Disclaimer: Copyright infringement not intended.

Context

- Banks have invoked the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act against telecom infrastructure provider GTL to recover their pending dues.

What is the Sarfaesi Act?

- The SARFAESI Act of 2002 was brought in to guard financial institutions against loan defaulters. To recover their bad debts, the banks under this law can take control of securities pledged against the loan, manage or sell them to recover dues without court intervention.

- The law is applicable throughout the country and covers all assets, movable or immovable, promised as security to the lender.

Aim of the SARFAESI Act

The SARFAESI Act has two main objectives, namely:

- Recovering the financial institutions’ and banks’ non-performing assets (NPAs) in a timely and effective manner.

- Allows financial organisations and banks to sell residential and commercial assets at auction if a borrower defaults on his or her debt.

Why was such a law needed?

- Before the law was enacted in December 2002, banks and other financial institutions were forced to take a lengthy route to recover their bad debts.

- The lenders would appeal in civil courts or designated tribunals to get hold of ‘security interests’ to recovery of defaulting loans, which in turn made the recovery slow and added to the growing list of lender’s non-performing assets.

Read about NPA : https://www.iasgyan.in/daily-current-affairs/non-performing-assets

Elements of the SARFAESI Act

The SARFAESI Act is applied to the entire country of India. The SARFAESI Act, 2002 provisions are in effect for modifying the four laws listed below:

- Indian Stamp Act, 1899.

- The recovery of the debts due to the Banks and Financial Institutions Act, 1993 (RDDBFI).

- The Depositories Act, 1996 and for those matters that are connected therewith or incidental thereto.

- The Reconstruction and Securitisation of Financial Assets and Enforcement of Security Interest Act, 2002.

What powers do banks have under the law?

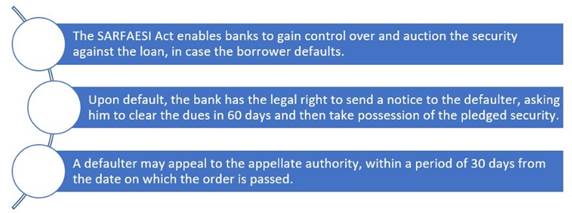

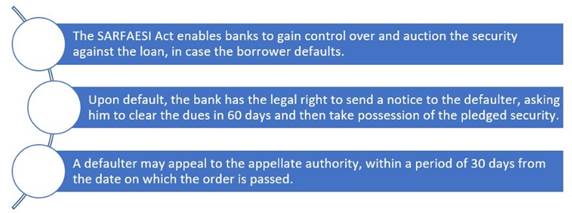

- The Act comes into play if a borrower defaults on his or her payments for more than six months. The lender then can send a notice to the borrower to clear the dues within 60 days. In case that doesn’t happen, the financial institution has the right to take possession of the secured assets and sell, transfer or manage them.

- The defaulter, meanwhile, has recourse to move an appellate authority set up under the law within 30 days of receiving a notice from the lender.

SARFAESI Act: Applicability

The SARFAESI Act mainly provides legal recourse for matters dealing with:

- Registration of asset reconstruction companies.

- Acquisition of rights or interest in financial assets.

- Measures for assets reconstruction.

- Resolution of disputes.

Provisions

If a borrower has not repaid, the banks have following powers:

- Take possession, sell or lease the assets

- Take over the management

- Appoint a manager

- Accept any money by 3rd parties for the borrowers

Features of SARFAESI ACT

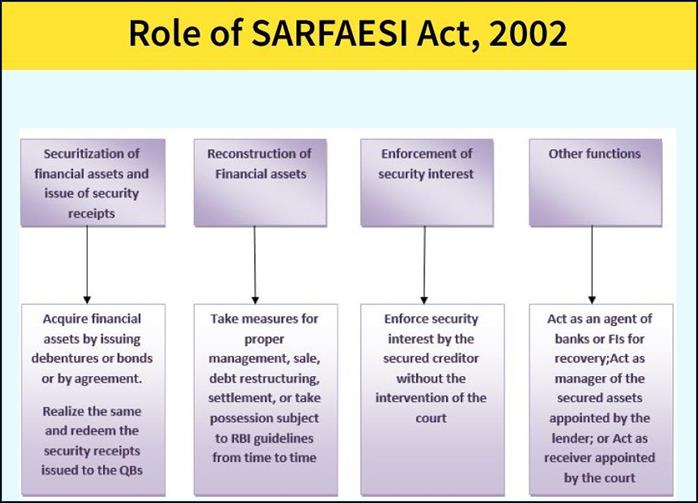

Securitization and Reconstruction of Financial Assets and Enforcement of Securities Interest Act, 2002 aims to protect banks and financial institutions from incurring losses. Its features are provided below:

