Description

Disclaimer: Copyright infringement not intended.

Context:

- Over the past decade, the Indian rupee has experienced significant fluctuations against the US dollar, raising concerns about its overall stability.

- However, the rupee's value is not solely determined by its exchange rate with the dollar but also by its effective exchange rate (EER) against a basket of currencies of major trading partners.

- This broader perspective provides a more comprehensive understanding of the rupee's performance in the global currency market.

Exchange Rate Index (EER)

- The Exchange Rate Index (EER) and the Consumer Price Index (CPI) are two important economic indicators used to understand different aspects of the economy.

- While the CPI measures changes in the prices of a representative basket of goods and services consumed by households, the EER tracks the value of a country's currency relative to a basket of foreign currencies, reflecting its competitiveness in international trade.

EER Calculation:

- The EER is calculated using a similar methodology to the CPI. It is an index of the weighted average of the rupee’s exchange rates against the currencies of India’s major trading partners.

- These currencies are weighted based on the share of each country in India’s total foreign trade. This means that currencies of countries with higher trade volumes with India will have a greater impact on the index.

CPI Calculation:

- The CPI, on the other hand, measures the weighted average retail price of a representative consumer basket of goods and services. This basket is designed to reflect the typical consumption patterns of households.

- The weights for each commodity in the CPI are based on their relative importance in the overall consumption basket, with more weight given to items that are more commonly purchased.

Key Similarities:

- Weighting System: Both indices use a weighting system to determine the importance of different components. This ensures that the index reflects the relative significance of currencies or commodities in the overall calculation.

- Representative Nature: Both indices aim to represent broader economic concepts. The EER reflects the competitiveness of a country's currency, while the CPI reflects the cost of living for consumers.

Importance and Use:

- Analytical Tools: Both indices are important analytical tools used in economic analysis. They provide insights into currency value (EER) and inflationary trends (CPI).

- Policy Implications: Governments and policymakers use both indices to formulate economic policies. For example, a high CPI may indicate a need for tighter monetary policy to control inflation, while a depreciating EER may prompt interventions to support the currency.

Measures of EER

Nominal Effective Exchange Rate (NEER):

- The NEER is a trade-weighted average rate at which the rupee is exchangeable with a basket of currencies.

- The Reserve Bank of India (RBI) has constructed NEER indices for the rupee against two baskets of currencies.

NEER Baskets:

- NEER Basket of Six Currencies:

- Includes the US dollar, euro, Chinese yuan, British pound, Japanese yen, and Hong Kong dollar.

- Represents a smaller basket of major trading partner currencies.

- NEER Basket of 40 Currencies:

- Covers a larger basket of currencies.

- Represents countries that account for about 88% of India’s annual trade flows.

Base Year and Calculation:

- The NEER indices are calculated with reference to a base year value of 100 for 2015-16.

- Increases in the index indicate the rupee's effective appreciation against the currencies in the basket, while decreases indicate overall exchange rate depreciation.

Recent Trends

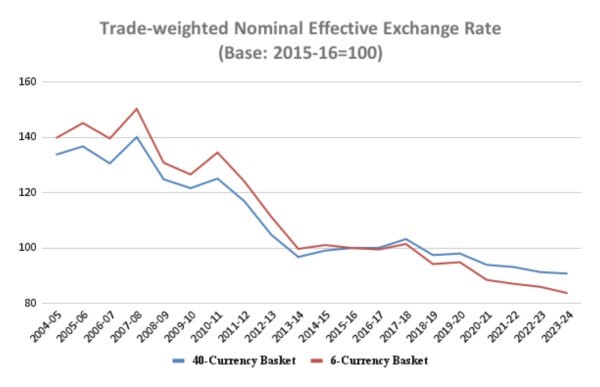

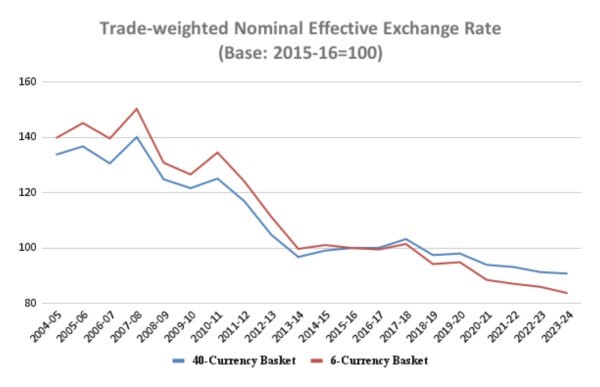

Rupee's NEER Decline

- 40-Currency Basket NEER:

- Declined by around 32.2% (from 133.8 to 90.8) between 2004-05 and 2023-24.

