Description

Disclaimer: Copyright infringement not intended.

Context

- Garment manufacturers in Tiurppur have called for a ban on export of cotton and cotton yarn as textile mills are increasing cotton yarn prices.

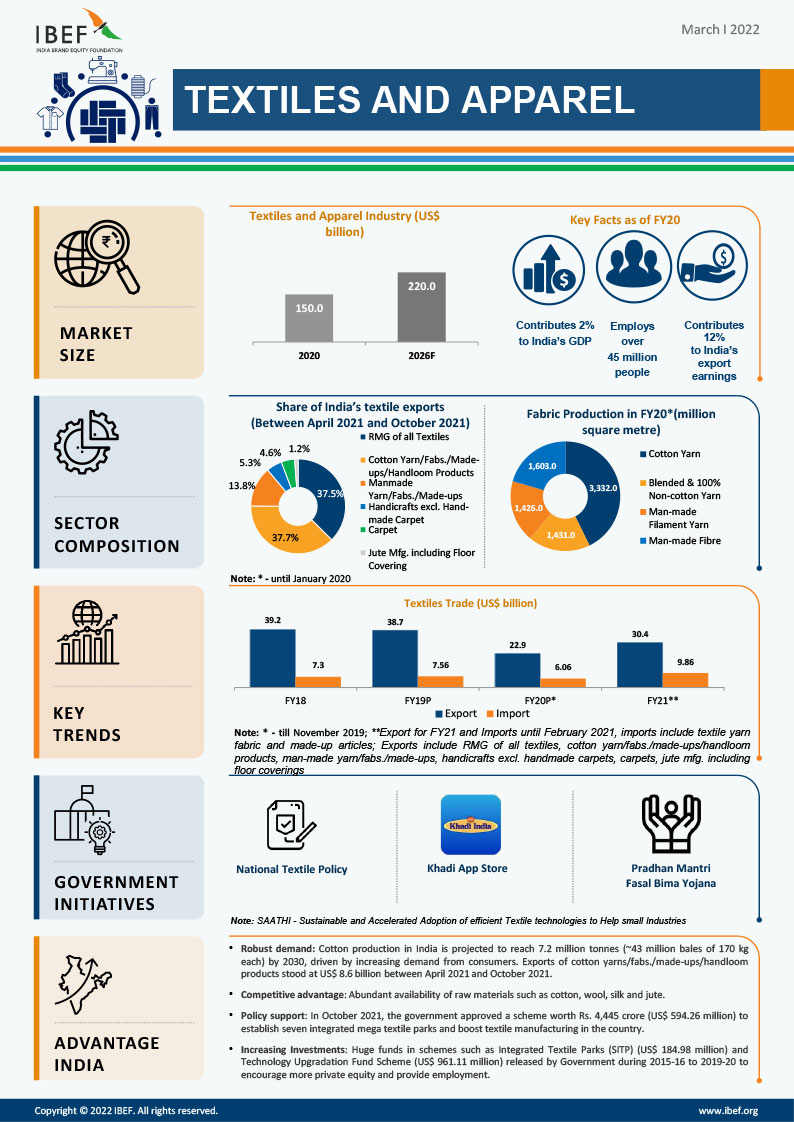

Indian Textile Sector: Some Statistics

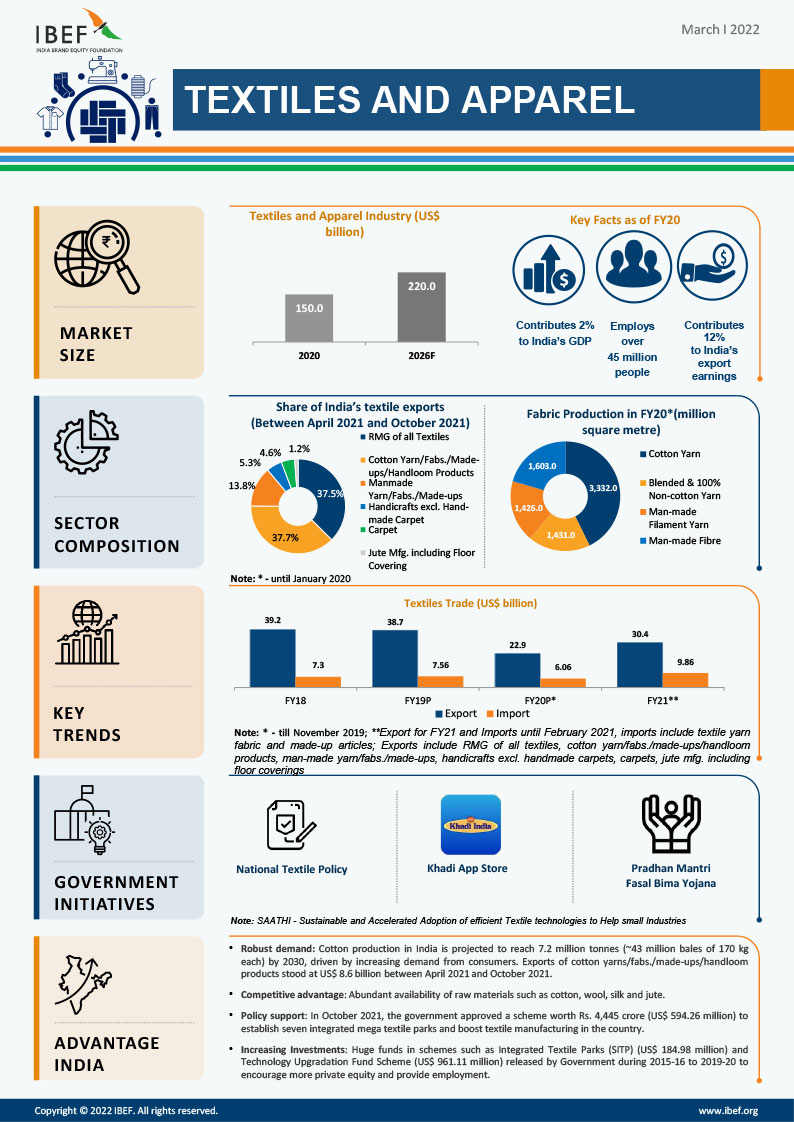

- Indian textile industry is the second largest producer of textiles in the world with a massive raw material and textiles manufacturing base. Note: China is the largest textile producing and exporting country in the world.

- This industry accounts for almost 24% of the world’s spindle capacity and 8% of global rotor capacity.

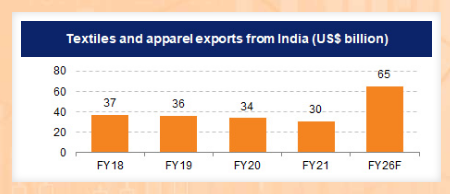

- The domestic apparel & textile industry in India contributes 5% to the country’s GDP, 7% of industry output in value terms, and 12% of the country’s export earnings. India is the 6th largest exporter of textiles and apparel in the world.

