Description

Copyright infringement not intended

Context: Securities and Exchange Board of India (SEBI) has decided to launch a new consultation on the matter of total expense ratio (TER) for mutual funds. This was the outcome of the SEBI Board meeting held recently which has instructed SEBI to prepare and publish another consultation paper, based on the data collected.

Details

- SEBI recently published a consultation paper proposing to enforce a uniform total expense ratio for all mutual fund schemes, aiming to increase transparency in the costs charged to unitholders. This was, however, resisted by the industry, especially the smaller funds.

- In the consultation paper, SEBI said that TER represents the maximum expense ratio that an investor may bear and, thus, it should be comprehensive of all the expenses permitted to be charged to an investor.

Total Expense Ratio (TER)

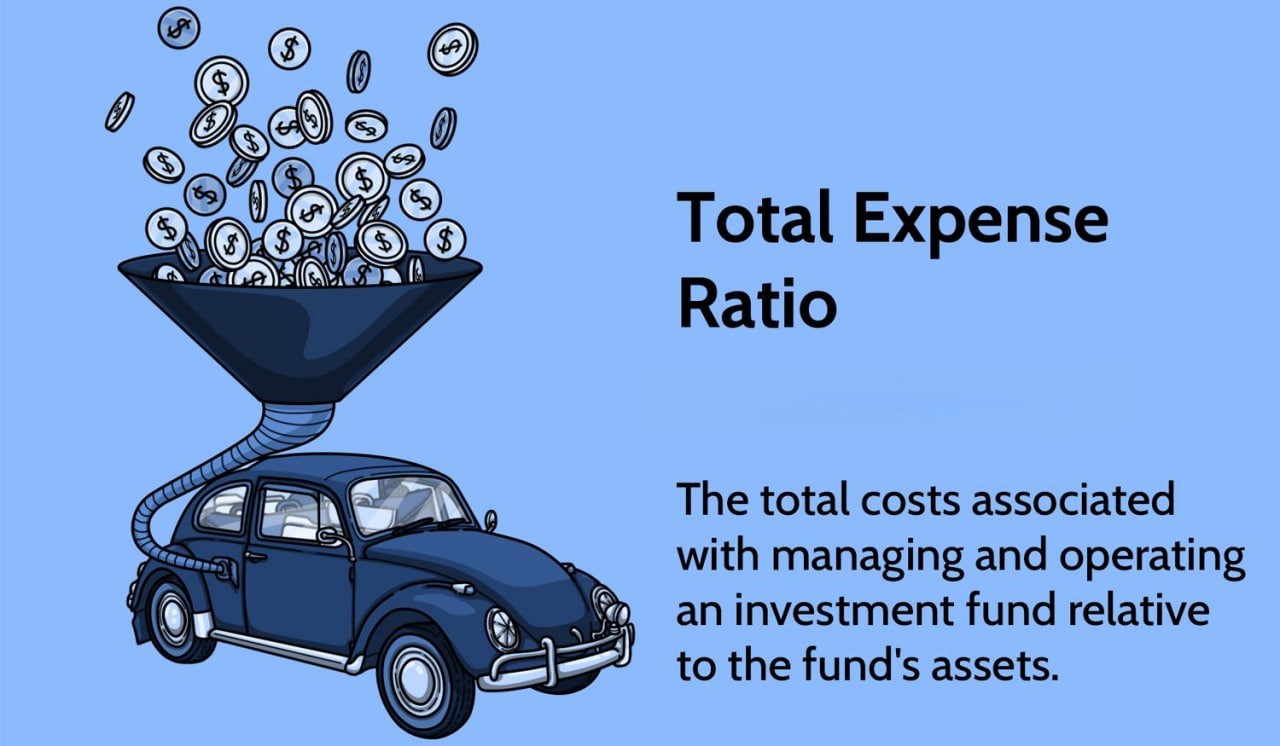

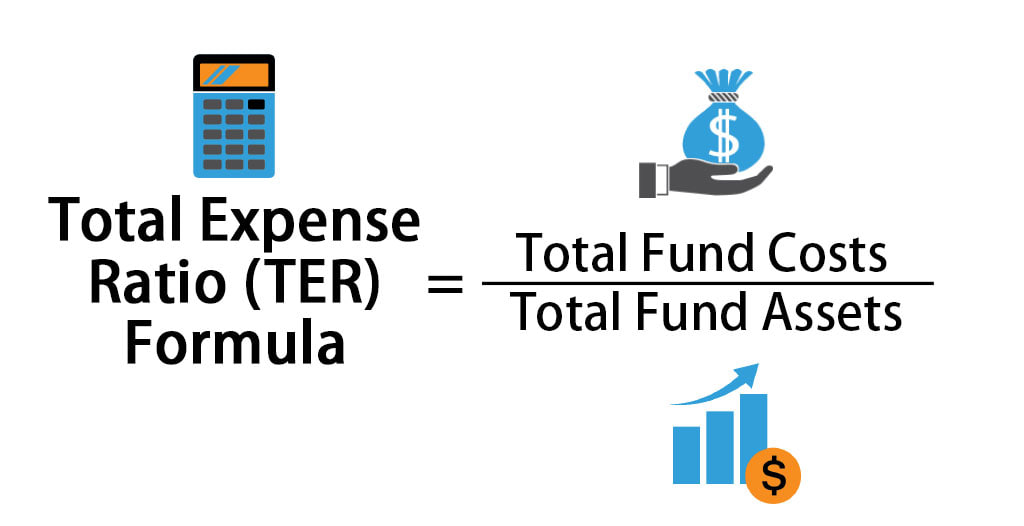

- Total Expense Ratio (TER) is a measure of the total cost of investing in a mutual fund scheme. It includes the fees paid to the fund manager, the administrative expenses, the distribution charges, and any other expenses incurred by the fund.