- Represents a broader basket of currencies of countries significant to India's trade.

- 6-Currency Basket NEER:

- Declined by 40.2% (from 139.8 to 83.7) over the same period.

- Represents a narrower basket of major trading partner currencies.

- USD Exchange Rate:

- The rupee's average exchange rate against the US dollar dropped by 45.7%.

- Fell from Rs 44.9 to Rs 82.8 over the same period.

- Simply put, the rupee’s “effective” depreciation of 32.2-40.2% against the currencies of all major trade partners of India over the last 20 years has been lower than its corresponding depreciation of 45.7% against the US dollar alone for this period. The reason for that is its weakening less relative to other currencies than vis-à-vis the dollar.

- The chart, moreover, reveals that the bulk of the NEER decline happened during 2004-05 to 2013-14.

- The rupee, in fact, strengthened thereafter till 2017-18, before resuming its weakening trend – albeit at a slower pace than during the UPA period

Implications

- Trade Competitiveness: A declining NEER indicates a loss of competitiveness in trade.

- Impact on Imports and Exports: A weaker rupee can make imports more expensive and exports more competitive in international markets.

- Inflationary Pressure: Depreciation of the rupee can lead to inflationary pressures, especially on imported goods and commodities.

Factors Contributing to the Decline

- Global Factors: Economic conditions, geopolitical events, and trade policies impacting global currencies.

- Domestic Factors: India's trade balance, inflation rate, and economic growth affecting currency value.

- Market Sentiment: Investor confidence, capital flows, and market speculation influencing currency movements.

Policy Considerations

- Exchange Rate Management: RBI's interventions in the foreign exchange market to stabilize the rupee.

- Export Promotion: Policies to enhance export competitiveness.

- Inflation Control: Measures to mitigate inflationary pressures from currency depreciation.

Real Effective Exchange Rate (REER)

Definition:

- The REER is a measure of a currency's value against a basket of other currencies, adjusted for inflation differentials.

- It reflects the relative purchasing power of a currency in terms of its international trading partners.

NEER vs. REER:

- While the NEER captures movements in the external value of a currency, the REER factors in inflation, reflecting changes in the internal value.

- NEER does not consider inflation, while REER adjusts for inflation differentials between the home country and its trading partners.

Illustration with Indonesian Rupiah:

- The Indonesian rupiah fell 8.5% against the US dollar, while the Indian rupee depreciated by 1.7%.

- However, India's CPI inflation rate of 4.9% stood above Indonesia’s 3.1%, indicating the rupiah's domestic purchasing power erosion was less than its international purchasing power, unlike the rupee.

Calculation and Impact:

- If a country's nominal exchange rate falls less than its domestic inflation rate, as in India's case, the currency has appreciated in "real" terms.

- REER helps understand the true value of a currency, considering both external and internal factors.