- India is one of the largest producers of cotton and jute in the world. India is also the 2nd largest producer of silk in the world and 95% of the world’s hand-woven fabric comes from India.

- India is the largest consumer and the second-largest producer of cotton with 6 Mn tons of cotton production every year which is about 23% of the world cotton.

- India is a global leader in jute production, accounting for about 70% of estimated world production.

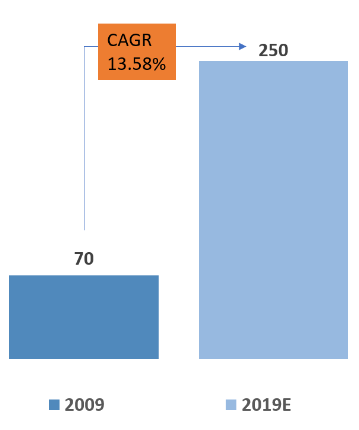

- The Indian technical textiles segment is estimated at $16 bn, approximately 6% of the global market.

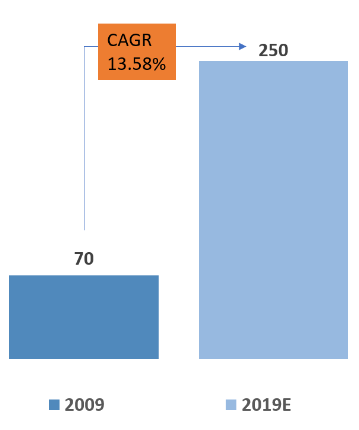

- The Indian technical textiles market was estimated at $17.6 bn in 2020-21 and grew at a CAGR of 10% since 2015-16.

- The textiles and apparel industry in India is the 2nd largest employer in the country providing direct employment to 45 million people and 100 million people in allied industries.

