Description

Disclaimer: Copyright infringement not intended.

Context

- Department of Pharmaceuticals, Ministry of Chemicals and Fertilizers has released the guidelines for the scheme “Strengthening of Pharmaceutical Industry (SPI)", with a total financial outlay of Rs.500 Cr for the period from FY 21-22 to FY 25-26.

About

- The scheme will address the rising demand in terms of support required to existing Pharma clusters and MSMEs across the country to improve their productivity, quality and sustainability.

The objectives of the scheme

- To strengthen the existing infrastructure facilities in order to make India a global leader in the Pharma Sector.

Features

- Under the Scheme, financial assistance to pharma clusters will be provided for creation of Common Facilities.

- This will not only improve the quality but also ensure the sustainable growth of clusters.

- Further, in order to upgrade the production facilities of SMEs and MSMEs so as to meet national and international regulatory standards (WHO-GMP or Schedule-M), interest subvention or capital subsidy on their capital loans will be provided, which will further facilitate the growth in volumes as well as in quality.

Components of the Scheme

- The Scheme has 3 components / sub-schemes:

Assistance to Pharmaceutical Industry for Common Facilities (APICF)

- This is to strengthen the existing pharmaceutical clusters’ capacity for their sustained growth by creating common facilities

- There will be support for clusters for creation of common facilities with the focus on R&D Labs, Testing Laboratories, Effluent Treatment Plants, Logistic Centres and Training Centres in this order of priority with an outlay of 178 Cr for the scheme period of five years is proposed.

Pharmaceutical Technology Upgradation Assistance Scheme (PTUAS)

- This is to facilitate Micro, Small and Medium Pharma Enterprises (MSMEs) of proven track record to meet national and international regulatory standards.

- Under this, support for about SME Industries is proposed, either through up to maximum of 5% per annum (6% in case of units owned and managed by SC/STs) of interest subvention or through Credit linked Capital subsidy of 10%.

- In both the cases, the loan supported under this is to a limit of 10 Crores and the eligible components of the loan have been listed out in the scheme guidelines.

- An outlay of 300 Cr has been earmarked for sub scheme for the scheme period of five years.

Pharmaceutical & Medical Devices Promotion and Development Scheme (PMPDS)

- This is to facilitate growth and development of Pharmaceutical and Medical Devices Sectors through study/survey reports, awareness programs, creation of database, and promotion of industry.

- Under this, knowledge and awareness about the Pharmaceutical and MedTech Industry will be promoted.

- This will be done by undertaking studies, building databases and bringing industry leaders, academia and policy makers together to share their knowledge and experience for overall development of the Pharma and Medical Devices sector.

- An outlay of 21.5 Cr has been earmarked for the sub scheme for the scheme period of five years.

Significance

- It is expected that the units supported under this scheme will act as Demonstration Firms for the pharma clusters and MSE Pharma Industries, to develop on quality and technology upgradation fronts.

Overview of India’s Pharma Sector

- The pharmaceutical industry in India was valued at an estimated US$42 billion in 2021.

- India is the world's third largest provider of generic medicines by volume, with a 20% share of total global pharmaceutical exports.

- It is also the largest vaccine supplier in the world by volume, accounting for more than 50% of all vaccines manufactured in the world.

- Major pharmaceutical hubs in India are: Vadodara, Ahmedabad, Ankleshwar, Vapi, Baddi, Sikkim, Kolkata, Visakhapatnam, Hyderabad, Bangalore, Chennai, Navi Mumbai, Mumbai, Pune and Aurangabad.

Some Challenges for the Indian Pharmaceutical Industry

Highly fragmented industry

- The Indian pharma industry is highly fragmented. The market is overloaded with generic manufacturers.

- This is a cause for concern because high fragmentation causes instability, volatility and uncertainty.

‘Out of Pocket (OoP) expenditure

It is limiting the access to medicines wherein, that Indian Insurance section does cater to patients in IP, and not in OP (Out Patient scenario), that causes quite a dent.

Talent Pool

- In India, the demand for these services has outstripped supply. There is a huge shortfall in ‘Healthcare Manpower’ of the country, right from Pharmacists, Nurses and Doctors and related.

