Disclaimer: Copyright infringement not intended.

Context

- Finance Ministry said that debit and credit card payments by individuals upto ₹700,000 will be excluded from the liberalised remittance scheme (LRS) and will not attract tax collected at source (TCS) from 1 July.

LRS

Background

- India has come a long way in liberalising foreign exchange transactions for its residents.

- Before 2004, transferring money overseas was a cumbersome procedure involving numerous approvals from the Reserve Bank of India ('RBI').

- The rationale behind these strict regulations was multifold.

- First, India closely watched its foreign exchange reserves to maintain a comfortable cushion for meeting its debt and interest obligations.

- Second, it restricted the outflow of money from the country to prevent destabilisation and devaluation of the rupee.

- Third, high imports into the country required funding through foreign exchange reserves

- However, as India solidified its position in the global markets, open cross-border capital flow became crucial for holistic economic growth.

- In 2004, the Committee on Procedures and Performance Audit on Public Services ('CPPAPS') recommended a scheme for liberalising personal outward remittances.

- The same year, RBI introduced the Liberalised RemittanceScheme ('LRS'), allowing Indian residents to make individual foreign exchange transactions with relative ease.

- In the two decades since, LRS has been instrumental in simplifying overseas expenses and investments for Indian residents.

- In 2021-22, India recorded USD $19.6 billion in outward remittances under LRS, marking an increase of USD $7 billion from the previous year.

- As COVID-19 curbs ease and the world bounces back from its economic fallout, LRS is gaining popularity once again.

What is the LRS remittance limit?

- LRS allows Indian residents to freely remit up to USD $250,000 per financial year for current or capital account transactions or a combination of both. Any remittance exceeding this limit requires prior permission from the RBI.

Who can remit funds using LRS?

- Only individual Indian residents are permitted to remit funds under LRS.

- Corporates, partnership firms, HUF, trusts, etc are excluded from its ambit.

- However, it is available to minors, provided that Form A2 is countersigned by the minor's natural guardian.

What types of transactions are permitted?

1) Capital account transactions:

- Opening of foreign currency account abroad with a bank;

- Acquisition of immovable property abroad, overseas direct investment (ODI) and overseas portfolio investment (OPI), in accordance with the Foreign Exchange Management (Overseas Investment) Rules, 2022, Foreign Exchange Management (Overseas Investment) Regulations, 2022 and Foreign Exchange Management (Overseas Investment) Directions, 2022;

- Extending loans, including loans in Indian Rupees to non-resident Indians (NRIs) who are relatives as defined in the Companies Act, 2013.

2) Current account transactions:

- Private visits abroad (excluding Nepal and Bhutan)

- Gifts/donations

- Going abroad on employment

- Emigration

- Maintenance of relatives abroad

- Business trips

- Medical treatment abroad

- Pursuing studies abroad

3) Other permissible transactions include purchasing objects of art subject to the provisions of other applicable laws such as the extant Foreign Trade Policy of the Government of India.

What types of transactions are prohibited?

Under LRS, the following types of transactions are expressly prohibited:

1) Transactions not permissible under Foreign Exchange Management Act, 1999

2) Remittance for margins or margin calls to overseas exchanges or overseas counterparty

3) Remittances for any purpose specifically prohibited under Schedule I or any item restricted under Schedule II of Foreign Exchange Management (Current Account Transaction) Rules, 2000

4) Capital account remittances to countries identified by Financial Action Task Force (FATF) as non-co-operative countries and territories or as notified by RBI

5) Remittances directly or indirectly to those individuals and entities identified as posing significant risk of committing acts of terrorism as advised separately by RBI to the banks

What are the formalities and documentation involved?

LRS permits outward remittance in the form of a demand draft either in the resident individual's own name or in the name of a beneficiary, against self-declaration of the remitter in the prescribed format. Individuals are also allowed to open, maintain and hold foreign currency accounts with a bank outside India for making remittances.

The following documentation is required from the remitter:

1) Designating a branch of an authorised dealer bank through which all the remittances will be made.

