Description

Disclaimer: Copyright infringement not intended.

Context

- Insurance companies have issued about 700 insurance surety bonds valued at approximately ₹3,000 crore.

- This follows the Centre's decision to make insurance surety bonds on par with bank guarantees for all government procurements.

Surety Bond Insurance

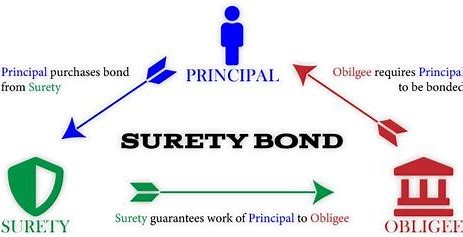

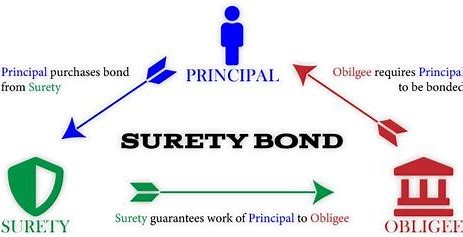

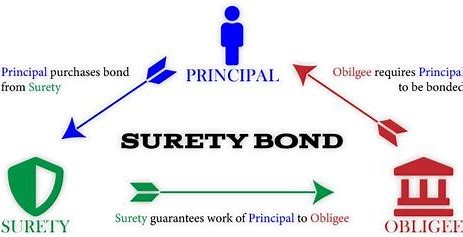

- Surety bonds are a three-way agreement that act as guarantees of payment.

- Insurers issue surety bonds, where the surety (insurance companies/banks) provides a financial guarantee to the obligee (government) that the principal (contractor) will fulfill their obligations as per the agreed terms.

Key Benefits

- Alternative to Bank Guarantees: Surety bonds offer a different solution compared to bank guarantees, where a significant amount of project funds of contractors does not get frozen.

- Security Arrangement: They act as a security arrangement for infrastructure projects, insulating both the contractor and the principal.

- Risk Transfer Tool: Surety Bond Insurance is a risk transfer tool for the principal, protecting them from losses if the contractor fails to meet contractual obligations.

Functionality

- Guarantee of Contractual Terms: Provides a contract of guarantee that contractual terms and business deals will be concluded according to mutually agreed terms.

- Claims and Recovery: If the contractor fails to fulfill contractual terms, the principal can raise a claim on the surety bond to recover losses incurred.

Financial Advantages

- No Large Collateral Required: Unlike bank guarantees, Surety Bond Insurance does not require large collateral from the contractor, freeing up significant funds for business growth.

- Debt Reduction: Helps in reducing the contractors' debts, addressing their financial concerns.

Impact on Infrastructure Projects

- Facilitates Growth: The product supports the growth of upcoming infrastructure projects in the country by providing financial flexibility and security to contractors.

Significance

- Efficient Use of Working Capital: Surety bonds ensure the efficient use of working capital and reduce the requirement for collateral, which construction companies need to provide.

- Risk Information Sharing: Insurers will work in tandem with financial institutions to share risk information, assisting in releasing liquidity in the infrastructure space without compromising on risk aspects.

IRDAI Surety Insurance Contracts Guidelines, 2022

- Effective Date: Came into effect on April 1, 2022.

- Premium Limit: The premium charged for all surety insurance policies underwritten in a financial year should not exceed 10% of the total gross written premium of that year, subject to a maximum of Rs 500 crore.

- Contract Bonds: Insurers can issue contract bonds assuring public entities, developers, subcontractors, and suppliers that the contractor will fulfill its contractual obligations.

- Types of Bonds Covered: Includes contract bonds, bid bonds, performance bonds, advance payment bonds, custom and court bonds, and retention money.

- Guarantee Limit: The limit of the guarantee should not exceed 30% of the contract value.

- Project-Specific Bonds: Surety insurance contracts should be issued only to specific projects and not clubbed for multiple projects.

Possible Risk Factors

- Lapse in Bond Coverage: A lapse in bond coverage can invalidate a license or contract.

- Bond Renewals: Required bond renewals could add to ongoing costs and hassle.

- New Concept in India: Surety bonds are relatively new in India, posing a risk as insurance companies have yet to achieve expertise in risk assessment.

- Unclear Pricing and Recourse: There is no clarity on pricing, recourse available against defaulting contractors, and reinsurance options.

Final Thought

- Stakeholder Consultation: The mentioned issues need to be addressed in consultation with all stakeholders.

- Government's Vision: This product launch aligns with the government's vision to upscale infrastructure development in the country, accelerating the pace of development for upcoming projects.

- Decisive Step: The Government of India is making concerted efforts to implement measures to accelerate infrastructure development, and Surety Bond Insurance is a decisive step in this direction.

|

PRACTICE QUESTION

Q. Explain the importance of surety bonds in India's infrastructure growth. Highlight the key aspects of the IRDAI Surety Insurance Contracts Guidelines, 2022. Assess the associated risks and propose mitigation strategies to expedite infrastructure development.

|

SOURCE: THE HINDU