Description

Disclaimer: Copyright infringement not intended.

Context

- The Supreme Court asked the Securities and Exchange Board of India (SEBI) and the government to produce the existing regulatory framework in place to protect investors from share market volatility.

Introduction

- The capital market is the backbone of every country as it can affect the financial position of the country and regulate the economy. The heart of economic growth lies in the capital market which helps in providing the allocation of funds and mobilization of resources.

- The capital markets cater to the need for a long-term fund that is required for the development of the industrial and commercial sectors.

.jpeg)

Capital market in India: A Brief Overview

- The capital market is the place that acts as the platform between the suppliers and the buyers.

- The savings and investments are channelized between the persons who have capital and the person who needs capital.

- In simpler terms, the market where buyers and sellers engage in trading of financial securities like bonds, stocks, etc. However, the market is much wider than securities. The participants during such transactions can be an individual as well as an institution.

- It includes all types of lending and borrowing. The capital market is generally for the raising of long-term funds. The markets deal mainly with debts and equity securities. There are different types of buyers such as businessmen, companies, government or it can be general people. The major regulatory body is the RBI (Reserve bank of India) assisted by the Ministry of Finance and the SEBI(Security Exchange Board of India).

The regulatory framework and legislation: A discussion

- Various organizations regulate the market to keep the economy stable. The regulatory structure has been framed under the four pillars that are the Ministry of Finance, Reserve Bank of India, Security and Exchange Board of India, and the National Stock Exchange.

Ministry of Finance(MoF)

- The ministry depicts that the Government of India plays a very important role and their economic policies and manifestos help in market regulation and framework.

- They formulate rules and analyze them for the efficient and effective growth of the market.

- The Department of Economic Affair which manages the market works under certain sets of laws that are the Depositories Act, 1996, Securities Contract (Regulation) Act, 1956, and Securities and Exchange Board of India Act, 1992. There are many other laws such as the Companies Act, 2013, etc.

Reserve Bank of India

- The body that was established in 1934 frames the policies, formulates the bodies and regulates the rules as per the current situation.

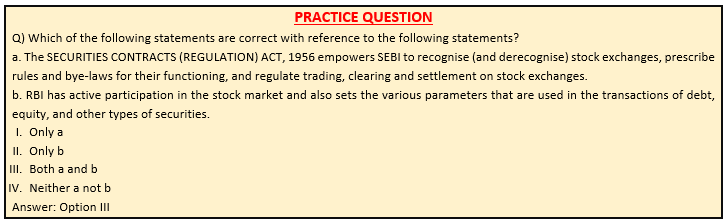

- RBI has active participation in the stock market and also sets the various parameters that are used in the transactions of debt, equity, and other types of securities. They are the bank regulators also as they have access to many bank accounts as they have large funds to control the capital market since banks have the most generated capital on hold.

- They also set various parameters for regulation such as repo rate, reverse repo rate, etc. They are the intermediary body between the market and the government. They have other various functions in capital markets such as the implementation of various monetary policies, managing the foreign exchange system, settlement, and payments systems.

Security Exchange Board of India (SEBI)

- This body can also be considered as the apex body of capital market regulators. SEBI is a principal regulatory body that is also a statutory body established under the SEBI Act,1992.

- SEBI was earlier established as the non-statutory body in 1988. They not only protect the interest of investors in securities but also promote the market.

- It supervises, controls, and manages several institutional brokers, investors, companies, and all other associated persons related to the market.

- The body’s primary function is to prohibit malpractice or unfair trade practices such as insider trading or manipulating funds.

- The stock exchanges work under the direct control of this body as they adopt a flexible and adaptable approach for regulating the market.

- They perform many other such regulatory functions such as training of intermediaries, auditing of stock exchanges, regulating and registering the mutual funds.

- Recently, the review and merger of SEBI(Issue and Listing of Debt Securities) Regulations, 2008 and SEBI(non-convertible Redeemable preference shares) Regulations 2013 into a single regulation- SEBI(Issue and Listing of Non-Convertible Securities) Regulations, 2021.

Acts governing the capital markets

- The Depositories Act,1996- The Act regulates the depositories in Securities. The primary objective of this Act is to ensure free transferability of securities with speed, accuracy and security. The Act eases the ownership of transferability of ownership from one person to another in a convenient way. It has made the securities freely transferable in case of Public limited companies along with the securities.

- Securities Contract (Regulation) Act, 1956- The regulatory Act deals in all types of issues related to Stock trading. The Act aims at smooth functioning of the stock exchanges. It prevents any kind of defective transactions. It especially deals in listing of stock exchanges and contracts in securities.

