmission intertwine and operate in conjunction and are difficult to disentangle. These are the challenges monetary authorities face in ensuring that changes to the repo rate actually help in achieving the policy objective. |

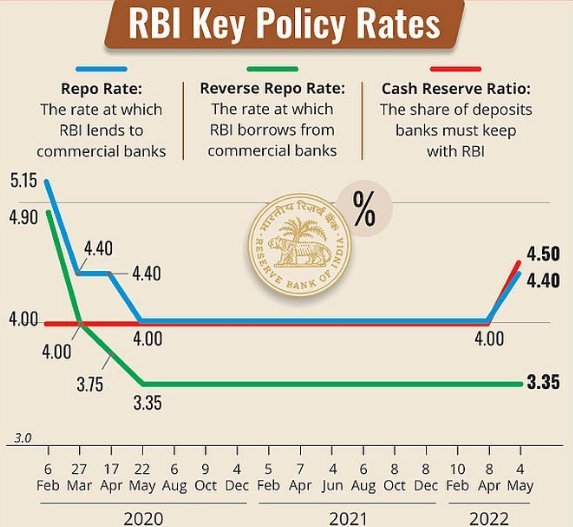

Reverse Repo Rate = Repo Rate – 1

MSF Rate = Repo Rate + 1

Unlike quantitative tools which have a direct effect on the entire economy’s money supply, qualitative tools are selective tools that have an effect in the money supply of a specific sector of the economy.

Monetary Policy Committee

The Governor of Reserve Bank of India is the chairperson ex officio of the committee.

Targeted consumer price index (CPI) inflation rate is= 4%

Upper tolerance limit of inflation is = Target inflation rate + 2% = (4% + 2%) =6%

Lower tolerance limit of inflation is = Target inflation rate – 2% = (4% – 2%) =2%

Targeted consumer price index (CPI) inflation rate period from = April 1, 2021

Targeted consumer price index (CPI) inflation rate period up to = March 31, 2026

THE RECENT SUDDEN RISE IN REPO RATE AND CRR

Why has the RBI increased the repo rate?

Impact

[Stock market]

[Loan and EMI Rates]

[Unequal impact]

[Inflation]

Must Read: https://www.iasgyan.in/daily-current-affairs/inflation-29

https://epaper.thehindu.com/Home/ShareArticle?OrgId=GO09QPPB4.1&imageview=0

Array ( [0] => daily-current-affairs/role-of-rbi-in-controlling-inflation [1] => daily-current-affairs [2] => role-of-rbi-in-controlling-inflation )

© 2025 iasgyan. All right reserved