- It is expressed as a percentage of the average net assets of the scheme over a period of time, usually a year.

- The TER of a mutual fund scheme affects its performance and returns. A higher TER means that more money is deducted from the fund's assets to pay for its expenses, leaving less money for investment and growth.

- A lower TER means that the fund has lower operating costs and can invest more money in the market, potentially generating higher returns.

- The total expense ratio (TER) is a measure of the total costs associated with managing and operating an investment fund, such as a mutual fund or an exchange-traded fund (ETF). The total cost of the fund is divided by the fund's total assets to arrive at a percentage amount, which represents the TER.

Challenges faced by mutual fund companies in managing their TER are:

Regulatory changes

- The Securities and Exchange Board of India (SEBI) has imposed various regulations on mutual fund companies to protect the interests of investors and ensure transparency and accountability. For example, SEBI has capped the TER of mutual fund schemes at different levels based on their category, size, and type. SEBI has also mandated that mutual fund companies disclose their TER daily on their websites and the stock exchanges.

- These regulations may affect the profitability and competitiveness of mutual fund companies and force them to reduce their TER or find alternative sources of revenue.

Market competition

- The mutual fund industry in India is highly competitive with over 40 players offering more than 2000 schemes across various categories and segments. To attract and retain investors, mutual fund companies have to offer innovative products, superior services, and competitive returns. This may require them to incur higher expenses on research, marketing, distribution, technology, and customer service. These expenses may increase their TER and reduce their margins.

Investor awareness

- Many investors in India are not fully aware of the concept and implications of TER. They may not understand how TER affects their returns and how to compare different schemes based on their TER. They may also not be aware of the various components and charges included in the TER and how they vary across different schemes and categories. This may lead to suboptimal investment decisions or dissatisfaction among investors.

Mutual fund companies can adopt some of the following measures:

Leverage technology

- Technology can help mutual fund companies reduce their operational costs and improve their efficiency and productivity. For example, they can use digital platforms to offer online services, such as account opening, transactions, statements, reports, alerts, etc., to their investors.

- They can also use artificial intelligence, machine learning, big data analytics, etc., to enhance their research capabilities, portfolio management, risk management, etc. These technologies can help them lower their TER and offer better value to their investors.

Focus on direct plans

- Direct plans are mutual fund schemes that do not involve any intermediary or commission. They are offered directly by the mutual fund company to the investor through its website or app. Direct plans have lower TER than regular plans as they save on distribution costs.

- Mutual fund companies can focus on promoting direct plans to their investors and educate them about the benefits of investing through direct plans. This can help them increase their assets under management (AUM) and reduce their TER.

Improve communication

- Communication is key to building trust and loyalty among investors. Mutual fund companies can improve their communication with their investors by providing clear, accurate, timely, and relevant information about their schemes, including their TER.

- They can also use various channels, such as social media, blogs, podcasts, webinars, etc., to educate their investors about various aspects of mutual fund investing, such as TER, returns, risks, goals, etc. This can help them increase investor awareness and satisfaction.

Conclusion

- The total expense ratio (TER) is a measure of the total costs associated with managing and operating an investment fund, such as a mutual fund or an exchange-traded fund (ETF). It is an important indicator of a fund's performance, as it reduces the fund's returns to investors.

Must-Read Articles:

Securities and Exchange Board of India (SEBI): https://www.iasgyan.in/daily-current-affairs/securities-and-exchange-board-of-india-sebi

|

PRACTICE QUESTION

Q. Which of the following statements is true about the Total Expense Ratio (TER)?

A) TER is the same as the management fee charged by the fund manager.

B) TER is the ratio of the fund's total income to its total assets.

C) TER is the percentage of the fund's assets that are consumed by fees and expenses each year.

D) TER is the difference between the fund's net asset value (NAV) and its market price.

Answer: C

Explanation: TER is not the same as the management fee, which is only one component of the total costs. TER is not related to the fund's income or its market price, but rather to its total assets.

Total Expense Ratio (TER) is a measure of the total costs associated with managing and operating an investment fund, such as a mutual fund or an exchange-traded fund (ETF). These costs consist primarily of management fees and additional expenses, such as trading fees, legal fees, auditor fees and other operational expenses. The total cost of the fund is divided by the fund's total assets to arrive at a percentage amount, which represents the TER.

|

https://www.thehindubusinessline.com/news/sebi-to-bring-fresh-consultation-on-total-expense-ratio-for-mfs/article67020745.ece