- India has also become the second-largest manufacturer of PPE in the world.

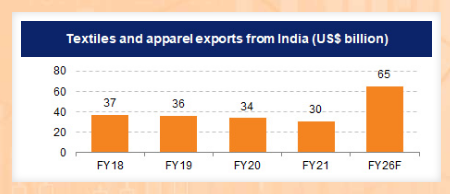

- India’s exports of textiles and apparel are expected to reach $100 bn in the next 5 years, growing at a CAGR of 11%.

- India has a share of 4% of the global trade in textiles and apparel.

- Average wage rates in India are 50-60 per cent lower than that in developed countries, thus enabling India to benefit from global outsourcing trends in labour intensive businesses such as garments and home textiles.

- As per the 4th All India Handloom Census 2019-20, there are 35.22 lakh handloom workers across the country.

- Textile sector accounts for 10% of the country’s manufacturing production, 5% of GDP, and 13% of its export earnings.

Fabric-wise stats

- Cotton – Second largest cotton and cellulosic fibres producing country in the world.

- Silk – India is the second largest producer of silk and contributes about 18% to the total world raw silk production.

- Wool –India has 3rd largest sheep population in the world, having 6.15 crores sheep, producing 45 million kg of raw wool, and accounting for 3.1% of total world wool production. India ranks 6th amongst clean wool producer countries and 9th amongst greasy wool producers.

- Man-Made Fibres– the fourth largest in synthetic fibres/yarns globally.

- Jute – India is the largest producer and second largest exporter of the jute goods.

Factors Favoring Growth of the Indian Textile Industry:

- Raw material base: India has high self- sufficiency for raw material particularly natural fibres. India’s cotton crop is the third largest in the world. Indian textile Industry produces and handles all types of fibres.

- Labour: Cheap labour and strong entrepreneurial skills have always been the backbone of the Indian textile Industry.

- Flexibility: The small size of manufacturing which is predominant in the apparel industry allows for greater flexibility to service smaller and specialized orders.

- Rich Heritage: The cultural diversity and rich heritage of the country offers good inspiration base for designers.

- Domestic market: Natural demand drivers including rising income levels, increasing urbanization and growth of the purchasing population drive domestic demand.

Challenges the textile India is facing

Shortage in supply of raw materials

- Because of pollution issues some unit of china and Europe has been shut down due to which rise in the prices of basic raw material has resulted and there are many other factors like weather etc which are influencing the raw material supply.

Increase in cost of raw material

- Unpredictable market conditions, weather, policies etc have resulted in an increase in raw material costs.

Environmental problems

- Environmental compliance often isn’t at the top of textile and garment importers’ concerns.

Infrastructure bottlenecks

- The low quality of India’s infrastructure continues to lag behind that of many other Asian countries.

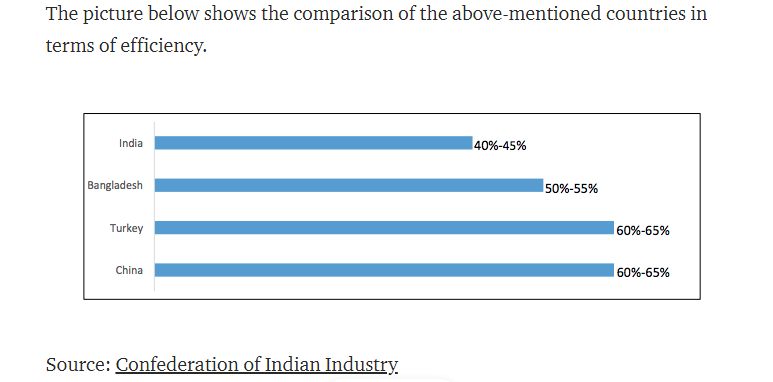

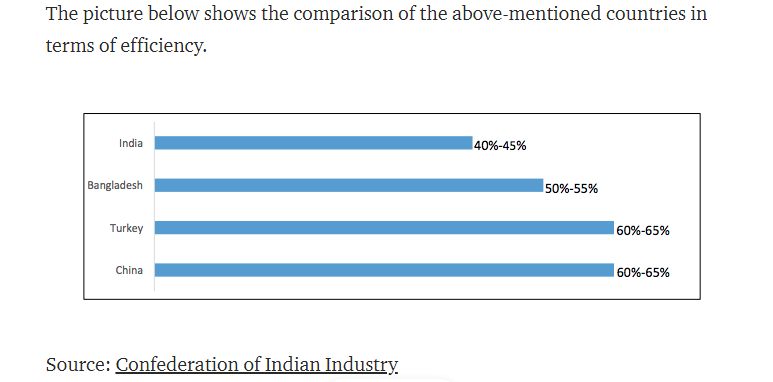

Lower Efficiency

- With the increasing global competition, one of the main factors affecting the growth of garment industry in India is the lower productivity level. India’s apparel factory productivity levels are relatively low compared to countries like Turkey, China and Bangladesh.