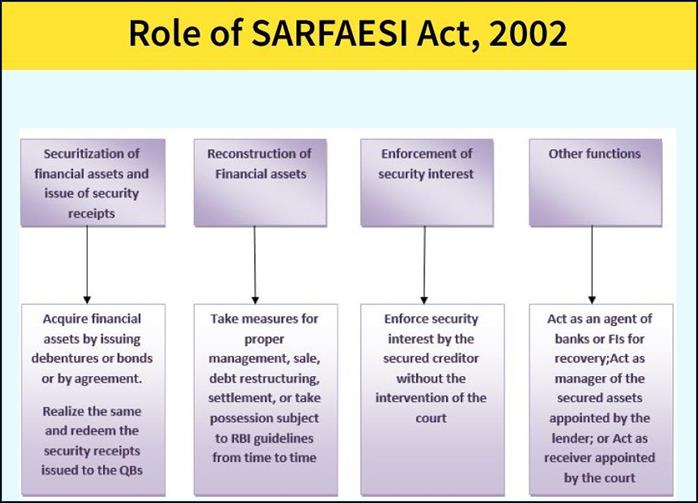

- Enforcement of security interests: The Act enforces security interests by the secured creditors with no involvement of the court. In case of a default by a borrower, the act authorizes the bank or a financial institution to issue a demand notice to the borrower and induces him/her to satisfy off the obligations within sixty days from the date of the notification.

- Reconstruction of financial assets: SARFAESI Act allows the banker and financial institutions to take legitimate measures of the management, sale, settlements, debt restriction, or take any possession under SBI guidelines every now and then.

- Securitization of financial assets and issue security receipts: The primary point of the securitization act is to make accessible the enforcement of security interest for example to take possessions of the assets that were given security for the loan.

- Act as an agent of banks or financial institutions: The SARFAESI Act 2002 acts as the manager of the secured assets given by the financial institutions and ensures that the dues are recovered at an ideal time.

What assets are covered under the SARFAESI Act?

- Any asset, i.e. movable or immovable, given as security by way of hypothecation, mortgage, or creation of a security interest in any other form except those excluded under Section 31 of the Act are covered under the SARFAESI Act.

Is SARFAESI Act applicable to cooperative banks?

- In 2020, the Supreme Court upheld amendments made to the SARFAESI Act in 2013, which included cooperative banks under the ambit of the Act.

Is SARFAESI Act applicable to NBFCs (Non-Banking Financial Companies)?

- The Ministry of Finance, vide its notification dated 24th February 2020, notified that the NBFCs with asset size of Rs.100 crores or more are eligible NBFCs that are covered under the SARFAESI Act to enforce security interest on debts amounting to at least Rs.50 lacs.

Which loans are not covered under SARFAESI Act?

The provisions of this Act apply to outstanding loans above Rs.1 lakh, which are classified as NPAs. The SARFAESI Act isn’t applicable for:

- Pledge of movables in accordance with The Indian Contract Act of 1872.

- Aircraft security is being developed.

- Establishment of a security interest in a vessel.

- No security interest is generated in a conditional sale, hire-purchase, or lease.

- Unpaid seller’s rights under The Sale of Goods Act of 1930.

- According to the Civil Procedure Code, 1908 properties are not attachable.

- A security interest in an amount less than or equal to Rs.1 lakh is granted.

- A security interest in agricultural land has been developed.

- The amount owed is less than 20% of the principal amount plus interest.

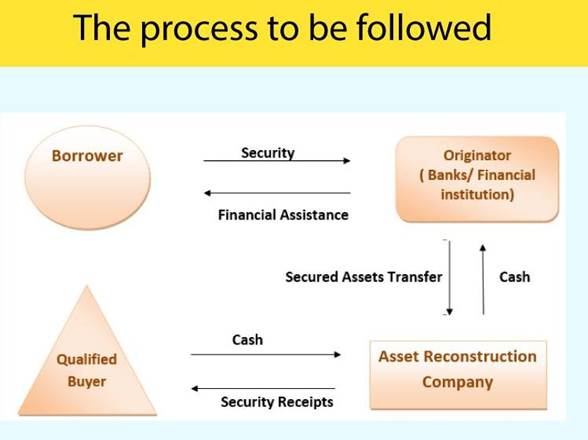

What are the modes of recovery under the SARFAESI Act?

