Disclaimer: Copyright infringement not intended.

Context

Technical Textiles

Global Market Size

Technical Textile in India

Government Initiatives to Boost Technical Textiles Market

In 2019, the Ministry of Textiles, Government of India dedicated 207 HSN codes to technical textiles to help in monitoring the data of import and export, in providing financial support and other incentives to manufacturers. The purpose of this classification is to increase international trade, and enable the market size to grow up to $ 26 Bn by the year 2020-21.

International technical textile manufacturers such as Ahlstrom, Johnson & Johnson, Du Pont Procter & Gamble, 3M, SKAPS, Kimberly Clark, Terram, Maccaferri, Strata Geosystems have already initiated operations in India.

India It is a flagship event organised by the Ministry of Textiles, in collaboration with Federation of Indian Chambers of Commerce & Industry (FICCI) and comprises of exhibitions, conferences and seminars with participation of stakeholders from across the global technical textile value chain.

With a view to position the country as a global leader in technical textiles, the CCEA has given its approval to set up a National Technical Textiles Mission with a total outlay of $ 194 Mn in February 2020.

The Mission shall be set up for a four year implementation period from FY 2020-24 and will have the following four components:

Schemes

Technology Mission on Technical Textiles (TMTT)

Centres of Excellence Ministry of Textiles had launched Technology Mission on Technical Textiles (TMTT) with two mini-missions for a period of five years from 2010-15 which entailed the creation of the following eight Centres of Excellence to provide infrastructure support, lead research and conduct tests of various technical textiles.

Amended Technology Upgradation Fund Scheme (ATUFS)

The Ministry of Textiles implemented ATUFS in January 2016, for a period of seven years. ATUFS’s larger objective is to improve exports and indirectly promote investments in the textile machinery. Under ATUFS, technology upgradation and CIS are offered to entities that are engaged in manufacturing textile and technical textile products under the guidance of TAMC (Technical Advisory Monitoring Committee).

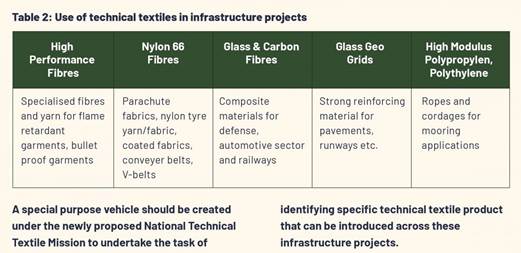

Capitalising the $ 1.4 Trn Infrastructure Fund

Aligning with the Prime Minister’s vision of achieving a $ 5 Trn economy, the Finance Minister unveiled a $ 1.4 Trn national infrastructure pipeline in December 2019 which will be implemented in the next five years. The projects identified include energy, road, railway, urban development, irrigation and health sectors, where technical textiles can be used extensively.

Samarth (Scheme for capacity building in textile sector)

The scheme had an estimated budget of Rs. 1,300 Crores and aimed to train 10 lakh persons over a period of 3 years (2017-20). This scheme has tried to address the shortage of skilled manpower in textile sector, including technical textiles.

National Technical Textiles Mission (NTTM)

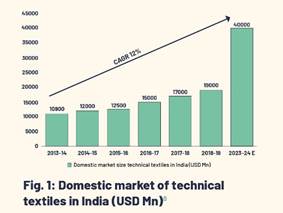

This is the most important, exclusive and ambitious scheme till date and it aims to position the country as a global leader in technical textiles market. Its aim is to take domestic market size of technical textiles industry to US$ 40-50 Billion by the year 2024 with an average growth rate of 15-20% per annum.

.jpg)

Way Ahead

Developing a National Textile Policy

In order to develop the textile industry into a strong and vibrant one, meet the growing needs of the people and contribute to sustainable growth of employment and economic growth, it is imperative that we have a sound and dynamic National Textile Policy. The National Textile Policy was released in 2000. With the textiles industry growing by leaps and bounds, there is a need for revising and updating the national textiles policy.

The revised policy should take stock of the changing domestic and global needs, acknowledge the potential of “the fourth industrial revolution”, improves the overall supply chain, including structural reforms to improve present trade practices. The policy should constitute an elaborate strategy on how to build the technical textiles industry, focusing on institutionalisation, standardisation, measures to deal with sustainability, R&D efforts to procure the fibres within India.

Research and Development

The technical textile sector in India is at a nascent stage and therefore R&D play a critical role to gain a lead in this sector. Recently, the government has also suggested creating a special fund for R&D worth $ 13 Mn in technical textiles. Along with these, more efforts will have to be made in the direction of fostering a well-developed R&D ecosystem

Creation of a National Centre for Research in Technical Textiles

The formation of a ‘National Centre of Research in Technical Textiles’ may be proposed as a first step towards creating a formal institutional structure. This may be established within an existing institution or as a separate entity.

FDI and formation of Joint Ventures

One of the effective ways to bridge this technological gap is to bring in Foreign Direct Investments (FDI) from leading countries such as Germany, Spain, Switzerland, Japan, Korea and Italy. Some global companies may consider bringing their technologies to India for supplying into domestic and overseas markets.

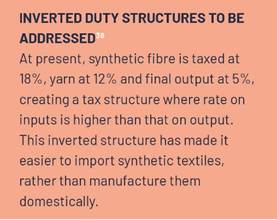

Import substitution & boosting domestic production

The huge cost of importing machinery into the country is only going to pose immense burden. Hence, there is a clear need to substitute imports through indigenous technology development, Joint Ventures and FDIs which will further propel the Make in India campaign to greater heights.

Creation of machine manufacturing clusters

The need to bolster the existing SITP scheme has been realised by the Ministry of Textiles. Having a dedicated park to manufacturing of textile machines in the country will prove beneficial to turn around the entire value chain and fill the existing gaps. The park should have state-of-the-art support infrastructure, developed land, uninterrupted power supply and other utilities for manufacturing and training centres for skilled manpower.

Closing Thought

|

TECHNICAL TEXTILES AMID COVID 19 Technical textiles, a sunrise sector, has become even more relevant during the Covid-19 crisis when the global manufacturing have come to a grinding halt and the ban on export of critical medical equipment including N95 face masks and protective gears, have made imports to India nearly impossible. India was entirely import dependent for PPE kits. From manufacturing 0 PPE kits in March, it soon rose to manufacturing 2.5 lakh a day in 60 days becoming the second largest manufacturer after China. Today, India stands to produce around 4.5 lakh PPEs and more than 1.5 crore masks a day. By transforming a Covid-19 crisis to an opportunity, India has proven its ability to innovate and rise to the challenge with limited resources and time. Therefore, it is even more essential for the government and industry to collaborate to boost technical textiles, a high value segment of this sector. |

© 2025 iasgyan. All right reserved