- Security and Exchange Board of India Act,1992- This Act provides the statutory powers to the SEBI organisation. The governing body regulates the market in a multifarious manner by protecting the interest of the shareholders, preventing any kind of malpractices in the market and promoting the development of the Securities Market. The Act provides wide powers and scope to the SEBI in order to effectively and efficiently run the capital market.

Decoding the role of SEBI in detail

- The SEBI Act empowers SEBI to protect the interests of investors and to promote the development of the capital/securities market, besides regulating it.

- SEBI was given the power to register intermediaries like stock brokers, merchant bankers, portfolio managers and regulate their functioning by prescribing eligibility criteria, conditions to carry on activities and periodic inspections.

- It also has the power to impose penalties such as monetary penalties, including suspending or cancelling the registration.

- The SECURITIES CONTRACTS (REGULATION) ACT, 1956 empowers SEBI to recognise (and derecognise) stock exchanges, prescribe rules and bye laws for their functioning, and regulate trading, clearing and settlement on stock exchanges.

- As part of the development of the securities market, Parliament passed the Depositories Act and SEBI made regulations to enforce the provisions. This Act introduced and legitimized the concept of dematerialised securities being held in an electronic form.

- Today almost all the listed securities are held in dematerialised form. SEBI set up the infrastructure for doing this by registering depositories and depository participants. The depository regulations empower SEBI to regulate functioning of depositories and depository participants by prescribing eligibility conditions, periodic inspections and powers to impose penalties including suspending or cancelling the registration as well as monetary penalties.

Can SEBI step in to curb market volatility?

- While SEBI does not interfere to prevent market volatility, exchanges have circuit filters — upper and lower — to prevent excessive volatility.

Must Read Article: https://www.iasgyan.in/daily-current-affairs/circuit-breakers

- But SEBI can issue directions to those who are associated with the market, and has powers to regulate trading and settlement on stock exchanges.

- Using these powers, SEBI can direct stock exchanges to stop trading, totally or selectively. It can also prohibit entities or persons from buying, selling or dealing in securities, from raising funds from the market and being associated with intermediaries or listed companies.

- What are the guidelines on fund-raising?

- The Companies Act, which regulates companies incorporated/registered in India, has delegated the authority to enforce some of its provisions to SEBI, including the regulation of raising capital, corporate governance norms such as periodic disclosures, board composition, oversight management and resolution of investor grievances.

- In order to regulate fund-raising activities, SEBI first brought out a set of guidelines called the Disclosure and Investor Protection Guidelines which were thereafter subsumed into a more comprehensive Issue of Capital and Disclosure Requirement Regulations.

- In order to ensure that listed companies followed corporate governance norms, SEBI notified the Listing Obligations and Disclosure Requirements Regulations in 2015.

- Besides these regulations, the Collective Investment Regulations define a CIS (collective investment scheme) and provide for penal actions against those running unregistered CIS schemes. Entities involved in fund-raising through issue of capital such as merchant bankers are also regulated through specific regulations.

The Case of Stock Exchanges

- The SCRA has empowered SEBI to recognize and regulate stock exchanges and later commodity exchanges in India; this was earlier done by the Union government. In fact, the term “securities” is defined in the SCRA and powers to declare an instrument as a security remain vested in SEBI.

- The rules and regulations made by SEBI under the SCRA relate to listing of securities like equity shares, the functioning of stock exchanges including control over their management and administration.

- These include powers to determine the manner in which a settlement is done on stock exchanges (and to keep them with the times for e.g. T+1) and recognising and regulating clearing corporations, which are central to the management of the trading system.

- An important aspect of the regulation of stock exchanges is also the provision for arbitrating disputes that arise between stock brokers who trade on stock exchanges and investors who are clients of such stock brokers. The Act also seeks to protect the interests of investors by creating an Investor Protection Fund for each stock exchange.

Safeguards against Fraud

- Fraud undermines regulation and prevents a market from being fair and transparent.

- SEBI notified the Prohibition of Fraudulent and Unfair Trade Practices Regulations in 1995 and the Prohibition of Insider Trading Regulations in 1992 to prevent the two key forms of fraud, market manipulation, and insider trading.

- These regulations, read with provisions of the SEBI Act, define species of fraud, who is an insider and prohibit such fraudulent activity and provide for penalties including disgorgement of ill-gotten gains.

- It must be noted that violation of these regulations are predicate offences that can lead to a deemed violation of the Prevention of Money Laundering Act.

- SEBI has been given the powers of a civil court to summon persons, seize documents and records, attach bank accounts and property, and to carry out investigations.

- Using these powers, SEBI has acted against entities and individuals like Satyam, Sahara India, Ketan Parekh and Vijay Mallya.

https://www.thehindu.com/business/markets/explained-how-is-the-stock-market-regulated-in-india/article66526291.ece