Description

Copyright infringement not intended

Context: The Senior Citizen Savings Scheme (SCSS) has seen a remarkable increase in collections in the first quarter of the current financial year, with a 176% rise on year to Rs 55,000 crore. This reflects the high demand for small saving schemes that help the Centre to partly fund its fiscal deficit.

Details

- The Centre has made the SCSS more attractive for senior citizens in the Budget for FY24 by raising the maximum deposit limit to Rs 30 lakh. This allows them to secure a steady income in their old age from a safe investment option.

- The SCSS is paying 8.2% interest per annum and has attracted 6,52,000 new accounts in the first three months of FY24. This is a significant jump from 0.296 million new accounts in the same period of the previous year.

Senior Citizen Savings Scheme (SCSS)

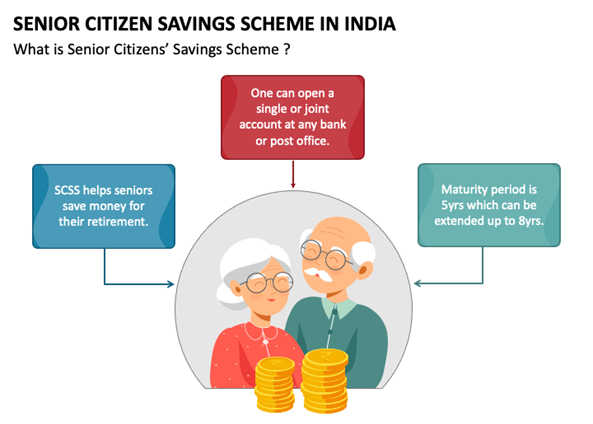

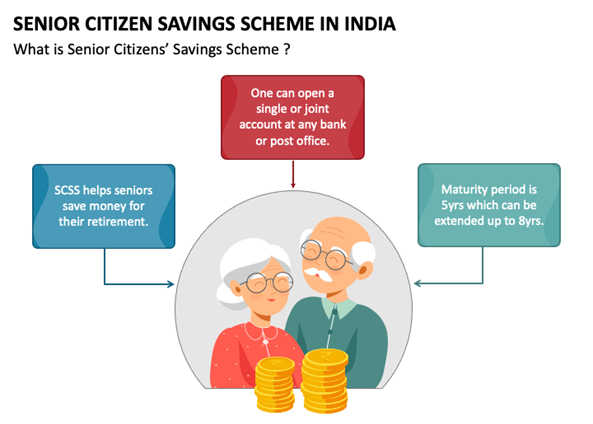

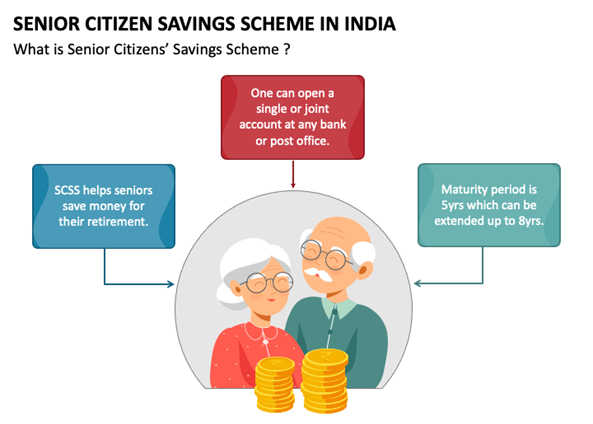

About

- Senior Citizen Savings Scheme (SCSS) is a government-backed investment option for senior citizens in India who want to secure a regular income after they reach 60 years of age.

- SCSS was launched in 2004 by the Ministry of Finance as a retirement benefit program for senior citizens.

- The scheme aims to provide a safe and reliable source of income for senior citizens who have limited or no pension or other sources of income.

- The scheme is available at post offices and authorized banks across India.

Features

- SCSS is open to Indian citizens who are 60 years or older. Retirees who have taken Voluntary Retirement Scheme (VRS) or Superannuation can also invest in SCSS if they are between 55 and 60 years of age. Retired defence personnel who are 50 years or older but below 60 years of age are also eligible.

- The scheme has a tenure of five years, which can be extended for another three years by submitting a form within one year of the account maturity. The account can be closed without any penalty after the completion of the tenure.

- Investors can open more than one SCSS account, either individually or jointly with their spouse. However, the joint account can only be opened with the spouse who is also eligible for SCSS.

- Investors can make a one-time deposit in SCSS, subject to the following limits:

- Minimum deposit: 1,000 (and in multiples thereof)

- Maximum deposit: 30 lahks or the amount received on retirement, whichever is lower.

- SCSS offers attractive interest rates that are paid quarterly to investors. The interest rate is fixed by the government and revised every quarter.

- Investors can withdraw their deposits from SCSS before maturity, subject to certain conditions and penalties. Premature withdrawal is allowed after one year of opening the account, but with a penalty of 1.5% of the deposit amount. After two years of opening the account, the penalty is reduced to 1% of the deposit amount.

- Deposits in SCSS are eligible for tax deduction under Section 80C of the Income Tax Act, up to a limit of Rs. 1.5 lakh per year. However, the interest earned from SCSS is taxable as per the investor's income tax slab.

Conclusion

- The SCSS is a beneficial savings scheme for senior citizens, but it also has some drawbacks that need to be improved. By addressing the issues, the SCSS can become a more viable and attractive option for senior citizens to secure their financial future.

Must-Read Articles:

SCHEMES FOR SENIOR CITIZENS: https://www.iasgyan.in/daily-current-affairs/schemes-for-senior-citizens

https://www.financialexpress.com/money/senior-citizens-saving-scheme-receipts-jump-176-in-q1/3165800/