Goods & Services Tax (GST)

- The tax structure GST (Goods and Service Tax) makes the garments expensive.

- GST has created distortions in the Textile and Apparel sector in India, impeding its competitiveness.

- The man-made fiber yarn is now taxed at 18%, while the fabric is taxed at 5%. The small businesses which buy yarn and produce fabric are directly impacted by this imbalance, affecting their sustainability.

- Apart from the policy limitations, system errors, delay in reimbursement of input credit, untimely implementation and limited knowledge of GST has hugely impacted the sector in the country.

- Although in the long-term GST is set to affect the apparel and textile sector of India positively, the short-term impact has brought many small-scale businesses to a complete halt.

Factor Costs

- The labor cost in India is higher than that of Bangladesh and marginally lower that China and Vietnam.

- China however compensated for this disadvantage through its training infrastructure.

- Although the Integrated Skill Development Scheme (ISDS) of the government is focused on growing the pool of skilled labor in the country, the growing labor costs are stealing away India’s competitive advantage in the apparel industry.

Limited FTAs

- Bangladesh, Cambodia, Pakistan, Turkey, etc. enjoy duty-free access to all the major textile markets of the US and the EU.

- India still lacks FTA advantages to major markets making Indian produce much more expensive compared to that of its competitors.

- Indian government’s current foreign policy is expected to bring in more trade agreements and trading partners for the country, but its direct impact on apparel trade will be seen only after the test of time.

Lack of Fiber neutrality

- Manmade textiles in apparel industry have a substantially big demand, worldwide. Despite being the second largest textile exporter in the world, India lags far behind in this category, due to limited availability of manmade fibers at competitive prices.

- The textile value chain in the country also bears a differential tax treatment. Hence, India’s competitors like Pakistan, Sri Lanka, China, Thailand and Indonesia who follow fiber neutral policy are much more aligned to the global apparel consumption patterns.

High Costs of Capital

- Compared to its competitors, India has one of the highest costs of capital, which directly affects India’s cost of production, and hence the country’s competitiveness in the global market.

- The current lending rate in India is between 11 to 12.5%, while China, Vietnam, and Turkey, offer capital at a rate of 5 to 7% only. To add to this equation, the high-power costs in the country further push India back.

Buyer-Driven Commodity Chains

- Industries with large retailers, big brand marketers, and trading companies develop decentralized production networks, mostly located in third world countries like India.

- So the main leverage here lies with the retailers and brand merchandisers at the marketing or retail end of the supply chain.

- Indian apparel industry is dominated by manufacturers who act as package suppliers for the foreign buyers. This lowers the bargaining power that Indian apparel sector has on global cues in the industry, thus preventing its unrestricted growth.

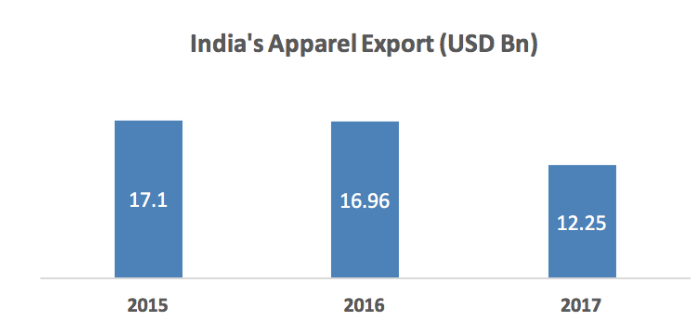

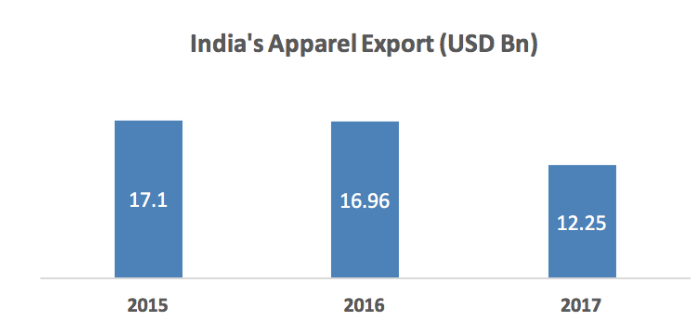

Export Growth Performance

- Textile and apparel sector has a declining status in developed economies.