A lack of a stable pricing and policy environment

- The challenge created by unexpected and frequent domestic pricing policy changes in India.

- It has created a vague environment for investments and innovations.

Lack in innovation

- India is rich in its manpower and talent. The government needs to invest in research initiatives and talent to grow India’s innovation.

Dependency for raw material

- India is heavily dependent on other countries for active pharmaceutical ingredients (API) and other intermediates. 80% of the APIs are imported from China.

- So India is, therefore, at the mercy of supply disruptions and unpredictable price fluctuations.

- Implementation of infrastructure improvement in the field of internal facilities is necessary to stabilize supply.

Some recent Reforms

- To foster an Atmanirbhar Bharat by enhancing the R&D, high-value production capabilities, import substitution and domestic manufacture of active pharmaceutical ingredient (API) the government has introduced a US$2 billion incentive program which will run from 2021-22 to 2027-28.

- In 2019 the Department of Pharmaceuticals announced that as part of the Make in India initiative, drugs for local use and exports must have 75% and 10% local APIs respectively and a bill of material must be produced for verification.

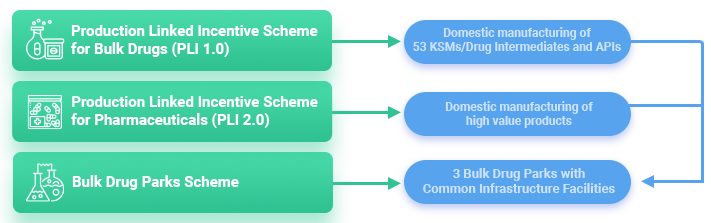

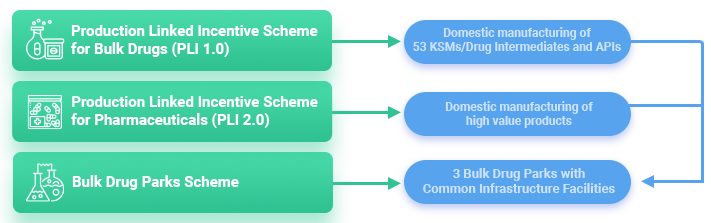

- The Production Linked Incentive (PLI) Scheme for promotion of domestic manufacturing of critical Key Starting Materials (KSMs)/Drug Intermediates (DIs) and Active Pharmaceutical Ingredients (APIs) in India.

Way Ahead

- India needs user friendly government policy for the common man to establish small scale, raw material manufacturing units/ incubators in all states. This will improve availability of raw materials to manufacture generic drugs at affordable rates.

- The government and industry should facilitate the pharmacist community to become entrepreneurs and promote incubators’ establishment.

- Raw material produced from small scale units should be properly validated in the testing laboratory of the state to ascertain their quality specifications.

- There is a need for a functional testing laboratory in every state to fasten the work of specification of raw materials.

- Small scale produces may be re-processed in another industry or via a chain of industry for quality products that can be used for parenteral/tailor-made formulations.

- Skilled manpower from academic institutions can be achieved through continuing education programmes.

- Research schemes should be initiated by the industry via direct contact with identified researcher/faculty.

- Incentives should be paid to students contributing towards development of any research formula for the industry.

- Develop strategies for raw material producing units with user friendly government policy for the small scale industry.

- There is a need for qualified workforce and optimization of workforce.

- It is important to promote approvals of pharmaceutical infrastructure and development, get clearance from the environment ministry and offer subsidies and tax exemptions to offer the much-needed boost to the Indian pharma industry.

- Focus on API manufacturing so that they can less rely on imported APIs. This can be fulfilled in several ways, including constructing dedicated zones for the manufacture of APIs.

- Regulatory authorities have to simplify the approval process because investment in emerging research and development (R & D) fields is much higher than generic ones. Working with other global regulatory bodies could help encourage pharmaceutical growth in India.

- AI can be used in almost every pharmaceutical industry for drug discovery, development, manufacturing, and marketing. AI can make all business operations efficient, cost-effective, and hassle-free.

https://www.pib.gov.in/PressReleasePage.aspx?PRID=1805146