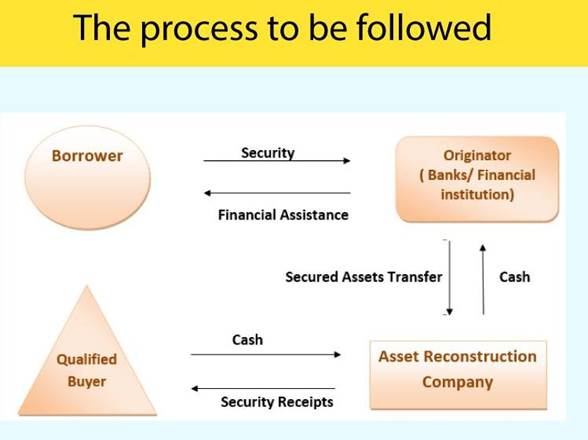

The Act provides for three methods of recovery of the NPAs, which includes:

- Securitisation

- Asset reconstruction

- Enforcement of security without the interruption of the court

Enforcement of Security Interest and Recovery of Debts Laws and Miscellaneous Provisions (Amendment) Act, 2016

The Enforcement of Security Interest and Recovery of Debts Laws and Miscellaneous Provisions (Amendment) Act, 2016 made certain amendments to the Sarfaesi Act, 2002 including the provisions relating to registration of security interests over property rights with the Central Registry for Securitisation, Asset Reconstruction and Security Interests.

- Under the Law prior to the amendment, the banks and financial institutions had to register security interests over property created in their favour by the borrowers within 30 days from the date of creation. Non-compliance with this requirement of registration was punishable as an offence with fine which may extend to Rs 5,000 per day. By the Amendment Act of 2016, the entire registration system has been transformed: The registration has been made voluntary and provision has been made to the effect that on registration of security interest created over property will constitute a public notice which will be effective from the date and time of registration and any dealing with such property by any person shall be subject to the security interest.

- The definition of security interest has been modified to include hire purchase or financial lease transactions.

- The registration system is extended to all secured creditors in addition to banks and financial institutions. The system is also extended to attachment orders issued by taxation authorities for recovery of government dues and any other attachment orders issued by any court or any authority.

- The banks and financial institutions will be able to exercise the right of enforcement of security with respect to defaulted loans only if the security interest created in their favour is registered. As far as the other secured lenders are concerned, they have no right of enforcement but they will get the benefit of public notice of security created in their favour from the date and time of registration.

- Section 26E has been inserted in the Sarfaesi Act which provides that notwithstanding anything contained in any other law for the time being in force, after the registration of security interest, the debts due to the secured creditor shall be paid in priority over all other debts and all revenues, taxes, cesses, and other rates payable to the central government or state government or local authority.

- Provision for integration of other registration systems with the Central Registry so that registration of the same security interest in more than one registry is avoided.

The above amendments are bringing the Indian Secured Transactions Law in conformity with the Legislative Guide for Secured Transactions Law recommended by the United Nations Commission on International Trade Law.

Challenges

- One of the Act’s significant flaws is that it does not apply to unsecured creditors.

- The bank has no influence over what happens to the asset after it is placed up for auction. If there are no buyers for the asset at the auction, the bank cannot proceed, pursuant to the previous conditions.

- Furthermore, the Government of India added a new clause in 2011 declaring that the bank might acquire the asset if there was no better bidder. This created another issue that if the factory was in the city, the bank might buy it and use it to erect a new branch or build a housing colony for its employees. However, if it was in an extremely remote place, it was useless to the bank.

- The Act’s provision permitted the bank to keep a specific asset for a maximum of seven years. However, if the bank does not get a reasonable bid within the specified time frame, the remedy for such a situation is not specified in the Act.

- In some cases, the auction process is hurriedly completed and it would be extremely difficult for the borrowers to get the transaction set-aside.

- Conflict between the Insolvency and Bankruptcy Code (IBC) and the Sarfaesi Act.

- The IBC provides for a non-obstante clause in section 238, giving the Code's provisions precedence over any other provision in law. The same has been confirmed by the Supreme Court in Encore Asset Reconstruction Company Pvt Ltd v. Ms Charu Sandeel Desai, where it stated that the IBC clearly prevailed over the Sarfaesi Act.

- The Sarfaesi Act provides for the setting up of (Asset Reconstruction Companies) ARCs, which are specialized financial institutions acquiring non-performing assets or bad assets from financial institutional and banks. However, it does not allow ARCs to submit resolution plans and its guidelines prohibit ARCs to infuse equity in insolvent companies at the resolution stage. Contrary to this, Section 29A of the IBC permits ARCs to become resolution applicants.

Final Thought

- For an insolvency regime to function effectively, clear harmonization for the interplay of the different laws will have to be done. Harmonization between IBC and Sarfaesi provisions is the need of the hour.

- Clarity of provisions in Auction notice and their ground level implementation is another need of the hour.

- The SARFAESI Act, 2002 is a vital Act for the advancement of the country’s economy, and broadening its scope is regarded as a necessary step in strengthening the country’s financial institutions.

https://indianexpress.com/article/explained/everyday-explainers/explained-what-is-the-sarfaesi-act-invoked-against-telecom-provider-gtl-8022947/

1.png)