2) Furnishing Form A2 for purchase of foreign exchange

3) Providing Permanent Account Number (PAN)

4) Adhering to the prescribed Know Your Customer (KYC) and Anti-Money Laundering (AML) guidelines

Lastly, it is not permissible for banks to extend any credit facilities to resident individuals for facilitating capital account remittances under LRS

Are there any tax obligations?

- Tax collected on source (TCS) is levied at the rate of 5% on all remittances above the threshold of Rs 7 lakh. However, the TCS deducted can be claimed as a refund at the time of filing income tax return (ITR) under Form 26 AS.

- If any profit is made on foreign investments made under LRS, it is taxable in India based on how long the investment was held. If the investment was for 24+ months, a long-term capital gains tax of 20% is imposed. Otherwise, gains from these investments are treated as normal income and taxed as per the applicable tax slabs.

- With more porous geographical borders and an integrated global economy, the frequency of foreign transactions has grown tremendously.

- LRS facilitates such transactions in a seamless manner while also safeguarding the country's foreign exchange against instability.

- Residents and entrepreneurs alike should familiarise themselves with the nuances of LRS to have a hassle-free remittance experience and optimise their foreign exchange dealings.

TCS

What is tax collection at source?

- The Income Tax Department defined TCS as an additional amount collected as tax by a seller of specified goods from the buyer at the time of sale over and above the sale amount and is remitted to the government account.

- Under this system, the person making the payment for specified goods or services is required to collect tax from the recipient of the payment and remit it to the government.

- The concept of TCS is primarily aimed at widening the tax base, preventing tax evasion, and ensuring the smooth collection of taxes. Simply put, it shifts the responsibility of tax collection from the government to the person making the payment.

How TCS works in India?

- In India, the provisions for TCS are governed by the Income Tax Act, 1961. According to these provisions, specific goods or services are identified for which the recipient is liable to pay tax at the time of purchase. The person making the payment is required to collect the applicable tax and deposit it with the government.

- The person collecting tax at source is required to obtain a Tax Collection Account Number (TAN) and file regular returns with the tax authorities. The rate at which tax is collected and the procedures for compliance vary depending on the nature of the goods or services.

TCS Rate Chart: Goods Collected Under TCS Provisions and Rates Applicable to them

- When the below-mentioned goods are used for the purpose of manufacturing, processing, or production purposes, then no taxes are levied.

- But if the same goods are used for trading purposes, then taxes will be levied. The tax payable is collected by the seller at the point of sale. The rate of TCS is different for goods specified under different categories :

|

Type of Goods or transactions

|

Rate

|

|

Liquor of alcoholic nature, made for consumption by humans

|

1%

|

|

Timber wood under a forest leased

|

2.5%

|

|

Tendu leaves

|

5%

|

|

Timber wood by any other mode than forest leased

|

2.5%

|

|

Forest produce other than Tendu leaves and timber

|

2.5%

|

|

Scrap

|

1%

|

|

Minerals like lignite, coal and iron ore

|

1%

|

|

Purchase of Motor vehicle exceeding Rs.10 Lakhs

|

1%

|

|

Parking lot, Toll Plaza and Mining and Quarrying

|

2%

|

Note: If the buyer fails to furnish his PAN, he shall be liable to pay Tax Collected at Source @ 5% or twice the normal rates, whichever is higher.

What are the cases of TCS Exemptions?

Tax collection at the source is exempted in the following cases:

- When the goods are used for personal consumption

- The goods are bought for manufacturing, processing or production and not for the purpose of trading those goods.

Difference between TCS and TDS

- It is important to note TCS is different from Tax Deducted at Source (TDS).

- TDS involves deducting a portion of the payment made to the recipient and remitting it to the government, whereas TCS involves collecting tax from the recipient at the time of payment.

- TCS and Tax Deducted at Source (TDS) are both mechanisms used by tax authorities to collect taxes, but they differ in their applicability and the point at which tax is collected. TCS is applicable to specific goods or services as identified by tax authorities, whereas TDS is applicable to a wider range of payments made to various categories of recipients.

- Under TCS, tax is collected by the person making the payment for goods or services from the recipient at the time of purchase or payment. In contrast, under TDS, tax is deducted by the person making the payment from the income or payment being made to the recipient.

