Description

In News

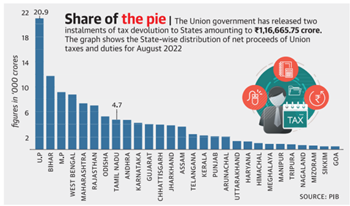

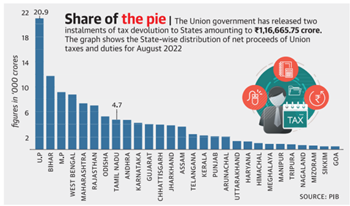

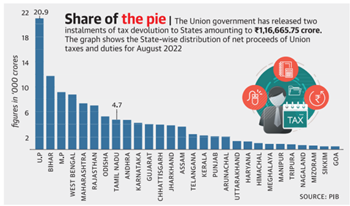

- The Union government has released over Rs 1.16 lakh crore to the States, which is equivalent to two monthly installments of tax devolution.

- The amount was released to push State governments’ capital spending abilities in this financial year.

Financial Relations between Union and State

- Part XII of the Indian Constitution deals with financial relations between the centre and the states.

- The Finance Commission (Article 280) makes recommendations to the President on the division of net tax receipts between the centre and the states.

- Indian Constitution divides the taxation authorities between the Central government and the states in the following ways;

- Parliament has sole authority to charge the taxes included in the Union List.

- The state legislature has sole authority to impose the taxes listed on the state list.

- The taxes included in the Concurrent List can be imposed by both Parliament and state legislatures.

- The Parliament has the residuary power of taxation (that is, the authority to impose taxes not listed in any of the three lists). The parliament has implemented a gift tax, a wealth tax, and an expenditure tax under this clause.

- The Union can make grants-in-aid to states, which Parliament can authorize. Such funds are applied to India's Consolidated Fund.

- The Union has the authority to make grants to states and to any institution within those states for public purposes.

Grants-in-Aid to the States: The Constitution provides for grants-in-aid to the states from Central resources in addition to revenue sharing between the Centre and the states. Statutory grants and discretionary grants are the two forms of grants-in-aid:

- Statutory Grants - Article 275 authorizes Parliament to offer grants to states in need of financial help, rather than to all states. Every year, these funds are charged to India's Consolidated Fund.

- Aside from this basic provision, the Constitution also provides for specific funds to promote the welfare of scheduled tribes in a state or to improve the standard of administration in scheduled areas in a state, such as Assam.

- The Finance Commission recommends that the states receive statutory grants (both general and particular) under Article 275.

- Discretionary Grants - Both the Centre and the states are empowered under Article 282 to give any grants for any public purpose, even if it falls outside of their respective legislative jurisdiction. The Centre makes grants to the states under this clause.

- Other Grants - The third sort of grant-in-aid was also included in the Constitution, but it was only for a limited time.

Borrowing by the Centre and the States

- The Union has the authority to grant loans to states and to guarantee loans raised by them.

- The Union government can borrow either within India or abroad, using the Consolidated Fund of India as security or providing guarantees, but only within the restrictions set by Parliament.

- Similarly, a state government can borrow inside India (but not overseas) on the security of its Consolidated Fund or provide guarantees, but only within the restrictions set by that state's legislature.

- Any state can borrow money from the federal government, and the federal government can guarantee loans raised by any state.

- The Consolidated Fund of India will be charged with any amounts required for the purpose of providing such loans.

- If any part of a loan made to the state by the Centre or in respect of which the Centre has offered a guarantee is still unpaid, the state cannot obtain any loan without the agreement of the Centre.

Report of the 15th Finance Commission for 2021-26

- Finance Commission is a constitutional body; it is formed by the President of India to give recommendations on centre-state financial relations.

- 15th Finance Commission headed by N. K. Singh.

- The share of states in the central taxes is recommended to be 41%.

- This is less than the 42% share recommended by the 14th Finance Commission.

- Over the 2021-26 period, the following grants will be provided from the centre’s resources:

- Revenue deficit grants: 17 states will receive grants worth Rs 2.9 lakh crore to eliminate the revenue deficit.

- Sector-specific grants of Rs 1.3 lakh crore will be given to states for eight sectors:

- Health

- School Education

- Higher Education

- Implementation of agricultural reforms

- Maintenance of PMGSY roads

- Judiciary

- Statistics

- Aspirational districts and blocks.

- A portion of these grants will be performance-linked.

- The Finance Commission recommended state-specific grants of Rs 49,599 crore. These will be given in the areas of:

- Social needs

- Administrative governance and infrastructure.

- Water and sanitation.

- Preservation of culture and historical monuments.

- High-cost physical infrastructure.

-

- The total grants to local bodies will be Rs 4.36 lakh crore (a portion of grants to be performance-linked) including;

- Rs 2.4 lakh crore for rural local bodies.

- Rs 1.2 lakh crore for urban local bodies.

- Rs 70,051 crore for health grants through local governments.

https://epaper.thehindu.com/Home/ShareArticle?OrgId=GM4A4SJPG.1&imageview=0