Description

Disclaimer: Copyright infringement not intended.

Context

- Union Minister for Finance & Corporate Affairs Smt. Nirmala Sitharaman approved the final Sovereign Green Bonds framework of India.

Green Bonds

- Green bonds are financial instruments that generate funds for investment in environmentally sustainable and climate-suitable projects. Also, green bonds command a relatively lower cost of capital compared to regular bonds.

India’s Sovereign Green Bond

- In keeping with the ambition to significantly reduce the carbon intensity of the economy, the Union Budget 2022-23 announced the issue of Sovereign Green Bonds.

- The issuance of Sovereign Green Bonds will help the Government of India (GoI) in tapping the requisite finance from potential investors for deployment in public sector projects aimed at reducing the carbon intensity of the economy.

Sovereign Green Bond Framework

- Green Bond Framework sets forth the obligations of the Government of India as a Green Bond issuer. The Framework applies to all sovereign Green Bonds issued by the Government of India.

- Payments of principal and interest on the issuances under this Framework are not conditional on the performance of the eligible projects. Investors in bonds issued under this Framework do not bear any project-related risks.

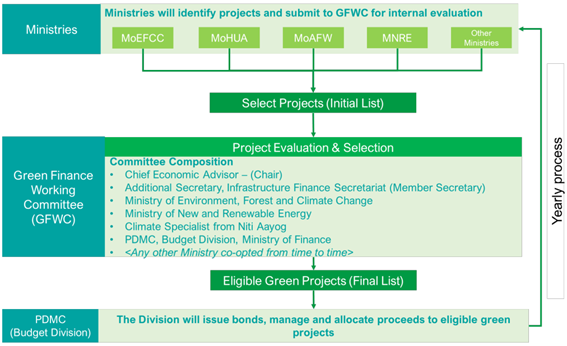

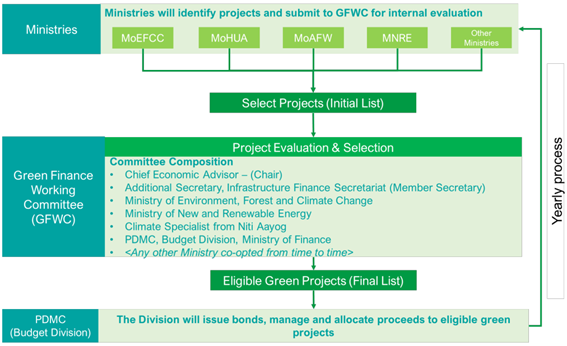

- Green Finance Working Committee (GFWC) was constituted to validate key decisions on the issuance of Sovereign Green Bonds.

Core Components of the Framework

Use of Proceeds

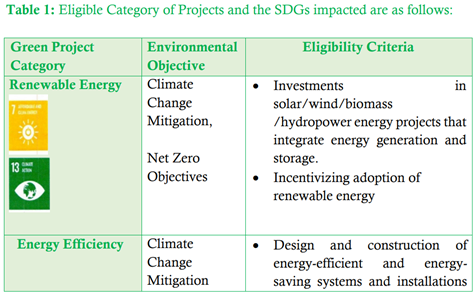

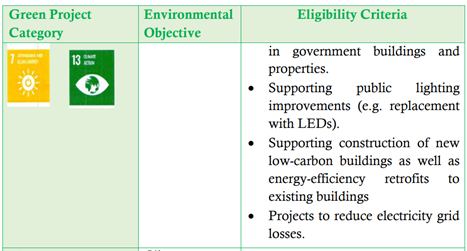

A ‘green project’ classification is based on the following principles:

- Encourages energy efficiency in resource utilization.

- Reduces carbon emissions and greenhouse gases.

- Promotes climate resilience and/or adaptation.

- Values and improves natural ecosystems and biodiversity, especially in accordance with SDG principles.