- This poses a huge opportunity for India’s apparel industry to grow, but the slowdown in the import growth of the country’s major apparel markets like the US and the EU is slowing down India’s export growth.

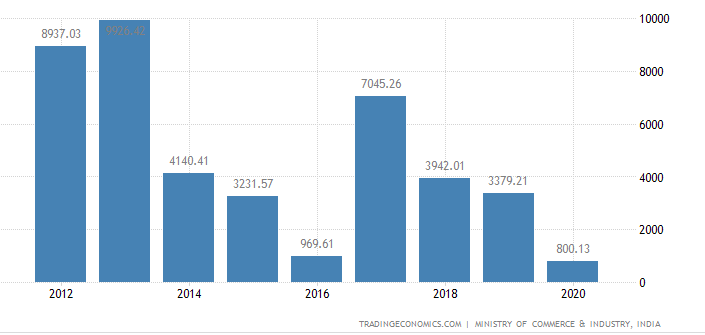

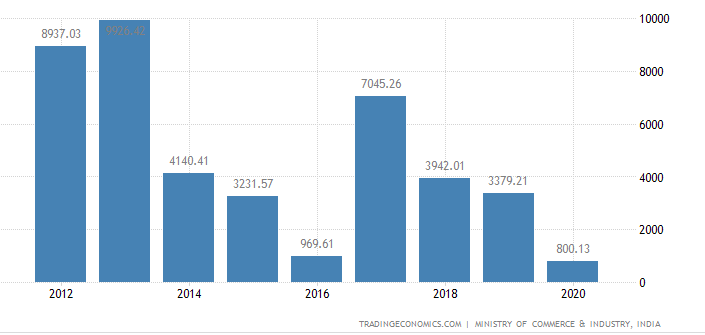

Fig: Indian Exports of Cotton

Other

- Changing government policies at the state and central government levels because of which major challenges are arising in the textile industry.

- Raising interest rates and labor wages and workers’ salaries.

- Access to the latest technology and failures to meet global standards in the highly competitive export market. Countries like China, Bangladesh, and Sri Lanka gives fierce competition in low price garment market.

Initiatives and measures to strengthen the textile sector in India

Removal of anti-dumping duty

- To boost exports in man-made fibre (MMF) sector, the government removed anti-dumping duty on PTA (Purified Terephthalic Acid), Viscose Staple Fibre and Acrylic.

PM MITRA scheme

- The government approved setting up of Seven Pradhan Mantri Mega Integrated Textile Region and Apparel (PM MITRA) Parks in Greenfield/Brownfield sites with an outlay of Rs 4,445 crore for a period of seven years up to 2027-28.

- These parks will enable the Indian textile industry to become globally competitive, attract large investment and boost employment generation, according to the ministry of textiles.

PLI scheme

- The government approved the Production Linked Incentive (PLI) scheme for textiles, with an approved outlay of Rs 10,683 crore, to promote production of MMF apparel, MMF fabrics and products of technical textiles in the country.

- This is expected to enable India’s textile sector to achieve size and scale and to become competitive.

RoSCTL extension

- The scheme of Rebate of State and Central Taxes and Levies (RoSCTL), that was effective from March 2019, has been extended till March 31, 2024 for exports of apparel/garments and made-ups in order to make the Indian textile sector competitive in the international market.

Other

- Amended Technology Upgradation Fund Scheme (ATUFS)

- Scheme for Integrated Textile Parks (SITP)

- Integrated Skill Development Scheme (ISDS)

- Technology Mission on Technical Textiles (TMTT)

- Swarnjayanti Gram Swarozgar Yojana (SGSY)

- Integrated Processing Development Scheme (IPDS)

- Merchandise Exports from India Scheme (MEIS)

- Market Development Assistance (MDA)

- Market Access Initiative (MAI)

- 100 per cent Foreign Direct Investment (FDI) in the textile sector under automatic route.

