Description

Disclaimer: Copyright infringement not intended.

Context

- Union Minister for Road Transport and Highways Shri Nitin Gadkari launched one of India’s first-ever Surety Bond Insurance products from Bajaj Allianz.

Surety Bond Insurance

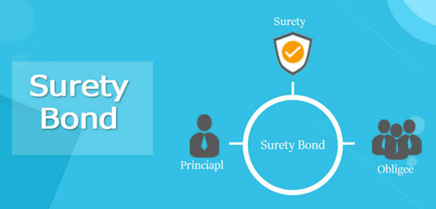

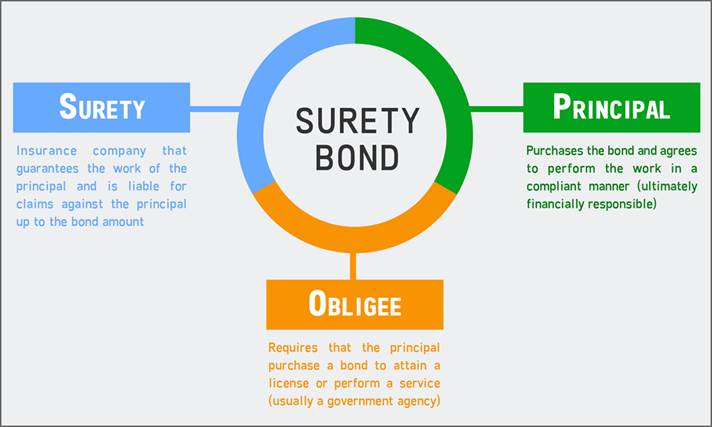

- Surety bonds are a contract or a three-way agreement that are guarantees of payment, which insurers issue.

- The surety (insurance companies/banks) provides the financial guarantee to the obligee (government) that the principal (contractor) will fulfil their obligations as per the agreed terms.

- Surety bonds will aid in developing an alternative to bank guarantees for the construction of infrastructure projects. However, these are different from bank guarantees as in this a considerable amount of the project funds of contractors does not get frozen.

- Surety Bond Insurance will act as a security arrangement for infrastructure projects and will insulate the contractor as well as the principal.

- The product will cater to the requirements of a diversified group of contractors, many of whom are operating in today’s increasingly volatile environment.

- The Surety Bond Insurance is a risk transfer tool for the Principal and shields the Principal from the losses that may arise in case the contractor fails to perform their contractual obligation.

- The product gives the principal a contract of guarantee that contractual terms and other business deals will be concluded in accordance with the mutually agreed terms. In case the contractor doesn’t fulfil the contractual terms, the Principal can raise a claim on the surety bond and recover the losses they have incurred.

- Unlike a bank guarantee, the Surety Bond Insurance does not require large collateral from the contractor thus freeing up significant funds for the contractor, which they can utilize for the growth of the business. The product will also help in reducing the contractors’ debts to a large extent thus addressing their financial worries. The product will facilitate the growth of upcoming infrastructure projects in the country.

.jpg)

Significance

- Surety bonds will ensure the efficient use of working capital and reduce the requirement of collateral, which construction companies need to provide.

- Insurers will work in tandem with financial institutions to share risk information. This will assist in releasing liquidity in the infrastructure space without compromising on risk aspects.

IRDAI Surety Insurance Contracts Guidelines, 2022

- The IRDAI Surety Insurance Contracts Guidelines, 2022 came into effect on April 1, 2022. As per the guidelines, the premium charged for all surety insurance policies underwritten in a financial year, including all instalments due in subsequent years for those policies, should not exceed 10% of the total gross written premium of that year, subject to a maximum of Rs 500 crore.

- Also, insurers can issue contract bonds, which assure the public entity, developers, subcontractors, and suppliers that the contractor will fulfil its contractual obligation while undertaking the project.

- Bonds that surety insurance covers include contract bonds, bid bonds, performance bonds, advance payment bonds, custom and court bonds and retention money.

- The limit of the guarantee should not exceed 30% of the contract value. Finally, surety insurance contracts should be issued only to specific projects and not clubbed for multiple projects.

.jpg)

Possible risk factors

- A few of the possible risk factors could be a lapse in bond coverage, which can invalidate a licence or contract. In addition, required bond renewals could add to ongoing costs and hassle.

- Considering that surety bonds are a relatively new concept in India, they are a risky product as insurance companies are yet to achieve the expertise in risk assessment in such a business.

- Moreover, there is no clarity on pricing, the recourse available against defaulting contractors, and reinsurance options.

Final Thought

- The above-mentioned issues need to be addressed in consultation with all the stakeholders.

- That’s apart this product launch is in line with the government's vision to up-scale the infrastructure development in the country to increase the pace of development of upcoming projects.

- The government of India is making concerted efforts to implement measures that will accelerate the development of infrastructure in India and Surety Bond Insurance is a decisive step in this direction.

https://pib.gov.in/PressReleaseIframePage.aspx?PRID=1884946