- In the case of TCS, the person making the payment is responsible for collecting the tax from the recipient and remitting it to the government. With TDS, the person making the payment deducts the tax and remits it to the government on behalf of the recipient.

- The rates and thresholds for TCS and TDS can differ. Tax rates for TCS may vary depending on the nature of goods or services, while TDS rates can vary based on the type of payment and the recipient's status.

- Both TCS and TDS require compliance and reporting obligations. The person collecting tax under TCS needs to obtain a Tax Collection Account Number (TAN) and file regular returns. Similarly, the person deducting tax under TDS needs to obtain a Tax Deduction Account Number (TAN) and file regular TDS returns.

TCS under LRS

- Under the Liberalised Remittance Scheme (LRS), TCS is applicable to certain foreign remittances made by individuals. The LRS allows resident individuals to freely remit a certain amount of money abroad for various permissible purposes, such as education, travel, investment, and gifting.

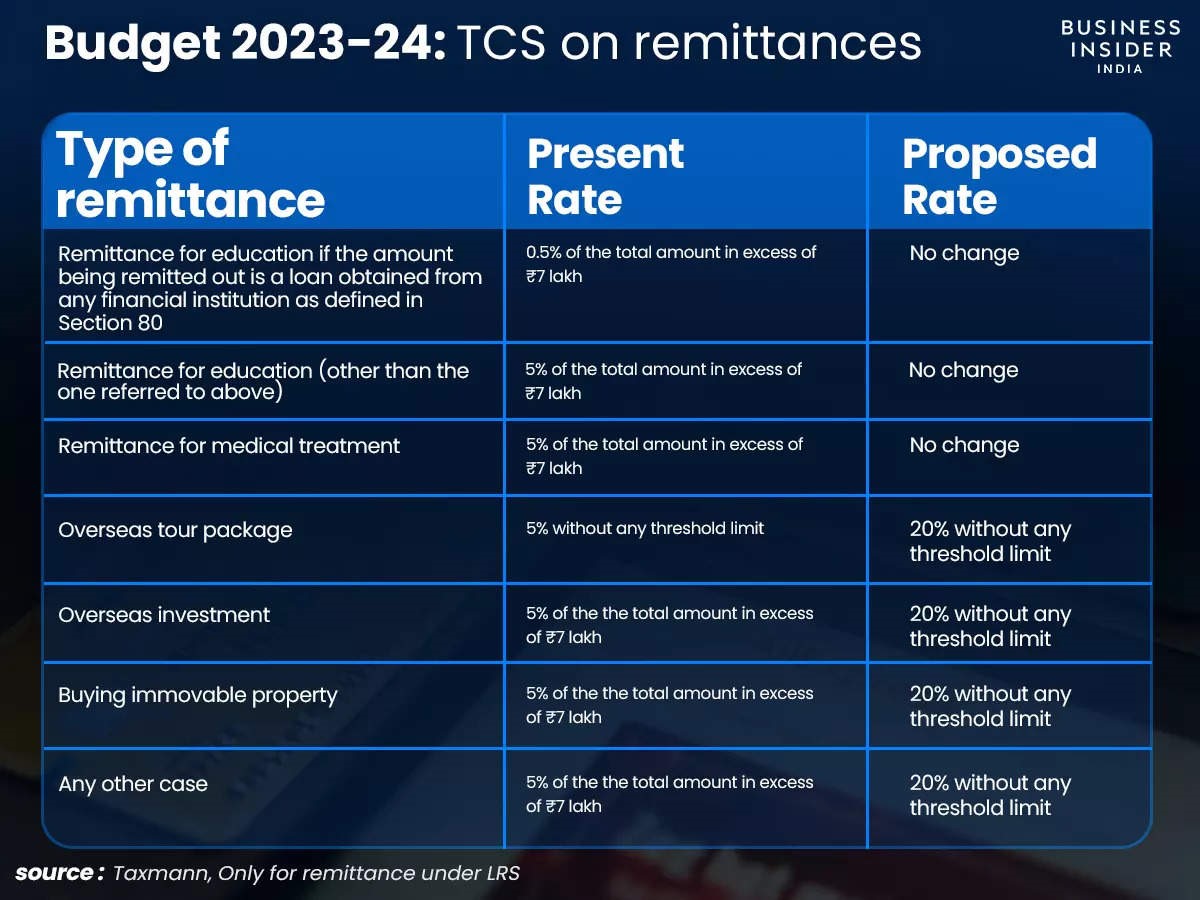

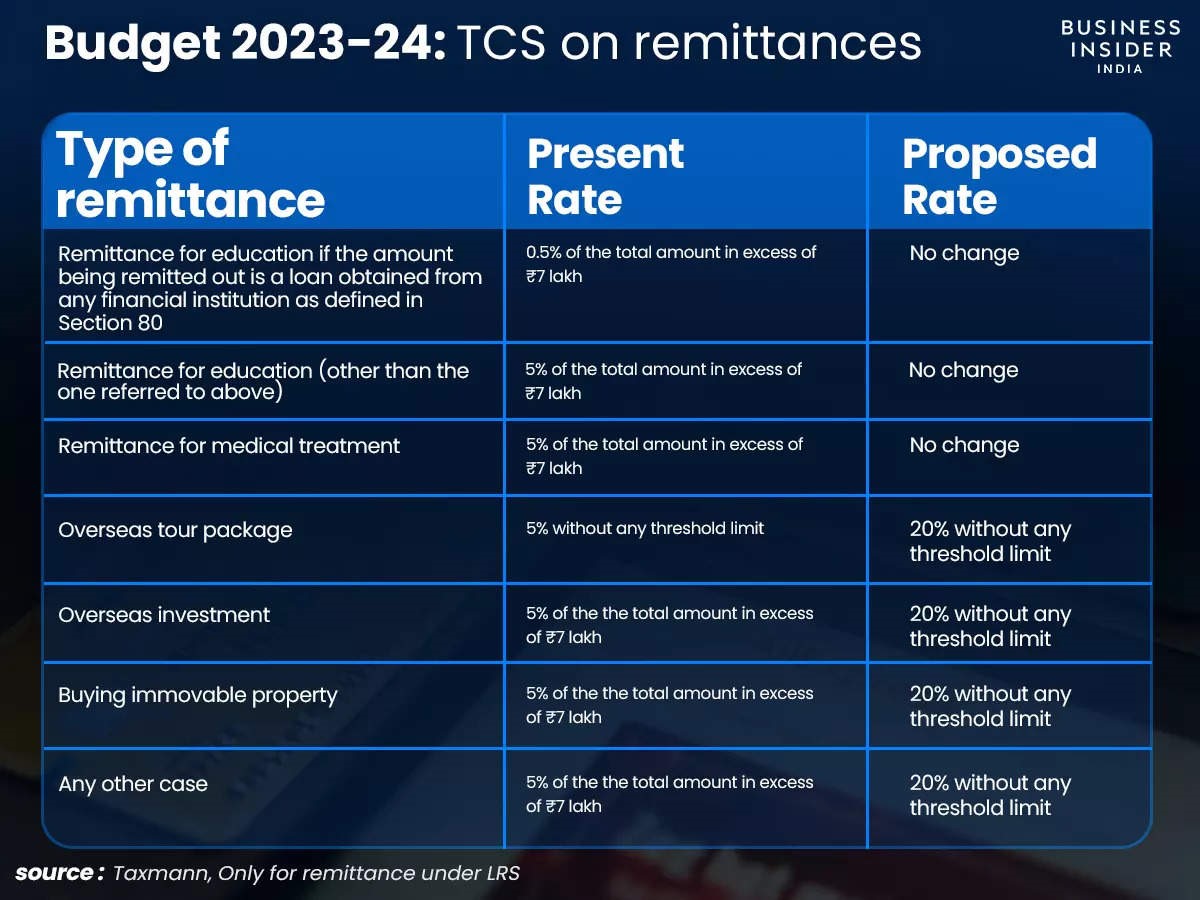

- When an individual makes a foreign remittance under the LRS, TCS may be applicable to the amount being remitted. Before this year's budget, a TCS rate of 5 per cent was applicable for remittances exceeding Rs 7 lakhs in a financial year.