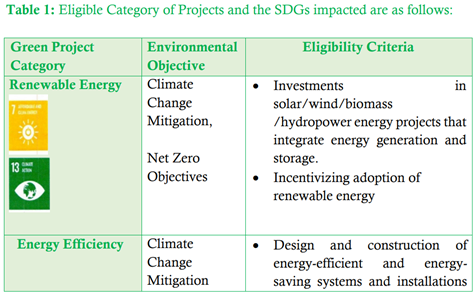

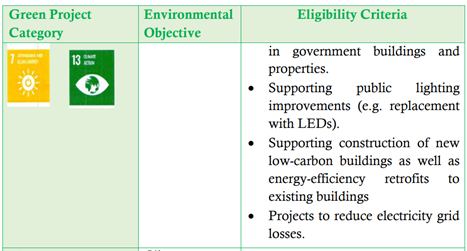

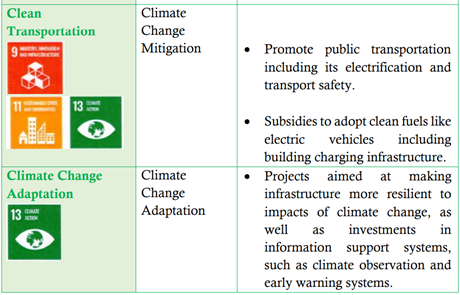

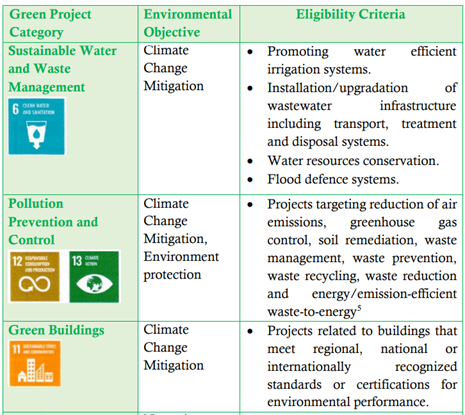

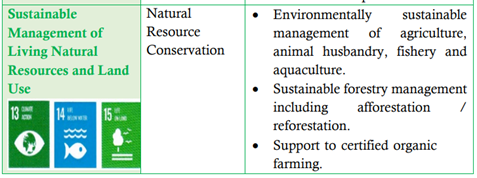

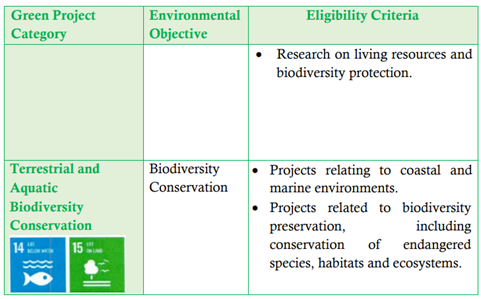

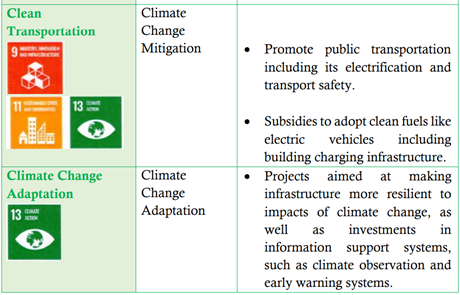

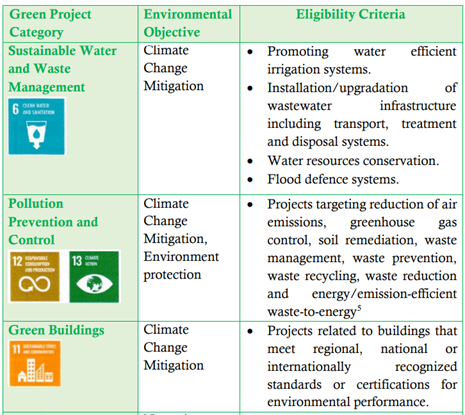

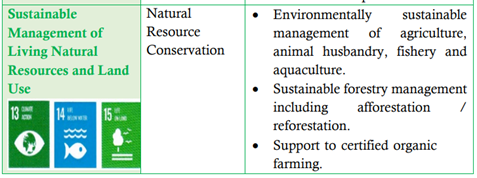

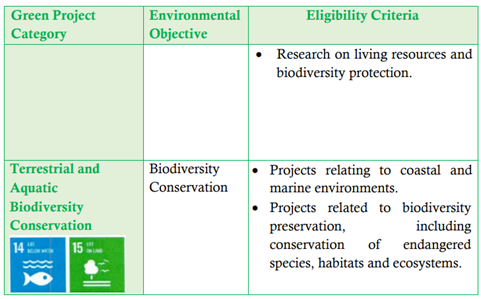

The Government of India will use the proceeds raised from Sovereign Green Bonds (SGrB) to finance and/or refinance expenditure (in parts or whole) for eligible green projects4 falling under ‘Eligible Categories’ defined in Table

Excluded Projects

- Projects involving new or existing extraction, production, and distribution

- of fossil fuels, including improvements and upgrades; or where the core

- energy source is fossil-fuel based

- Nuclear power generation

- Direct waste incineration

- Alcohol, weapons, tobacco, gaming, or palm oil industries

- Renewable energy projects generating energy from biomass using feedstock originating from protected areas

- Landfill projects

- Hydropower plants larger than 25 MW

Expenditures directly related to fossil fuels are excluded. However, investments/expenditures aimed at a relatively cleaner Compressed Natural Gas (CNG) are allowed as an ‘eligible expenditure’ when used in public transportation projects only. Subsidy/incentive for private transportation using CNG is neither envisaged nor included.

Management of Proceeds

- The proceeds will be deposited to the Consolidated Fund of India (CFI), and then funds from the CFI will be made available for eligible green projects. A separate account will be created and maintained by the Ministry of Finance.