- Ambedkar Hastshilp Vikas Yojana (AHVY) Scheme.

- 100% subsidy is given to women weavers for construction of individual workshed.

- Strategic Projects in the areas of Specialty Fibres and Geotextiles under the Flagship Programme National Technical Textiles Mission (NTTM).

- PAHCHAN initiative.

- Production-Linked Incentive (PLI) Scheme in Textiles Products for Enhancing India’s Manufacturing Capabilities and Enhancing Exports – Atmanirbhar Bharat.

- Comprehensive Powerloom Cluster Development Scheme (CPCDS) for developing Powerloom Mega Clusters to create world-class infrastructure to integrate the production chain, to fulfill the business needs of the local Small and Medium Enterprises (SMEs) and to boost production and export etc.

- Comprehensive Handloom Cluster Development Scheme (CHCDS).

- Textile Workers' Rehabilitation Fund Scheme.

- Comprehensive Handicrafts Cluster Development Scheme (CHCDS) scheme seeks to benefit poor artisans located in far flung areas of the country.

- Group Insurance Scheme for Powerloom Workers.

- Jute Technology Mission (JTM).

- North East Region Textile Promotion Scheme (NERTPS).

- Catalytic Development Programme to promote sericulture.

- Pashmina Wool Development Scheme seeks to benefit Pashmina wool growers.

- Techtextil India, a trade fair focused on technical textiles, nonwovens and composites.

- SAMARTH training.

- National Handloom Development Programme (NHDP).

- Weaver MUDRA Scheme.

- India-Japan pact on cooperation in textiles will facilitate Indian exporters to meet the requirements of Japanese importers as per the latter’s technical regulations.

- Cabinet Committee on Economic Affairs (CCEA) approved mandatory packaging of food grains and sugar in jute material for the Jute Year 2019-20.

- ‘Hastkala Sahyog Shivirs’ in handloom-handicrafts clusters.

- Directorate General of Foreign Trade (DGFT) has revised rates for incentives under the Merchandise Exports from India Scheme (MEIS) for two subsectors of Textiles Industry - Readymade garments and Made ups - from 2 per cent to 4 per cent.

- Ready- made garment manufacturing units.

- Merchandise Exports from India Scheme (MEIS).

- Centers of trade facilitation.

- Interest Equalization Scheme.

- Financial assistance (up to 50%) for technology up gradation.

- reduced the duty drawback rates on garment exports. Duty drawback is the duty refund that a business gets against what it paid for importing the raw material.

Way Ahead

- For making the textile industry competitive in the global market we need to focus on technology up-gradation and expand weaving capacity to scale-up operations.

- To enable the textile industry to compete at the highest level we need support from both central and state government.

- The state government should provide all the approval in place, including the provision of common effluent treatment plants for rapid scaling up of business.

- Indian textile industry need to take into consideration are training their workforce to meet the changing demands of the modern market world, reducing the taxes imposed on the exported products that are subsided by the government.

- Enabling a proper supply of gas is also very important to maintain the function of the textile industry.

- Creating capital subsidy, providing one window solution to resolve the industry problems, enabling a fixed price on yarn for a yearly basis will create a smooth flow of work and will also benefit the poor farmers of the nation.

- Active role of textile associations and experts.

- Capitalizing on Anti-Chinese sentiment of the world.

- Venturing in new avenues such as Meditech, which have demand in future.

- An OECD study has actually concluded that a 10% growth in logistics performance, results in 70% increase in bilateral imports. With globalization at play, logistical performance and the simplification and standardization of processes like customs is required to further strengthen India on the global apparel trade map.

Conclusion

- The Indian textile industry is at present is one of the largest and most important sectors in the economy in terms of output foreign exchange earnings and employment in India.

- The industry is facing numerous problems and among them the most important once are those of liquidity for many organized sector units, demand recession and insufficient price realization.

- The long-range problems include the need for sufficient modernization and restructuring of the entire industry to cater more effectively to the demands of the domestic and foreign markets for textiles as per the needs of today and tomorrow

- The industry has earned a unique place in the economy due to its strong future outlook, numerous employment opportunities have been generated, and the strong export numbers can be seen in the upcoming time.

https://www.thehindu.com/business/high-cotton-prices-hurt-textile-mills-garment-units/article65378668.ece