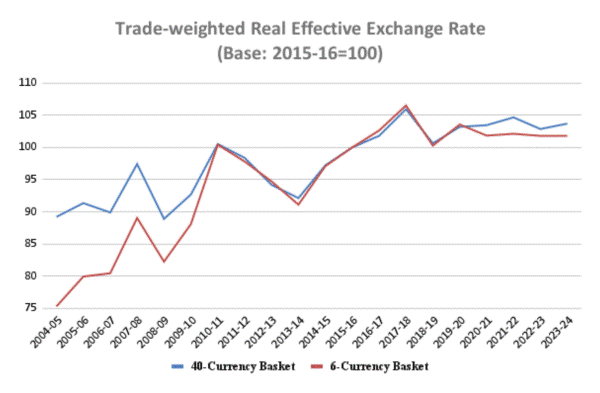

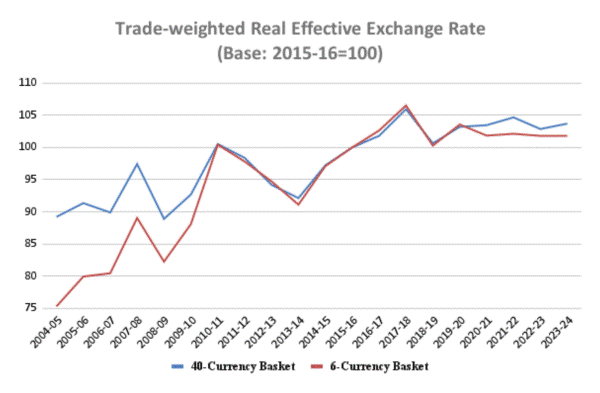

Trend Analysis

- 20-Year REER Chart:

- The chart maps the rupee's trade-weighted REER for the last 20 years, with a base year value of 100 for 2015-16.

- It shows the rupee has strengthened in real terms over time, with values at or above 100 for 9 out of 10 years of the Modi government, contrary to the weakening trend seen in NEER or the USD exchange rate.

Overvaluation Analysis

Assumption of Fair Valuation:

- If the rupee was considered "fairly" valued in 2015-16 when the EER indices were set to 100, any value above 100 indicates overvaluation.

- The rupee is currently overvalued to that extent in terms of its REER.

Impact of Overvaluation:

- Any increase in REER implies that the costs of Indian exports are rising more than the prices of imports.

- This leads to a loss of trade competitiveness, which can be detrimental in the long run.

Implications for Trade Competitiveness

Loss of Competitiveness:

- Overvaluation can make Indian exports more expensive in international markets.

- Imports, on the other hand, become relatively cheaper, potentially leading to increased import dependency.

Trade Balance Concerns:

- A persistent overvaluation can negatively impact the trade balance, as exports may decline while imports increase.

Policy Considerations

Exchange Rate Policy:

- Authorities may consider adjusting the exchange rate to enhance export competitiveness.

- However, abrupt changes can also lead to market uncertainties and volatility.

Structural Reforms:

- Focus on improving productivity and reducing production costs to maintain competitiveness.

- Investment in infrastructure, technology, and skill development to enhance export capabilities.

Importance of Balanced Approach:

- While addressing overvaluation is important, a balanced approach is needed to ensure macroeconomic stability and long-term growth.

|

Nominal Effective Exchange Rate (NEER) and Real Effective Exchange Rate (REER)

Nominal Effective Exchange Rate (NEER) and Real Effective Exchange Rate (REER) are important indicators in international economics used to assess a country's currency value, trade competitiveness, and overall economic performance.

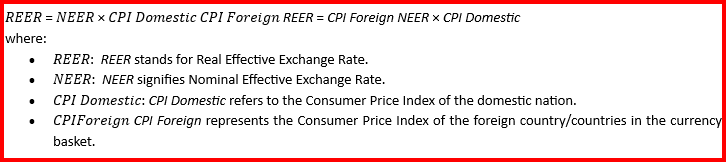

Real Effective Exchange Rate (REER)

REER is the weighted average of a country's currency against an index or basket of other relevant currencies, adjusted for inflation. It considers the relative trade balances of each country's currency to those of all other countries in the index. An increase in a nation's REER indicates that exports are becoming more expensive while imports are becoming more affordable. REER measures a country's competition with its trading partners on the world stage and is calculated using the formula:

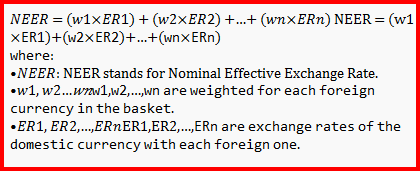

Nominal Effective Exchange Rate (NEER)

NEER is the unadjusted weighted average rate at which one country's currency is exchanged for a basket of foreign currencies. It measures a country's capacity to compete internationally in the foreign exchange market and is calculated using the formula:

Significance of NEER and REER

NEER and REER are crucial for understanding a country's exchange rate dynamics, trade competitiveness, and overall economic performance. They provide insights into a nation's currency value in relation to its trading partners and real purchasing power. In India, these indicators play a significant role in assessing the country's external competitiveness and economic performance.

|

|

PRACTICE QUESTION

Q. Examine the factors contributing to the recent fluctuations in the Indian rupee against the US dollar. Assess the implications of these fluctuations on India's economy and strategies to enhance the rupee's stability.

|