- The Public Debt Management Cell (PDMC) will keep a track of proceeds within the existing guidelines regarding debt management, and monitor the allocation of funds towards eligible green expenditures. Unallocated proceeds, if any, will be carried forward to successive years for investment in eligible green projects only.

Significance of the Sovereign Green Bond Framework

- At COP 26, India underlined the need to start the one-word movement 'LIFE' which means 'Lifestyle For Environment' urging for mindful and deliberate utilization instead of mindless and destructive consumption of natural resources.

- India further enhanced its ambition on addressing climate. These include five nectar elements (Panchamrit) of India’s climate action:

1) Reach 500GW non-fossil energy capacity by 2030.

2) 50 percent of its energy requirements from renewable energy by 2030.

3) Reduction of total projected carbon emissions by one billion tonnes from now to 2030.

4) Reduction of the carbon intensity of the economy by 45 percent by 2030, over 2005 levels.

5) Achieving the target of net zero emissions by 2070.

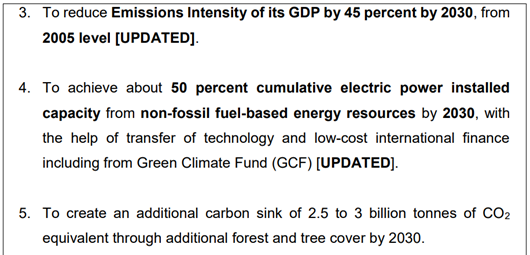

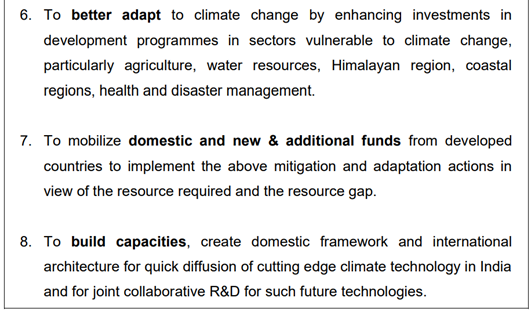

Updated NDC Targets

- As mentioned earlier, the issuance of Sovereign Green Bonds will help the Government of India (GoI) in tapping the requisite finance from potential investors for deployment in public sector projects aimed at reducing the carbon intensity of the economy.

- This approval will further strengthen India’s commitment towards its Nationally Determined Contribution (NDCs) targets, adopted under the Paris Agreement, and help in attracting global and domestic investments in eligible green projects.

https://dea.gov.in/sites/default/files/Framework%20for%20Sovereign%20Green%20Bonds.pdf