- However, the rule was changed in the Union Budget 2023 as TCS rate was hiked to 20 per cent under LRS, except for educational and medical purposes where the old rates would apply.

- The responsibility of collecting TCS lies with the authorized dealer (bank or financial institution) through which the remittance is made. The authorized dealer collects the TCS from the individual making the remittance and deposits it with the government.

- It's important to note that TCS under the LRS is not applicable to all types of foreign remittances. Certain categories, such as payments for imports, transactions under the government's foreign aid programs, and remittances by certain exempt entities, are excluded from the scope of TCS.

How to claim TCS refund?

- Individuals who have paid TCS under the LRS can claim credit for the tax while filing their income tax return. The TCS amount paid can be set off against the individual's final tax liability.

- It's advisable to consult the relevant provisions of the Income Tax Act, 1961, and seek guidance from tax professionals or authorized dealers to understand the specific rules and implications of TCS under the Liberalised Remittance Scheme in India.

Further details on the recent changes pertaining to TCS under LRS

- Concerns were raised about the applicability of Tax Collection at Source (TCS) to small transactions under the Liberalized Remittance Scheme (LRS).

- To avoid any procedural ambiguity, it has been decided that any payments by an individual using their international Debit or Credit cards upto Rs 7 lakh per financial year will be excluded from the LRS limits and hence, will not attract any TCS.

- While it has also raised the rate of tax from 5% to 20%, except for education and medical treatment-related expenses.

- With the latest decision to retain the ₹700,000 monetary threshold for forex purchases from 1 July, individuals making these purchases have been spared of the hassles of such tax at source and subsequently adjusting it either at the time of paying quarterly advance tax or at the time of filing the tax return.

- The necessary changes to the Rules (Foreign Exchange Management (Current Account Transactions Rules), 2000) will be issued separately.

Significance of the move

- The relief comes in the context of an increasing number of Indians making payments in forex to goods and services from abroad including for purchase of e-books, videos and online coaching as the consumption of these services are on the rise.

- Even now, online purchases of goods and services in forex by individuals while in India above the ₹700,000 threshold using either debit or credit card are covered under the 5% TCS obligation.

- If the payment is made in Indian rupee, for example, for a subscription of a web streaming service like Netflix, to the Indian arm of the foreign parent, it was any way out of the TCS liability and was not to come under TCS even after 1 July.

- If the payment is in rupee, the bank does not have to do currency conversion and it is not covered under LRS and no TCS is applicable.

- Experts welcomed the decision to retain the ₹700,000 threshold for TCS on forex purchases after 1 July. The hue and cry was justified as even small international payments could have been subject to TCS and would have severely impacted taxpayers as they would have to wait till the time of filing of return to get the refund or adjust the same.

Note: The finance ministry changed a rule under Foreign Exchange Management Act (FEMA) effective from Tuesday bringing use of credit cards abroad for expenses by individuals during a foreign visit under the RBI's US$250,000 cap under the LRS. That rule change also meant such use of credit cards abroad is under a 5% TCS levy immediately, which will go up to 20% from 1 July.

|

PRACTICE QUESTION

Q. Consider the following statements:

1. Remittance for margins or margin calls to overseas exchanges or overseas counterparty are expressly prohibited under the liberalized remittance scheme (LRS).

2. Any payments by an individual using their international Debit or Credit cards upto Rs 10 lakh per financial year is excluded from the LRS limits and hence, does not attract any Tax collection at the source (TCS).

3. Tax collection at the source is exempted when the goods are bought for manufacturing, processing or production and not for the purpose of trading those goods.

Which of the above statements are correct?

(a) Only 1

(b) Only 1 and 3

(c) Both 2 and 3

(d) 1,2 and 3

Correct Answer: B- Only 1 and 3

|

https://www.livemint.com/economy/centre-exempts-tax-at-source-on-credit-debit-card-purchases-upto-rs-700-000-from-1-july-11684507976737.html#:~:text=The%20ministry's%20move%20is%20significant,and%20medical%20treatment%20related%20expenses.